EX-10.7

Published on February 22, 2019

Exhibit 10.7

COMPANY CONFIDENTIAL

BALL CORPORATION

ECONOMIC VALUE ADDED

INCENTIVE COMPENSATION PLAN

|

|

|

|

|

Updated April 26, 2016 |

|

|

|

Replaces August 11, 2011 |

|

|

COMPANY CONFIDENTIAL

BALL CORPORATION

ECONOMIC VALUE ADDED

INCENTIVE COMPENSATION PLAN

1. Statement of Purpose

The purpose of the Ball Corporation (the "Company") Economic Value Added Incentive Compensation Plan (the "Plan") is to produce sustained shareholder value improvement by establishing a direct link between Economic Value Added ("EVA") and annual short-term incentive compensation payments.

2. Administration of the Plan

The Committee of management of the Company (the “EVA Committee”)shall be the administrator of the Plan, with oversight and governance by the Human Resources Committee of the Board of Directors (the “HR Committee”). The HR Committee shall have full power to formulate additional regulations and make interpretations for carrying out the Plan. The HR Committee shall also be empowered to make any and all of the determinations not herein specifically authorized which may be necessary or desirable for the effective administration of the Plan. Any decision or interpretation of any provision of this Plan adopted by the HR Committee shall be final and conclusive. The Corporate Compensation Department is responsible for executing the administration of the Plan.

3. Eligibility

Eligibility to participate is limited to employees in locations and positions approved by the EVA Committee or in the case of an Officer of the Company by the HR Committee.

4. Targets

4.1. Establishment of Target Incentive Percent - At the time a Participant commences participation in the Plan, there shall be established for each Participant a Target Incentive Percent. The Target Incentive Percent for such Participant for any future Year(s) may be increased, decreased or left unchanged from the prior Year. Following the end of each Year, the Target Incentive Percent for that Year will be multiplied by the Base Salary of such Participant for that Year to arrive at the Target Incentive Amount for such Participant. The Target Incentive Amount will then be multiplied by the Performance Factor for that Year to arrive at the amount of the Award, if any, and the amount of adjustment to the Participant's Bank balance, if any.

|

Updated April 26, 2016 |

1 |

|

|

Effective January 1, 1994 |

|

|

|

Replaces August 11, 2011 |

|

|

COMPANY CONFIDENTIAL

4.2. Establishment of Target EVA - For any one Year, Target EVA shall equal the sum of (i) the prior year's Target EVA and (ii) one-half (1/2) the amount of the prior year's Incremental EVA.

Adjustments to the Target EVA (as computed above) may be made, with the approval of the HR Committee due to changes in the composition of the Participating Units, or for other reasons at the discretion of the HR Committee.

5. Calculation of Performance Factors, Awards, Banks, and Distributions

5.1. Calculation of the Performance Factor

a. If Incremental EVA (i.e., Actual EVA less Target EVA) is positive, the Performance Factor is determined as follows:

|

Performance Factor = |

1+ |

Incremental EVA |

|

|

Positive Leverage Factor |

b. If Incremental EVA is zero (0), the Performance Factor is 1.00.

c. If Incremental EVA is negative, the Performance Factor is determined as follows:

|

Performance Factor = |

1- |

Incremental EVA |

|

|

Negative Leverage Factor |

5.2. Calculation of Participant's Award - The Performance Factor will be multiplied by the Participant's Target Incentive Amount to arrive at each Participant's Award for the Year.

If a Participant has multiple Participation Bases, the Performance Factor for each Participation Basis will be determined separately and accumulated to compute the Participant's total Award.

Except with the prior approval of the HR Committee, the total Award for a Participating Unit may not exceed one-third (1/3) of Positive Incremental EVA generated by that Unit, computed before consideration of such Awards. The Leverage Factor of the Participating Unit will be amended if the total Award of the Unit exceeds one-third (1/3).

5.3. Determination of Distributions,Bank Balances and Distribution Date - To encourage sustained improvements to EVA, there are cases when earned incentive will be deferred and credited to a Participant's Bank balance. Correspondingly, to ensure accountability for performance in

|

Updated April 26, 2016 |

2 |

|

|

Effective January 1, 1994 |

|

|

|

Replaces August 11, 2011 |

|

|

COMPANY CONFIDENTIAL

down periods, there are cases when a negative Bank balance will be created for a Participant. Appendix A sets out the Plan distribution rules.

The distribution date shall be once each year and no later than March 15 of the year following the year for which an Award was calculated.

The formulas and examples of Determination of Distributions and Bank Balances are contained in Appendix A and B and are incorporated by reference herein and form a part of the Plan.

5.4. De Minimis Bank Balances - If after determination of the Distribution for the Year, the Bank balance is positive but less than Ten Thousand Dollars ($10,000.00) or equivalent in the Participant’s local currency using the most recent calendar year-end foreign exchange rate, then such balance will be added to the Distribution for the Year, and the Bank balance will thereby be brought to zero.

5.5. Calculation of Award Distributions When a Participant has Multiple Participation Bases - In the event a Participant has multiple Participation Bases for a Year, then Awards, Banks, Performance Factors and Target Incentive Amounts shall be calculated separately and independently for each Participation Basis.

Bank balances shall be maintained separately for each Participation Basis. A Bank Balance from one Participation Basis may not be offset against a Bank balance of another Participation Basis.

5.6. Changes in Participation Basis - In the event a Participant experiences a change in Participation Basis during a Year, then Awards, Banks, Performance Factors and Target Incentive Amounts shall be calculated separately and independently for each Participation Basis of such Participant using those portions of the Participant's Base Salary actually paid for service while included in each separate Participation Basis.

Bank balances shall be maintained separately for each Participation Basis.

5.7. Changes in Target Incentive Percent - In the event a Participant experiences a change in Target Incentive Percent without experiencing a change in Participation Basis during a Year, then Award calculations and Bank adjustments will be made separately using those portions of the Participant's Base Salary actually paid for service while participating at each separate Target Incentive Percent.

Separate Bank accounts shall not be maintained because of changes in a Participant's Target Incentive Percent.

5.8. Qualification of Distributions for Other Plans - Distributions from the Plan to active Participants shall qualify as incentive payments for the purpose

|

Updated April 26, 2016 |

3 |

|

|

Effective January 1, 1994 |

|

|

|

Replaces August 11, 2011 |

|

|

COMPANY CONFIDENTIAL

of any deferred compensation plan(s) maintained by the Company, and as such, may be deferred by Participants eligible to defer under the terms and conditions of such plan(s). Such eligibility for deferral is not automatic and shall only be as authorized for eligible employees under the rules of such plan(s). Notwithstanding anything to the contrary in such plan(s), no portion of any Award or any Bank, prior to actual Distribution, shall qualify for the purposes of deferral under the terms and conditions of such plan(s).

6. Leverage Factors

6.1. Establishment of Positive Leverage Factor - The Positive Leverage Factor is determined by the EVA Committee, with the approval of the HR Committee. The determination of the Positive Leverage Factor considers a number of judgmental factors including, but not limited to, the volatility of earnings and the capital invested in each Participating Unit and the Total Incentive Amount for all Participants in each Participating Unit.

It is anticipated that changes to the Positive Leverage Factor will not be made often. Circumstances which may warrant a change in the Positive Leverage factor include significant changes which affect the Participating Unit, including a change in the composition of the Participating Unit, permanent changes in market conditions, and acquisitions and/or divestitures.

6.2. Establishment of Negative Leverage Factor - The Negative Leverage Factor is equal to the Positive Leverage Factor multiplied by a factor of two (2.0).

7. Distributions Following Termination

7.1. Eligibility - A Participant who terminates employment prior to the Distribution Date of a Year shall not be eligible for any Distribution for such Year or any future Distributions, unless such termination is by reason of Retirement, Death or Disability. Regardless of Retirement status, any Participant whose employment terminates for cause shall not be eligible to receive any Distributions. In cases involving location closures or reduction in force programs, the EVA Committee may approve an exception to these eligibility guidelines and pro-rate as needed for time of service.

7.2. Distributions for the Year of Retirement, Death or Disability - Distributions for a Participant for the Year of such Participant's termination of employment by reason of Retirement, Death or Disability shall be on the same basis as for all other Participants and pro-rated as needed for time of service.

|

Updated April 26, 2016 |

4 |

|

|

Effective January 1, 1994 |

|

|

|

Replaces August 11, 2011 |

|

|

COMPANY CONFIDENTIAL

Complete Distribution of Bank(s) of Participants who have experienced a termination of employment by reason of Retirement, Death or Disability shall be accomplished no later than the normal Distribution Date following the Year of such termination by reason of Retirement, Death or Disability.

7.3. Obligation for Negative Bank Balances - If, after the Distribution made for the Year of Retirement, Death or Disability, the Participant's Bank balance is negative, then such Bank balance will be eliminated without further obligation of the Participant to the Company. Participants who terminate for reasons other than Retirement, Death or Disability and at the time of termination have a negative Bank balance will have no obligation to the Company related to the negative Bank balance.

8. Beneficiary Designation

The Participant shall have the right, at any time and from time to time, to designate and/or change or cancel any person/persons or entity as to his Beneficiary (both principal and contingent) to whom Distribution under this Plan shall be made in the event of such Participant's death prior to a Distribution. Any Beneficiary change or cancellation shall become effective only when filed in writing with the Corporate Compensation Department during the Participant's lifetime on a form provided by or otherwise acceptable to the Company. In locations where there is a mandatory line of succession, payment will be made in accordance with local law.

The filing of a new Beneficiary designation form will cancel all Beneficiary designations previously filed. Any finalized divorce of a Participant subsequent to the date of filing of a Beneficiary designation form shall revoke any prior designation of the divorced spouse as a Beneficiary. The spouse of a Participant domiciled in a community property jurisdiction shall be required to join in any designation of Beneficiary other than the spouse in order for the Beneficiary designation to be effective.

If a Participant fails to designate a Beneficiary as provided above, or, if such Beneficiary designation is revoked by divorce, or otherwise, without execution of a new designation, or if all designated Beneficiaries predecease the Participant, then the Distribution shall be made to the Participant's estate.

9. Miscellaneous

9.1. Unsecured General Creditor - Participants and their beneficiaries, heirs, successors and assigns shall have no legal or equitable rights, interests, or other claim in any property or assets of the Employer. Any and all assets shall remain general, unpledged, unrestricted assets of the Employer. The Company's obligation under the Plan shall be that of an unfunded and unsecured promise to pay money in the future, and there shall be no obligation to establish any fund, any security or any

|

Updated April 26, 2016 |

5 |

|

|

Effective January 1, 1994 |

|

|

|

Replaces August 11, 2011 |

|

|

COMPANY CONFIDENTIAL

otherwise restricted asset, in order to provide for the payment of amounts under the Plan.

9.2. Obligations To The Employer - If a Participant becomes entitled to a Distribution under the Plan, and, if, at the time of the Distribution, such Participant has outstanding any debt, obligation or other liability representing an amount owed to the Employer, then the Employer may offset such amounts owing to it or any affiliate against the amount of any Distribution. Such determination shall be made by the EVA Committee. Any election by the EVA Committee not to reduce any Distribution shall not constitute a waiver of any claim for any outstanding debt, obligation, or other liability representing an amount owed to the Employer.

9.3. Nonassignability - Neither a Participant nor any other person shall have any right to commute, sell, assign, transfer, pledge, anticipate, mortgage or otherwise encumber, transfer, hypothecate or convey in advance of actual receipt the amounts, if any, payable hereunder, or any part thereof, which are, and all rights to which are, expressly declared to be unassignable and nontransferable. No part of an Award and/or Bank, prior to actual Distribution, shall be subject to seizure or sequestration for the payment of any debts, judgments, alimony or separate maintenance owed by a Participant or any other person, nor shall it be transferable by operation of law in the event of the Participant's or any other person's bankruptcy or insolvency.

9.4. Taxes: Withholding - To the extent required by law, the Company shall withhold from all cash Distributions made, any amount required to be withheld by the federal, state, provincial or local government.

9.5. No Right to Continued Employment or Participation - Nothing contained in this Plan, nor any action taken hereunder, shall be construed as a contract of employment or as giving any Eligible Employee, Participant or former Participant any right to be retained in the employ of the Employer. Participation is discretionary and is not a contractual right. Designation as an Eligible Employee or as a Participant is on a year-by-year basis and may or may not be renewed for any employment years not yet commenced.

9.6. Applicable Law - This Plan shall be governed and construed in accordance with the laws of the State of Indiana, or if not possible, in accordance with applicable local laws.

9.7. Validity - In the event any provision of the Plan is held invalid, void, or unenforceable, the same shall not affect, in any respect whatsoever, the validity of any other provision of the Plan.

9.8. Notice - Any notice or filing required or permitted to be given to the HR Committee shall be sufficient if in writing and hand delivered, or sent by

|

Updated April 26, 2016 |

6 |

|

|

Effective January 1, 1994 |

|

|

|

Replaces August 11, 2011 |

|

|

COMPANY CONFIDENTIAL

registered or certified mail, to the principal office of the Company, directed to the attention of the President and CEO of the Company. Such notice shall be deemed given as of the date of delivery or, if delivery is made by mail, as of the date shown on the postmark on the receipt for registration or certification.

10. Amendment and Termination of the Plan

10.1. Amendment - The HR Committee may at any time amend the Plan in whole or in part provided, however, that no amendment shall be effective to affect the Participant's right to designate a beneficiary.

10.2. Termination of the Plan

a. Employer's Right to Terminate. The HR Committee may at any time terminate the Plan as to prospective earning of Awards, if it determines in good faith that the continuation of the Plan is not in the best interest of the Company and its shareholders. No such termination of the Plan shall reduce any Distribution already made.

b. Payments Upon Termination of the Plan. Upon any termination of the Plan under this Section, Awards for future years shall not be made. With respect to the Year in which such termination takes place, the employer will pay to each Participant the Participant's Award for such Year or partial Year, no later than March 15 in the calendar year following the year of termination of the Plan. Bank Distributions shall be made in their entirety to the Participants no later than March 15 in the calendar year following the year of termination of the Plan.

11. Definitions

11.1. Award - "Award" means the dollar amount (positive or negative) which results from the multiplication of the Participant's Target Incentive Amount for the Year, by the Performance Factor for the same Year.

11.2. Bank - "Bank" means a dollar amount account that maintains the balance of unpaid positive and negative Awards earned in accordance with the terms and conditions of the Plan. Bank balances are maintained by Participant, and the Company does not transfer cash into such Bank accounts. The Bank accounts exist only as bookkeeping records to evidence the Company's obligation to pay these amounts in accordance with Plan requirements. (See Appendix A for bank rules.)

|

Updated April 26, 2016 |

7 |

|

|

Effective January 1, 1994 |

|

|

|

Replaces August 11, 2011 |

|

|

COMPANY CONFIDENTIAL

No interest is charged or credited on amounts in the Bank. Participants are never vested in amounts in the Bank, and such amounts are not earned until the respective Distribution Date.

11.3. Base Salary - "Base Salary" means the Participant's actual base salary earnings paid during the Year, excluding incentive payments, salary continuation, and other payments which are not, in the sole determination of the EVA Committee, actual base salary.

11.4. Beneficiary - "Beneficiary" means the person or persons designated as such in accordance with Section 8.

11.5. Disability - "Disability" means a bodily injury or disease, as determined by the Company, that totally and continuously prevents the Participant, for at least six (6) consecutive months, from engaging in an "occupation" for pay or profit. During the first twenty-four (24) months of total disability, "occupation" means the Participant's regular occupation. After that period, "occupation" means any occupation for which the Participant is reasonably fitted, based upon the Participant's education, training or experience as determined by the Compnay.

11.6. Distribution - "Distribution" means the payment of incentive compensation in cash or bank balance adjustment(s).

11.7. Distribution Date - "Distribution Date" means the date on which the Employer makes Distributions. The Distribution Date shall be once each Year and no later than March 15 of the Year following the Year for which an Award was calculated.

11.8. Economic Value Added - "Economic Value Added" ("EVA") is a measure of corporate performance. EVA is computed by subtracting a charge for the use of invested capital from Net Operating Profit After Tax.

EVA = Net Operating Profit After Tax less (Invested Capital X

Required Rate of Return on Capital)

11.9. Effective Date - "Effective Date" means the date on which the Plan commences.

11.10. Eligible Employee - "Eligible Employee" means an employee who is in a location and position approved for participation by the EVA Committee or in the case of an Officer of the Company by the HR Committee.

11.11. Employer - "Employer" (also referred to as the "Company") means Ball Corporation and its wholly owned subsidiaries.

11.12. EVA Committee - "EVA Committee" is a Committee of the management of the Company that consists of the Chief Executive Officer, Chief Financial Officer,the senior most Human Resources position of the

|

Updated April 26, 2016 |

8 |

|

|

Effective January 1, 1994 |

|

|

|

Replaces August 11, 2011 |

|

|

COMPANY CONFIDENTIAL

Company and other key positions as determined by the Chief Executive Officer.

11.13. Incremental EVA - "Incremental EVA" is the difference (positive or negative) between the year's Target EVA and actual EVA.

11.14. Invested Capital - "Invested Capital" means total assets less non-interest bearing current liabilities. Average Invested Capital for the year represents the average of twelve month-end amounts.

11.15. HR Committee - "HR Committee" means the HR Committee of the Board of Directors.

11.16. Negative Leverage Factor - "Negative Leverage Factor" means that amount of negative Incremental EVA required to obtain a Performance Factor of zero (0).

11.17. Net Operating Profit After Tax - "Net Operating Profit After Tax" (also referred to as "NOPAT") means operating income before financing costs and income taxes reduced by income taxes which are computed by applying a statistical tax rate appropriate to the jurisdiction(s) in which the Company or Participating Unit operates.

11.18. Participant - "Participant" means an Eligible Employee in the Plan. Designation as a Participant must be renewed annually.

11.19. Participating Unit - "Participating Unit" means an organization within the Company or a wholly owned subsidiary for which EVA Targets are established.

11.20. Participation Basis - "Participation Basis" means the Company or Participating Unit or combination of Participating Units and/or Company upon whose performance the Performance Factor for the Year is calculated for a Participant.

11.21. Performance Factor - "Performance Factor" means that number described in Section 5.1 and which is multiplied by a Participant's Target Incentive Amount to arrive at such Participant's Award.

11.22. Plan - "Plan" means this Economic Value Added Incentive Compensation Plan.

11.23. Positive Leverage Factor - "Positive Leverage Factor" means that amount of positive Incremental EVA required to obtain a Performance Factor of two (2.0).

|

Updated April 26, 2016 |

9 |

|

|

Effective January 1, 1994 |

|

|

|

Replaces August 11, 2011 |

|

|

COMPANY CONFIDENTIAL

11.24. Retirement - "Retirement" means termination of employment by a Participant for whatever reason other than Death or Disability after attainment of age and service years which, when combined, equals or exceeds seventy (70), subject to a minimum age of fifty-five (55). This definition of Retirement is subject to any existing or additional statutory requirements or prescribed definition of retirement as set forth by local laws in jurisdictions where the Plan is to be implemented and which would take precedence., A Participant who has experienced a Retirement as defined herein shall be termed a "Retiree."

11.25. Target EVA - "Target EVA" means that amount of EVA (positive or negative) which, if attained, produces a Performance Factor of one (1.000).

11.26. Target Incentive Amount - "Target Incentive Amount" means that dollar amount determined by multiplying the Participant's Base Salary by such Participant's Target Incentive Percent.

11.27. Target Incentive Percent - "Target Incentive Percent" means that percent of Base Salary which is established by management, consistent with the guidelines approved by the EVA Committee or in the case of an Officer of the Company by the HR Committee, as being the percent of Base Salary to be paid to the Participant if Target EVA is achieved.

11.28. Year - "Year" means the calendar year in respect of which performance is measured under the Plan.

|

Updated April 26, 2016 |

10 |

|

|

Effective January 1, 1994 |

|

|

|

Replaces August 11, 2011 |

|

|

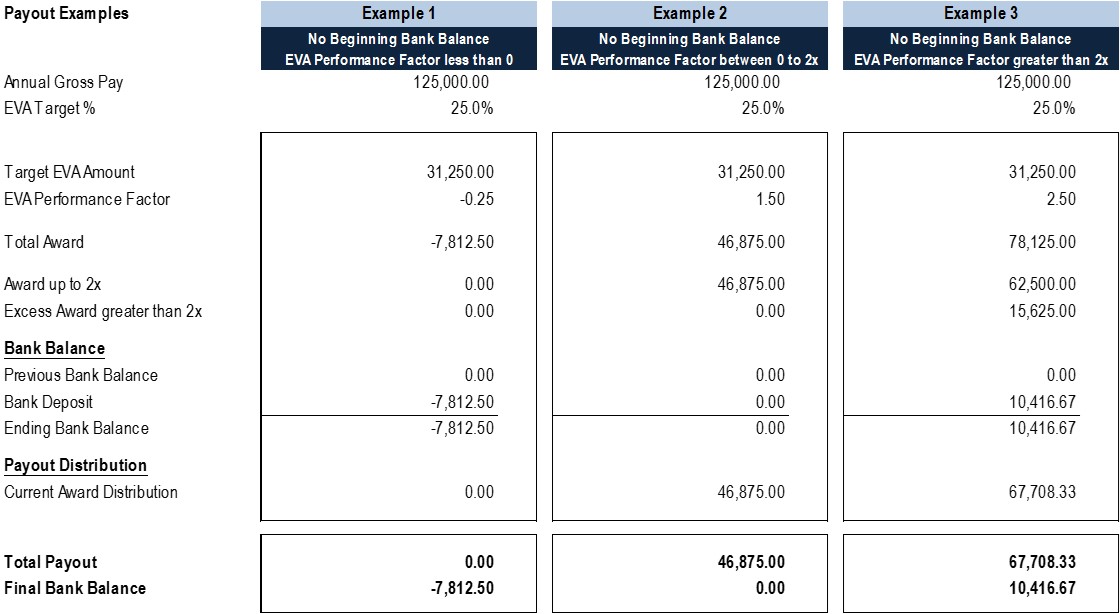

Appendix A

Determination of Distributions

and Bank Balances

|

Beginning Bank |

Performance |

Distribution |

Change in Bank |

Example |

|

Zero |

Negative |

Zero. |

Negative balance equal to the negative Award. |

1 |

|

Zero |

Zero – 2x |

100% of Award. |

No change. |

2 |

|

Zero |

> 2x |

100% of Award up to 2x, plus 1/3 of Award in excess of 2x. |

Positive balance equal to 2/3 of the Award in excess of 2x. |

3 |

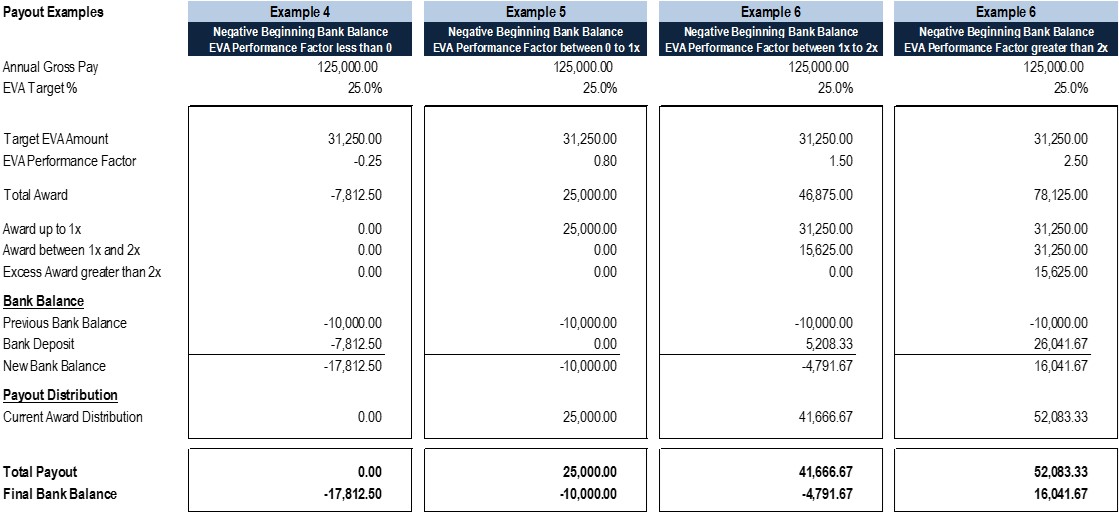

|

Negative |

Negative |

Zero. |

Negative balance increased by the negative award. |

4 |

|

Negative |

Zero – 1x |

100% of Award. |

No change. |

5 |

|

Negative |

1x – 2x |

100% of Award less 1/3 of Award above 1x until the negative bank is eliminated. |

Negative balance reduced by 1/3 of Award above 1x, until negative balance is eliminated. |

6 |

|

Negative |

> 2x |

100% of Award to 2x, less 1/3 of Award between 1x to 2x and, if needed to eliminate the negative bank, 100% of Award over 2x until negative balance is eliminated. |

Negative balance reduced by 1/3 of Award between 1x to 2x and, if needed to eliminate the negative bank, 100% of the Award over 2x until the negative balance is eliminated. If the negative balance is “repaid” , then the Distribution is capped at 2xand the remaining Award creates a positive bank. |

7 |

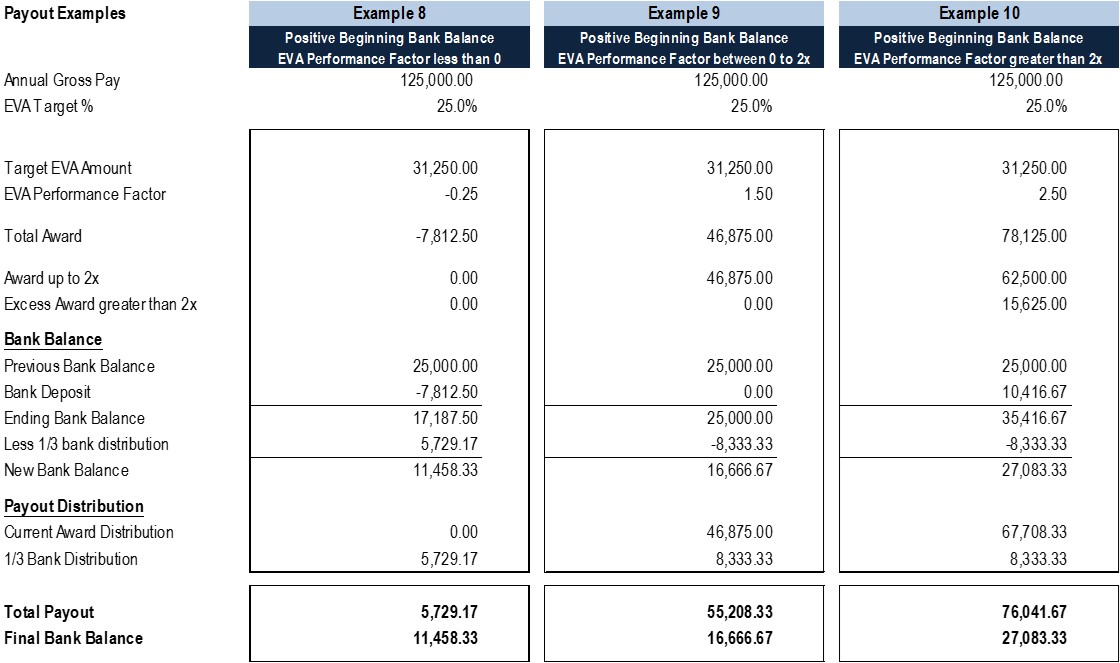

|

Positive |

Negative |

1/3 of bank balance after applying the current negative Award. If the negative Award exceeds the beginning bank balance, the Distribution is zero. |

The positive balance is reduced by the negative Award and any Distribution from the bank. |

8 |

|

Positive |

Zero – 2x |

100% of Award plus 1/3 of the beginning bank balance. |

The positive balance is reduced by the 1/3 of the beginning balance Distributed. |

9 |

|

Positive |

> 2x |

100% of Award up to 2x, plus 1/3 of Award in excess of 2x, plus 1/3 of the beginning bank balance. |

The positive balance is increased by 2/3 of the Award in excess of 2x and then reduced by 1/3 of the beginning bank balance Distributed. |

10 |

|

Effective January 1, 1994 |

|

|

|

Replaces July 9, 2008 |

|

|

Appendix B

Payout Examples

|

Effective January 1, 1994 |

|

|

|

Replaces July 9, 2008 |

|

|

Appendix B

Payout Examples

|

Effective January 1, 1994 |

|

|

|

Replaces July 9, 2008 |

|

|

Appendix B

Payout Examples

|

Effective January 1, 1994 |

|

|

|

Replaces July 9, 2008 |

|

|

Appendix B

Payout Examples

EXAMPLE CALCULATIONS

|

Effective January 1, 1994 |

|

|

|

Replaces July 9, 2008 |

|

|