10-K: Annual report pursuant to Section 13 and 15(d)

Published on February 20, 2025

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM

For the fiscal year ended

For the transition period from to

Commission File Number

State of |

||

(State or other jurisdiction of |

(I.R.S. Employer |

|

incorporation or organization) |

Identification No.) |

(Address of registrant’s principal executive office) |

(Zip Code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

Trading Symbol |

Name of each exchange on which registered |

||

Securities registered pursuant to Section 12(g) of the Act: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ⌧ NO ◻

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES ◻ ⌧

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ⌧ NO ◻

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months. ☒ NO ◻

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Accelerated filer ◻ |

Non-accelerated filer ◻ |

Smaller reporting company |

||||

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ◻

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YES

The aggregate market value of voting stock held by non-affiliates of the registrant was $

Number of shares and rights outstanding as of the latest practicable date.

Class |

Outstanding at February 18, 2025 |

|

Common Stock, without par value |

|

|

DOCUMENTS INCORPORATED BY REFERENCE

1. |

Proxy statement to be filed with the Commission within 120 days after December 31, 2024, to the extent indicated in Part III. |

Ball Corporation

ANNUAL REPORT ON FORM 10-K

For the year ended December 31, 2024

TABLE OF CONTENTS

|

|

|||

|

Page Number |

|||

4 |

|||

11 |

|||

18 |

|||

18 |

|||

19 |

|||

21 |

|||

21 |

|||

21 |

|||

22 |

|||

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

23 |

||

32 |

|||

33 |

|||

35 |

|||

Report of Independent Registered Public Accounting Firm (PCAOB ID |

35 |

||

Consolidated Statements of Earnings for the Years Ended December 31, 2024, 2023 and 2022 |

37 |

||

38 |

|||

39 |

|||

Consolidated Statements of Cash Flows for the Years Ended December 31, 2024, 2023 and 2022 |

40 |

||

Consolidated Statements of Shareholders’ Equity for the Years Ended December 31, 2024 2023 and 2022 |

41 |

||

42 |

|||

42 |

|||

52 |

|||

53 |

|||

56 |

|||

60 |

|||

60 |

|||

61 |

|||

62 |

|||

62 |

|||

63 |

|||

63 |

|||

63 |

|||

64 |

|||

64 |

|||

66 |

|||

67 |

|||

71 |

|||

80 |

|||

81 |

|||

83 |

|||

PART I.

Item 1. Business

Ball Corporation and its consolidated subsidiaries (collectively, Ball, the company, we or our) is one of the world’s leading suppliers of aluminum packaging for the beverage, personal care and household products industries. The company was organized in 1880 and incorporated in the state of Indiana, United States of America (U.S.), in 1922. Our sustainable, aluminum packaging products are produced for a variety of end uses and are manufactured in facilities around the world. In 2024, our total consolidated net sales were $11.80 billion. In the third quarter of 2023, Ball entered into a Stock Purchase Agreement (Agreement) with BAE Systems, Inc. (BAE) and, for the limited purposes set forth therein, BAE Systems plc, to sell all outstanding equity interests in Ball’s aerospace business to BAE. On February 16, 2024, the company completed the divestiture of the aerospace business. See Note 4 for further details.

Our largest product line is aluminum beverage containers and we also produce extruded aluminum aerosol containers, recloseable aluminum bottles across multiple consumer categories, aluminum slugs and aluminum cups. At December 31, 2024, the assets and liabilities of the aluminum cups operating segment are presented as current assets held for sale and current liabilities held for sale on the consolidated balance sheet. See Note 4 for further details.

We sell our aluminum packaging products globally to large multinational beverage, personal care and household products companies with which we have developed long-term relationships. This is evidenced by our high customer retention and large number of long-term supply contracts. While we have a diversified customer base, we sell a significant portion of our packaging products to major companies and brands, as well as to numerous regional customers. Our significant customers include top consumer packaging and beverage companies.

We are headquartered in Westminster, Colorado, and our stock is listed for trading on the New York Stock Exchange under the ticker symbol BALL.

Our Strategy

We exist to unlock the infinite potential of aluminum to advance a world free from waste. By leveraging our competitive advantages of bringing our scale to sustainability, the power of our partnerships and the unmatched talent of our people we will deliver on our promise of We Care… We Work… We Win…

We maintain a clear and disciplined financial strategy focused on executing an efficient operating model to deliver comparable diluted earnings per share growth in excess of 10 percent per annum over the long-term, maximize cash flow, increase Economic Value Added (EVA®) dollars and return value to shareholders.

The cash generated by our businesses is used primarily: (1) to finance the company’s operations, (2) to service the company’s debt, (3) to return value to our shareholders via stock buybacks and dividend payments, and (4) to fund organic or inorganic growth investments. From time to time, we have evaluated and expect to continue to evaluate possible transactions that we believe will benefit the company and our shareholders, which may include strategic acquisitions, divestitures of parts of our company or equity investments. At any time, we may be engaged in discussions or negotiations at various stages of development with respect to one or more possible transactions or may have entered into non-binding letters of intent. As part of any such initiatives, we may participate in processes being run by other companies or leading our own activities. The compensation of many of our employees is tied to the company’s performance through our EVA®-based incentive programs.

Sustainability

At Ball Corporation, we deliver circular aluminum packaging solutions and exist to unlock the infinite potential of aluminum to advance a world free from waste.

Our approach to sustainability has evolved over the past 20 years. Today, Ball’s sustainability strategy is driven by high standards around carbon footprint reduction and the circularity of our products. Utilizing strategic partnerships across our value chain, we work to simplify sustainability for our customers by delivering scalable solutions that enable us to win together. This includes aligning our own 2030 Sustainability Goals and strategy to our customers’ climate-related targets, sustainability goals and regulatory requirements.

4

We focus our sustainability efforts on environmental, social and governance impacts. Our vision is to advance sustainability through aluminum packaging. This is exhibited through our commitment to achieve a science-based 55 percent reduction in our greenhouse gas (GHG) footprint by 2030 and net zero carbon emissions prior to 2050. In addition, Ball is committed to hiring, training and retaining a highly qualified and high-performing employee population to work in our manufacturing facilities and offices, and we do so with the intention of having a skilled and engaged workforce.

Our innovation and manufacturing teams around the world focus on continuously driving operational excellence in support of Ball’s resource efficiency goals. This drives process optimization, including products designed for optimum metal efficiency, real time monitoring to improve energy efficiency and reuse of water, as well as the reduction of waste and spoilage within our manufacturing plants. Our commitment extends beyond our walls and includes purchasing aluminum from Aluminum Stewardship Initiative (ASI) certified sustainable sources and reducing value chain emissions, all in order to facilitate the achievement of Ball and its customers’ sustainability targets.

Today’s consumers are increasingly choosing brands based on their sustainability credentials. Ball customers understand this growing priority and their unique position in impacting the environment, especially through the packaging materials they use. In addition, with growing packaging design regulations around the world, aluminum cans are well positioned to incur low compliance costs due to circularity credentials, such as favorable recycling rates and recycled content. As of 2023, Ball beverage cans contained 70 percent recycled content on average globally. Aluminum packaging unlocks the full potential of packaging to help customers convey their purpose to consumers, while limiting regulatory exposure. We are committed to moving toward a truly circular economy, where materials can be, and actually are, used again and again.

Aluminum cans, bottles and cups are an attractive option for sustainability-conscious brands with commitments to real world recyclability and increasing their usage of recycled materials in consumer packaging. Aluminum containers are designed to be recycled without losing quality and retain a high economic value, pushing aluminum collection, sorting and recycling rates to the highest of any beverage packaging material. That is why 75 percent of all aluminum ever produced is still in use today.

At a global 71 percent recycling rate with low yield losses and high product-to-product recycling loops, aluminum beverage packaging is the leader not only in recycling, but in circularity. Because recycling aluminum saves resources and uses significantly less energy than primary aluminum production, we are innovating and collaborating with our customers, supply chain, industry groups and other public and private partners to establish and financially support initiatives to increase recycling rates around the world. We work together to create effective collection and recycling systems, and educate consumers about the sustainability and circularity benefits of aluminum packaging.

At Ball, we believe our people and our culture enable our success and make it possible for us to deliver on our promises to customers, investors, communities and all of our stakeholders. We are working hard to create a culture and environment in which zero injuries become the reality, so everyone working for or within Ball gets home safe and healthy to their families and friends every day. We continue to invest in hiring, training and retaining our employees at every level across the organization to ensure we have the right people with the right skills in the right roles, and are providing them with opportunities to advance their careers. This includes a global Belonging, Inclusion and Diversity (BI&D) strategy, which ensures we have a sustainable workforce, and foster a safe and inclusive work environment where everyone feels they belong and are valued for their differences and contributions. A focus on BI&D among individuals and teams helps to unleash ideas and fuel innovation, driving growth and economic value throughout our global organization.

A healthy and sustainable business also depends on thriving communities. Ball’s commitment to the communities where we live and operate is an integral part of our corporate culture, as we continue to support organizations, programs and civic initiatives that advance sustainable livelihoods. Community engagement is how our company and our employees enrich the places where we live and work beyond providing jobs, benefits and paying local taxes. Through the Ball Foundation, corporate giving, employee giving and volunteerism, we invest in the future of the communities that sustain us. Each year Ball and its employees donate, volunteer and support non-profit organizations centered on building sustainable communities through recycling, education, and disaster preparedness and relief initiatives.

The company’s focus towards sustainability has been recognized by external organizations. For the seventh year in a row, Ball received an A- score in CDP’s climate change program. In addition, Ball earned a MSCI AAA ESG rating,

5

received a Gold Medal in recognition of overall sustainability achievements through EcoVadis and was recognized as one of America’s Most Responsible Companies by Newsweek.

Human Capital and Employees

Ball Corporation’s people are its greatest asset and we are proud to outline the material aspects of our human capital program. At the end of 2024, the company and its subsidiaries employed approximately 16,000 employees, including approximately 5,000 employees in the U.S. Details of collective bargaining agreements are included within Item 1A, Risk Factors of this annual report.

Our Culture

Embracing our rich 145-year history, we are a company that respects and values each of our employees and their collective desire to deliver value to all our stakeholders. We embrace our diversity and are “one Ball” in valuing:

| ● | Leading with integrity; |

| ● | Working to create an enduring impact; and |

| ● | Winning through our customer focus |

Belonging, Inclusion & Diversity

At Ball, fostering a workplace where every employee feels valued and empowered to contribute their best work has been an essential part of our success. Since 2015, we have had a dedicated focus on inclusion, recognizing that a diverse workforce enhances innovation, collaboration, and business outcomes. In 2024, we expanded this focus to include Belonging, reinforcing our commitment to creating an environment where all employees feel respected, connected, and supported in their professional growth.

Our Global Inclusion Council, sponsored by our Chief Executive Officer and Chief Human Resources Officer, serves as a platform for collaboration and alignment on key Belonging, Inclusion & Diversity (BI&D) priorities. Our leaders across all business segments are committed to cultivating a workplace where every employee can thrive. We remain committed to furthering our efforts in ensuring a highly qualified workforce – diverse and non-diverse, reinforcing our belief that an inclusive and engaged workforce drives long-term business success.

Our approach to BI&D is integrated into our broader talent and business strategy. We prioritize fostering an inclusive culture, ensuring equitable access to opportunities, and supporting a workplace that reflects the diverse perspectives of the communities where we operate.

Talent

Attracting, developing and retaining top talent is essential to our success. Over the past decade, we have expanded our talent management organization with dedicated acquisition and development functions, implementing rigorous hiring processes and standardized assessments to align with our cultural values and strategic goals.

Embedded in our approach is the “Inspire, Connect, Achieve” leadership framework, which defines clear behaviors for people leaders to drive performance and cultural alignment. We have also strengthened succession planning through a holistic strategy that combines challenging assignments, formal development plans and professional coaching to build a strong pipeline of future leaders.

These efforts ensure we maintain a high-performing, engaged workforce ready to achieve our long-term objectives.

6

Training and Development

We are committed to fostering a culture of continuous learning and development, equipping our employees with the skills and resources needed to thrive in a rapidly evolving business environment. To complement this, our performance enablement approach prioritizes employee growth and continuous improvement. The performance enablement methodology encourages regular, meaningful performance conversations between managers and employees, while actively mitigating bias and fostering a fair and enriching developmental experience. These efforts enhance the data available for talent discussions and decision-making.

We believe that investing in our employees’ growth is essential to driving both individual and organizational success, which is why we provide comprehensive resources to support learning and development at all levels:

| ● | Ball Academy Platform: A seamless and unified learning experience designed to help employees thrive, grow and achieve their fullest potential. |

| ● | Leadership Development Programs: Tailored programs for leaders at all levels that blend theoretical knowledge with practical application. |

| ● | LinkedIn Learning Access: Available to all employees for self-paced learning and skill enhancement. |

| ● | Professional Coaching: Personalized development opportunities through a partnership with a global coaching firm. |

| ● | Educational Support: Tuition reimbursement and instructional programs for continuous learning. |

| ● | Leadership Communications: Monthly newsletters for leaders addressing timely topics such as team wellbeing, managing change, setting goals, improving team performance, fostering belonging and inclusion and sharing effective leadership practices. |

| ● | Compliance Training: Annual training on compliance, antitrust, bribery, corruption and our business code of conduct for key management, sales and supply chain personnel. |

These initiatives reflect our commitment to investing in our employees’ development, enhancing their skills and cultivating a culture of continuous learning and growth.

Employee Engagement

In 2024, Ball Corporation faced a year of transformation, introducing a new operating model and brand identity. Amid these changes, the company prioritized keeping employees informed and engaged, underscoring its commitment to fostering trust and unity across the organization.

An employee engagement survey conducted in October 2024 demonstrated the resilience of Ball's workforce. With an impressive global response rate of 81 percent, the survey revealed strong alignment with the company’s vision and values. Employees expressed pride in being part of Ball and confidence in its future. Engagement levels remained robust, with scores exceeding or meeting industry norms in key areas, including overall engagement and inclusion and belonging.

Insights from the employee engagement survey are guiding Ball's efforts to develop action plans that address employee feedback and build on the company’s strengths. As Ball looks to 2025, the focus remains on driving higher engagement and advancing team effectiveness to sustain a culture of collaboration and innovation.

Total Rewards

Our global total rewards philosophy enables business performance by offering comprehensive total rewards that attract, retain and motivate our employees and promote their overall wellbeing. In addition, our competitive pay positioning strategy allows employees to share in business success and be rewarded through a variety of compensation opportunities reflective of their individual potential and contributions. Base pay is positioned in a competitive range of the applicable market median in each jurisdiction, differentiated based on skills, knowledge and experience, and designed to attract and retain the best talent. Beginning in 2025, we have introduced a common enterprise-wide approach for enabling individual performance and delivering competitive incentive rewards, which are key to advancing our business and strengthening our One Ball winning culture. Our short-term incentive plan for salaried employees will reward individual

7

performance as well as company performance, thereby encouraging a high-performing culture. Long-term incentives for our most senior employees aid retention and provide a longer-term focus on key business metrics. We also have programs which provide additional opportunity for, and retention of, our employees who show the highest potential to develop into future leaders.

Health, Safety and Wellbeing

The health, safety and wellbeing of all employees is a top priority at Ball. Our environmental, health and safety function and our operations executives partner to consistently reinforce policies and procedures that are designed to reduce workplace risks and ensure safe methods of plant production, including through regular training and reporting on injuries and lost-time incidents. We sponsor a variety of health and wellbeing programs designed to support all aspects of our employees’ wellbeing, including their physical, emotional, social and financial health. In addition, the Employee Assistance Program provides employees and their families access to mental health, stress management and other support resources essential to navigating life changes and challenges.

Additional information on our human capital programs can be found in the Ball Corporation Combined Annual and Sustainability Report, which is available at www.ball.com/sustainability.

Our Reportable Segments

On February 16, 2024, the company completed the divestiture of its aerospace business. The transaction represents a strategic shift; therefore, the company’s consolidated financial statements reflect the aerospace business’ financial results as discontinued operations for all periods presented. The aerospace business was historically presented as a reportable segment. Effective as of the first quarter of 2024, the company reports its financial performance in the three reportable segments outlined below: (1) beverage packaging, North and Central America; (2) beverage packaging, Europe, Middle East and Africa (beverage packaging, EMEA) and (3) beverage packaging, South America. Ball also has investments in the U.S., Guatemala, Panama and Vietnam that are accounted for using the equity method of accounting and, accordingly, those results are not included in segment sales or earnings. Additional financial information related to each of our segments is included in Item 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations, and in Note 3 to the consolidated financial statements within Item 8 of this Annual Report on Form 10-K (annual report).

Beverage Packaging, North and Central America, Segment

Beverage packaging, North and Central America, is Ball’s largest segment, accounting for 48 percent of consolidated net sales in 2024. Aluminum beverage containers are primarily sold under multi-year supply contracts to fillers of carbonated soft drinks, beer, energy drinks and other beverages.

Aluminum beverage containers and ends are produced at 16 manufacturing facilities in the U.S., one in Canada and two in Mexico. The beverage packaging, North and Central America, segment also includes interests in three investments that are accounted for using the equity method. Ball permanently ceased production at its aluminum beverage can manufacturing facility in Kent, Washington in the first quarter of 2024.

According to publicly available information and company estimates, the North American aluminum beverage container industry represents approximately 138 billion units. Five companies manufacture substantially all of the aluminum beverage containers in the U.S., Canada and Mexico. Ball, the largest producer in the region, shipped approximately 48 billion aluminum beverage containers in North and Central America in 2024, which represented approximately 34 percent of the aggregate shipments in these countries. Historically, sales volumes of metal beverage containers in North America tend to be highest during the period from April through September. All of the beverage containers produced by Ball in the U.S., Canada and Mexico are made of aluminum. In North and Central America, a diverse base of more than six global suppliers provide almost all of our aluminum can and end sheet requirements.

Beverage containers are sold based on price, quality, service, innovation and sustainability in a highly competitive market, which is relatively capital intensive and characterized by facilities that run more or less continuously in order to operate profitably. In addition, the aluminum beverage container competes aggressively with other packaging materials which include meaningful industry positions by the glass bottle in the packaged beer industry and the polyethylene terephthalate (PET) bottle in the carbonated soft drink and water industries.

8

We limit our exposure to changes in the cost of aluminum as a result of the inclusion of provisions in most of our aluminum beverage container sales contracts to pass-through aluminum price changes, as well as through the use of derivative instruments.

Beverage Packaging, EMEA, Segment

The beverage packaging, EMEA, segment accounted for 29 percent of Ball’s consolidated net sales in 2024. Our EMEA region operations include 19 facilities throughout Europe and one facility each in Cairo, Egypt, and Manisa, Turkey. In the third quarter of 2022, Ball completed the sale of its aluminum beverage packaging business located in Russia, which included three aluminum beverage can manufacturing facilities. For the countries in which we currently operate, the aluminum beverage container market is approximately 93 billion containers, and we are the largest producer with an estimated 39 percent of shipments in this region. The markets served by our beverage packaging, EMEA, segment, including Egypt and Turkey, are highly regional in terms of sales growth rates and packaging mix. Four companies manufacture substantially all of the metal beverage containers in EMEA. Our EMEA beverage facilities, shipped 36 billion aluminum beverage containers in 2024.

Historically, sales volumes of metal beverage containers in EMEA tend to be highest during the period from May through August, with a smaller increase in demand leading up to the winter holiday season in the U.K. Much like in other parts of the world, the aluminum beverage container competes aggressively with other packaging materials used by the beer and carbonated soft drink industries. The glass bottle is heavily utilized in the packaged beer industry, while the PET container is utilized in the carbonated soft drink, beer, juice and water industries. These trends are evolving, however, as customers, regulators and non-governmental organizations continue to press for more sustainable packaging in the wake of the global pollution crisis. More and more brands are choosing aluminum beverage packaging because of its closed-loop recyclability and other sustainability credentials. Using a new calculation implemented by the European Union (EU) in 2022, the overall recycling rate for aluminum beverage cans in the EU, U.K., Switzerland, Norway and Iceland was approximately 75 percent in 2022.

Raw material supply contracts in this region generally have longer term agreements. Five global aluminum suppliers provide almost all of our aluminum can and end sheet requirements. The company minimizes its exchange rate risk using derivative and supply contracts in local currencies. We limit our exposure to changes in the cost of aluminum as a result of the inclusion of provisions in most of our aluminum beverage container sales contracts to pass-through aluminum price changes, as well as through the use of derivative instruments.

Beverage Packaging, South America, Segment

The beverage packaging, South America, segment accounted for 17 percent of Ball’s consolidated net sales in 2024. Our operations consist of 12 facilities—9 in Brazil and one each in Argentina, Chile and Paraguay. For the countries where we operate, the South American aluminum beverage container market is approximately 43 billion containers, and we are the largest producer in this region with an estimated 45 percent of South American shipments in 2024. Four companies currently manufacture substantially all of the aluminum beverage containers in the regions served by our beverage packaging, South America, segment. The company’s South American beverage facilities shipped approximately 19 billion aluminum beverage containers in 2024.

Historically, sales volumes of beverage containers in South America tend to be highest during the period from September through December. In South America, two global suppliers provide virtually all our aluminum can and end sheet requirements with certain requirements also being imported from Asia.

We limit our exposure to changes in the cost of aluminum as a result of the inclusion of provisions in most of our aluminum beverage container sales contracts to pass-through aluminum price changes, as well as through the use of derivative instruments.

9

Other

Other consists of a non-reportable operating segment (beverage packaging, other) that manufactures and sells aluminum beverage containers in India, Saudi Arabia and Myanmar; a non-reportable operating segment that manufactures and sells extruded aluminum aerosol containers and recloseable aluminum bottles across multiple consumer categories as well as aluminum slugs (personal & home care, formerly aerosol packaging) throughout North America, South America, Europe, and Asia; a non-reportable operating segment that manufactures and sells aluminum cups (aluminum cups); undistributed corporate expenses; and intercompany eliminations and other business activities.

Beverage Packaging, Other

Our aluminum beverage packaging operations in the beverage packaging, other, segment consist of four facilities – two in India and one each in Saudi Arabia and Myanmar. Our aluminum can and end sheet requirements are provided by several suppliers. Our manufacturing facility in Saudi Arabia, Ball United Arab Can Manufacturing Company, is an investment 51 percent owned by Ball and consolidated in our results. In November 2024, the company entered into an agreement to sell 41 percent of its share in Ball United Arab Can Manufacturing Company, which will trigger deconsolidation upon closing of the transaction. See Note 4 for further details. Additionally, Ball has ownership interests in an equity method investment in Vietnam.

Personal & Home Care

Our personal & home care (PHC) operations manufacture and sell extruded aluminum aerosol containers, recloseable aluminum bottles across multiple consumer categories, and aluminum slugs, which represented less than 5 percent of Ball’s consolidated net sales in 2024. There are 10 manufacturing facilities that manufacture these products – six in Europe and one each in Canada, Brazil, Mexico and India. Included within the PHC facility count are facilities in Lummen, Belgium and Llinars del Vallés, Spain that the company acquired in late-October 2024 through the acquisition of the entire share capital of Alucan Entec, S.A. See Note 4 for further details regarding this acquisition. The PHC market in which we operate shipped approximately 8.2 billion units in 2024 and we are one of the major producers in this market with shipments of 1.5 billion aluminum PHC containers, representing approximately 19 percent of total shipments in the market. Our aluminum PHC requirements are provided by several suppliers.

Aluminum Cups

At December 31, 2024, the assets and liabilities of the aluminum cups operating segment are presented as current assets held for sale and current liabilities held for sale on the consolidated balance sheet. See Note 4 for further details.

Patents

In the opinion of the company’s management, none of our active patents or groups of patents is material to the successful operation of our business as a whole. We manage our intellectual property portfolio to obtain the durations necessary to achieve our business objectives.

Research and Development

Research and development (R&D) efforts are primarily directed toward packaging innovation, specifically the development of new features, sizes, shapes and types of containers, as well as new uses for existing containers. Other R&D efforts seek to improve manufacturing efficiencies and the overall sustainability of our products. Our R&D activities are primarily conducted in a technical center located in Westminster, Colorado.

Where to Find More Information

Ball Corporation is subject to the reporting and other information requirements of the Securities Exchange Act of 1934, as amended (Exchange Act). Reports and other information filed with the Securities and Exchange Commission (SEC) pursuant to the Exchange Act may be inspected and copied at the public reference facility maintained by the SEC in Washington, D.C. The SEC maintains a website at www.sec.gov containing our reports, proxy materials and other items. The company also maintains a website at www.ball.com/investors on which it provides a link to access Ball’s SEC reports free of charge, under the link “Financial Results.”

10

The company has established written Ball Corporation Corporate Governance Guidelines; a Ball Corporation Executive Officers and Board of Directors Business Ethics Statement; a Business Ethics Code of Conduct; and charters for its Audit Committee, Nominating/Corporate Governance Committee, Human Resources Committee and Finance Committee. These documents are available on the company’s website at www.ball.com/investors, under the link “Governance.” A copy may also be obtained upon request from the company’s corporate secretary. The company’s Combined Annual and Sustainability Report is available at www.ball.com/sustainability.

The company will post on its website the nature of any amendments to the company’s codes of ethics that apply to executive officers and directors, including the chief executive officer, chief financial officer and controller, and the nature of any waiver or implied waiver from any code of ethics granted by the company to any executive officer or director. These postings will appear on the company’s website at www.ball.com/investors, under the link “Governance.”

Nothing on our website, including postings to the “Governance” and “Financial Results” pages, or the Ball Corporation Combined Annual and Sustainability Report, or sections thereof, shall be deemed incorporated by reference into this annual report.

Item 1A. Risk Factors

Any of the following risks could materially and adversely affect our business, results of operations, cash flows and financial condition.

General Risks

If we do not effectively manage change and growth, our business could be adversely affected.

Our future revenue and operating results will depend on our ability to effectively manage the anticipated growth of our business. We have experienced fluctuations in the growth in demand for our products and services in recent years and are rebalancing our operations, managing our headcount, and developing new and innovative product offerings to balance our supply positions with our customers’ requirements in each region. These circumstances have placed significant demands on our management as well as our financial and operational resources, and present several challenges, including:

| ● | rebalancing manufacturing capacity, maintaining quality and optimizing production; |

| ● | identifying, attracting and retaining qualified personnel; |

| ● | developing and retaining our global sales, marketing and administrative infrastructure and capabilities; |

| ● | increasing our regulatory compliance capabilities, particularly in new lines of business; |

| ● | optimizing our expertise in a number of disciplines, including marketing, licensing, and merchandising; and |

| ● | implementing appropriate operational, financial and IT systems and internal controls. |

Our business, operating results and financial condition are subject to particular risks in certain regions of the world.

We may experience an operating loss in one or more regions of the world for one or more periods, which could have a material adverse effect on our business, operating results or financial condition. Moreover, overcapacity, which often leads to lower prices, may develop over time in certain regions in which we operate even if demand continues to grow. More generally, supply and demand fluctuations could make it difficult for us to forecast and meet certain customers’ needs. Our ability to manage such operational fluctuations and to maintain adequate long-term strategies in the face of such developments will be critical to our continued growth and profitability.

The loss of a key customer, or a reduction in its requirements, could have a significant negative impact on our sales.

We sell a majority of our packaging products to a relatively limited number of major beverage, personal care and household product companies, some of which operate in multiple geographical markets we serve.

Although the majority of our customer contracts are long-term, these contracts, unless they are renewed, expire in accordance with their respective terms and are terminable under certain circumstances, such as our failure to meet quality, volume or market pricing requirements. Because we depend on a relatively limited number of major customers, our business, financial condition or results of operations could be adversely affected by the loss of any of these

11

customers, a reduction in the purchasing levels of these customers, a strike or work stoppage by a significant number of these customers’ employees or an adverse change in the terms of the supply agreements with these customers.

We have a significant level of debt that could have important consequences for our business and any investment in our securities.

The company had $5.69 billion of interest-bearing debt at December 31, 2024. Such indebtedness could have significant consequences for our business and any investment in our securities, including:

| ● | increasing our vulnerability to adverse economic, industry or competitive developments; |

| ● | requiring more of our cash flows from operations to be dedicated to the payment of principal and interest on our indebtedness, thus limiting our cash flow available to fund our operations, capital expenditures and future business opportunities or the return of cash to our shareholders; |

| ● | restricting us from making additional acquisitions; |

| ● | limiting our ability to obtain additional financing for working capital, capital expenditures, product development, debt service requirements, acquisitions and general corporate or other purposes; and |

| ● | limiting our flexibility in planning for, or reacting to, changes in our business or market conditions and placing us at a competitive disadvantage compared to our competitors who may be less leveraged and who, therefore, may be able to take advantage of opportunities that our leverage prevents us from exploiting. |

We face competitive risks from many sources that may negatively impact our profitability.

Competition within the packaging industry is intense. Increases in productivity, combined with potential surplus capacity, have maintained competitive pricing pressures. The principal methods of competition in the general packaging industry are price, innovation, sustainability, service and quality. Some of our competitors may have greater financial, technical and marketing resources, and some may currently have excess capacity. Our current or potential competitors may offer products at a lower price or products that are deemed superior to ours. The global economic environment has resulted in reductions in demand for our products in some instances, which, in turn, could increase these competitive pressures.

We are subject to competition from alternative products, which could result in lower profits and reduced cash flows.

Our aluminum packaging products are subject to significant competition from substitute products, particularly plastic carbonated soft drink bottles made from PET, single serve and returnable beer bottles and other beverage containers made of glass, cardboard or other materials. Competition from plastic carbonated soft drink bottles is particularly intense in the U.S. and Europe, and there is competition from glass beer bottles in Brazil. There can be no assurance that our products will successfully compete against alternative products, which could result in a reduction in our profits or cash flows.

Our packaging businesses have a narrow product range, and our business would suffer if usage of our products decreased or if decreases occur in the demand for the beverages and other goods filled in our products.

The majority of our consolidated net sales were from the sale of beverage containers, and we expect to derive a significant portion of our future revenues and cash flows from the sale of beverage containers. Our business would suffer if the use of beverage containers decreased. Accordingly, broad acceptance by consumers of aluminum containers for a wide variety of beverages is critical to our future success. If demand for glass and PET bottles increases relative to aluminum containers, or the demand for aluminum containers does not develop as expected, our business, results of operations, cash flows and financial condition could be materially adversely affected.

12

Our business, financial condition, cash flows and results of operations are subject to risks resulting from broader geographic operations.

We derived approximately 54 percent of our consolidated net sales from outside of the U.S. for the year ended December 31, 2024. The sizeable scope of operations inside and outside of the U.S. may lead to more volatile financial results and make it more difficult for us to manage our business. Reasons for this include, but are not limited to, the following:

| ● | political and economic instability; |

| ● | governments’ restrictive trade policies; |

| ● | the imposition or rescission of duties, tariffs, taxes or government royalties; |

| ● | exchange rate risks; |

| ● | inflation of direct input costs; |

| ● | virus and disease outbreaks and responses thereto; and |

| ● | difficulties in enforcement of contractual obligations and intellectual property rights. |

We are exposed to exchange rate fluctuations.

The company’s financial results are exposed to currency exchange rate fluctuations and a significant proportion of assets, liabilities and earnings are denominated in non-U.S. dollar currencies. The company presents its financial statements in U.S. dollars and has a significant proportion of its net assets, debt and income in non-U.S. dollar currencies, primarily the euro, as well as the currencies of Argentina, Egypt, Turkey and other emerging markets. The company’s financial results and capital ratios are therefore sensitive to movements in currency exchange rates.

We manage our exposure to currency fluctuations, particularly our exposure to fluctuations in the euro to U.S. dollar exchange rate to attempt to mitigate the effect of cash flow and earnings volatility associated with exchange rate changes. We primarily use derivative instruments to manage our currency exposures and, as a result, we experience gains and losses on these derivative positions, which are offset by the impact of currency fluctuations on existing assets and liabilities.

We are vulnerable to fluctuations and disruptions in the supply and price of raw materials.

We purchase aluminum and other raw materials and packaging supplies, including dunnage, from several sources. While all such materials and supplies are available from independent suppliers, they are subject to fluctuations in price and availability attributable to a number of factors, including general economic conditions, commodity price fluctuations (particularly aluminum on the London Metal Exchange), the demand by other industries for the same raw materials and the availability of complementary and substitute materials. Although we enter into commodities purchase agreements from time to time and sometimes use derivative instruments to seek to manage our risk, we cannot ensure that our current suppliers of raw materials will be able to supply us with sufficient quantities at reasonable prices. Economic, financial, and operational factors, including strikes or labor shortages, as well as governmental action, could impact our suppliers, thereby causing supply shortages. Increases in raw material costs, including potential increases due to tariffs, sanctions, or other trade actions, could have a material adverse effect on our business, financial condition or results of operations. Global supply chain disruptions can negatively impact our results. In the Americas, Europe and Asia, some contracts do not allow us to pass along increased raw material costs and we generally use derivative agreements to seek to manage this risk. Our hedging procedures may be insufficient and our results could be materially impacted if costs of materials increase. Due to the fixed-price contracts, increased prices could decrease our sales volume over time. The delayed timing in recovering the pass-through of increasing raw material costs may also impact our short-term profitability and certain costs due to price increases or supply chain inefficiencies may be unrecoverable, which would also impact our profitability.

13

Net earnings and net assets could be materially affected by an impairment of goodwill.

We have a significant amount of goodwill recorded on our consolidated balance sheet as of December 31, 2024. We are required at least annually to test the recoverability of goodwill. The recoverability test of goodwill is based on the current fair value of our identified reporting units. Fair value measurement requires assumptions and estimates of many critical factors, including revenue and market growth, operating cash flows and discount rates. If general market conditions deteriorate in portions of our business, we could experience a significant decline in the fair value of our reporting units. This decline could lead to an impairment of all or a significant portion of the goodwill balance, which could materially affect our U.S. GAAP net earnings and net assets.

If the investments in Ball’s pension plans, or in the multi-employer pension plans in which Ball participates, do not perform as expected, we may have to contribute additional amounts to the plans, which would otherwise be available for other general corporate purposes.

Ball maintains defined benefit pension plans covering a significant portion of its current and former employees in the United States, which are funded based on certain actuarial assumptions. The plans’ assets consist primarily of common stocks, fixed-income securities and alternative investments. Market declines, longevity increases or legislative changes, such as the Pension Protection Act in the U.S., could result in a prospective decrease in our available cash flow and net earnings over time, and the recognition of an increase in our pension obligations could result in a reduction to our shareholders’ equity. Additional risks exist related to the company’s participation in multi-employer pension plans. Assets contributed to a multi-employer pension plan by one employer may be used to provide benefits to employees of other participating employers. If a participating employer in a multi-employer pension plan stops contributing to the plan, the unfunded obligations of the plan may be borne by the remaining participants. This could result in increases to our contributions to the plans as well as pension expense.

Restricted access to capital markets could adversely affect our short-term liquidity and prevent us from fulfilling our obligations under the notes issued pursuant to our bond indentures.

A reduction in global market liquidity could:

| ● | restrict our ability to fund working capital, capital expenditures and other business activities; |

| ● | increase our vulnerability to general adverse economic and industry conditions, including the credit risks stemming from the economic environment; |

| ● | limit our flexibility in planning for, or reacting to, changes in our businesses and the industries in which we operate; |

| ● | restrict us from making strategic acquisitions or exploiting business opportunities; and |

| ● | limit, along with the financial and other restrictive covenants in our debt, among other things, our ability to borrow additional funds, dispose of assets, pay cash dividends or refinance debt maturities. |

If market interest rates increase, our variable-rate debt and any need to refinance debt will create higher debt service requirements, which adversely affects our cash flows. While we sometimes enter into agreements limiting our exposure, any such agreements may not offer complete protection from this risk.

14

The global credit, financial and economic environment could have a negative impact on our results of operations, financial position or cash flows.

The overall credit, financial and economic environment could have significant negative effects on our operations, including:

| ● | the creditworthiness of customers, suppliers and counterparties could deteriorate resulting in a financial loss or a disruption in our supply of raw materials; |

| ● | volatile market performance could affect the fair value of our pension assets, potentially requiring us to make significant additional contributions to our defined benefit pension plans to maintain prescribed funding levels; |

| ● | a significant weakening of our financial position or operating results could result in noncompliance with our debt covenants; and |

| ● | reduced cash flows from our operations could adversely affect our ability to execute our long-term strategy to repurchase our stock and invest in our businesses. |

Changes in U.S. generally accepted accounting principles (U.S. GAAP) and SEC rules and regulations could materially impact our reported results.

U.S. GAAP and SEC accounting and reporting changes are common. These changes could have significant effects on our reported results when compared to prior periods and other companies and may even require us to retrospectively adjust prior periods. Additionally, material changes to the presentation of transactions in the consolidated financial statements could impact key ratios that investors, analysts and credit rating agencies use to assess or rate Ball’s performance and could ultimately impact our ability to access the credit markets in an efficient manner.

A material weakness in our internal control over financial reporting could, if not remediated, result in material misstatements in our financial statements.

Management is responsible for establishing and maintaining adequate internal control over financial reporting, as defined in Rule 13a-15(f) under the Securities Exchange Act. A material weakness is defined as a deficiency, or combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of annual or interim financial statements will not be prevented or detected on a timely basis. If a material weakness is identified, management could conclude that internal control over financial reporting is not effective based on criteria set forth by the Committee of Sponsoring Organization of the Treadway Commission in “Internal Control—An Integrated Framework (2013).” If a material weakness is identified, a remediation plan would be designed to address the material weakness. If remedial measures are insufficient to address the material weakness, or if additional material weaknesses in internal control are discovered or occur in the future, our consolidated financial statements may contain material misstatements and we could be required to restate our financial results. As of December 31, 2024, the company had no material weaknesses.

We face risks related to health epidemics, pandemics and other outbreaks, which could adversely affect our business.

Health epidemics, pandemics and other outbreaks could give rise to circumstances that cause one or more of the following risk factors to occur:

| ● | We could lose key customers, customers could become insolvent or have a reduction in demand for our products and services; |

| ● | We could be subject to changes in laws and governmental regulations that adversely affect our business and operations; |

| ● | We could be subject to adverse fluctuations in currency exchange rates; |

| ● | We might lose key management and operating personnel; |

| ● | We may be subject to disruptions in the supply or price of our raw materials; |

| ● | We may face prolonged work stoppages at our facilities; |

| ● | We may be impacted by government budget constraints or government shutdowns; |

| ● | Our pension plan investments may not perform as expected, and we may be required to make additional contributions to our pension plans which would otherwise be available for other general corporate purposes; |

| ● | Our access to capital markets may be restricted, which could adversely affect our short-term liquidity and prevent us from fulfilling our obligations under the notes issued pursuant to our bond indentures; |

15

| ● | We may be subject to increased information technology (IT) security threats and reduced network access availability; |

| ● | Our operations and those of our principal customers and suppliers could be designated as non-essential in key markets; and |

| ● | A material weakness in our internal control over financial reporting or a material misstatement in our financial statements could occur. |

Governmental and regulatory risks

Changes in laws and governmental regulations may adversely affect our business and operations.

We and our customers and suppliers are subject to various federal, state, provincial and local laws and regulations, which have been increasing in number and complexity. Each of our, and their, facilities is subject to federal, state, provincial and local licensing and regulation by health, environmental, workplace safety and other agencies in multiple jurisdictions. Requirements of worldwide governmental authorities with respect to manufacturing, manufacturing facility locations within the jurisdiction, product content and safety, climate change, workplace safety and health, environmental, expropriation of assets and other standards could adversely affect our ability to manufacture or sell our products, and the ability of our customers and suppliers to manufacture and sell their products. In addition, we face risks arising from compliance with and enforcement of numerous and complex federal, state, provincial and local laws and regulations.

Enacted regulatory developments regarding the reporting and use of “conflict minerals” mined from the Democratic Republic of the Congo and adjoining countries could affect the sourcing, availability and price of minerals used in the manufacture of certain of our products. As a result, there may only be a limited pool of suppliers who provide conflict-free materials, and we cannot give assurance that we will be able to obtain such products in sufficient quantities or at competitive prices. Also, because our supply chains are complex, we may face reputational challenges with our customers and other stakeholders if we are unable to sufficiently verify the origins of all materials used in the products that we sell. The compliance and reporting aspects of these regulations may result in incremental costs to the company.

While deposit systems and other container-related legislation have been adopted in some jurisdictions, similar legislation has been defeated in public referenda and legislative bodies in many others. We anticipate that continuing efforts will be made to consider and adopt such legislation in the future. The packages we produce are widely used and perform well in U.S. states, Canadian provinces and European countries that have deposit systems, as well as in other countries worldwide.

Environmental, social and governance reporting requirements and other legislation and regulatory requirements exist and are also evolving. The compliance costs associated with current and proposed laws and potential regulations could be substantial, and any failure or alleged failure to comply with these laws or regulations could lead to litigation or governmental action, all of which could adversely affect our financial condition or results of operations.

Our business faces the potential of increased regulation on some of the raw materials utilized in our packaging operations.

Our operations are subject to federal, state, provincial and local laws and regulations in multiple jurisdictions relating to some of the raw materials, including epoxy-based coatings utilized in our container making process. Epoxy-based coatings may contain Bisphenol-A (BPA). Scientific evidence evaluated by regulatory agencies in the U.S., Canada, Europe, Japan, Australia and New Zealand has consistently shown these coatings to be safe for food contact at current levels, and these regulatory agencies have stated that human exposure to BPA from epoxy-based container coatings is well below safe exposure limits set by government bodies worldwide. A significant change in these regulatory agency statements, adverse information concerning BPA or other chemicals present in our coatings, or rulings made within certain federal, state, provincial and local jurisdictions could have a material adverse effect on our business, financial condition or results of operations. Ball recognizes that significant interest exists in non-epoxy based coatings, and we have been proactively working with coatings suppliers and our customers to transition to alternative coatings. In addition, various U.S. states have passed or are contemplating legislation restricting, and the EU is reviewing a proposal to restrict, the use of materials that contain intentionally added per- and polyfluoroalkyl substances (PFAS), which may require the company to continue to incur costs to convert existing coatings to accommodate PFAS-free coatings. To mitigate these risks, the Company is working with its suppliers to require them to remove PFAS-containing coatings from our products.

16

Earnings and cash flows can be impacted by changes in tax laws.

As a U.S.-based multinational business, the company is subject to income tax in the U.S. and numerous jurisdictions outside the U.S., as well as recent OECD, European Commission and other trans-national initiatives that seek to impose minimum tax thresholds on most multi-national companies. The relevant tax rules and regulations are complex, often changing and, in some cases, are interdependent. If these or other tax rules and regulations should change, the company’s earnings and cash flows could be impacted.

The company’s worldwide provision for income taxes is determined, in part, through the use of significant estimates and judgments. Numerous transactions arise in the ordinary course of business where the ultimate tax determination is uncertain. The company undergoes tax examinations by various worldwide tax authorities on a regular basis. While the company believes its estimates of its tax obligations are reasonable, the final outcome after the conclusion of any tax examinations and any litigation could be materially different from what has been reflected in the company’s historical financial statements.

Technological risks

Decreases in our ability to develop or apply new technology and know-how may affect our competitiveness.

Our success depends partially on our ability to improve production processes and services. We must also introduce new products and services to meet changing customer needs. If we are unable to implement better production processes or to develop new products through research and development or licensing of new technology, we may not be able to remain competitive with other manufacturers. As a result, our business, financial condition, cash flows or results of operations could be adversely affected.

Increased information technology (IT) security threats and more sophisticated and targeted computer crime could pose a risk to our systems, networks, products, solutions and services, as well as those of our suppliers and customers.

The company’s IT systems, or any third party’s system on which the company relies, as well as those of our suppliers and customers, could fail on their own accord or may be vulnerable to a variety of interruptions or shutdowns, including interruptions or shutdowns due to natural disasters, power outages or telecommunications failures, terrorist attacks or failures during the process of upgrading or replacing software or hardware. Increased global IT security threats and more sophisticated and targeted computer crime also pose a risk to the security of our systems and networks and the confidentiality, availability and integrity of our data, as well as to the security and data of our suppliers and customers. The company has a number of shared service centers where many of the company’s IT systems are concentrated and any disruption at such a location could impact the company’s business within the operating zones served by the impacted service center.

While we attempt to mitigate all of these risks to our networks, systems and data by employing a number of measures, including employee training, comprehensive monitoring of our networks and systems, and maintenance of backup and protective systems, our systems, networks, products, solutions and services remain potentially vulnerable to advanced persistent threats or other IT disruptions. Depending on their nature and scope, such threats could potentially lead to the compromise of confidential information, improper use of our systems and networks, manipulation and destruction of data, defective products, harm to individuals or property, contractual or regulatory actions and fines, penalties and potential liabilities, production downtimes and operational disruptions, which in turn could adversely affect our reputation, competitiveness and results of operations. Data privacy and protection laws are evolving and present increasing compliance challenges, which may increase our costs, affect our competitiveness and could expose us to substantial fines or other penalties.

Human capital risks

If we fail to retain key management and personnel, we may be unable to implement our key objectives.

We believe our future success depends, in part, on our experienced management team. Unforeseen losses of key members of our management team without appropriate succession and/or compensation planning could make it difficult for us to manage our business and meet our objectives.

17

Prolonged work stoppages at facilities with union employees could jeopardize our financial position.

As of December 31, 2024, 13 percent of our North American employees and 27 percent of our European employees were covered by collective bargaining agreements. These collective bargaining agreements have staggered expirations during the next several years. Although we consider our employee relations to be generally good, a prolonged work stoppage or strike at any facility with union employees could have a material adverse effect on our business, financial condition, cash flows or results of operations. In addition, we cannot ensure that upon the expiration of existing collective bargaining agreements, new agreements will be reached without union action or that any such new agreements will be on terms satisfactory to us.

Environmental risks

Adverse weather and climate changes may result in lower sales.

We manufacture packaging products primarily for beverages. Unseasonable weather can reduce demand for certain beverages packaged in our containers. Climate changes and the increasing frequency of severe weather events could have various effects on the demand for our products, our supply chain and the costs of inputs to our production and delivery of products in different regions around the world. Our plants’ production may be prevented or curtailed due to severe or unanticipated weather and climate events.

Our business is subject to substantial environmental remediation and compliance costs.

Our operations are subject to federal, state, provincial and local laws and regulations in multiple jurisdictions relating to environmental hazards, such as emissions to air, discharges to water, the handling and disposal of hazardous and solid wastes and the clean-up of hazardous substances. We have been designated, along with numerous other companies, as a potentially responsible party for the clean-up of several hazardous waste sites. Additionally, there is increased focus on the regulation of greenhouse gas emissions and other environmental issues worldwide. We strive to mitigate such risks related to environmental issues, including through the purchase of renewable energy, the adoption of sustainable practices, and by positioning ourselves as a sustainability leader in our industry.

Item 1B. Unresolved Staff Comments

There were no matters required to be reported under this item.

Item 1C. Cybersecurity

Risk management and strategy

Ball Corporation is committed to maintaining a strong cybersecurity posture.

The company employs a standards-based cybersecurity program aligned to the National Institute of Standards and Technology (NIST) Cybersecurity Framework (CSF), including ongoing assessment and continuous improvement to address the rapidly evolving threat landscape. Ball partners closely with a strong network of external partners, including conducting annual assessments of the cyber risk management program against the NIST CSF.

We continually refine our approach to address evolving cybersecurity regulations, identify potential and emerging security risks, and implement strategies to manage these risks. Ball has developed an incident response plan that includes a cyber incident materiality assessment with appropriate leadership governance. In addition, we have aligned our incident response plan with our enterprise risk and global crisis management processes.

In response to the ever-evolving cyber threat landscape, Ball utilizes external experts to support continuous improvement across our cyber program, processes and operations. Our collaboration with these third-parties includes regular audits,

18

threat assessments, and consultation on cyber enhancements. In addition, we also augment and extend our cyber team using a select partners that are integrated as members of our global operations. This provides us with expanded global threat intel and enhances our ability to deliver continuous global cyber operations 24/7.

We are aware that there are potential cybersecurity risks associated with third-party service providers. Prior to engaging with third-party providers, Ball conducts thorough security assessments. We monitor for third-party cyber incidents and manage any third-party cyber incidents under our incident response plan and processes. Our oversight of third-party cyber risk aids our ability to lessen and mitigate impacts related to data breaches and other security incidents originating from third-parties.

Ball faces risks from cybersecurity threats that could have a material adverse effect on the company, including its business strategy, results of operations, financial condition and reputation. Refer to Item 1A, Risk Factors – Technological Risks, for additional details on cybersecurity risks that could potentially materially affect the company, including its business strategy, results of operations, financial condition and reputation.

Governance

Ball’s Chief Information Security Director (CISD) reports to the Senior Vice President and Chief Information Officer (CIO) and leads the company’s cybersecurity team.

Item 2. Properties

The company’s properties described below are well maintained, and management considers them to be adequate and utilized for their intended purposes.

Ball’s corporate headquarters are located in Westminster, Colorado, U.S. Ball’s manufacturing locations, which are owned or leased by the company, are set forth below. Facilities in the process of being constructed, or that have permanently ceased production, have been excluded from the list. In addition to the facilities listed, the company leases other warehousing space.

Beverage packaging, North and Central America, locations:

| ● | Bowling Green, Kentucky |

| ● | Conroe, Texas |

| ● | Fairfield, California |

| ● | Findlay, Ohio |

| ● | Fort Atkinson, Wisconsin |

| ● | Fort Worth, Texas |

| ● | Glendale, Arizona |

| ● | Golden, Colorado |

| ● | Goodyear, Arizona |

| ● | Kapolei, Hawaii |

| ● | Monterrey, Mexico |

| ● | Monticello, Indiana |

| ● | Pittston, Pennsylvania |

19

| ● | Queretaro, Mexico |

| ● | Rome, Georgia |

| ● | Saratoga Springs, New York |

| ● | Tampa, Florida |

| ● | Whitby, Ontario, Canada |

| ● | Williamsburg, Virginia |

Beverage packaging, EMEA, locations:

| ● | Belgrade, Serbia |

| ● | Bierne, France |

| ● | Cabanillas del Campo, Spain |

| ● | Cairo, Egypt |

| ● | Ejpovice, Czech Republic |

| ● | Fosie, Sweden |

| ● | Fredericia, Denmark |

| ● | Gelsenkirchen, Germany |

| ● | Kettering, United Kingdom |

| ● | La Selva, Spain |

| ● | Lublin, Poland |

| ● | Ludesch, Austria |

| ● | Manisa, Turkey |

| ● | Mantsala, Finland |

| ● | Milton Keynes, United Kingdom |

| ● | Mont, France |

| ● | Nogara, Italy |

| ● | Pilsen, Czech Republic |

| ● | Wakefield, United Kingdom |

| ● | Waterford, Ireland |

| ● | Widnau, Switzerland |

Beverage packaging, South America, locations:

| ● | Aguas Claras, Brazil |

| ● | Asuncion, Paraguay |

| ● | Brasilia, Brazil |

| ● | Buenos Aires, Argentina |

| ● | Extrema, Brazil |

| ● | Frutal, Brazil |

| ● | Jacarei, Sao Paulo, Brazil |

| ● | Manaus, Brazil |

| ● | Pouso Alegre, Brazil |

| ● | Recife, Brazil |

| ● | Santiago, Chile |

| ● | Tres Rios, Rio de Janeiro, Brazil |

Beverage packaging, Other, locations:

| ● | Dammam, Saudi Arabia (presented as held for sale as of December 31, 2024 on the consolidated balance sheet) |

| ● | Mumbai, India |

| ● | Sri City, India |

| ● | Yangon, Myanmar |

20

Personal & home care locations:

| ● | Ahmedabad, India (presented as held for sale as of December 31, 2024 on the consolidated balance sheet) |

| ● | Beaurepaire, France |

| ● | Bellegarde, France |

| ● | Devizes, United Kingdom |

| ● | Itupeva, Brazil |

| ● | Llinars del Vallés, Spain |

| ● | Lummen, Belgium |

| ● | San Luis Potosí, Mexico |

| ● | Sherbrooke, Quebec, Canada |

| ● | Velim, Czech Republic |

Aluminum cups location:

| ● | Rome, Georgia (presented as held for sale as of December 31, 2024 on the consolidated balance sheet) |

Item 3. Legal Proceedings

Details of the company’s legal proceedings are included in Note 22 to the consolidated financial statements within Item 8 of this annual report.

Item 4. Mine Safety Disclosures

Not applicable.

Part II.

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Ball Corporation common stock is listed for trading on the New York Stock Exchange under the ticker symbol BALL. There were 8,354 common shareholders of record on February 18, 2025.

Common Stock Repurchases

The following table summarizes the company’s repurchases of its common stock during the fourth quarter of 2024.

Purchases of Securities | |||||||||

($ in millions) |

|

Total Number of Shares Purchased (a) |

|

Average Price Paid per Share |

|

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs (a) |

|

Maximum Number of Shares that May Yet Be Purchased Under the Plans or Programs (b) |

|

October 1 to October 31, 2024 |

1,893,489 |

$ |

66.04 |

1,893,489 |

27,117,752 |

||||

November 1 to November 30, 2024 |

3,865,124 |

61.50 |

3,865,124 |

23,252,628 |

|||||

December 1 to December 31, 2024 |

4,972,167 |

58.32 |

4,972,167 |

18,280,461 |

|||||

Total |

10,730,780 |

10,730,780 |

|||||||

(a) |

Includes any open market purchases (on a trade-date basis), share repurchase agreements and/or shares retained by the company to settle employee withholding tax liabilities. |

(b) |

On April 24, 2024, Ball’s Board of Directors approved the repurchase by the company of up to a total of 40 million shares of its common stock. This repurchase authorization replaced all previous authorizations. On January 29, 2025, the Board of Directors approved the repurchase by the company of up to a total of $4.00 billion in shares of its common stock. This repurchase authorization replaced the April 24, 2024, authorization. |

21

Shareholder Return Performance

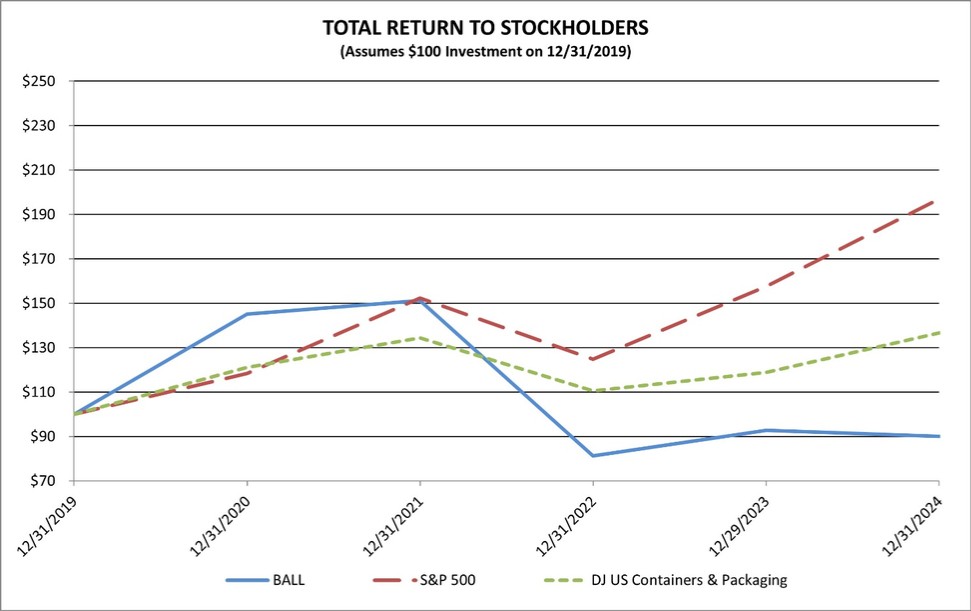

The line graph below compares the annual percentage change in Ball Corporation’s cumulative total shareholder return on its common stock with the cumulative total return of the Dow Jones Containers & Packaging Index and the S&P Composite 500 Stock Index for the five-year period ended December 31, 2024. The graph assumes $100 was invested on December 31, 2019, and that all dividends were reinvested. The Dow Jones Containers & Packaging Index total return has been weighted by market capitalization.

Total Return Analysis

12/31/2019 |

12/31/2020 |

12/31/2021 |

12/31/2022 |

12/31/2023 |

12/31/2024 |

|||||||||||||

BALL |

$ |

100.00 |

$ |

145.19 |

$ |

151.18 |

$ |

81.29 |

$ |

92.79 |

$ |

90.04 |

||||||

S&P 500 |

100.00 |

118.40 |

152.39 |

124.79 |

157.59 |

197.02 |

||||||||||||

DJ US Containers & Packaging |

100.00 |

121.14 |

134.41 |

110.49 |

118.91 |

136.67 |

||||||||||||

Source: Bloomberg

Item 6. [Reserved]

Removing and reserving Item 6 of Part II.

22

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations