425: Filing under Securities Act Rule 425 of certain prospectuses and communications in connection with business combination transactions

Published on March 20, 2015

Filed pursuant to Rule 425 under the

Securities Act of 1933, as amended, and

deemed filed under Rule 14a-12 under the

Securities Exchange Act of 1934, as amended

Filer: Ball Corporation

Commission File No.: 001-07349

Subject Company: Ball Corporation

Commission File No.: 001-07349

|

|

1 | © BALL CORPORATION | BALL.COM Ball Corporations offer to acquire Rexam PLC |

|

|

2 | © BALL CORPORATION | BALL.COM Forward-Looking Statements This presentation contains forward-looking statements concerning future events and financial performance. Words such as expects, anticipates, estimates and similar expressions identify forward-looking statements. Such statements are subject to risks and uncertainties, which could cause actual results to differ materially from those expressed or implied. The company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Key risks and uncertainties are summarized in filings with the Securities and Exchange Commission, including Exhibit 99 in our Form 10-K, which are available on our website and at www.sec.gov. Factors that might affect: a) our packaging segments include product demand fluctuations; availability/cost of raw materials; competitive packaging, pricing and substitution; changes in climate and weather; crop yields; competitive activity; failure to achieve productivity improvements or cost reductions; mandatory deposit or other restrictive packaging laws; customer and supplier consolidation, power and supply chain influence; changes in major customer or supplier contracts or loss of a major customer or supplier; political instability and sanctions; and changes in foreign exchange or tax rates; b) our aerospace segment include funding, authorization, availability and returns of government and commercial contracts; and delays, extensions and technical uncertainties affecting segment contracts; c) the company as a whole include those listed plus: changes in senior management; regulatory action or issues including tax, environmental, health and workplace safety, including U.S. FDA and other actions or public concerns affecting products filled in our containers, or chemicals or substances used in raw materials or in the manufacturing process; technological developments and innovations; litigation; strikes; labor cost changes; rates of return on assets of the companys defined benefit retirement plans; pension changes; uncertainties surrounding the U.S. government budget, sequestration and debt limit; reduced cash flow; ability to achieve cost-out initiatives; interest rates affecting our debt; and successful or unsuccessful acquisitions and divestitures, including, with respect to the proposed Rexam PLC acquisition, the effect of the announcement of the acquisition on our business relationships, operating results and business generally; the occurrence of any event or other circumstances that could give rise to the termination of our definitive agreement with Rexam PLC in respect of the acquisition; the outcome of any legal proceedings that may be instituted against us related to the definitive agreement with Rexam PLC; and the failure to satisfy conditions to completion of the acquisition of Rexam PLC, including the receipt of all required regulatory approvals. |

|

|

3 | © BALL CORPORATION | BALL.COM Important Information This presentation may be deemed to be solicitation material in respect of the proposed acquisition of Rexam PLC (Rexam) by Ball Corporation (Ball), including the issuance of shares of Ball common stock in respect of the proposed acquisition. In connection with the foregoing proposed issuance of Ball common stock, Ball expects to file a proxy statement on Schedule 14A with the Securities and Exchange Commission (the SEC). To the extent Ball effects the acquisition of Rexam as a Scheme under English law, the issuance of Ball common stock in the acquisition would not be expected to require registration under the Securities Act of 1933, as amended (the Act), pursuant to an exemption provided by Section 3(a)(10) under the Act. In the event that Ball determines to conduct the acquisition pursuant to an offer or otherwise in a manner that is not exempt from the registration requirements of the Act, it will file a registration statement with the SEC containing a prospectus with respect to the Ball common stock that would be issued in the acquisition. INVESTORS AND SECURITY HOLDERS OF BALL ARE URGED TO READ THESE MATERIALS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS IN CONNECTION WITH THE ACQUISITION THAT BALL WILL FILE WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT BALL, THE PROPOSED ISSUANCE OF BALL COMMON STOCK, AND THE PROPOSED ACQUISITION. The preliminary proxy statement, the definitive proxy statement, the registration statement/prospectus, in each case as applicable, and other relevant materials in connection with the proposed issuance of Ball common stock and the acquisition (when they become available), and any other documents filed by Ball with the SEC, may be obtained free of charge at the SECs website at www.sec.gov. In addition, investors and security holders may obtain free copies of the documents filed with the SEC by sending a request to: Investor Relations, Ball Corp., 10 Longs Peak Drive, Broomfield, CO 80021-2510. Ball and its directors and executive officers may be deemed to be participants in the solicitation of proxies from Balls stockholders with respect to the proposed acquisition, including the proposed issuance of Ball common stock in respect of the proposed acquisition. Information about Balls directors and executive officers and their ownership of Balls common stock is set forth in Balls Annual Report on Form 10-K for the fiscal year ended December 31, 2014, which was filed with the SEC on February 20, 2015 and Balls definitive proxy statement for its 2015 Annual Meeting of Stockholders, which was filed with the SEC on March 16, 2015. Information regarding the identity of the potential participants, and their direct or indirect interests in the solicitation, by security holdings or otherwise, will be set forth in the proxy statement and/or prospectus and other materials to be filed with the SEC in connection with the proposed acquisition and issuance of Ball common stock in the proposed acquisition. |

|

|

4 | © BALL CORPORATION | BALL.COM Important Information (Contd) This document is provided for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell, shares of Ball Corporation ("Ball") or Rexam Plc ("Rexam"). Further to the announcement released by Ball Acquisition Limited on February 19, 2015 (the Announcement) of its offer to acquire the entire issued and to be issued share capital of Rexam (the Offer"), (i) such Offer will be made pursuant to the terms of a circular to be issued by Rexam to its shareholders in due course following satisfaction of waiver of certain pre-conditions, setting out the terms and conditions of the Offer, including details of how to vote in respect of the Offer (the "Circular"), and (ii) Ball will in due course following satisfaction of waiver of certain pre-conditions publish a prospectus for the purposes of EU Directive 2003/71/EC (together with any applicable implementing measures in any Member State, the "Prospectus Directive") in relation to shares which will be issued by it in connection with the Offer (the "Prospectus"). Any decision in respect of, or in response to, the Offer should be made only on the basis of the information in the Circular and the Prospectus. Investors are advised to read the Circular and the Prospectus carefully. This document is an advertisement and not a prospectus for the purposes of the Prospectus Directive. Accordingly, investors should not subscribe for, or purchase, any securities except on the basis of the information to be contained in the Prospectus, when published, which will be prepared in accordance with the Prospectus Directive. Copies of the Prospectus, when published, will be available from Balls website at www.ball.com. The Ball Responsible Officers (as defined in the Announcement) each accept responsibility for the information contained in this document. To the best of the knowledge and belief of the Ball Responsible Officers (who have taken all reasonable care to ensure that such is the case), the information contained in this document for which they are responsible is in accordance with the facts and does not omit anything likely to affect the import of such information. |

|

|

5 | © BALL CORPORATION | BALL.COM Transaction will benefit customers 1 2 3 4 5 Local Competition Shipping Costs are Very Significant Complementary Footprints Limited Overlaps and Lowered Freight Costs Powerful Customers History of Self- Supply and Sponsored Entry Multiple Substrates Plastic (PET) and Glass Substantial Efficiencies Marginal Cost Reductions |

|

|

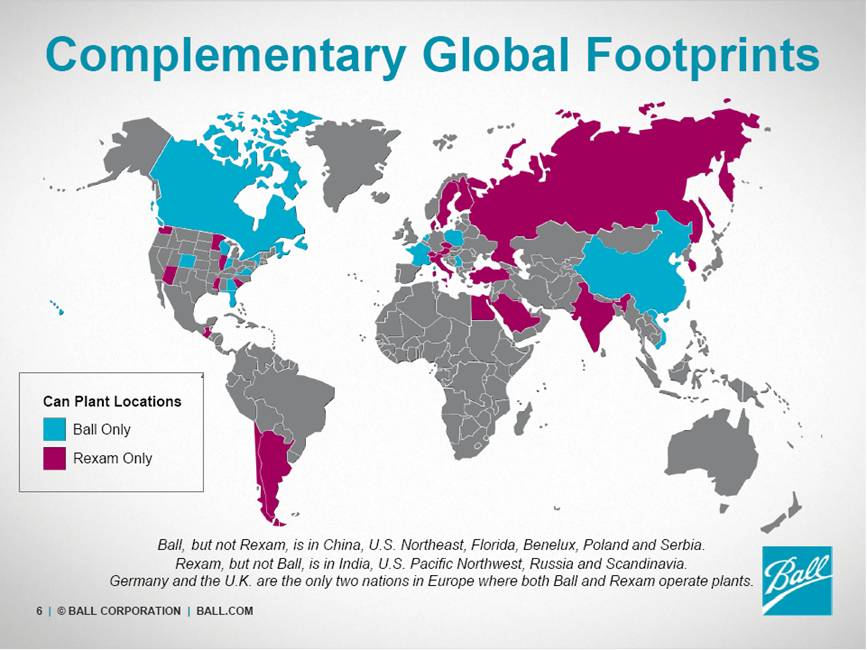

6 | © BALL CORPORATION | BALL.COM Complementary Global Footprints Ball, but not Rexam, is in China, U.S. Northeast, Florida, Benelux, Poland and Serbia. Rexam, but not Ball, is in India, U.S. Pacific Northwest, Russia and Scandinavia. Germany and the U.K. are the only two nations in Europe where both Ball and Rexam operate plants. Can Plant Locations Ball Only Rexam Only |

|

|

7 | © BALL CORPORATION | BALL.COM Global Beverage Packaging Plastic/PET 31% Glass 33% Cans 21% Other 15% Nearly 1.5 Trillion Units Annually |

|

|

8 | © BALL CORPORATION | BALL.COM Our Geographic Markets are Local Cost Breakdown of an Aluminum Can 68% Material Costs 6% Freight Costs 26% Conversion Costs Shipping Empty Cans is Inefficient and Expensive Complementary Footprints of Ball and Rexam Plants Reduced Shipping Distances Lower Prices for Customers |

|

|

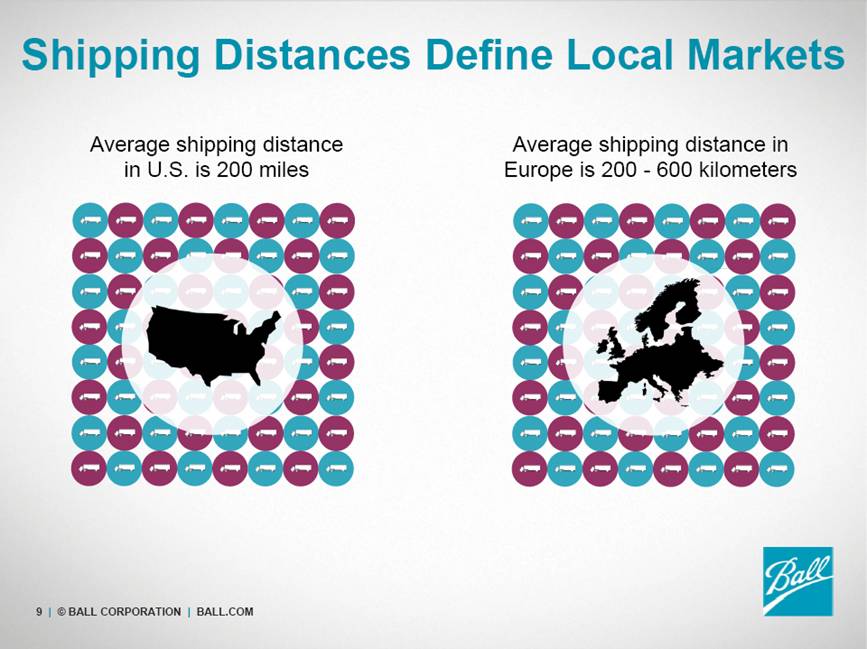

9 | © BALL CORPORATION | BALL.COM Shipping Distances Define Local Markets Average shipping distance in Europe is 200 - 600 kilometers Average shipping distance in U.S. is 200 miles |

|

|

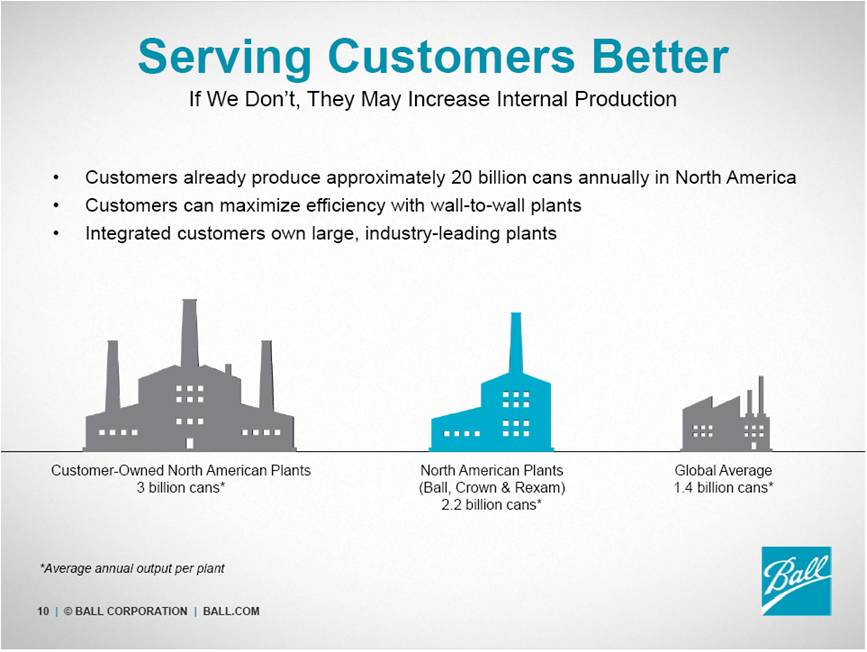

10 | © BALL CORPORATION | BALL.COM Serving Customers Better Customers already produce approximately 20 billion cans annually in North America Customers can maximize efficiency with wall-to-wall plants Integrated customers own large, industry-leading plants If We Dont, They May Increase Internal Production Customer-Owned North American Plants 3 billion cans* North American Plants (Ball, Crown & Rexam) 2.2 billion cans* Global Average 1.4 billion cans* *Average annual output per plant |

|

|

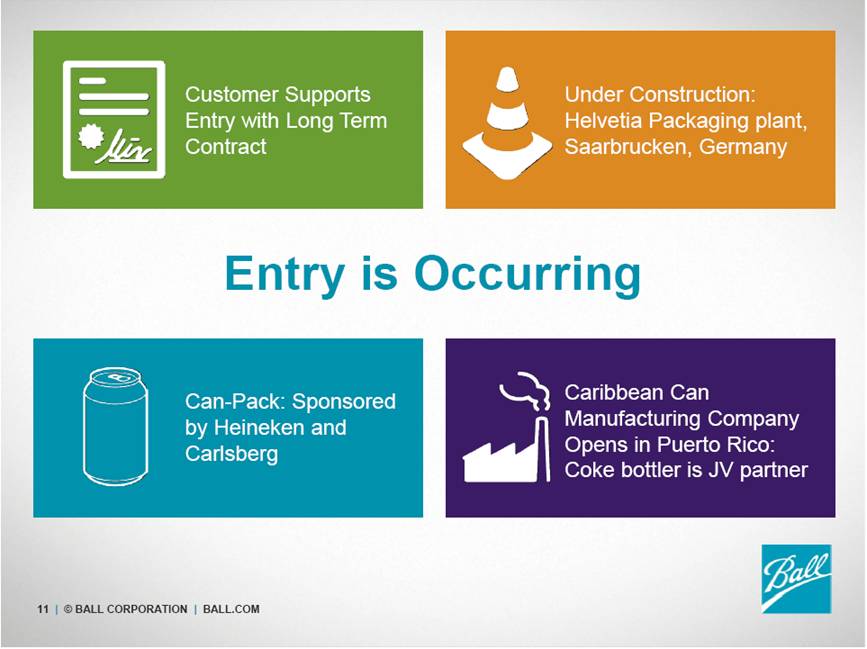

11 | © BALL CORPORATION | BALL.COM Entry is Occurring Customer Supports Entry with Long Term Contract Can-Pack: Sponsored by Heineken and Carlsberg Under Construction: Helvetia Packaging plant, Saarbrucken, Germany Caribbean Can Manufacturing Company Opens in Puerto Rico: Coke bottler is JV partner |

|

|

12 | © BALL CORPORATION | BALL.COM What the Press Says Antitrust regulators often balk at deals if there are just three big competitors. But in this case, the beer companies themselves make cans, and in some cases sell them. Anheuser Busch InBev's Metal Container Corp makes 45 percent of the cans needed for its U.S. production, and sells to PepsiCo and Coca-Cola, according to the beer maker's website. MillerCoors owns 50 percent of can maker Rocky Mountain Metal Corp, while Ball owns the other 50 percent. - Ball, Rexam merger's antitrust approval likely in the can experts, WestlawNext/Reuters, Diane Bartz, March 12, 2015 "The two companies' drive to create a global player with a presence in most major regions comes at a time when major beer groups such as SABMiller PLC and Anheuser-Busch InBev NV operate globally following their own period of consolidation as do soft drinks suppliers. Coke and SABMiller agreed to combine their soft-drink bottling operations in southern and eastern Africa last November. The combination of Ball and Rexam is likely a response to this consolidation, creating a company that can better cater for customers than its predecessor firms, which were both under-represented in some regions, said Jefferies analyst Sandy Morris." - Ball Corp. Rolls Up Rexam With Sweetened $6.7 Billion Offer, Wall Street Journal, Rory Gallivan, Feb. 19, 2015 "The deal is expected to create an industry giant that can better manage capital spending and costs as aluminum premiums rise. Can makers currently have to contend with record-high aluminum premiums and the cost of getting the metal out of storage is anticipated to peak again by mid-2015." - Ball Corporation In $6.85B Sweetened Deal To Acquire Rexam PLC, Value Walk, Feb. 19, 2015 "A deal would make strategic sense because of complementary manufacturing footprints. Rexam, which produces about 60bn cans a year for drinks companies including PepsiCo, AB InBev and Carlsberg, is strong in emerging markets such as Russia and India, while Ball has a presence in China, Vietnam and Myanmar." - Rexam agrees £4.3bn offer from US rival Ball, Financial Times, Tanya Powley, Feb. 19, 2015 |