DEF 14A: Definitive proxy statements

Published on March 12, 2019

Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant ý | ||

|

Filed by a Party other than the Registrant o |

||

Check the appropriate box: |

||

|

o |

Preliminary Proxy Statement |

|

|

o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

ý |

Definitive Proxy Statement |

|

|

o |

Definitive Additional Materials |

|

|

o |

Soliciting Material under §240.14a-12 |

|

| BALL CORPORATION | ||||

|

(Name of Registrant as Specified In Its Charter) |

||||

|

|

||||

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||||

Payment of Filing Fee (Check the appropriate box): |

||||

|

ý |

No fee required. |

|||

|

o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|||

|

(1) |

Title of each class of securities to which transaction applies: |

|||

| (2) |

Aggregate number of securities to which transaction applies: |

|||

| (3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

| (4) |

Proposed maximum aggregate value of transaction: |

|||

| (5) |

Total fee paid: |

|||

|

o |

Fee paid previously with preliminary materials. |

|||

|

o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|||

|

(1) |

Amount Previously Paid: |

|||

| (2) |

Form, Schedule or Registration Statement No.: |

|||

| (3) |

Filing Party: |

|||

| (4) |

Date Filed: |

|||

BALL CORPORATION

Notice of 2019

Annual Meeting

of Shareholders

and Proxy Statement

Wednesday,

April 24, 2019,

7:30 A.M., local time

10 Longs Peak Drive,

Broomfield, Colorado

Ball and

![]() are trademarks of Ball Corporation, Reg. U.S. Pat. & Tm. Office

are trademarks of Ball Corporation, Reg. U.S. Pat. & Tm. Office

Ball Corporation

10 Longs Peak Drive, Broomfield, Colorado

March 12, 2019

Dear Ball Corporation Shareholders,

On behalf of Ball Corporation's Board of Directors, it is my privilege to write to you to highlight a few of the Corporation's accomplishments and prospects that are outlined in detail in the attached 2019 Proxy Statement. As a Board, we truly believe that Ball is in the middle of a transformative period of growth and success.

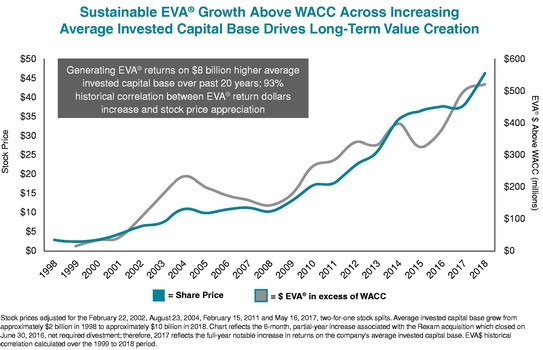

As you review this year's Proxy Statement, please note the new section describing the Corporation's sustainability initiative that emphasizes the customer and consumer benefits of infinitely recyclable aluminum containers in the face of global concerns about plastic packaging. In addition, this year's Compensation Discussion and Analysis reviews the 2018 shareholder listening tour, where management and certain members of the Board of Directors met in person with shareholders holding nearly fifty percent of our shares and communicated with those holding over ninety percent. In these conversations, we received strong affirmation of our disciplined Economic Value Added ("EVA®") filter for both capital allocation and our executive compensation program. Our shareholders and Board of Directors continue to strongly support management's EVA® focus, which has served the Corporation's shareholders well for over two decades.

In 2018, the Corporation again increased EVA® dollars by generating higher operating earnings, investing in and executing on global growth capital projects in the metal packaging businesses well in excess of our depreciation, investing in our aerospace business to position us for strong expected growth, commercializing the sustainability attributes of the aluminum packaging portfolio, divesting our underperforming U.S. steel food and aerosol assets, announcing the sale of our underperforming China beverage can business, paying down debt and returning approximately $850 million in capital to shareholders. Although EVA® dollars were relatively flat in 2018 versus 2017, the sale of the underperforming businesses and the completion of the key capital and other projects will generate meaningful EVA® dollar growth in future years.

Ball Corporation has also positioned itself as a leader in overall diversity and inclusion. We have utilized our already strong culture to drive significantly higher our overall diversity metrics across the Corporation, and have used the retirements of several Board members to reconstitute our Board of Directors to more closely resemble the world in which we operate. As a result of this initiative, in January 2019, Ball Corporation was named by Forbes as its #1 Employer for Diversity and Inclusion.

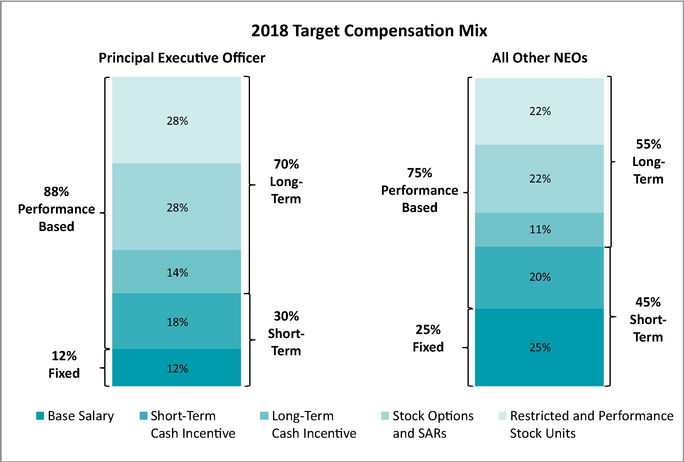

Based on its review of the Corporation's executive compensation program, the Human Resources Committee is confident that the program and its pay-for-performance metrics have directly contributed to the successful performance of the Corporation over many years and have resulted in an executive team closely aligned with shareholders. Accordingly, our Board of Directors recommends that shareholders vote "FOR" the advisory vote approving Ball's executive officer compensation.

Thank you for your investment in Ball Corporation and for this opportunity to reflect on our recent accomplishments and exciting future, and why I am so proud to be a member of the Ball Corporation team.

Stuart A. Taylor II Chairman, Human Resources Committee |

i

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

Wednesday, April 24, 2019

7:30 A.M., local time

10 Longs Peak Drive, Broomfield, Colorado 80021

The Annual Meeting of Shareholders of Ball Corporation will be held at the Corporation's offices, 10 Longs Peak Drive, Broomfield, Colorado 80021-2510, on Wednesday, April 24, 2019, at 7:30 A.M. (MDT) for the following purposes:

- 1.

- To

elect three directors for three-year terms expiring at the Annual Meeting of Shareholders to be held in 2022;

- 2.

- To

ratify the appointment of PricewaterhouseCoopers LLP as the independent registered public accounting firm for the Corporation for 2019;

- 3.

- To

approve, by non-binding advisory vote, the compensation of the named executive officers ("NEOs") as disclosed in the following Proxy Statement; and

- 4.

- To consider any other business as may properly come before the meeting, although it is anticipated that no business will be conducted other than the matters listed above.

Only holders of common stock of record at the close of business on March 1, 2019, are entitled to notice of and to vote at the Annual Meeting or any adjournment thereof. A Proxy Statement containing important information about the meeting and the matters being voted upon appears on the following pages.

Your vote is important. You are urged to read the accompanying proxy materials carefully and in their entirety and submit your proxy as soon as possible so that your shares can be voted at the meeting in accordance with your instructions. You have a choice of submitting your proxy by the Internet or by telephone, or, if you request a paper copy of the materials, by mail.

|

By Order of the Board of Directors, Charles E. Baker Corporate Secretary |

March 12,

2019

Broomfield, Colorado

PLEASE NOTE: The 2019 Annual Meeting of Shareholders will be held to tabulate the votes cast and to report the results of voting on the items described above. No management presentations or other business matters are planned for the meeting.

BALL CORPORATION

10 Longs Peak Drive, Broomfield, Colorado 80021-2510

PROXY STATEMENT

March 12, 2019

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD WEDNESDAY, APRIL 24, 2019

Important Notice Regarding the Availability of Proxy Materials

for the Annual Shareholder Meeting

The Proxy Statement, Form 10-K and Annual Report are Available

at http://materials.proxyvote.com

To Shareholders of Ball Corporation:

This Proxy Statement and the accompanying proxy are furnished to shareholders in connection with the solicitation by the Board of Directors of Ball Corporation (the "Corporation" or "Ball") of proxies to be voted at the Annual Meeting of Shareholders (the "Annual Meeting") to be held April 24, 2019, for the purposes stated in the accompanying notice of the meeting. We are first furnishing and making available to shareholders the proxy materials on March 12, 2019.

Please submit your proxy as soon as possible so that your shares can be voted at the meeting. All properly completed proxies submitted by telephone or the Internet, and all properly executed written proxies returned by shareholders who request paper copies of the proxy materials, that are delivered pursuant to this solicitation, will be voted at the meeting in accordance with the directions given in the proxy, unless the proxy is revoked prior to completion of voting at the meeting. Only holders of record of shares of the Corporation's common stock as of the close of business on March 1, 2019, the record date for the Annual Meeting, are entitled to notice of and to vote at the meeting, or at any adjournments or postponements of the meeting.

Any Ball Corporation shareholder of record as of March 1, 2019, the record date, desiring to submit a proxy by telephone or via the Internet will be required to enter the unique voter control number imprinted on the Ball Corporation proxy card, and therefore should have the proxy card for reference when initiating the process.

|

|

To submit your proxy by telephone, call 1-800-690-6903 on a touch-tone telephone and follow the menu instructions provided. There is no charge for this call. | |

|

|

To submit your proxy over the Internet, log on to the Website www.proxyvote.com and follow the instructions provided. |

Similar instructions are included on the enclosed proxy card.

A shareholder of record of the Corporation may revoke a proxy in writing at any time prior to the meeting by sending written notice of revocation to the Corporate Secretary; by voting again by telephone; by voting via the Internet; by voting in writing if you requested your materials in paper copy; or by voting in person at the meeting.

1

Why am I receiving the Proxy Statement? You are receiving the Proxy Statement because you owned shares of Ball Corporation common stock on March 1, 2019, the record date, and that entitles you to vote at the Annual Meeting. The Corporation's Board of Directors ("Board") is soliciting your proxy to vote at the scheduled 2019 Annual Meeting or at any later meeting should the scheduled Annual Meeting be adjourned or postponed for any reason. Your proxy will authorize specified people (proxies) to vote on your behalf at the Annual Meeting in accordance with your written instructions. By use of a proxy, you can vote, whether or not you attend the meeting.

What will I be voting on? You will be voting on (1) the election of three director nominees named in this Proxy Statement for terms expiring at the 2022 annual meeting of shareholders; (2) the ratification of the appointment of PricewaterhouseCoopers LLP as the Corporation's independent registered public accounting firm for 2019; and (3) an advisory vote to approve the compensation of the named executive officers.

What are the Board of Directors' recommendations? The Board recommends a vote (1) FOR the election of the three director nominees named in this Proxy Statement; (2) FOR the ratification of the appointment of PricewaterhouseCoopers LLP as the Corporation's independent registered public accounting firm for 2019; and (3) FOR the advisory vote on the compensation of the named executive officers.

Could other matters be decided at the Annual Meeting? We do not know of any other matters that will be raised at the Annual Meeting. The Chairman will allow presentation of a proposal or a nomination for the Board from the floor at the Annual Meeting only if the proposal or nomination was properly submitted. The proxies will have discretionary authority, to the extent permitted by law, to vote for or against other matters that may properly come before the Annual Meeting as those persons deem advisable.

How many votes can be cast by all shareholders? Each share of Ball Corporation common stock is entitled to one vote on each of the three directors to be elected and one vote on each other matter that is properly presented at the Annual Meeting.

How do I vote my shares if I am a record holder? If you are a record holder of shares; that is, the shares are registered in your name and not the name of your broker or other nominee, you are urged to submit your proxy as soon as possible, so that your shares can be voted at the meeting in accordance with your instructions. You may submit your proxy by telephone or via the Internet as instructed on page 1 of the Proxy Statement and on your proxy card, or you can complete, sign, date and mail your proxy card if you request a paper copy of the proxy materials. You may also vote by attending the Annual Meeting, or sending a personal representative to the Annual Meeting with an appropriate proxy, in order to vote. Unless you or a personal representative plan to be in attendance and vote at the meeting, your vote must be received no later than 11:59 P.M. (EDT) on Tuesday, April 23, 2019.

How do I vote my shares if I hold my shares under the Employee Stock Purchase Plan ("ESPP") or the 401(k) Plan? Participants may vote their shares in the manner set forth above; however, shares held through the ESPP or the 401(k) Plan must be voted by 11:59 P.M. (EDT) on Sunday, April 21, 2019. The Trustee of the 401(k) Plan will vote the unvoted shares for each voting item in the same proportion as the voted shares for each item. The Administrator of the ESPP will vote the unvoted shares for that Plan in accordance with the Board of Directors' recommendations.

How do I vote my shares if I hold my shares in "street name" through a bank or broker? If you hold your shares as a beneficial owner through a bank, broker or other nominee, you must provide voting instructions to your bank, broker or other nominee by the deadline provided in the materials you receive from your bank, broker or other nominee to ensure your shares are voted in the way you would like at the meeting. Your bank, broker or other nominee will send you specific instructions in this regard to vote your shares. If you do not provide instructions to your bank, broker or other nominee, whether your shares are voted depends on the type of item being considered for a vote. For example, under applicable stock exchange rules, brokers are permitted to vote on "discretionary" items if the voting instructions from the beneficial owners of the shares are not provided in a timely manner. Brokers are not permitted to vote on "nondiscretionary" items. The proposal to approve the appointment of independent auditors is considered a "discretionary" item. This means that brokerage firms may vote in their discretion on this matter on behalf of clients who have not furnished voting instructions at least ten days before the date of the meeting. In contrast, the other items to be voted on at the Annual Meeting are "nondiscretionary" items. This means brokerage firms that have not received voting instructions from their clients on these items may not vote on them. These so-called "broker nonvotes" will be included in the calculation of the number of votes considered to be present at the meeting for purposes of determining a quorum, but will not be considered in determining the number of votes necessary for approval and will have no effect on the outcome of the votes for such items.

Can I revoke my proxy or change my vote? Shareholders of record may revoke their proxies or change their votes in writing at any time prior to the meeting by sending written notice of revocation to the Corporate Secretary; by voting again by telephone or via the Internet; by voting in writing if they requested their materials in paper copy; or by voting in person at the meeting. Attendance in and of itself at the Annual Meeting will not revoke a proxy. For shares you hold beneficially but not of record, you may change your vote by submitting new voting instructions to your bank, broker or other nominee or, if you have obtained a valid proxy from your broker or nominee giving you the right to vote your shares, by attending the meeting and voting in person.

2

VOTING SECURITIES AND PRINCIPAL SHAREHOLDERS

At the close of business on March 1, 2019, there were outstanding 334,169,531 shares of common stock. Each of the shares of common stock is entitled to one vote. Shareholders do not have cumulative voting rights with respect to the election of directors.

Based on Schedule 13G filings with the Securities and Exchange Commission ("SEC"), the following table indicates the beneficial owners of more than 5% of the Corporation's outstanding common stock as of December 31, 2018:

| Name and Address of Beneficial Owner |

Shares Beneficially Owned |

Percent of Class |

|||||

|---|---|---|---|---|---|---|---|

The Vanguard Group |

37,494,129 | (1) | 11.05 | ||||

T. Rowe Price Associates, Inc. |

34,089,830 |

(2) |

10.00 |

||||

BlackRock, Inc. |

21,577,035 |

(3) |

6.40 |

||||

Wellington Management Group LLP |

18,391,864 |

(4) |

5.42 |

||||

- (1)

- 388,619

shares with sole power to vote or direct to vote.

75,516 shares with shared power to vote or direct to vote.

37,037,245 shares with sole power to dispose of or to direct the disposition of.

456,884 shares with shared power to dispose of or to direct the disposition of.

Vanguard Fiduciary Trust Company ("VFTC"), a wholly owned subsidiary of The Vanguard Group, Inc., is the beneficial owner of 286,827 shares or 0.08% of the common stock outstanding of the Corporation as a result of its serving as investment manager of collective trust accounts.

Vanguard Investments Australia, Ltd. ("VIA"), a wholly owned subsidiary of The Vanguard Group, Inc., is the beneficial owner of 267,347 shares or 0.07% of the common stock outstanding of the Corporation as a result of its serving as investment manager of Australian investment offerings.

- (2)

- 11,893,653

shares with sole voting power.

34,089,830 shares with sole dispositive power.

No shares with shared voting power and shared dispositive power. - (3)

- 18,803,800

shares with sole voting power.

21,577,035 shares with sole dispositive power.

No shares with shared voting power.

No shares with shared dispositive power. - (4)

- 14,799,749

shares with shared voting power.

18,391,864 shares with shared dispositive power.

No shares with sole voting and dispositive power.

The securities reported by Wellington Management Group LLP, as parent holding company of certain holding companies and Wellington Investment Advisers, are owned of record by clients of Wellington Investment Advisors. Wellington Investment Advisors Holdings LLP controls directly or indirectly through Wellington Management Global Holdings, Ltd., Wellington Investment Advisors. Wellington Investment Advisors Holdings LLP is owned by Wellington Group Holdings LLP. Wellington Group Holdings LLP is owned by Wellington Management Group LLP.

3

The following table lists the beneficial ownership of common stock of the Corporation of our director nominees, continuing directors, all individuals who served as either our Chief Executive Officer ("CEO") or our Chief Financial Officer ("CFO") during the last fiscal year, the three other highest paid executive officers (and one former executive officer) of the Corporation and, as a group, all of such persons and our other executive officers as of the close of business on March 1, 2019.

| | | | | | | | | | | | | | | | | | | | | | |

|

|

Title of Class |

Name of |

|

Shares Beneficially Owned (1) |

Percent of Class (2) |

|

Number of Shares Which Become Available or Subject to Options Exercisable or Which Become Exercisable Within 60 Days of March 1, 2019 (3) |

|

Deferred Share or Stock Unit Equivalent (4) |

|

Restricted Stock Shares or Units (5) |

| ||||||||

| | | | | | | | | | | | | | | | | | | | | | |

|

Common | Robert W. Alspaugh |

84,820 | * | 78,820 | 40,959 | 78,820 | ||||||||||||||

|

| Common | Charles E. Baker |

| 507,317 | (6) | * | | 285,871 | | 146,243 | | 56,742 | | |||||||

|

Common | John A. Bryant |

| * | | | 3,576 | ||||||||||||||

|

| Common | Michael J. Cave |

| 6,000 | * | | | | 6,179 | | 26,460 | | ||||||||

|

Common | Daniel W. Fisher |

118,213 | * | 77,714 | 9,817 | 89,138 | ||||||||||||||

|

| Common | John A. Hayes |

| 2,891,760 | (7) | * | | 2,383,666 | | 699,278 | | 259,944 | | |||||||

|

Common | Daniel J. Heinrich |

9,500 | * | | 3,389 | 19,464 | ||||||||||||||

|

| Common | Pedro H. Mariani |

| 6,000 | * | | | | | | 54,148 | | ||||||||

|

Common | Scott C. Morrison |

924,055 | * | 552,897 | 293,654 | 86,332 | ||||||||||||||

|

| Common | Georgia R. Nelson |

| 18,000 | * | | | | 70,166 | | 86,820 | | ||||||||

|

Common | Cynthia A. Niekamp |

6,000 | * | | | 19,464 | ||||||||||||||

|

| Common | Lisa A. Pauley |

| 706,233 | (8) | * | | 273,340 | | 196,282 | | 59,673 | | |||||||

|

Common | James N. Peterson |

30,400 | * | | | | ||||||||||||||

|

| Common | Cathy D. Ross |

| | * | | | | 2,952 | | 7,101 | | ||||||||

|

Common | Theodore M. Solso |

254,394 | (9) | * | 132,512 | 135,468 | 132,512 | |||||||||||||

|

| Common | Stuart A. Taylor II |

| 167,356 | * | | | | 108,320 | | 172,176 | | ||||||||

|

Common | All of the above and present executive officers as a group (19) |

6,062,792 | (10) | 1.8 | 3,992,629 | 1,799,163 | 1,241,238 | |||||||||||||

| | | | | | | | | | | | | | | | | | | | | | |

- (1)

- Full

voting and dispositive investment power, unless otherwise noted.

- (2)

- *

Indicates less than 1% ownership.

- (3)

- Includes

RSUs that may vest or options that may vest or be acquired upon exercise during the next 60 days.

- (4)

- These

deferred shares or stock units are equivalent to an equal number of shares of common stock that have been deferred to the Ball Corporation

Deferred Compensation Company Stock Plans, with no voting rights or dispositive investment power with respect to the underlying common stock prior to its issuance.

- (5)

- These

Restricted Stock Shares or Restricted Stock Units have no voting rights or dispositive investment power.

- (6)

- Includes

800 shares owned by Mr. Baker's children, as to which he disclaims beneficial ownership.

- (7)

- Includes

147,782 shares held in trust, as to which he disclaims beneficial ownership.

- (8)

- Includes

283,475 shares owned by Ms. Pauley's spouse, as to which she disclaims beneficial ownership.

- (9)

- Includes

56,000 shares held in trust, as to which Mr. Solso disclaims beneficial ownership.

- (10)

- Includes 488,057 shares to which beneficial ownership is disclaimed. In addition, no shares have been pledged as security.

4

VOTING ITEM 1ELECTION OF DIRECTORS

Pursuant to our Amended Articles of Incorporation, as amended, and the Indiana Business Corporation Law, our Board of Directors is divided into three classes, as nearly equal in number as possible, with directors serving staggered three-year terms. Amendments to the Indiana Business Corporation Law in 2009 made this classified Board structure statutorily required for Ball Corporation, effective from and after July 31, 2009. On April 24, 2019, three persons are to be elected to serve as directors until the 2022 Annual Meeting of Shareholders. Unless otherwise instructed on the accompanying proxy, the persons named in the proxy intend to vote for nominees Daniel J. Heinrich, Georgia R. Nelson and Cynthia A. Niekamp to hold office as directors of the Corporation until the 2022 Annual Meeting of Shareholders (Class I), or, in each case, until his or her respective successor is elected and qualified. Each of the nominees has consented to be named as a candidate in the Proxy Statement and has agreed to serve if elected. If, for any reason, any of the nominees becomes unavailable for election, the shares represented by proxies will be voted for any substitute nominee or nominees designated by the Board. The Board has no reason to believe that any of the nominees will be unable to serve.

Robert W. Alspaugh, who has served as a director since 2008 and Theodore M. Solso, who has served as a director since 2003, have reached the retirement age for directors and will both retire at the time of the 2019 Annual Meeting. The Corporation wishes to express its sincere appreciation to Messrs. Alspaugh and Solso for their significant contributions to the Corporation and its shareholders during their long and distinguished tenure as directors.

Under the Corporation's Amended Articles of Incorporation, as amended, in an uncontested election, which is the case at this Annual Meeting, directors are elected by a majority of the votes cast by the shares entitled to vote in the election at a meeting at which a quorum is present. If more "against" than "for" votes are received, the Corporation's Bylaws require the director to tender his or her resignation and the Nominating/Corporate Governance Committee must make a recommendation to the Board to consider whether to accept the resignation. The relevant Bylaw provisions are set out in Exhibit A to this Proxy Statement. For this vote, abstentions and broker nonvotes are considered neither votes "for" nor "against" and will not affect the outcome of the vote. Proxies may not be voted for a greater number of persons than the three named nominees.

Set forth for each director nominee in Class I and for each continuing director in Classes II and III is the director's principal occupation and employment during the past five years or, if longer, the period during which the director has served as a director, and certain other information, including his or her public company directorships during the past five years.

The Board of Directors recommends a vote "FOR" the election of each nominee for Director named.

5

BALL CORPORATION BOARD COMPOSITION

| The Nominating Committee considers many factors with respect to board composition. | ||

|

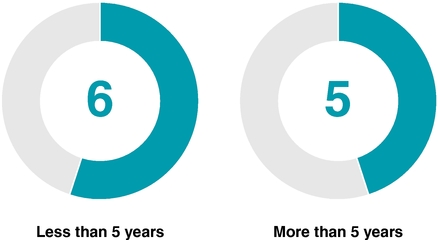

TENURE |

||

|

The Corporation has a mandatory retirement age of 72 for all Board members in part to ensure the board benefits from a balanced mix of perspectives. The Board is well balanced with a mix of long standing directors and directors who have joined the Corporation in the last 5 years. |

||

|

AVERAGE TENURE = 6.4 YEARS |

||

|

|

|

| | | |

|

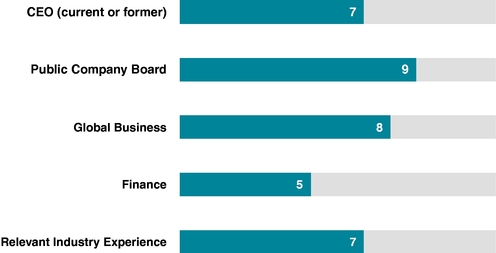

EXPERIENCE The Board is composed of members with diverse qualifications and experience that support the Corporation's business strategy and future business needs.

|

6

DIRECTOR NOMINEES AND CONTINUING DIRECTORS

To Be Elected for a Term of Three Years Until the 2022 Annual Meeting (Class I)

Daniel J. Heinrich

Director since: 2016

Age: 62

Board Committees: Audit and Nominating/Corporate Governance

Other Public Company Boards: Director, ARAMARK, Philadelphia, Pennsylvania; and Edgewell Personal Care Company, Shelton, Connecticut.

Mr. Heinrich was executive vice president and chief financial officer of The Clorox Company from 2003 to 2011. Previous corporate roles include senior vice president and treasurer at Transamerica Finance Corporation; senior vice president, treasurer and controller at Granite Management Company; and senior vice president, chief accounting officer and controller at First Nationwide Bank.

Specific qualifications, attributes, skills and experience: Mr. Heinrich joined The Clorox Company in 2001 as vice president and controller and served as its executive vice president and chief financial officer from 2003 until 2011. As CFO for Clorox, Mr. Heinrich served as a member of its executive and employee benefits committees, secretary to the audit and finance committees of the board, and board member for most of the company's subsidiaries. He had senior management responsibility for the financial aspects of a large, global organization including its global business services, mergers and acquisitions, accounting, tax and information technology activities. Mr. Heinrich also serves on the boards of ARAMARK, where he chairs the audit committee and serves on its finance committee, and Edgewell Personal Care, where he serves on its finance and compensation committees. Additionally, Mr. Heinrich serves on the board of a large, privately held winery where he is a member of its audit and finance committees, its management development and compensation committee, and participates on various operating and advisory committees. Mr. Heinrich's extensive management and board experience clearly qualify him to serve as a director of our Corporation.

Georgia R. Nelson

Director since: 2006

Age: 69

Board Committees: Human Resources and Nominating/Corporate Governance

Other Public Company Boards: Director, Cummins Inc., Columbus, Indiana; TransAlta Corporation, Calgary, Alberta; and Sims Metal Management Ltd., Botany, Australia.

Ms. Nelson has been President and Chief Executive Officer, PTI Resources, LLC, Chicago, Illinois, since June 2005; was President, Midwest Generation EME, LLC, Chicago, Illinois, April 1999 to June 2005; and was General Manager, Edison Mission Energy Americas, Irvine, California, January 2002 to June 2005.

Specific qualifications, attributes, skills and experience: Ms. Nelson has enjoyed a successful career in the energy industry, serving as a senior executive for several U.S. and international energy companies, including as President of Midwest Generation EME, LLC from April 1999 to June 2005 and General Manager of Edison Mission Energy Americas from January 2002 to June 2005. She has had extensive international experience as well as environmental and policy experience on four continents. Ms. Nelson regularly lectures on business and corporate governance matters including at Northwestern University's Kellogg Graduate School of Management, and serves on the advisory committee of the Center for Executive Women at Northwestern. Ms. Nelson is a National Association of Corporate Directors ("NACD") Board Leadership Fellow. Previously Ms. Nelson served as a director of CH2M Inc. and on four other publicly traded company boards. Ms. Nelson's leadership roles in global businesses, as well as her service on other company boards, clearly qualify her to serve as a director of our Corporation.

7

Cynthia A. Niekamp

Director since: 2016

Age: 59

Board Committees: Human Resources and Finance

Other Public Company Boards: Director, Magna International Inc., Toronto, Ontario. In the past five years, she also served on the board of Cooper Tire & Rubber Company.

Ms. Niekamp is a former senior executive of PPG Industries, Inc., having served from 2009 to 2016 as senior vice president of automotive coatings. Prior to that, she was president and general manager of TorqTransfer Systems at BorgWarner Inc.; senior vice president and chief financial officer at MeadWestvaco Corporation (now WestRock Company); and held various leadership roles at TRW, Inc. and General Motors Company.

Specific qualifications, attributes, skills and experience: Ms. Niekamp joined PPG in 2009 as vice president of automotive coatings and was promoted to senior vice president in 2010. She had responsibility for a sizeable business with operations across 15 countries and more than 6,000 employees. She also served as a member of the PPG operating committee until her retirement in 2016. While at PPG, Ms. Niekamp charted and implemented a strategy to improve the financial performance of the business unit and to double its revenues. She also accelerated the business' growth into emerging countries, diversified the customer base and pursued strategic acquisitions. Previously, Ms. Niekamp served as president and general manager of BorgWarner's TorqTransfer Systems division, a supplier of engineered-four-wheel drive systems to major automakers. She also served in various executive roles for MeadWestvaco Corporation (now WestRock Company), including vice president, corporate strategy and planning; senior vice president, strategy and specialty operations; and chief financial officer, and has previously served on four other publicly traded company boards. She is also a NACD Board Leadership Fellow. Ms. Niekamp's extensive management and board experience clearly qualify her to serve as a director.

8

To Continue in Office Until the 2020 Annual Meeting (Class II)

John A. Hayes

Director since: 2010

Age: 53

Other Public Company Boards: None

Mr. Hayes has been Chairman, Ball Corporation since April 2013; President and Chief Executive Officer, Ball Corporation, since January 2011. He was President and Chief Operating Officer, January 2010 to January 2011; Executive Vice President and Chief Operating Officer, 2008 to 2010; President, Ball Packaging Europe and Senior Vice President, Ball Corporation, 2007 to 2008; Executive Vice President, Ball Packaging Europe and Vice President, Ball Corporation, 2005 to 2006; Vice President, Corporate Strategy, Marketing and Development, 2003 to 2005; Vice President, Corporate Planning and Development, 2000 to 2003; Senior Director, Corporate Planning and Development, 1999.

Specific qualifications, attributes, skills and experience: Prior to joining Ball Corporation in 1999, Mr. Hayes was a Vice President of Lehman Brothers Inc. and part of an investment banking team which focused on merger and acquisition and financing advice to several major companies, including the Corporation. At Ball, Mr. Hayes initially headed our corporate development and planning activities as Senior Director and then Vice President, Corporate Planning and Development, taking on the added responsibilities of marketing and new product development from 2003 to mid-2005. He then served as President of Ball Packaging Europe, which produced excellent financial results and strong revenue growth under his leadership. During 2008 and 2009, Mr. Hayes served as Ball's Executive Vice President and Chief Operating Officer, successfully leading our key operating divisions through the economic and financial crisis. In January 2010, he was named our President and Chief Operating Officer and joined the Ball Board. In January 2011, he became our President and Chief Executive Officer, and in April 2013 he also became our Chairman. Mr. Hayes' extensive investment banking and leadership experience within Ball, including as CEO for the past eight years, make him well qualified to serve as a director.

Cathy D. Ross

Director since: 2017

Age: 61

Board Committees: Audit and Nominating/Corporate Governance

Other Public Company Boards: Director, Steelcase, Inc., Grand Rapids, Michigan. In the past five years, she has also served on the board of Avon Products, Rye, New York.

Ms. Ross was chief financial officer and executive vice president, FedEx Express from 2010 until her retirement in July 2014. Prior to that, Ms. Ross was senior vice president and chief financial officer of FedEx Express from 2004 until 2010; and Vice President, Express Financial Planning from 1998 to 2004.

Specific qualifications, attributes, skills and experience: As an executive of Federal Express, Ms. Ross was responsible for the company's worldwide financial affairs, including financial planning, reporting and analysis, accounting and controls, as well as long-range strategic planning. Ms. Ross' 30-year career with Federal Express began in 1984 as a senior financial analyst, and she held numerous other leadership roles of increasing responsibility during her tenure there. Prior to joining Federal Express, Ms. Ross worked for Kimberly-Clark Corporation as a cost analyst and a cost analyst supervisor from 1982 until 1984. She has also worked for a subsidiary of Procter and Gamble. Ms. Ross holds a master's degree in business administration from the University of Memphis and a bachelor's degree from Christian Brothers University in Memphis. Ms. Ross' leadership roles, financial expertise and experience, and service on other global public company boards (including on their audit committees) make her well qualified to serve as a director.

9

Stuart A. Taylor II

Director since: 1999

Age: 58

Board Committees: Audit and Human Resources

Other Public Company Boards: Director, Hillenbrand, Inc., Batesville, Indiana. In the past five years, he also served on the board of Essendant, Inc., Deerfield, Illinois.

Mr. Taylor has been the Chief Executive Officer, The Taylor Group LLC, Chicago, Illinois, since June 2001; he was Senior Managing Director, Bear, Stearns & Co. Inc., Chicago, Illinois, 1999 to 2001.

Specific qualifications, attributes, skills and experience: Prior to starting his own private equity firm, Mr. Taylor spent 19 years in investment banking. The majority of that time was spent at Morgan Stanley in its Corporate Finance Department. In that capacity he executed a number of mergers and acquisitions and financings, including working with Ball in 1993 on the acquisition of Heekin Can Company. He also spent time at several other firms including Bear Stearns where he was a Senior Managing Director and Head of the Chicago office. In 2001, Mr. Taylor established The Taylor Group LLC, of which he is Chief Executive Officer, a successful investment company that primarily invests in small to mid-market businesses. Mr. Taylor has been a director of Ball since 1999, acted as our Presiding Director from 2004 to 2008 and chairs our Human Resources Committee. He is also a director of another U.S.-based public company. Mr. Taylor's extensive experience as an investment banker, entrepreneurial investor and Ball Board member make him well qualified to serve as a director.

10

To Continue in Office Until the 2021 Annual Meeting (Class III)

John A. Bryant

Director since: 2018

Age: 52

Board Committees: Audit and Nominating/Corporate Governance

Other Public Company Boards: Director, Macy's Inc; Compass PLC

Mr. Bryant was an executive at Kellogg Company for 20 years and was its Chief Executive Officer from January 2011 to September 2017.

Specific qualifications, attributes, skills and experience: Mr. Bryant joined Kellogg Company in 1998 and held a variety of roles including chief financial officer; president, North America; president, international; and chief operating officer before becoming chief executive officer in January 2011. He retired as chairman of the board in March 2018 and chief executive officer in September 2017. In addition to his role on Ball's board, Bryant serves as a board member of Macy's Inc., and Compass PLC. He has also served as a trustee of the W.K. Kellogg Foundation Trust, and on the boards of directors of Catalyst and The Consumer Goods Forum. Mr. Bryant has extensive knowledge and expertise in accounting and financial matters, branded consumer products and consumer dynamics, crisis management, international markets, people management, manufacturing and strategy, and strategic planning. Mr. Bryant's extensive experience as a senior executive at a leading U.S.-based public company, including as its CEO for over seven years, make him well qualified to serve as a director.

Michael J. Cave

Director since: 2014

Age: 58

Board Committees: Audit and Finance

Other Public Company Boards: Director, Esterline Technologies, Bellevue, Washington; Harley-Davidson, Inc., Milwaukee, Wisconsin; and Aircastle Limited, Stamford, Connecticut.

Mr. Cave was Senior Vice President, The Boeing Company, and President of Boeing Capital Corp. from 2010 to 2014, and served for many years in senior management positions at Boeing.

Specific qualifications, attributes, skills and experience: Mr. Cave served for 31 years in various managerial capacities for The Boeing Company. Most recently, Mr. Cave served as Senior Vice President and President of Boeing Capital Corp., a subsidiary of The Boeing Company, from 2010 to 2014. Prior to that, he served as Senior Vice President of Business Development and Strategy at The Boeing Company, as well as Vice President of Business Strategy & Marketing of Boeing Commercial Airplanes from 2006 until late 2009. Prior to that, Mr. Cave served as Vice President & General Manager of Boeing's Airplane Programs division and focused on the strategy, product development and business results associated with those products. From 2003 to 2006, Mr. Cave served as the Chief Financial Officer of Boeing's Commercial Airplanes division and held various other senior positions prior to 2003. In addition to his accounting and financial expertise, Mr. Cave has broad experience in marketing and informational systems. He also serves on the Board of Directors of Harley Davidson, Inc. (and as its non-executive Chairman), Aircastle Limited and Esterline Technologies. In 2004, Mr. Cave was honored with the Award for Executive Excellence by the Hispanic Engineer National Achievement Awards Corporation. His experience and qualifications make him well qualified to serve as a director.

11

Pedro Henrique Mariani

Director since: 2017

Age: 65

Board Committee: Finance

Other Company Boards: Member of the board, Banco Bocom BBM, a Brazilian financial institution and member of FEBRABAN (Brazilian Federation of Banks).

Specific qualifications, attributes, skills and experience: Mr. Mariani joined BBM Group in 1981, was elected to the executive committee of Banco BBM in 1983. He was appointed its chief executive officer in 1991. Currently, he is the chief executive officer and chairman of the board of directors at Banco Bocom BBM. Mr. Mariani was president of ANBID (Brazilian Association of Investment Banks) between 1996 and 2000, and was a member of the Brazilian Financial System Council from 1988 to 1996. From 1995 to 2015, Mr. Mariani was an ex officio member of the board of directors of Latapack-Ball Embalagens Limitada, which was a joint venture between Ball and its Brazilian partners that owned and operated a successful beverage can business in Brazil with annual revenues in excess of $590 million in 2015, the year in which Ball acquired the equity interests of its partners. Mr. Mariani and his family have also held interests in packaging and other businesses in Brazil for many years.

Mr. Mariani has a bachelor's degree in economics from Pontifícia Universidade Católica do Rio de JaneiroPUC/RJ, Brazil, with specialization in Econometrics and Operational Research. Mr. Mariani's professional background, packaging industry and other business background, and banking experience, as well as his financial acumen and knowledge of South America make him well qualified to serve as a board member.

12

BOARD LEADERSHIP STRUCTURE AND RISK OVERSIGHT

In April 2013, John A. Hayes was named Chairman of the Board, having been elected a director in 2010. In 2011, prior to his election as Chairman, Mr. Hayes was named President and Chief Executive Officer ("CEO"). Mr. Hayes assumed the position of Chairman after more than 14 years with Ball, most recently serving as President and CEO and a member of the Board.

Our Board of Directors is currently composed of Mr. Hayes, as well as 10 other directors, all of whom are independent directors, except for Mr. Hayes and Mr. Mariani. The Board has four standing committeesAudit, Nominating/Corporate Governance, Human Resources and Finance. Each of the committees, except for Finance, is composed solely of independent directors (the Finance Committee is primarily composed of independent directors), with each of the four committees, having an independent director serving as chairman. Mr. Solso has served as Lead Independent Director since April 2013.

Although the Corporation's Bylaws do not require that the roles of Chairman and CEO be combined, we believe our Corporation and its shareholders are well served by this traditional board leadership model. Having a single person lead the Corporation and the Board provides clear leadership, helps to maintain uniform management vision for the Corporation and the Board and provides efficiency. The Board believes that the CEO is the person best suited to serve as Chairman, because he is the person most familiar with the Corporation's businesses and the most capable of effectively identifying strategic priorities and opportunities and leading the Board in the discussion of the execution of the Corporation's strategy. Pursuant to SEC and New York Stock Exchange ("NYSE") rules, regularly scheduled executive sessions of nonmanagement directors are held. Executive sessions of independent directors are also held at least annually. Such meetings promote open discussion by nonmanagement and independent directors, enabling them to serve as a check on management, if necessary. The meetings of the independent directors are chaired by the Lead Independent Director, who is appointed by the Board.

In accordance with NYSE requirements, our Audit Committee is responsible for overseeing the risk management function of the Corporation. While the Audit Committee has primary responsibility for overseeing risk management, the entire Board is involved in overseeing risk management for the Corporation. Additionally, each Board committee considers the specific risks within its area of responsibility. Our Internal Audit Department has, for many years, analyzed various areas of risk to the Corporation and has provided risk assessment and analysis to our Audit Committee. In 2007, the Corporation established a comprehensive Enterprise Risk Management process which is now supervised by our Senior Vice President and Chief Financial Officer, whereby key corporate and divisional risks are systematically identified and assessed on a regular basis. The results of this ongoing risk assessment are reported to our Audit Committee and to our Board at least annually.

One of the responsibilities of our Board of Directors is to evaluate the effectiveness of the Board and make recommendations involving its organization and operation. The Board annually conducts a robust self-evaluation process that is discussed at the January meeting of the Directors, following which the Chairman holds detailed one-on-one meetings with each Director to discuss the evaluations and any other matters raised by the Directors. We recognize that different board leadership structures may be appropriate for different companies and at different times. We believe our current leadership structure, with Mr. Hayes serving as Chairman, President and CEO, a Board with a majority of independent directors, an independent chairman for each of our standing Board committees, and separate meetings of nonmanagement and independent directors, led by the Lead Independent Director, provides the most effective form of leadership for our Corporation at this time. We believe that our directors provide effective oversight of risk management through the Board's regular dialogue with Ball management, the Enterprise Risk Management process, annual Board and Committee self-evaluation, and assessment of specific risks within each Board committee's areas of responsibility.

Ball's Nominating/Corporate Governance Committee consistently applies the principles of diversity and inclusion that are among our core values, in its consideration of candidates for Board positions. In addition to considering characteristics such as business and professional experience, education and skills, the Committee utilizes a robust director candidate review process that considers a variety of other characteristics, such as race, gender and national origin, all leading to differences of viewpoint and other individual qualities that contribute to Board heterogeneity. This has resulted in a diverse group of talented and capable Board members, as described in more detail under "Director Nominees and Continuing Directors."

13

To identify potential Board candidates, the Committee works with a globally-recognized consulting firm, providing particular guidelines and a matrix of specific characteristics that are used to assess Board candidates, which include characteristics of diversity. After a thorough review process by our consultant against the criteria that have been provided, the pool of qualified candidates is presented to the Committee. Selected candidates are further assessed and interviewed by the Committee, considering the values and needs of the Company more closely, including the need for a diverse Board.

Our Board embodies the principle of diversity. Over the past five years, the Corporation has added six new directors to the Board, each of whom has significantly enhanced the diversity of the Board of Directors of the Corporation, creating a stronger Board as a result. The Committee will continue to identify opportunities to strengthen the diversity of our Board when considering candidates in the future.

Sustainability is a key part of our business strategy at Ball. By enhancing the unique sustainability credentials of our products along their life cycles, we position our metal beverage and aerosol containers as the most sustainable packaging choice and help our customers grow their businesses. Aluminum is an infinitely recyclable material. It also has the highest scrap value of all commonly used packaging substrates. These qualities make beverage and aerosol containers an increasingly attractive option for sustainability conscious consumers and brands who acknowledge that metal packaging is a true enabler of a circular economy in terms of economic value, recyclability, real recycling and the avoidance of down cycling. In 2017, Resource Recycling Systems recognized aluminum beverage cans as the most recycled beverage package in the world, with a global weighted average recycling rate for aluminum of 69 percent. This finding solidifies the aluminum can as the leader in real recycling, where the package is collected and then transformed into an item of equal value (product to product or material to material recycling). In comparison, only 43 percent of PET and 46 percent of glass bottles were collected for recycling, although not necessarily recycled.

In some of Ball's markets such as Brazil, China and several European countries, recycling rates for aluminum beverage cans are at or above 90 percent. The most recently available recycling rates for aluminum beverage cans are 97 percent in Brazil in 2017, 74 percent in Europe in 2015, and 49 percent in the U.S. in 2016.

We focus our sustainability efforts on product stewardship, operational excellence, talent management and community engagement. In our global operations, we work on continuous improvement of employee safety, energy and water efficiency, waste generation and air emissions.

Because metal recycling saves resources and uses significantly less energy than primary metal production, the biggest opportunity to further enhance the positive environmental attributes of metal packaging is to increase recycling rates. In markets where recycling rates are below where we believe they should be, we help establish and financially support packaging collection and recycling initiatives. These initiatives typically focus on collaborating with public and private partners to create effective collection and recycling systems, including education of consumers about the sustainability benefits of metal packaging.

Corporate Governance Guidelines

The Board has established Corporate Governance Guidelines to comply with the relevant provisions of Section 303A of the NYSE Listed Company Manual (the "NYSE Listing Standards"). The Corporate Governance Guidelines are set forth on the Corporation's Website at www.ball.com/investors under "Corporate Governance." A copy may also be obtained upon request from the Corporation's Corporate Secretary.

Policies on Business Ethics and Conduct

Ball established a Corporate Compliance Committee in 1993, which now consists of a focal point in each operating division and which is chaired by a designated Compliance Officer. The Committee provides quarterly reports to management and to the Audit Committee. The Committee also publishes a code of business ethics, which is in the form of the Business Ethics Code of Conduct. The Board has adopted a separate additional business ethics statement referred to as the Ball Corporation Executive Officers and Directors Business Ethics Statement ("Executive Officers and Directors

14

Ethics Statement") designed to establish principles requiring the highest level of ethical behavior toward achieving business success within the requirements of the law and the Corporation's policies and ethical standards. The Business Ethics Code of Conduct and the Executive Officers and Directors Ethics Statement are set forth on the Corporation's Website at www.ball.com/investors under "Corporate Governance" and then under "Highlights." Copies may also be obtained upon request from the Corporation's Corporate Secretary.

Director Training

All new directors receive orientation training soon after being elected to the Board. Continuing education programs are made available to directors including internal presentations, third-party presentations and externally offered programs. Four directors attended externally offered director training programs in 2018.

Communications With Directors

The Corporation has established means for shareholders or others to send communications to the Board. Persons interested in communicating with the Board, its individual directors or its committees may send communications in writing to the Corporate Secretary or the Chairman of the Board. The communication should be sent in care of the Corporate Secretary, Ball Corporation, by mail to P.O. Box 5000, Broomfield, Colorado 80038-5000 or facsimile transmission to 303-460-2691.

In accordance with the NYSE and SEC requirements, the Corporation has established additional means for interested parties to send communications to the Board and selected committees, which are described on the Corporation's Website at www.ball.com/investors under "Corporate Governance."

Shareholder proposals for inclusion in the Corporation's proxy materials will continue to be handled and must be communicated as disclosed in this Proxy Statement under "Shareholder Proposals for 2019 Annual Meeting."

Meetings of Nonmanagement and Independent Directors

The Board meets regularly and not less than four times per year. Nonmanagement directors meet as a separate group at each regularly scheduled Board of Directors meeting. Independent directors meet at least annually. Theodore M. Solso serves as Lead Independent Director.

Director Independence Standards

Pursuant to the NYSE Listing Standards, the Board has adopted a policy adhering to the director independence requirements of the NYSE in determining the independence of directors. These standards are described on the Corporation's Website at www.ball.com/investors under "Corporate Governance."

The Board has determined that a majority of the Board is independent. Based upon the NYSE independence standards, during 2018 each of the members of the Board was and currently is independent with the exception of Messrs. Hayes and Mariani.

BOARD MEETINGS AND ANNUAL MEETING

The members of the Board are expected to attend all meetings of the Board, relevant committee meetings and the Annual Meeting of Shareholders. The Board held five meetings during 2018. Every legacy director attended 80% or more of the aggregate of the total number of meetings of the Board and the total number of meetings held by all committees of the Board on which the director served. All directors at the time attended the 2018 Annual Meeting. Mr. Bryant attended all Board and applicable committee meetings since his respective appointments.

15

The Board has an Audit Committee, Nominating/Corporate Governance Committee, Human Resources Committee and Finance Committee.

Audit Committee

The primary purpose of the Audit Committee is to assist the Board in fulfilling its responsibilities to oversee management's conduct and the integrity of the Corporation's public financial reporting process, including the oversight of (1) accounting policies; (2) the system of internal accounting controls over financial reporting; (3) disclosure controls and procedures; (4) the performance of PricewaterhouseCoopers LLP as the independent registered public accounting firm of the Corporation (the "independent auditor"); (5) the Internal Audit Department; and (6) the Corporation's risk management. The Audit Committee is also responsible for engaging and evaluating the Corporation's independent auditor and its lead engagement partner, including the qualifications and independence of both; resolving any differences between management and the independent auditor regarding financial reporting; reviewing and preapproving all audit and non-audit fees and services provided by the independent auditor; and establishing procedures for the receipt, retention and treatment of complaints regarding accounting, internal accounting controls or auditing matters.

Members of the Audit Committee are Messrs. Alspaugh, Bryant (who joined the Committee in December 2018), Cave, Heinrich and Ms. Ross. The Board has determined that each member of the Audit Committee is independent and financially literate, has accounting or financial management expertise and is an Audit Committee financial expert under the NYSE Listing Standards and the SEC regulations. The Audit Committee met nine times during 2018.

The Report of the Audit Committee is set forth later in this Proxy Statement. The Committee has considered the non-audit services provided during 2018 and 2017 by the independent auditor as disclosed below and determined the services were compatible with maintaining the auditor's independence. The Committee believes the fees paid to the independent auditor in respect of the services were appropriate, necessary and cost-efficient in the management of the business of the Corporation and are compatible with maintaining the auditor's independence.

Audit Fees and Services

The following table represents fees for professional services rendered by PricewaterhouseCoopers LLP, the Corporation's independent auditor, for 2018 and 2017. Audit fees included the audit of the Corporation's annual Consolidated Financial Statements, reviews of quarterly reports and the auditor's report under the Sarbanes-Oxley Act of 2002, together with fees for statutory and subsidiary audits, SEC registration statements, comfort letter and consents. Audit-related services consisted principally of consultations related to the Corporation's acquisitions and divestitures, audits of employee benefit plans, audits of carve-out financial statements, and pending accounting pronouncements. Tax fees consisted principally of tax compliance matters related to tax audits, return preparation fees and fees for tax consultations.

| | | | | | | | | | | |

|

|

|

Fiscal 2018 |

|

Fiscal 2017 |

| ||||

| | | | | | | | | | | |

|

||||||||||

|

Audit Fees |

$ | 10,654,000 | $ | 10,610,000 | | ||||

|

||||||||||

|

Audit-Related Fees |

$ | 1,648,000 | $ | 481,000 | | ||||

|

||||||||||

|

Tax Fees |

$ | 1,233,000 | $ | 2,432,000 | | ||||

|

||||||||||

|

All Other Fees |

$ | 18,000 | $ | 29,000 | | ||||

| | | | | | | | | | | |

The Audit Committee's Charter requires management to submit for preapproval all audit, audit-related and non-audit-related services to be performed by the independent auditor. Management and the independent auditor submit a report of fees for review and preapproval by the Committee on a quarterly basis. The Audit Committee requires management and the independent auditor to submit a report at least annually regarding audit, audit-related, tax and all other fees paid by the Corporation to the independent auditor for services rendered in the immediately preceding two fiscal years. The Committee considers whether the fees for non-audit and audit-related services are compatible with maintaining the

16

auditor's independence and requires management and the independent auditor to confirm this as well. The Audit Committee preapproved 100% of all of the above-referenced fees paid in 2018 and 2017 for services that were provided by PricewaterhouseCoopers LLP.

A copy of the Audit Committee Charter is set forth on the Corporation's Website at www.ball.com/investors, under "Corporate Governance."

Nominating/Corporate Governance Committee

The Nominating/Corporate Governance Committee is responsible for assisting the Board in fulfilling its responsibility to identify qualified individuals to become Board members; recommending to the Board the selection of Board nominees for the next Annual Meeting of Shareholders; addressing the independence and effectiveness of the Board by advising and making recommendations on matters involving the organization and operation of the Board, Corporate Governance Guidelines and directorship practices; overseeing the evaluation of the Board and its committees; and reviewing and assessing the Corporation's sustainability activities and performance. The Nominating/Corporate Governance Committee utilizes the standards set forth below for considering director nominees.

Members of the Nominating/Corporate Governance Committee are Messrs. Bryant (who joined the Committee in December 2018), Taylor and Solso and Mses. Nelson and Ross. The Board has determined that the members of the Committee are independent under the NYSE Listing Standards. The Nominating/Corporate Governance Committee met four times during 2018.

The Board has established a process whereby nominees for the Board may be submitted by members of the Board, the CEO, shareholders and any other persons. The Committee considers these recommended candidates in light of criteria set forth below.

The Committee will seek candidates who meet at a minimum the following criteria: (1) have sufficient time to attend or otherwise be present at Board, relevant Board committee and Shareholders' meetings; (2) will subscribe to Ball Corporation's Corporate Governance Guidelines and the Executive Officers and Directors Ethics Statement; (3) demonstrate credentials and experience in a broad range of corporate matters; (4) have experience, qualifications, attributes and skills that would qualify them to serve as a director; (5) will subscribe to the finalized strategic and operating plans of the Corporation as approved by the Board from time to time; (6) are not affiliated with special interest groups that represent major causes or constituents; and (7) meet the criteria, if any, for being a director of the Corporation as set forth in the Indiana Business Corporation Law, the Articles of Incorporation and the Bylaws of the Corporation.

As further described in the Board Diversity section on pages 13-14, the Committee will apply the principles of diversity in consideration of candidates. The Committee utilizes third-party consultants to identify and screen candidates on a confidential basis for service on the Board. The Committee will also determine candidates' qualifications in light of the standards set by the Committee and by evaluating the qualifications of all candidates in an attempt to select the most qualified nominees suited to serve as a director while attempting to ensure that a majority of the Board is independent and, where needed, to meet the NYSE and SEC requirements for financial literacy, accounting or financial management expertise or audit committee financial expert status.

The Nominating/Corporate Governance Committee will consider candidates recommended by shareholders in accordance with the Corporation's Bylaws. Any such recommendation should be in writing and addressed to the Chair, Nominating/Corporate Governance Committee, in care of the Corporate Secretary, Ball Corporation, by mail to P.O. Box 5000, Broomfield, Colorado 80038-5000 or facsimile transmission to 303-460-2691.

The Nominating/Corporate Governance Committee received no recommendations for candidates as nominees for the Board from a security holder or group of security holders that beneficially owned more than 5% of the Corporation's voting common stock for at least one year as of the date of the recommendation.

A copy of the Nominating/Corporate Governance Committee Charter is set forth on the Corporation's Website at www.ball.com/investors under "Corporate Governance."

17

Human Resources Committee

The primary purpose of the Human Resources Committee is to assist the Board in fulfilling its responsibilities related to the evaluation and compensation of the CEO and overseeing and approving the compensation of the other executive officers of the Corporation; approving the Corporation's stock and cash incentive compensation programs including awards to executive officers and the number of shares to be optioned and/or granted from time to time to employees of the Corporation; approving and receiving reports on major benefit plans, plan changes and determinations and discontinuations of benefit plans; discussing the performance evaluation system and succession planning system of the Corporation, including discussions with the CEO about the succession plan for the CEO; hiring experts, including executive compensation consultants, as deemed appropriate to advise the Committee; assessment of compensation-related risks; and authorizing the administration of compensation programs and the filing of required reports with federal, state and local governmental agencies.

Members of the Human Resources Committee are Messrs. Heinrich, Solso and Taylor, and Mses. Nelson and Niekamp. The Board has determined that the members of the Committee are independent under the NYSE Listing Standards. The Human Resources Committee met five times during 2018. A copy of the Human Resources Committee Charter is set forth on the Corporation's Website at www.ball.com/investors under "Corporate Governance."

Finance Committee

The Finance Committee assists the Board in fulfilling its responsibility to oversee management in the financing and related risk management of the Corporation, the status of the Corporation's retirement plans and insurance policies and the Corporation's policies relating to interest rates, commodity hedging and currency hedging. The Committee may hire experts as deemed appropriate to advise the Committee in the performance of its duties. The Committee reports to the Board concerning the financing of the Corporation and the performance of the Committee.

The members of the Finance Committee are Messrs. Alspaugh, Cave, and Mariani and Ms. Niekamp. The Committee met four times during 2018. A copy of the Finance Committee Charter is set forth on the Corporation's Website at www.ball.com/investors under "Corporate Governance."

TRANSACTIONS WITH RELATED PERSONS, PROMOTERS

AND CERTAIN CONTROL PERSONS

Ball Corporation has adopted a policy with respect to transactions with related persons requiring its executive officers and directors to comply with all SEC and NYSE requirements concerning transactions between the Corporation and "related persons," as defined in the applicable SEC and NYSE rules. One of our named executive officers, Daniel W. Fisher, shares a household with our senior director, transformation management office, whose 2018 compensation was in excess of $120,000. To facilitate compliance with the related persons policy, the Board adopted procedures for the review, approval or ratification of any transaction required to be reported under the applicable rules. The policy provides that each executive officer and director will promptly report to the Chairman of the Board any transaction with the Corporation undertaken or contemplated by such officer or director, by any beneficial owner of 5% or more of the Corporation's voting securities or by any immediate family member. The Chairman of the Board will refer any transaction to the General Counsel for review and recommendation. Upon receipt of such review and recommendation, the matter will be brought before the Nominating/Corporate Governance Committee to consider whether the transaction in question should be approved, ratified, suspended, revoked or terminated. This policy for transactions with related persons is stated in writing and is part of the Ball Corporation Executive Officers and Directors Ethics Statement. The written form of the policy can be found on the Corporation's Website, as indicated in the section "Policies on Business Ethics and Conduct" on page 15 herein.

18

EXECUTIVE COMPENSATION DISCUSSION AND ANALYSIS

This Compensation Discussion and Analysis ("CD&A") portion of the proxy statement describes Ball Corporation's business strategy, the strong alignment of our pay-for-performance executive compensation programs with, both the business strategy and shareholder interests, and the shareholder listening tour conducted following the 2018 Say-on-Pay vote. The CD&A also provides the required compensation disclosure for 2018 for the Corporation's named executive officers.

Ball Corporation is a leading global manufacturer of aluminum packaging, primarily for beverage, personal care and household products, and is a provider of aerospace technologies, largely for the United States government. The corporation continues to execute its long-term Drive for 10 vision of maximizing value in its existing businesses, expanding into new products and capabilities, aligning with the right customers and markets, broadening its geographic reach, and leveraging its know-how and technological expertise to provide a competitive advantage, as well as by deploying capital into growth investments while also divesting inefficient capital. Our business strategy is focused on: making beverage cans the most sustainable package in the supply chain to provide solutions for our customers to the world's plastic pollution crisis while furthering business growth; delivering the financial projections, business cost savings and industry leadership as a result of the Rexam acquisition; effectively executing in our core businesses to best serve our customers; continuously improving and optimizing operations and asset utilization; maximizing the Economic Value Added ("EVA®") returns of capital investments and innovations; and continuously developing our talent network, including a focus on workforce engagement, diversity and inclusion. Throughout, prudent capital allocation and EVA® discipline always underpin active management of our businesses with the ultimate goal of maximizing shareholder value.

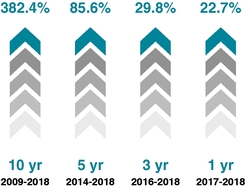

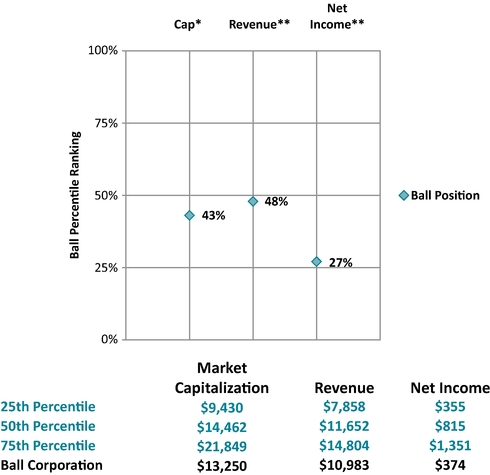

During 2018, strong global demand for aluminum beverage and aerosol packaging products, growth in Ball's aerospace business, and continued long-term focus on earnings and cash flow allowed us to return approximately $850 million to shareholders. In addition, year-over-year EVA® growth in 2018 generated on the corporation's $10 billion of average invested capital led to an annual total shareholder return of 22.7%. The chart below summarizes certain key financial results for fiscal year 2018 compared to fiscal year 2017*:

| | | | | | | |

|

2018* |

2017* |

% Change |

|||

| | | | | | | |

Revenue (net sales) |

$11.6 billion | $11.0 billion | 5.5% | |||

Net Earnings (comparable basis) |

$775.0 million | $728.0 million | 6.5% | |||

Free Cash Flow** |

$750.0 million | $922.0 million | (18.7)% | |||

Capital Expenditures |

$816.0 million | $556.0 million | 46.8% | |||

Net Debt |

$6.0 billion | $6.5 billion | (7.7)% | |||

EVA® Generated (above 9% after-tax) |

$241.5 million | $240.4 million | 0.5% | |||

Closing Stock Price on December 31 |

$45.98 | $37.85 | 21.5% | |||

Diluted Earnings Per Share (comparable basis) |

$2.20 | $2.04 | 7.8% | |||

| | | | | | | |

- *

- Certain

of these financial measures are on a non-U.S. GAAP basis and should be considered in connection with the Consolidated Financial Statements contained

within Item 8 of the 2018 Annual Report on Form 10-K (the "Annual Report"). Non-U.S. GAAP measures should not be considered in isolation and should not be considered superior to,

or a substitute for, financial measures calculated in accordance with U.S. GAAP. A reconciliation of non-GAAP measures to U.S. GAAP is available in Items 6 and 7 of the Annual

Report. Share-based numbers within the table have been adjusted for the 2-for-1 stock split in 2017.

- **

- Free cash flow defined as cash from operations less capital expenditures. The years referenced above were impacted by a higher year-over-year level of capital expenditures to complete the 4-line Goodyear, Arizona and 2-line Cabanillas, Spain beverage manufacturing facilities, additional investments in specialty beverage can production and the sizeable expansion of our aerospace infrastructure.

During 2018, the corporation continued to positively focus on its culture and employee engagement. In an all-employee engagement survey, the corporation achieved a sustainable employee engagement rate of 83%, significantly higher than manufacturing and aerospace peers, placing Ball near high performance companies in several categories, and exceeding high performance benchmarks in the areas of community and sustainability. In addition, Ball was named by Forbes as its #1 Employer for Diversity in early 2019. The dedication, clear focus and hard work of our employees, and our recognizing

19

the importance of knowing who we are, where we are going and what is important, has positioned Ball Corporation to drive long-term value for all stakeholders in 2019 and beyond.

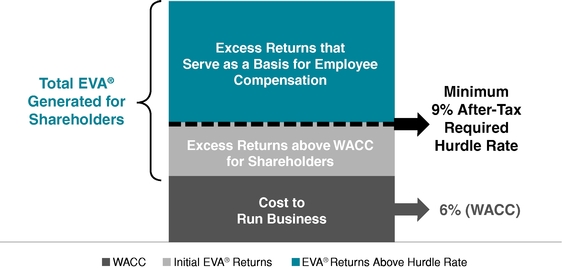

Ball's EVA® Focused Business Strategy Drove Key Capital Decisions in 2018Ball Corporation's vision for the future relies upon its long-held EVA® discipline. All lines of business and strategic initiatives are consistently measured through an EVA® lens. EVA® by simple definition is sales less operating costs ("NOPAT" or net operating profit after-tax) less a cost of capital charge. Ball Corporation has, for more than 25 years, sought to increase total EVA® generated year-on-year so as to deliver sustained shareholder value creation. Requiring each business to earn returns higher than its cost of capital drives managers to make the best long-term decisions for our stakeholders, by intelligently cutting costs through lean initiatives, implementing process efficiencies, undertaking focused outsourcing efforts, investing in innovation, technology and infrastructure capital to drive profitable growth, and turning working capital faster and/or reducing working capital and assets within marginal or underperforming businesses.

During 2018, some of the company actions to enhance long-term EVA® included:

-

-

Completing the construction of state-of-the art specialty beverage manufacturing facilities in the United States and Spain,

-

-

Installing specialty beverage can lines in Argentina, Chile, Mexico, Serbia, Switzerland, and Texas,

-

-

Investing to expand our aerospace infrastructure in Colorado to support over $2.2 billion of contracted backlog and 900 new employees,

-

-

Rationalizing five high-cost, less efficient beverage can facilities in the United States, Europe and Brazil,

-

-

Selling our U.S. steel food and steel aerosol packaging businesses into a 49 percent owned joint venture resulting in

$600 million in cash proceeds to further reduce our leverage and return value to shareholders,

-

-

Announcing the sale of our beverage can manufacturing assets in China to an existing Chinese company, and

-

- Launching our biennial sustainability report and setting an enhanced greenhouse gas emission reduction target of 27 percent by 2030, compared to a 2017 baseline.

Although EVA® dollars generated in 2018 were relatively flat as compared to 2017, the sale of the underperforming businesses and the completion of the significant capital and other projects noted above will generate EVA® dollar growth for our shareholders over a multi-year period.