10-K: Annual report pursuant to Section 13 and 15(d)

Published on February 22, 2013

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2012

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 1-7349

Ball Corporation

|

State of Indiana |

|

35-0160610 |

|

(State of other jurisdiction of |

|

(I.R.S. Employer |

|

Incorporation or organization) |

|

Identification No.) |

|

10 Longs Peak Drive, P.O. Box 5000 |

|

|

|

Broomfield, Colorado |

|

80021-2510 |

|

(Address of registrants principal executive office) |

|

(Zip Code) |

Registrants telephone number, including area code: (303) 469-3131

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Name of each exchange on which registered |

|

Common Stock, without par value |

|

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES x NO o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES o NO x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months. YES x NO o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrants knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of accelerated filer and large accelerated filer in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer x |

|

Accelerated filer o |

|

|

|

|

|

Non-accelerated filer o |

|

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YES o NO x

The aggregate market value of voting stock held by non-affiliates of the registrant was $6.4 billion based upon the closing market price and common shares outstanding as of July 1, 2012.

Number of shares and rights outstanding as of the latest practicable date.

|

Class |

|

Outstanding at February 15, 2013 |

|

Common Stock, without par value Preferred Stock Purchase Right |

|

149,437,900 shares 74,718,950 rights |

DOCUMENTS INCORPORATED BY REFERENCE

1. Proxy statement to be filed with the Commission within 120 days after December 31, 2012, to the extent indicated in Part III.

Ball Corporation and Subsidiaries

ANNUAL REPORT ON FORM 10-K

For the year ended December 31, 2012

Ball Corporation and its consolidated subsidiaries (Ball, we, the company or our) is one of the worlds leading suppliers of metal packaging to the beverage, food, personal care and household products industries. The company was organized in 1880 and incorporated in the state of Indiana, United States of America (U.S.), in 1922. Our packaging products are produced for a variety of end uses and are manufactured in facilities around the world. We also provide aerospace and other technologies and services to governmental and commercial customers within our aerospace and technologies segment. In 2012, our total consolidated net sales were $8.7 billion. Our packaging businesses were responsible for 90 percent of our net sales, with the remaining 10 percent contributed by our aerospace business.

Our largest product lines are aluminum and steel beverage containers. We also produce steel food containers and steel and aluminum containers for beverages, food, personal care and household products, as well as steel paint cans, decorative steel tins and aluminum slugs.

We sell our packaging products mainly to major beverage, food, personal care and household products companies with which we have developed long-term customer relationships. This is evidenced by our high customer retention and our large number of long-term supply contracts. While we have a diversified customer base, we sell a majority of our packaging products to relatively few major companies in North America, Europe, the Peoples Republic of China (PRC), Brazil, Mexico and Argentina, as do our equity joint ventures in the U.S. and Vietnam. Our significant customers include: Anheuser-Busch InBev n.v./s.a., Heineken N.V., MillerCoors LLC, PepsiCo Inc. and its affiliated bottlers, SABMiller plc, The Coca-Cola Company and its affiliated bottlers, and Unilever N.V.

Our aerospace business is a leader in the design, development and manufacture of innovative aerospace systems for civil, commercial and national security aerospace markets. It produces spacecraft, instruments and sensors, radio frequency systems and components, data exploitation solutions and a variety of advanced aerospace technologies and products that enable deep space missions.

We are headquartered in Broomfield, Colorado. Our stock is traded on the New York Stock Exchange under the ticker symbol BLL.

Our Strategy

Our overall business strategy is defined by our Drive for 10 vision, which at its highest level is a mindset around perfection, with a greater sense of urgency around our future success. Our Drive for 10 vision encompasses five strategic levers that are key to growing our businesses and achieving long-term success. These five levers are:

· Maximizing value in our existing businesses

· Expanding into new products and capabilities

· Aligning ourselves with the right customers and markets

· Broadening our geographic reach and

· Leveraging our know-how and technological expertise to provide a competitive advantage

We also maintain a clear and disciplined financial strategy focused on improving shareholder returns through:

· Delivering earnings per share growth of 10 percent to 15 percent per annum over the long-term

· Focusing on free cash flow generation

· Increasing Economic Value Added (EVA®) dollars

The cash generated by our businesses is used primarily: (1) to finance the companys operations, (2) to fund strategic capital investments, (3) to fund stock buy-back programs and dividend payments and (4) to service the companys debt. We will, when we believe it will benefit the company and our shareholders, make strategic acquisitions, enter into joint ventures or divest parts of our company. The compensation of many of our employees is tied directly to the companys performance through our EVA® incentive programs.

Our Reporting Segments

Ball Corporation reports its financial performance in four reportable segments: (1) metal beverage packaging, Americas and Asia; (2) metal beverage packaging, Europe; (3) metal food and household products packaging, Americas; and (4) aerospace and technologies. Ball also has investments in the U.S. and Vietnam which are accounted for using the equity method of accounting and, accordingly, those results are not included in segment sales or earnings. Financial information related to each of our segments is included in Note 2 to the consolidated financial statements within Item 8 of this Annual Report on Form 10-K (annual report).

Metal Beverage Packaging, Americas and Asia, Segment

Metal beverage packaging, Americas and Asia, is Balls largest segment, accounting for 52 percent of consolidated net sales in 2012. Metal beverage containers are primarily sold under multi-year supply contracts to fillers of carbonated soft drinks, beer, energy drinks and other beverages.

Americas

Metal beverage containers and ends are produced at 17 manufacturing facilities in the U.S., one in Canada and four in Brazil. Ends are produced within four of the U.S. facilities, including two facilities that manufacture only ends, and one facility in Brazil. Additionally, Rocky Mountain Metal Container, LLC, a 50-percent investment owned by Ball and MillerCoors LLC, operates metal beverage container and end manufacturing facilities in Golden, Colorado.

The North American metal beverage container manufacturing industry is relatively mature, and industry volumes for certain types of containers have declined over the past several years. Where growth or contractions are projected in certain markets or for certain products, Ball undertakes selected capacity increases or decreases in its existing facilities to meet market demand, which may include both permanent and temporary capacity realignment. Late in the second quarter of 2012, we were notified of a reduction in standard 12-ounce container requirements for a Beverage, Americas, customer, starting in January 2013. A meaningful portion of this reduction in volume will be offset with growing demand for specialty container volumes from new and existing customers. We expanded our Alumi-Tek® bottle production to our Golden, Colorado, facility, and expanded our specialty container capabilities in several of our facilities.

In August 2010, Ball acquired an additional 10.1 percent economic interest in its Brazilian metal beverage packaging joint venture, Latapack-Ball Embalagens Ltda. (Latapack-Ball), through a transaction with the joint venture partner, Latapack S.A. This transaction increased the companys overall economic interest in the joint venture to 60.1 percent and resulted in Ball becoming the primary beneficiary of the entity and, consequently, consolidating the joint venture. In February 2011, we announced plans to construct a new metal beverage container manufacturing facility in northeast Brazil, which is one of the fastest growing regions of the country. The new facility is located in Alagoinhas, Bahia, and began production in the first quarter of 2012 with the output from the first line contracted under a long-term agreement. In December 2012, we announced the construction of a second can line in Alagoinhas, which is expected to begin production in the second half of 2013.

According to publicly available information and company estimates, the combined Americas metal beverage container industry represents approximately 116 billion units. Five companies manufacture substantially all of the metal beverage containers in the U.S. and Canada and three companies manufacture substantially all such containers in Brazil. Two of these producers and three other independent producers also manufacture metal beverage containers in Mexico. Ball produced approximately 43 billion recyclable metal beverage containers in the Americas in 2012 about 37 percent of the aggregate production. Sales volumes of metal beverage containers in North America tend to be highest during the period from April through September while in Brazil, sales volumes tend to be highest from September through December. All of the beverage containers produced by Ball in the U.S., Canada and Brazil are made of aluminum, as are almost all beverage containers produced by our competitors in those countries. In 2012 we were able to recover substantially all aluminum-related cost increases levied by sheet producers through either financial or contractual means. In the metal beverage packaging, Americas, segment, six aluminum suppliers provide virtually all of our requirements.

Metal beverage containers are sold based on price, quality, service, innovation and sustainability in a highly competitive market, which is relatively capital intensive and is characterized by facilities that run more or less continuously in order to operate profitably. In addition, the metal beverage container competes aggressively with other packaging materials. The glass bottle has maintained a meaningful position in the packaged beer industry, while the polyethylene terephthalate (PET) container has grown significantly in the carbonated soft drink and water industries over the past quarter century.

We believe we have limited our exposure related to changes in the costs of aluminum ingot as a result of the inclusion of provisions in most metal beverage container sales contracts to pass through aluminum ingot price changes, as well as through the use of derivative instruments.

Asia

The metal beverage container market in the PRC is approximately 19 billion containers, of which Balls operations represented an estimated 28 percent in 2012. Our percentage of the industry makes us one of the largest manufacturers of metal beverage containers in the PRC, and we plan to prudently add capacity where necessary to continue to supply this growing market. Eight other manufacturers account for the remainder of the production. Our operations include the manufacture of aluminum containers and ends in five facilities in the PRC. We also manufacture and sell high-density plastic containers in two PRC facilities primarily servicing the motor oil industry.

In October 2011, we acquired our partners 60 percent interest in Qingdao M.C. Packaging Ltd. (QMCP), a joint venture metal beverage container facility in Qingdao, PRC. The facility was relocated and expanded in Qingdao, PRC, and began production in the second quarter of 2012. Additionally, in March 2011, we entered into a joint venture agreement with Thai Beverage Can Limited to construct a beverage container manufacturing facility in Vietnam that began production in the first quarter of 2012.

In June 2010, we acquired Guangdong Jianlibao Group Co., Ltds 65 percent interest in a joint venture metal beverage container and end facility (JFP) in Sanshui (Foshan), PRC. Ball had owned 35 percent of the joint venture facility since 1992.

We believe we have limited our exposure related to changes in the costs of aluminum ingot as a result of the inclusion of provisions in most metal beverage container sales contracts to pass through aluminum ingot price changes, as well as through the use of derivative instruments.

Metal Beverage Packaging, Europe, Segment

The European metal beverage container market, excluding Russia, is approximately 54 billion containers, and we are the second largest producer with an estimated 32 percent of European shipments. The European market is highly regional in terms of sales growth rates and packaging mix.

During the third quarter of 2012, we acquired Tubettificio Europeo S.p.A. (Tubettificio), a small regional manufacturer of metal beverage packaging containers in Italy and consolidated it into other existing facilities. In January 2011, Ball completed the acquisition of Aerocan S.A.S. (Aerocan), a leading European supplier of extruded aluminum aerosol containers, for 221.7 million ($295.2 million) in cash and assumed debt, which was net of $26.2 million of cash acquired. The acquisition of Aerocan has enabled Ball to expand into a new product category that is growing faster than other parts of our business, while aligning with a new customer base at returns that meet or exceed the companys cost of capital. See Note 3 to the consolidated financial statements within Item 8 of this annual report for further details.

The metal beverage packaging, Europe, segment, which accounted for 22 percent of Balls consolidated net sales in 2012, supplies two-piece metal beverage containers and ends for producers of carbonated soft drinks, beer, energy drinks and other beverages, as well as extruded aluminum aerosol containers and aluminum slugs. The European operations consist of 16 facilities 10 beverage container facilities, three extruded aluminum aerosol facilities, two beverage end facilities and one aluminum slug facility of which four are located in Germany, four in the United Kingdom, four in France and one each in the Netherlands, Poland, Serbia and the Czech Republic. In addition, Ball is currently renting additional space on the premises of a supplier in Haslach, Germany, in order to produce the Ball Resealable End (BRE). The European beverage facilities produced approximately 17 billion metal beverage containers in 2012, with approximately 57 percent of those being produced from aluminum and 43 percent from steel. Six of the beverage container facilities use aluminum and four use steel. The European aluminum aerosol facilities produced approximately 725 million aluminum aerosol containers in 2012.

Beginning in the first quarter of 2013, the European extruded aluminum packaging operations will be reflected in the metal food and household products packaging, Americas, segment.

Sales volumes of metal beverage containers in Europe tend to be highest during the period from May through August with a smaller increase in demand leading up to the winter holiday season in the United Kingdom. Much like other parts of the world, the metal beverage container competes aggressively with other packaging materials used by the European beer and carbonated soft drink industries. The glass bottle is heavily utilized in the packaged beer industry, while the PET container is utilized in the carbonated soft drink, beer, juice and water industries.

European raw material supply contracts are generally for a period of one year, although Ball has negotiated some longer term agreements. In Europe three steel suppliers and two aluminum suppliers provide 94 percent of our requirements. Aluminum is traded primarily in U.S. dollars, while the functional currencies of the European operations are non-U.S. dollars. The company generally tries to minimize the resulting exchange rate risk using derivative and supply contracts in local currencies. In addition, purchase and sales contracts generally include fixed price, floating and pass-through pricing arrangements.

Metal Food and Household Products Packaging, Americas, Segment

The metal food and household products packaging, Americas, segment, accounted for 16 percent of consolidated net sales in 2012. Ball produces two-piece and three-piece steel food containers and ends for packaging vegetables, fruit, soups, meat, seafood, nutritional products, pet food and other products. The segment also manufactures and sells aerosol, paint and general line containers, as well as decorative specialty containers, extruded aluminum aerosol containers and aluminum slugs. There are a total of 14 facilities in the U.S., one in Canada and one in Mexico, that produce these products. In addition, the company manufactures and sells steel aerosol containers in two facilities in Argentina.

Sales volumes of metal food containers in North America tend to be highest from May through October as a result of seasonal fruit, vegetable and salmon packs. We estimate our 2012 shipments of approximately 5 billion steel food containers to be approximately 17 percent of total U.S. and Canadian metal food container shipments. We estimate our aerosol business accounts for approximately 39 percent of total annual U.S. and Canadian steel aerosol shipments. In the U.S. and Canada, we are the leading supplier of aluminum slugs used in the production of extruded aluminum aerosol containers and estimate our percentage of the total industry shipments to be approximately 87 percent.

In December 2012, the company acquired Envases del Plata S.A. de C.V. (Envases), a leading producer of extruded aluminum aerosol packaging in Mexico with a single manufacturing facility in San Luis Potosí, for cash of $55.9 million, net of cash acquired, and assumed debt of $72.7 million. The facility produces extruded aluminum aerosol containers for personal care and household products for customers in North, Central and South America and employs approximately 150 people. The acquisition is expected to provide a platform to grow the companys existing North American extruded aluminum business, providing a new end market for the companys products, including the companys ReAlTM technology that enables the use of recycled material and meaningful lightweighting in the manufacture of extruded aluminum packaging.

Competitors in the metal food container product line include two national and a small number of regional suppliers and self manufacturers. Several producers in Mexico also manufacture steel food containers. Competition in the U.S. steel aerosol container market primarily includes three other national suppliers. Steel containers also compete with other packaging materials in the food and household products industry including glass, aluminum, plastic, paper and pouches. As a result, profitability for this product line is dependent on price, cost reduction, service and quality. In North America, three steel suppliers provide nearly 65 percent of our tinplate steel. We believe we have limited our exposure related to changes in the costs of steel tinplate and aluminum as a result of the inclusion of provisions in many sales contracts to pass through steel and aluminum cost changes and the existence of certain other steel container sales contracts that incorporate annually negotiated metal costs. In 2012, we were able to pass through the majority of steel cost increases levied by producers.

Cost containment is crucial to maintaining profitability in the food and aerosol container manufacturing industries and Ball is focused on doing so. Toward that end, in the second quarter of 2011, Ball closed its metal food container manufacturing facility in Richmond, British Columbia.

In February 2013, Ball announced the closure of its metal food and aerosol container manufacturing facility in Elgin, Illinois. The facility, which produces aerosol and specialty steel cans as well as flat steel sheet used by other Ball food and household products packaging facilities, will cease production in the fourth quarter of 2013, and its production capacity will be consolidated into other Ball facilities. In connection with the closure, the company will record an estimated after-tax charge of approximately $21 million for employee severance, pension and other employee benefits costs, the write down to net realizable value of certain fixed assets and other closure costs.

Aerospace and Technologies Segment

Balls aerospace and technologies segment, which accounted for 10 percent of consolidated net sales in 2012, includes national defense hardware; antenna and video component technologies; civil and operational space hardware; and systems engineering services. The segment develops spacecraft, sensors and instruments, radio frequency systems and other advanced technologies for the civil, commercial and national security aerospace markets. The majority of the aerospace and technologies business involves work under contracts, generally from one to five years in duration, as a prime contractor or subcontractor for the U.S. Department of Defense (DoD), the National Aeronautics and Space Administration (NASA) and other U.S. government agencies. The company competes against both large and small prime contractors and subcontractors for these contracts. Contracts funded by the various agencies of the federal government represented 90 percent of segment sales in 2012.

Intense competition and long operating cycles are key characteristics of both the companys business and the aerospace and defense industry. It is common in the aerospace and defense industry for work on major programs to be shared among a number of companies. A company competing to be a prime contractor may, upon ultimate award of the contract to another competitor, become a subcontractor for the ultimate prime contracting company. It is not unusual to compete for a contract award with a peer company and, simultaneously, perform as a supplier to or a customer of that same competitor on other contracts, or vice versa.

Geopolitical events, and shifting executive and legislative branch priorities have resulted in an increase in opportunities over the past decade in areas matching our aerospace and technologies segments core capabilities in space hardware. The businesses include hardware, software and services sold primarily to U.S. customers, with emphasis on space science and exploration, environmental and earth sciences, and defense and intelligence applications. Major activities frequently involve the design, manufacture and testing of satellites, remote sensors and ground station control hardware and software, as well as related services such as launch vehicle integration and satellite operations. Uncertainties in the federal government budgeting process could delay the funding, or even result in cancellation of certain programs currently in our reported backlog.

Other hardware activities include target identification, warning and attitude control systems and components; cryogenic systems for reactant storage, and associated sensor cooling devices; star trackers, which are general-purpose stellar attitude sensors; and fast-steering mirrors. Additionally, the aerospace and technologies segment provides diversified technical services and products to government agencies, prime contractors and commercial organizations for a broad range of information warfare, electronic warfare, avionics, intelligence, training and space systems needs.

Backlog in the aerospace and technologies segment was $1.0 billion and $897 million at December 31, 2012 and 2011, respectively, and consisted of the aggregate contract value of firm orders, excluding amounts previously recognized as revenue. The 2012 backlog includes $601 million expected to be recognized in revenues during 2013, with the remainder expected to be recognized in revenues thereafter. Unfunded amounts included in backlog for certain firm government orders, which are subject to annual funding, were $573 million and $470 million at December 31, 2012 and 2011, respectively. Year-over-year comparisons of backlog are not necessarily indicative of the trend of future operations due to the nature of varying delivery and milestone schedules on contracts and funding of programs.

Discontinued Operations Plastic Packaging, Americas

In August 2010, we completed the sale of our plastics packaging, Americas, business to Amcor Limited and received gross proceeds of $258.7 million. This amount included $15 million of contingent consideration recognized at closing and was net of post-closing adjustments of $21.3 million. The sale of our plastics packaging business included five U.S. facilities that manufactured PET bottles and preforms and polypropylene bottles, as well as associated customer contracts and other related assets and liabilities.

Patents

In the opinion of the companys management, none of our active patents or groups of patents is material to the successful operation of our business as a whole. We manage our intellectual property portfolio to obtain the durations necessary to achieve our business objectives.

Research and Development

Research and development (R&D) efforts in our packaging segments are primarily directed toward packaging innovation, specifically the development of new features, sizes, shapes and types of containers, as well as new uses for existing containers. Other additional R&D efforts in these segments seek to improve manufacturing efficiencies and the overall sustainability of our products. Our packaging R&D activities are primarily conducted in the Ball Technology & Innovation Center (BTIC) located in Westminster, Colorado, and in a technical center located in Bonn, Germany.

In our aerospace business, we continue to focus our R&D activities on the design, development and manufacture of innovative aerospace products and systems. This includes the production of spacecraft, instruments and sensors, radio frequency and system components, data exploitation solutions and a variety of advanced aerospace technologies and products that enable deep space missions. Our aerospace R&D activities are conducted at various locations in the U.S.

Additional information regarding company R&D activity is contained in Note 1 to the consolidated financial statements within Item 8 of this annual report, as well as in Item 2, Properties.

Sustainability and the Environment

Sustainability is a key part of maximizing value at Ball. In our global operations, we focus our sustainability efforts on employee safety, and reducing energy, water, waste and air emissions. In addition to those operational priorities, we identified innovation, recycling, talent management, supply chain management and community involvement as priorities for our corporate sustainability efforts. By continuously working toward reducing the environmental impacts of our products throughout their life cycle, we also improve our financial results. Information about our corporate management, goals and performance data are available at www.ball.com/sustainability.

The biggest opportunity to further minimize the environmental impacts of metal packaging is to increase recycling rates. Aluminum and steel are infinitely recyclable materials, and metal packaging is already the most recycled packaging in the world. By using recycled material for the production of aluminum and steel, up to 95 percent of the energy used for the production of virgin material can be saved. In some of Balls markets such as Brazil, China and several European countries, recycling rates for beverage containers are in excess of 90 percent. Recycling rates vary throughout Europe but average around 67 percent for aluminum beverage containers and 71 percent for steel containers. The 2011 recycling rate in the U.S. for aluminum beverage containers was 65 percent. The 2011 U.S. recycling rate for steel containers was 71 percent.

In several of Balls markets we help establish and financially support recycling initiatives. Educating consumers about the benefits of recycling aluminum and steel containers and collaborating with industry partners to create effective collection and recycling systems contribute to increased recycling rates. For more details about programs we support, please visit www.ball.com/recycling.

Employee Relations

At the end of 2012, the company and its subsidiaries employed approximately 8,800 employees in the U.S. and 6,200 in other countries. Details of collective bargaining agreements are included within Item 1A, Risk Factors, of this annual report.

Where to Find More Information

Ball Corporation is subject to the reporting and other information requirements of the Securities Exchange Act of 1934, as amended (Exchange Act). Reports and other information filed with the Securities and Exchange Commission (SEC) pursuant to the Exchange Act may be inspected and copied at the public reference facility maintained by the SEC in Washington, D.C. The SEC maintains a website at www.sec.gov containing our reports, proxy materials and other items. The company also maintains a website at www.ball.com on which it provides a link to access Balls SEC reports free of charge.

The company has established written Ball Corporation Corporate Governance Guidelines; a Ball Corporation Executive Officers and Board of Directors Business Ethics Statement; a Business Ethics booklet; and Ball Corporation Audit Committee, Nominating/Corporate Governance Committee, Human Resources Committee and Finance Committee charters. These documents are set forth on the companys website at www.ball.com, under the link Investors, and then under the link Corporate Governance. A copy may also be obtained upon request from the companys corporate secretary. The companys sustainability report and updates on Balls progress are available at www.ball.com/sustainability.

The company intends to post on its website the nature of any amendments to the companys codes of ethics that apply to executive officers and directors, including the chief executive officer, chief financial officer and controller, and the nature of any waiver or implied waiver from any code of ethics granted by the company to any executive officer or director. These postings will appear on the companys website at www.ball.com under the link Investors, and then under the link Corporate Governance.

Any of the following risks could materially and adversely affect our business, financial condition or results of operations.

Our business, operating results and financial condition are subject to particular risks in certain regions of the world.

We may experience an operating loss in one or more regions of the world for one or more periods, which could have a material adverse effect on our business, operating results or financial condition. Moreover, overcapacity, which often leads to lower prices, exists in a number of the regions in which we operate and may persist even if demand grows. Our ability to manage such operational fluctuations and to maintain adequate long-term strategies in the face of such developments will be critical to our continued growth and profitability.

There can be no assurance that the companys business acquisitions will be successfully integrated into the acquiring company. (See Note 3 to the consolidated financial statements within Item 8 of this annual report for details of acquisitions made during the three years ended December 31, 2012.)

While we have what we believe to be well designed integration plans, if we cannot successfully integrate the acquired operations with those of Ball, we may experience material negative consequences to our business, financial condition or results of operations. The integration of companies that have previously been operated separately involves a number of risks, including, but not limited to:

· demands on management related to the increase in our size after the acquisition;

· the diversion of managements attention from the management of existing operations to the integration of the acquired operations;

· difficulties in the assimilation and retention of employees;

· difficulties in the integration of departments, systems, including accounting systems, technologies, books and records and procedures, as well as in maintaining uniform standards, controls (including internal accounting controls), procedures and policies;

· expenses related to any undisclosed or potential liabilities; and

· retention of major customers and suppliers.

We may not be able to achieve potential synergies or maintain the levels of revenue, earnings or operating efficiency that each business had achieved or might achieve separately. The successful integration of the acquired operations will depend on our ability to manage those operations, realize revenue opportunities and, to some degree, eliminate redundant and excess costs.

The loss of a key customer, or a reduction in its requirements, could have a significant negative impact on our sales.

We sell a majority of our packaging products to relatively few major beverage, packaged food, personal care and household product companies, some of which operate in North America, South America, Europe and Asia.

Although the majority of our customer contracts are long-term, these contracts are terminable under certain circumstances, such as our failure to meet quality, volume or market pricing requirements. Because we depend on relatively few major customers, our business, financial condition or results of operations could be adversely affected by the loss of any of these customers, a reduction in the purchasing levels of these customers, a strike or work stoppage by a significant number of these customers employees or an adverse change in the terms of the supply agreements with these customers.

The primary customers for our aerospace segment are U.S. government agencies or their prime contractors. Our contracts with these customers are subject to several risks, including funding cuts and delays, technical uncertainties, budget changes, competitive activity and changes in scope.

We face competitive risks from many sources that may negatively impact our profitability.

Competition within the packaging and aerospace industries is intense. Increases in productivity, combined with existing or potential surplus capacity in the industry, have maintained competitive pricing pressures. The principal methods of competition in the general packaging industry are price, innovation and sustainability, service and quality. In the aerospace industry they are technical capability, cost and schedule. Some of our competitors may have greater financial, technical and marketing resources, and some may currently have significant excess capacity. Our current or potential competitors may offer products at a lower price or products that are deemed superior to ours. The global economic environment has resulted in reductions in demand for our products in some instances, which, in turn, could increase these competitive pressures.

We are subject to competition from alternative products, which could result in lower profits and reduced cash flows.

Our metal packaging products are subject to significant competition from substitute products, particularly plastic carbonated soft drink bottles made from PET, single serve beer bottles and other food and beverage containers made of glass, cardboard or other materials. Competition from plastic carbonated soft drink bottles is particularly intense in the U.S., Europe and the PRC. Certain of our aerospace products are also subject to competition from alternative products and solutions. There can be no assurance that our products will successfully compete against alternative products, which could result in a reduction in our profits or cash flow.

Our packaging businesses have a narrow product range, and our business would suffer if usage of our products decreased.

For the year ended December 31, 2012, 74 percent of our consolidated net sales were from the sale of metal beverage containers, and we expect to derive a significant portion of our future revenues and cash flows from the sale of metal beverage containers. Our business would suffer if the use of metal beverage containers decreased. Accordingly, broad acceptance by consumers of aluminum and steel containers for a wide variety of beverages is critical to our future success. If demand for glass and PET bottles increases relative to metal containers, or the demand for aluminum and steel containers does not develop as expected, our business, financial condition or results of operations could be materially adversely affected.

Changes in laws and governmental regulations may adversely affect our business and operations.

We and our customers and suppliers are subject to various federal, state and provincial laws and regulations, which are increasing in number and complexity. Each of our, and their, facilities is subject to federal, state, provincial and local licensing and regulation by health, environmental, workplace safety and other agencies in multiple jurisdictions. Requirements of worldwide governmental authorities with respect to manufacturing, manufacturing facility locations within the jurisdiction, product content and safety, climate change, workplace safety and health, environmental, expropriation of assets and other standards could adversely affect our ability to manufacture or sell our products, and the ability of our customers and suppliers to manufacture and sell their products. In addition, we face risks arising from compliance with and enforcement of increasingly numerous and complex federal, state, country and provincial laws and regulations.

Enacted regulatory developments regarding the reporting and use of conflict minerals mined from the Democratic Republic of the Congo and adjoining countries could affect the sourcing and availability of minerals used in the manufacture of certain of our products. As a result, there may only be a limited pool of suppliers who provide conflict-free materials, and we cannot give assurance that we will be able to obtain such products in sufficient quantities or at competitive prices. Also, because our supply chain is complex, we may face reputational challenges with our customers and other stakeholders if we are unable to sufficiently verify the origins of all materials used in the products that we sell. The compliance and reporting aspects of these regulations may result in incremental costs to the company.

While deposit systems and other container-related legislation have been adopted in some jurisdictions, similar legislation has been defeated in public referenda and legislative bodies in many others. We anticipate that continuing efforts will be made to consider and adopt such legislation in the future. The packages we produce are widely used and perform well in U.S. states, Canadian provinces and European countries that have deposit systems, as well as in other countries world-wide.

Significant environmental, employment-related and other legislation and regulatory requirements exist and are also evolving. The compliance costs associated with current and proposed laws and potential regulations could be substantial, and any failure or alleged failure to comply with these laws or regulations could lead to litigation or governmental action, all of which could adversely affect our financial condition or results of operations.

Our business, financial condition and results of operations are subject to risks resulting from broader geographic operations.

We derived approximately 37 percent of our consolidated net sales from outside of the U.S. for the year ended December 31, 2012. The sizeable scope of operations outside of the U.S. may lead to more volatile financial results and make it more difficult for us to manage our business. Reasons for this include, but are not limited to, the following:

· political and economic instability;

· governments restrictive trade policies;

· the imposition of duties, taxes or government royalties;

· exchange rate risks;

· difficulties in enforcement of contractual obligations and intellectual property rights; and

· the geographic, language and cultural differences between personnel in different areas of the world.

Any of these factors, many of which are also present in the U.S., could materially adversely affect our business, financial condition or results of operations.

We are exposed to exchange rate fluctuations.

Our reporting currency is the U.S. dollar. A portion of Balls operations, including assets and liabilities and revenues and expenses, have been denominated in various currencies other than the U.S. dollar, and we expect such operations will continue to be so denominated. As a result, the U.S. dollar value of these operations has varied, and will continue to vary, with exchange rate fluctuations. Ball has been, and is presently, primarily exposed to fluctuations in the exchange rate of the euro, British pound, Canadian dollar, Polish zloty, Chinese yuan, Brazilian real and other currencies.

A decrease in the value of any of these currencies compared to the U.S. dollar, could reduce our profits from these operations and the value of their net assets when reported in U.S. dollars in our financial statements. This could have a material adverse effect on our business, financial condition or results of operations as reported in U.S. dollars. In addition, fluctuations in currencies relative to currencies in which the earnings are generated may make it more difficult to perform period-to-period comparisons of our reported results of operations.

We manage our exposure to currency fluctuations, particularly our exposure to fluctuations in the euro to U.S. dollar exchange rate, in order to attempt to mitigate the effect of cash flow and earnings volatility associated with exchange rate changes. We primarily use forward contracts and options to manage our currency exposures and, as a result, we experience gains and losses on these derivative positions offset, in part, by the impact of currency fluctuations on existing assets and liabilities. Our inability to properly manage our exposure to currency fluctuations could materially impact our results.

If we fail to retain key management and personnel, we may be unable to implement our key objectives.

We believe that our future success depends, in part, on our experienced management team. Unforeseen losses of key members of our management team without appropriate succession and/or compensation planning could make it difficult for us to manage our business and meet our objectives.

Decreases in our ability to apply new technology and know-how may affect our competitiveness.

Our success depends partially on our ability to improve production processes and services. We must also introduce new products and services to meet changing customer needs. If we are unable to implement better production processes or to develop new products through research and development or licensing of new technology, we may not be able to remain competitive with other manufacturers. As a result, our business, financial condition or results of operations could be adversely affected.

Adverse weather and climate changes may result in lower sales.

We manufacture packaging products primarily for beverages and foods. Unseasonably cool weather can reduce demand for certain beverages packaged in our containers. In addition, poor weather conditions or changes in climate that reduce crop yields of fruits and vegetables can adversely affect demand for our food containers. Climate change could have various effects on the demand for our products in different regions around the world.

We are vulnerable to fluctuations in the supply and price of raw materials.

We purchase aluminum, steel and other raw materials and packaging supplies from several sources. While all such materials are available from independent suppliers, raw materials are subject to fluctuations in price and availability attributable to a number of factors, including general economic conditions, commodity price fluctuations (particularly aluminum on the London Metal Exchange), the demand by other industries for the same raw materials and the availability of complementary and substitute materials. Although we enter into commodities purchase agreements from time to time and sometimes use derivative instruments to seek to manage our risk, we cannot ensure that our current suppliers of raw materials will be able to supply us with sufficient quantities at reasonable prices. Economic and financial factors could impact our suppliers, thereby causing supply shortages. Increases in raw material costs could have a material adverse effect on our business, financial condition or results of operations. In the Americas, Europe and Asia, some contracts do not allow us to pass along increased raw material costs and we generally use derivative agreements to seek to manage this risk. Our hedging procedures may be insufficient and our results could be materially impacted if costs of materials increase. Due to the fixed price contracts and derivative activities, while increasing raw material costs may not impact our near-term profitability, increased prices could decrease our sales volume over time.

Prolonged work stoppages at facilities with union employees could jeopardize our financial position.

As of December 31, 2012, approximately 46 percent of our North American packaging facility employees and approximately 75 percent of our European packaging plant employees were covered by collective bargaining agreements. These collective bargaining agreements have staggered expirations during the next several years. Although we consider our employee relations to be generally good, a prolonged work stoppage or strike at any facility with union employees could have a material adverse effect on our business, financial condition or results of operations. In addition, we cannot ensure that upon the expiration of existing collective bargaining agreements, new agreements will be reached without union action or that any such new agreements will be on terms satisfactory to us.

Our aerospace and technologies segment is subject to certain risks specific to that business.

In our aerospace business, U.S. government contracts are subject to reduction or modification in the event of changes in requirements, and the government may also terminate contracts at its convenience pursuant to standard termination provisions. In such instances, Ball may be entitled to reimbursement for allowable cost and profits on authorized work that has been performed through the date of termination.

In addition, budgetary constraints may result in further reductions to projected spending levels by the U.S. government. In particular, government expenditures are subject to the potential for automatic reductions, generally referred to as sequestration. Sequestration may occur during 2013, resulting in significant additional reductions to spending by various U.S government defense and aerospace agencies on both existing and new contracts, as well as the disruption of ongoing programs. Even if sequestration does not occur, we expect that budgetary constraints and ongoing concerns regarding the U.S. national debt will continue to place downward pressure on agency spending levels. Due to these and other factors, overall spending on various programs could decline, which could result in significant reductions to revenue, cash flows, net earnings and backlog primarily in our aerospace and technologies segment.

We use estimates in accounting for many of our programs in our aerospace business, and changes in our estimates could adversely affect our future financial results.

We account for sales and profits on some long-term contracts in our aerospace business in accordance with the percentage-of-completion method of accounting, using the cumulative catch-up method to account for updates in estimates. The percentage-of-completion method of accounting involves the use of various estimating techniques to project revenues and costs at completion and various assumptions and projections relative to the outcome of future events, including the quantity and timing of product deliveries, future labor performance and rates, and material and overhead costs. These assumptions involve various levels of expected performance improvements. Under the cumulative catch-up method, the impact of updates in our estimates related to units shipped to date is recognized immediately.

Because of the significance of the judgments and estimates described above, it is likely that we could record materially different amounts if we used different assumptions or if the underlying circumstances or estimates were to change. Accordingly, updates in underlying assumptions, circumstances or estimates may materially affect our future financial performance.

Our backlog includes both cost-type and fixed-price contracts. Cost-type contracts generally have lower profit margins than fixed-price contracts. Our earnings and margins may vary depending on the types of government contracts undertaken, the nature of the work performed under those contracts, the costs incurred in performing the work, the achievement of other performance objectives and their impact on our ability to receive fees.

As a U.S. government contractor, we could be adversely affected by changes in regulations or any negative findings from a U.S. government audit or investigation.

We operate in a highly regulated environment and are routinely audited and reviewed by the U.S. government and its agencies, such as the Defense Contract Audit Agency (DCAA) and Defense Contract Management Agency (DCMA). These agencies review performance under our contracts, our cost structure and our compliance with applicable laws, regulations and standards, as well as the adequacy of, and our compliance with, our internal control systems and policies. Systems that are subject to review under the new DoD Federal Acquisition Regulation Supplement (DFARS) effective May 18, 2011, are accounting and billing systems, purchasing systems, estimating systems, material management and accounting systems and earned value management systems. Any costs ultimately found to be unallowable or improperly allocated to a specific contract will not be reimbursed or must be refunded if already reimbursed. If an audit uncovers improper or illegal activities, we may be subject to civil and criminal penalties, sanctions or suspension or debarment from doing business with the U.S. government. Whether or not illegal activities are alleged, the U.S. government also has the ability to decrease or withhold certain payments when it deems systems subject to its review to be inadequate. If such actions were to result in suspension or debarment, this could have a material adverse effect on our business.

Our business is subject to substantial environmental remediation and compliance costs.

Our operations are subject to federal, state, provincial and local laws and regulations in multiple jurisdictions relating to environmental hazards, such as emissions to air, discharges to water, the handling and disposal of hazardous and solid wastes and the cleanup of hazardous substances. We have been designated, along with numerous other companies, as a potentially responsible party for the cleanup of several hazardous waste sites. Based on available information, we do not believe that any costs incurred in connection with such sites will have a material adverse effect on our financial condition, results of operations, capital expenditures or competitive position. There is increased focus on the regulation of greenhouse gas emissions and other environmental issues worldwide.

Our business faces the potential of increased regulation on some of the raw materials utilized in our packaging operations.

Our operations are subject to federal, state, provincial and local laws and regulations in multiple jurisdictions relating to some of the raw materials, such as epoxy-based coatings utilized in our container making process. Epoxy-based coatings may contain Bisphenol-A (BPA). Scientific evidence evaluated by regulatory agencies in the United States, Canada, Europe, Japan, Australia and New Zealand has consistently shown these coatings to be safe for food contact at current levels, and these regulatory agencies have stated that human exposure to BPA from epoxy-based container coatings is well below safe exposure limits set by government bodies worldwide. A significant change in these regulatory agency statements or other adverse information concerning BPA could have a material adverse effect on our business, financial condition or results of operations. Ball recognizes that significant interest exists in non epoxy-based coatings, and we have been proactively working with coatings suppliers and our customers to evaluate alternatives to current coatings.

Net earnings and net worth could be materially affected by an impairment of goodwill.

We have a significant amount of goodwill recorded on the consolidated balance sheet as of December 31, 2012. We are required at least annually to test the recoverability of goodwill. The recoverability test of goodwill is based on the current fair value of our identified reporting units. Fair value measurement requires assumptions and estimates of many critical factors, including revenue and market growth, operating cash flows and discount rates. If general market conditions deteriorate in portions of our business, we could experience a significant decline in the fair value of reporting units. This decline could lead to an impairment of all or a significant portion of the goodwill balance, which could materially affect our U.S. GAAP net earnings and net worth.

If the investments in Balls pension plans, or in the multiemployer pension plans in which Ball participates, do not perform as expected, we may have to contribute additional amounts to the plans, which would otherwise be available to cover operating expenses and fund growth opportunities.

Ball maintains defined benefit pension plans covering substantially all of its North American and United Kingdom employees, which are funded based on certain actuarial assumptions. The plans assets consist primarily of common stocks, fixed income securities and, in the U.S., alternative investments. Market declines, longevity increases or legislative changes, such as the Pension Protection Act in the U.S., could result in a prospective decrease in our available cash flow and net earnings over time, and the recognition of an increase in our pension obligations could result in a reduction to our shareholders equity. Additional risks exist related to the companys participation in multiemployer pension plans. Assets contributed to a multiemployer pension plan by one employer may be used to provide benefits to employees of other participating employers. If a participating employer in a multiemployer pension plan stops contributing to the plan, the unfunded obligations of the plan may be borne by the remaining participants. This could result in increases to our contributions to the plans as well as pension expense.

Restricted access to capital markets could adversely affect our short-term liquidity and prevent us from fulfilling our obligations under the notes issued pursuant to our bond indentures.

On December 31, 2012, we had total debt of $3.3 billion and unused committed credit lines of approximately $773 million. A reduction in global market liquidity could:

· restrict our ability to fund working capital, capital expenditures, research and development expenditures and other business activities;

· increase our vulnerability to general adverse economic and industry conditions, including the credit risks stemming from the economic environment;

· limit our flexibility in planning for, or reacting to, changes in our businesses and the industries in which we operate;

· restrict us from making strategic acquisitions or exploiting business opportunities; and

· limit, along with the financial and other restrictive covenants in our debt, among other things, our ability to borrow additional funds, dispose of assets, pay cash dividends or refinance debt maturities.

In addition, approximately one-fourth of our debt bears interest at variable rates. If market interest rates increase, variable-rate debt will create higher debt service requirements, which would adversely affect our cash flow. While we sometimes enter into agreements limiting our exposure, any such agreements may not offer complete protection from this risk.

The global credit, financial and economic environment could have a negative impact on our results of operations, financial position or cash flows.

The overall credit, financial and economic environment could have significant negative effects on our operations, including the following:

· the creditworthiness of customers, suppliers and counterparties could deteriorate resulting in a financial loss or a disruption in our supply of raw materials;

· volatile market performance could affect the fair value of our pension assets, potentially requiring us to make significant additional contributions to our defined benefit plans to maintain prescribed funding levels;

· a significant weakening of our financial position or operating results could result in noncompliance with our debt covenants; and

· reduced cash flow from our operations could adversely affect our ability to execute our long-term strategy to increase liquidity, reduce debt, repurchase our stock and invest in our businesses.

Changes in U.S. generally accepted accounting principles (U.S. GAAP) and Securities and Exchange Commission (SEC) rules and regulations could materially impact our reported results.

U.S. GAAP and SEC accounting and reporting changes are common and have become more frequent and significant over the past several years. Furthermore, the U.S. and international accounting standard setters are in the process of jointly converging several key accounting standards. These changes could have significant effects on our reported results when compared to prior periods and other companies and may even require us to retrospectively adjust prior periods. Additionally, material changes to the presentation of transactions in the consolidated financial statements could impact key ratios that analysts and credit rating agencies use to rate Ball and ultimately our ability to access the credit markets in an efficient manner.

Increased information technology (IT) security threats and more sophisticated and targeted computer crime could pose a risk to our systems, networks, products, solutions and services.

Increased global IT security threats and more sophisticated and targeted computer crime pose a risk to the security of our systems and networks and the confidentiality, availability and integrity of our data. While we attempt to mitigate these risks by employing a number of measures, including employee training, comprehensive monitoring of our networks and systems, and maintenance of backup and protective systems, our systems, networks, products, solutions and services remain potentially vulnerable to advanced persistent threats. Depending on their nature and scope, such threats could potentially lead to the compromise of confidential information, improper use of our systems and networks, manipulation and destruction of data, defective products, production downtimes and operational disruptions, which in turn could adversely affect our reputation, competitiveness and results of operations.

Item 1B. Unresolved Staff Comments

There were no matters required to be reported under this item.

The companys properties described below are well maintained, are considered adequate and are being utilized for their intended purposes.

Balls corporate headquarters and the aerospace and technologies segment management offices are located in Broomfield, Colorado. The operations of the aerospace and technologies segment occupy a variety of company-owned and leased facilities in Colorado, which together aggregate 1.4 million square feet of office, laboratory, research and development, engineering and test and manufacturing space. Other aerospace and technologies operations carry on business in smaller company-owned and leased facilities in New Mexico, Ohio, Virginia and Washington, D.C.

The offices of the companys various North American packaging operations are located in Westminster, Colorado; the offices for the European packaging operations are located in Zurich, Switzerland; the offices for the PRC packaging operations are located in Hong Kong; and Latapack-Balls offices are located in São Paulo, Brazil. The companys BTIC research and development facility and European technical center are located in Westminster, Colorado, and in Bonn, Germany, respectively.

Information regarding the approximate size of the manufacturing locations for significant packaging operations, which are owned or leased by the company, is set forth below. Facilities in the process of being constructed or that have ceased production have been excluded from the list. Where certain locations include multiple facilities, the total approximate size for the location is noted. In addition to the facilities listed, the company leases other warehousing space.

|

|

|

Approximate |

|

|

|

|

Floor Space in |

|

|

Plant Location |

|

Square Feet |

|

|

|

|

|

|

|

Metal beverage packaging, Americas and Asia, manufacturing facilities: |

|

|

|

|

North America |

|

|

|

|

Fairfield, California |

|

337,000 |

|

|

Golden, Colorado |

|

509,000 |

|

|

Gainesville, Florida |

|

88,000 |

|

|

Tampa, Florida |

|

276,000 |

|

|

Rome, Georgia |

|

386,000 |

|

|

Kapolei, Hawaii |

|

131,000 |

|

|

Monticello, Indiana |

|

356,000 |

|

|

Saratoga Springs, New York |

|

290,000 |

|

|

Wallkill, New York |

|

312,000 |

|

|

Reidsville, North Carolina |

|

452,000 |

|

|

Findlay, Ohio (a) |

|

733,000 |

|

|

Whitby, Ontario, Canada |

|

205,000 |

|

|

Conroe, Texas |

|

275,000 |

|

|

Fort Worth, Texas |

|

322,000 |

|

|

Bristol, Virginia |

|

242,000 |

|

|

Williamsburg, Virginia |

|

400,000 |

|

|

Fort Atkinson, Wisconsin |

|

250,000 |

|

|

Milwaukee, Wisconsin (including leased warehouse space) (a) |

|

502,000 |

|

|

|

|

|

|

|

South America |

|

|

|

|

Alagoinhas, Bahia, Brazil |

|

375,000 |

|

|

Jacarei, Sao Paulo, Brazil |

|

467,000 |

|

|

Salvador, Bahia, Brazil |

|

99,000 |

|

|

Tres Rios, Rio de Janeiro, Brazil |

|

418,000 |

|

(a) Includes both metal beverage container and metal food container manufacturing operations.

|

|

|

Approximate |

|

|

|

|

Floor Space in |

|

|

Plant Location (continued) |

|

Square Feet |

|

|

|

|

|

|

|

Metal beverage packaging, Americas and Asia, manufacturing facilities (continued): |

|

|

|

|

Asia |

|

|

|

|

Beijing, PRC |

|

303,000 |

|

|

Hubei (Wuhan), PRC |

|

237,000 |

|

|

Sanshui (Foshan), PRC |

|

544,000 |

|

|

Shenzhen, PRC |

|

377,000 |

|

|

Taicang, PRC (leased) |

|

81,000 |

|

|

Tianjin, PRC |

|

47,000 |

|

|

Qingdao, PRC |

|

326,000 |

|

|

|

|

|

|

|

Metal beverage packaging, Europe, manufacturing facilities: |

|

|

|

|

Velim, Czech Republic |

|

186,000 |

|

|

Beaurepaire, France |

|

83,000 |

|

|

Bellegarde, France |

|

124,000 |

|

|

Bierne, France |

|

263,000 |

|

|

La Ciotat, France |

|

393,000 |

|

|

Braunschweig, Germany |

|

258,000 |

|

|

Hassloch, Germany |

|

283,000 |

|

|

Hermsdorf, Germany |

|

425,000 |

|

|

Weissenthurm, Germany |

|

331,000 |

|

|

Oss, Netherlands |

|

344,000 |

|

|

Radomsko, Poland |

|

312,000 |

|

|

Belgrade, Serbia |

|

352,000 |

|

|

Devizes, United Kingdom |

|

94,000 |

|

|

Deeside, United Kingdom |

|

115,000 |

|

|

Rugby, United Kingdom |

|

175,000 |

|

|

Wrexham, United Kingdom |

|

222,000 |

|

|

|

|

|

|

|

Metal food and household products packaging, Americas, manufacturing facilities: |

|

|

|

|

North America |

|

|

|

|

Springdale, Arkansas |

|

286,000 |

|

|

Oakdale, California |

|

370,000 |

|

|

Danville, Illinois |

|

110,000 |

|

|

Elgin, Illinois (including leased warehouse space) |

|

563,000 |

|

|

Baltimore, Maryland (including leased warehouse space) |

|

251,000 |

|

|

San Luis Potosí, Mexico |

|

84,000 |

|

|

Columbus, Ohio |

|

305,000 |

|

|

Findlay, Ohio (a) |

|

733,000 |

|

|

Hubbard, Ohio |

|

175,000 |

|

|

Horsham, Pennsylvania |

|

162,000 |

|

|

Sherbrooke, Quebec, Canada |

|

99,000 |

|

|

Chestnut Hill, Tennessee |

|

305,000 |

|

|

Verona, Virginia |

|

72,000 |

|

|

Weirton, West Virginia (leased) |

|

332,000 |

|

|

DeForest, Wisconsin |

|

400,000 |

|

|

Milwaukee, Wisconsin (including leased warehouse space) (a) |

|

502,000 |

|

|

|

|

|

|

|

South America |

|

|

|

|

Buenos Aires, Argentina (leased) |

|

34,000 |

|

|

San Luis, Argentina |

|

51,000 |

|

(a) Includes both metal beverage container and metal food container manufacturing operations.

Details of the companys legal proceedings are included in Note 21 to the consolidated financial statements within Item 8 of this annual report.

Item 4. Mine Safety Disclosures.

Not applicable.

Item 5. Market for the Registrants Common Stock and Related Stockholder Matters

Ball Corporation common stock (BLL) is traded on the New York Stock Exchange. There were 5,479 common shareholders of record on February 15, 2013.

Common Stock Repurchases

The following table summarizes the companys repurchases of its common stock during the quarter ended December 31, 2012.

|

Purchases of Securities |

| |||||||||

|

($ in millions) |

|

Total Number |

|

Average |

|

Total Number of |

|

Maximum Number of |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

October 1 to October 28, 2012 |

|

|

|

$ |

|

|

|

|

21,243,709 |

|

|

October 29 to November 25, 2012 |

|

1,947,528 |

|

$ |

43.90 |

|

1,947,528 |

|

19,296,181 |

|

|

November 26 to December 29, 2012 |

|

2,609,809 |

|

$ |

44.50 |

|

2,609,809 |

|

16,686,372 |

|

|

Total |

|

4,557,337 |

|

$ |

44.24 |

|

4,557,337 |

|

|

|

(a) Includes open market purchases (on a trade-date basis) and/or shares retained by the company to settle employee withholding tax liabilities.

(b) The company has an ongoing repurchase program for which shares are authorized from time to time by Balls board of directors. On January 25, 2012, the Board authorized the repurchase by the company of up to a total of 30 million shares. This repurchase authorization replaced all previous authorizations.

Quarterly Stock Prices and Dividends

Quarterly prices for the companys common stock, as reported on the New York Stock Exchange composite tape, and quarterly dividends in 2012 and 2011 (on a calendar quarter basis) were:

|

|

|

2012 |

|

2011 |

| ||||||||||||||||||||

|

|

|

4th |

|

3rd |

|

2nd |

|

1st |

|

4th |

|

3rd |

|

2nd |

|

1st |

| ||||||||

|

|

|

Quarter |

|

Quarter |

|

Quarter |

|

Quarter |

|

Quarter |

|

Quarter |

|

Quarter |

|

Quarter |

| ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

|

High |

|

$ |

45.47 |

|

$ |

43.79 |

|

$ |

43.70 |

|

$ |

42.99 |

|

$ |

36.11 |

|

$ |

40.56 |

|

$ |

39.55 |

|

$ |

37.43 |

|

|

Low |

|

41.11 |

|

39.33 |

|

38.39 |

|

35.66 |

|

29.69 |

|

30.67 |

|

35.60 |

|

33.41 |

| ||||||||

|

Dividends per share |

|

0.10 |

|

0.10 |

|

0.10 |

|

0.10 |

|

0.07 |

|

0.07 |

|

0.07 |

|

0.07 |

| ||||||||

Shareholder Return Performance

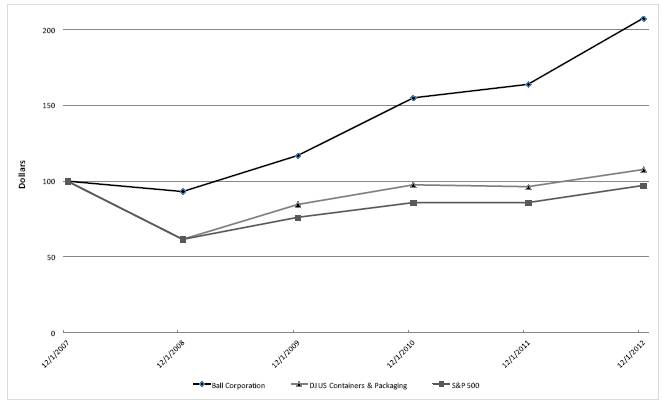

The line graph below compares the annual percentage change in Ball Corporations cumulative total shareholder return on its common stock with the cumulative total return of the Dow Jones Containers & Packaging Index and the S&P Composite 500 Stock Index for the five-year period ended December 31, 2012. It assumes $100 was invested on December 31, 2007, and that all dividends were reinvested. The Dow Jones Containers & Packaging Index total return has been weighted by market capitalization.

TOTAL RETURN TO STOCKHOLDERS

(Assumes $100 investment on 12/31/07)

Total Return Analysis

|

|

|

12/31/2007 |

|

12/31/2008 |

|

12/31/2009 |

|

12/31/2010 |

|

12/31/2011 |

|

12/31/2012 |

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

Ball Corporation |

|

$ |

100.00 |

|

$ |

93.28 |

|

$ |

117.01 |

|

$ |

155.14 |

|

$ |

164.09 |

|

$ |

207.62 |

|

|

DJ US Containers & Packaging |

|

$ |

100.00 |

|

$ |

61.55 |

|

$ |

84.76 |

|

$ |

97.78 |

|

$ |

96.27 |

|

$ |

107.76 |

|

|

S&P 500 |

|

$ |

100.00 |

|

$ |

61.51 |

|

$ |

75.94 |

|

$ |

85.65 |

|

$ |

85.65 |

|

$ |

97.13 |

|

Source: Bloomberg L.P. ®Charts

Item 6. Selected Financial Data

Five-Year Review of Selected Financial Data

Ball Corporation and Subsidiaries

|

($ in millions, except per share amounts) |

|

2012 |

|

2011 |

|

2010 |

|

2009 |

|

2008 |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

Net sales |

|

$ |

8,735.7 |

|

$ |

8,630.9 |

|

$ |

7,630.0 |

|

$ |

6,710.4 |

|

$ |

6,826.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

Earnings before interest and taxes (EBIT) |

|

$ |

790.5 |

|

$ |

836.9 |

|

$ |

764.6 |

|

$ |

653.8 |

|

$ |

580.6 |

|

|

Total interest expense |

|

(194.9 |

) |

(177.1 |

) |

(158.2 |

) |

(117.2 |

) |

(137.7 |

) | |||||

|

Earnings before taxes |

|

$ |

595.6 |

|

$ |

659.8 |

|

$ |

606.4 |

|

$ |

536.6 |

|

$ |

442.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

Net earnings attributable to Ball Corporation from: |

|

|

|

|

|

|

|

|

|

|

| |||||

|

Continuing operations (a) |

|

$ |

406.3 |

|

$ |

446.3 |

|

$ |

542.9 |

|

$ |

390.1 |

|

$ |

314.9 |

|

|

Discontinued operations |

|

(2.8 |

) |

(2.3 |

) |

(74.9 |

) |

(2.2 |

) |

4.6 |

| |||||

|

Total net earnings attributable to Ball Corporation |

|

$ |

403.5 |

|

$ |

444.0 |

|

$ |

468.0 |

|

$ |

387.9 |

|

$ |

319.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

Basic earnings per share (b): |

|

|

|

|

|

|

|

|

|

|

| |||||

|

Basic continuing operations (a) |

|

$ |

2.63 |

|

$ |

2.70 |

|

$ |

3.00 |

|

$ |

2.08 |

|

$ |

1.64 |

|

|

Basic discontinued operations |

|

(0.02 |

) |

(0.01 |

) |

(0.41 |

) |

(0.01 |

) |

0.03 |

| |||||

|

Basic earnings per share |

|

$ |

2.61 |

|

$ |

2.69 |

|

$ |

2.59 |

|

$ |

2.07 |

|

$ |

1.67 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

Weighted average common shares outstanding (000s) (b) |

|

154,648 |

|

165,275 |

|

180,746 |

|

187,572 |

|

191,714 |

| |||||

|

|

|

|

|

|

|

|

|