DEF 14A: Definitive proxy statements

Published on March 9, 2012

QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant ý | |||

|

Filed by a Party other than the Registrant o |

|||

Check the appropriate box: |

|||

|

o |

Preliminary Proxy Statement |

||

|

o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

||

|

ý |

Definitive Proxy Statement |

||

|

o |

Definitive Additional Materials |

||

|

o |

Soliciting Material Pursuant to §240.14a-12 |

||

| BALL CORPORATION | ||||

|

(Name of Registrant as Specified In Its Charter) |

||||

|

|

||||

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||||

| Payment of Filing Fee (Check the appropriate box): | ||||

|

ý |

No fee required. |

|||

|

o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|||

| (1) |

Title of each class of securities to which transaction applies: |

|||

| (2) |

Aggregate number of securities to which transaction applies: |

|||

| (3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

| (4) |

Proposed maximum aggregate value of transaction: |

|||

| (5) |

Total fee paid: |

|||

|

o |

Fee paid previously with preliminary materials. |

|||

|

o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|||

|

(1) |

Amount Previously Paid: |

|||

| (2) |

Form, Schedule or Registration Statement No.: |

|||

| (3) |

Filing Party: |

|||

| (4) |

Date Filed: |

|||

BALL CORPORATION

10 Longs Peak Drive, Broomfield, Colorado 80021-2510

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD WEDNESDAY, APRIL 25, 2012

The Annual Meeting of Shareholders of Ball Corporation will be held at the Corporation's offices, 10 Longs Peak Drive, Broomfield, Colorado 80021-2510, on Wednesday, April 25, 2012, at 8:00 A.M. (MDT) for the following purposes:

- 1.

- To

elect three directors for three-year terms expiring at the Annual Meeting of Shareholders to be held in 2015;

- 2.

- To

ratify the appointment of PricewaterhouseCoopers LLP as the independent registered public accounting firm for the Corporation for 2012;

- 3.

- To

approve, by non-binding advisory vote, the compensation of the named executive officers ("NEOs") as disclosed in the following Proxy

Statement; and

- 4.

- To consider any other business as may properly come before the meeting, although it is anticipated that no business will be conducted other than the matters listed above.

Only holders of common stock of record at the close of business on March 1, 2012, are entitled to notice of and to vote at the Annual Meeting or any adjournment thereof. A Proxy Statement containing important information about the meeting and the matters being voted upon appears on the following pages.

Your vote is important. You are urged to read the accompanying proxy materials carefully and in their entirety and submit your proxy as soon as possible so that your shares can be voted at the meeting in accordance with your instructions. You have a choice of submitting your proxy by Internet or by telephone, or, if you request a paper copy of the materials, by mail.

| By Order of the Board of Directors, | ||

|

Charles E. Baker Corporate Secretary |

March 9, 2012

Broomfield, Colorado

Important Notice Regarding the Availability of Proxy Materials for the

Ball Corporation Annual Shareholder Meeting to be Held on Wednesday, April 25, 2012:

The Proxy Statement, Form 10-K and Annual Report of Ball Corporation are Available at

http://materials.proxyvote.com/058498

PLEASE NOTE: The 2012 Annual Meeting of Shareholders will be held to tabulate the votes cast and

to report the results of voting on the items described above. No management presentations

or other business matters are planned for the meeting.

Ball and

![]() are trademarks of Ball Corporation, Reg. U.S. Pat. & Tm. Office

are trademarks of Ball Corporation, Reg. U.S. Pat. & Tm. Office

BALL CORPORATION

10 Longs Peak Drive, Broomfield, Colorado 80021-2510

PROXY STATEMENT

March 9, 2012

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD WEDNESDAY, APRIL 25, 2012

Important Notice Regarding the Availability of Proxy Materials for the Annual

Shareholder Meeting to be Held on Wednesday, April 25, 2012:

The Proxy Statement, Form 10-K and Annual Report are Available at

http://materials.proxyvote.com/058498

To Shareholders of Ball Corporation:

This Proxy Statement and the accompanying proxy are furnished to shareholders in connection with the solicitation by the Board of Directors of Ball Corporation (the "Corporation" or "Ball") of proxies to be voted at the Annual Meeting of Shareholders (the "Annual Meeting") to be held April 25, 2012, for the purposes stated in the accompanying notice of the meeting. We are first furnishing and making available to shareholders the proxy materials on March 9, 2012.

Please submit your proxy as soon as possible so that your shares can be voted at the meeting. All properly completed proxies submitted by telephone or Internet, and all properly executed written proxies returned by shareholders who request paper copies of the proxy materials, that are delivered pursuant to this solicitation, will be voted at the meeting in accordance with the directions given in the proxy, unless the proxy is revoked prior to completion of voting at the meeting. Only holders of record of shares of the Corporation's common stock as of the close of business on March 1, 2012, the record date for the Annual Meeting, are entitled to notice of and to vote at the meeting, or at any adjournments or postponements of the meeting.

Any Ball Corporation shareholder of record as of March 1, 2012, the record date, desiring to submit a proxy by telephone or via the Internet will be required to enter the unique voter control number imprinted on the Ball Corporation proxy, and therefore should have the proxy for reference when initiating the process.

-

-

To submit your proxy by telephone, call 1-800-690-6903 on a touch-tone

telephone and follow the menu instructions provided. There is no charge for this call.

-

- To submit your proxy over the Internet, log on to the Web site www.proxyvote.com and follow the instructions provided.

Similar instructions are included on the enclosed proxy.

A shareholder of record of the Corporation may revoke a proxy in writing at any time prior to the meeting by sending written notice of revocation to the Corporate Secretary; by voting again by telephone; by voting via the Internet; by voting in writing if you requested your materials in paper copy; or by voting in person at the meeting.

1

Why am I receiving the Proxy Statement? You are receiving the Proxy Statement because you owned shares of Ball Corporation common stock on March 1, 2012, the record date, and that entitles you to vote at the Annual Meeting. The Corporation's Board of Directors is soliciting your proxy to vote at the scheduled 2012 Annual Meeting or at any later meeting should the scheduled Annual Meeting be adjourned or postponed for any reason. Your proxy will authorize specified people (proxies) to vote on your behalf at the Annual Meeting in accordance with your written instructions. By use of a proxy, you can vote, whether or not you attend the meeting.

What will I be voting on? You will be voting on (1) the election of three director nominees named in this Proxy Statement for terms expiring in April 2015; (2) the ratification of the appointment of PricewaterhouseCoopers LLP as the independent registered public accounting firm for 2012; and (3) an advisory vote to approve named executive officer compensation.

What are the Board of Directors' recommendations? The Board recommends a vote (1) for the election of the three director nominees named in this Proxy Statement; (2) for the ratification of the appointment of PricewaterhouseCoopers, LLP as the Corporation's independent registered public accounting firm for 2012; and (3) for the advisory vote on executive officer compensation.

Could other matters be decided at the Annual Meeting? We do not know of any other matters that will be raised at the Annual Meeting. The Chairman will allow presentation of a proposal or a nomination for the Board from the floor at the Annual Meeting only if the proposal or nomination was properly submitted. The proxies will have discretionary authority, to the extent permitted by law, to vote for or against other matters that may properly come before the Annual Meeting as those persons deem advisable.

How many votes can be cast by all shareholders? Each share of Ball Corporation common stock (other than 688 shares of common stock that have been granted as restricted stock without voting rights) is entitled to one vote on each of the three directors to be elected and one vote on each other matter that is properly presented at the Annual Meeting.

How do I vote my shares if I am a record holder? If you are a record holder of shares, that is the shares are registered in your name and not the name of your broker or other nominee, you are urged to submit your proxy as soon as possible, so that your shares can be voted at the meeting in accordance with your instructions. You may submit your proxy by telephone or via the Internet as instructed on the first page of the Proxy Statement and on your proxy, or you can complete, sign, date and mail your proxy card if you request a paper copy of the proxy materials. You may also vote by attending the Annual Meeting, or sending a personal representative to the Annual Meeting with an appropriate proxy, in order to vote. Unless you or a personal representative plan to be in attendance and vote at the meeting, your vote must be received no later than 11:59 P.M. (EDT) on Tuesday, April 24, 2012.

How do I vote my shares if I hold my shares under the Employee Stock Purchase Plan ("ESPP") or the 401(k) Plan? Participants may vote their shares in the manner set forth above, however, shares held through the Plans must be voted by 11:59 P.M. (EDT) on Sunday, April 22, 2012. Any unvoted shares will be voted by the Trustee of the 401(k) Plan and by the Administrator of the ESPP in accordance with the Plans and the Board of Directors' recommendations.

How do I vote my shares if I hold my shares in "street name" through a bank or broker? If you hold your shares as a beneficial owner through a bank, broker or other nominee, you must provide voting instructions to your bank, broker or other nominee by the deadline provided in the materials you receive from your bank, broker or other nominee to ensure your shares are voted in the way you would like at the meeting. Your bank, broker or other nominee will send you specific instructions in this regard to vote your shares. If you do not provide instructions to your bank, broker or other nominee, whether your shares are voted depends on the type of item being considered for a vote. For example, under applicable stock exchange rules, brokers are permitted to vote on "discretionary" items if they are not provided in a timely manner voting instructions from the beneficial owners of the shares, and they are not permitted to vote on "nondiscretionary" items. The proposal to approve the appointment of independent auditors is considered a "discretionary" item. This means that brokerage firms may vote in their discretion on this matter on behalf of clients who have not furnished voting instructions at least 10 days before the date of the meeting. In contrast, the election of directors and the advisory vote on executive compensation are "nondiscretionary" items. This means brokerage firms that have not received voting instructions from their clients on these proposals may not vote on them. These so-called "broker nonvotes" will be included in the calculation of the number of votes considered to be present at the meeting for purposes of determining a quorum, but will not be considered in determining the number of votes necessary for

2

approval and will have no effect on the outcome of the vote for Directors and the advisory vote on executive compensation.

Can I revoke my proxy or change my vote? Shareholders of record may revoke their proxies or change their votes in writing at any time prior to the meeting by sending written notice of revocation to the Corporate Secretary; by voting again by telephone or via the Internet; by voting in writing if they requested their materials in paper copy; or by voting in person at the meeting. Attendance in and of itself at the Annual Meeting will not revoke a proxy. For shares you hold beneficially but not of record, you may change your vote by submitting new voting instructions to your broker or nominee or, if you have obtained a valid proxy from your broker or nominee giving you the right to vote your shares, by attending the meeting and voting in person.

VOTING SECURITIES AND PRINCIPAL SHAREHOLDERS

At the close of business on March 1, 2012, there were outstanding 156,341,205 shares of common stock (together with the associated preferred stock purchase rights under the Rights Agreement dated as of July 26, 2006, between the Corporation and Computershare Investor Services, LLC, as amended). Other than 688 shares of common stock granted as restricted stock without voting rights, each of the shares of common stock is entitled to one vote. Shareholders do not have cumulative voting rights with respect to the election of directors.

Based on Schedule 13G filings with the Securities and Exchange Commission ("SEC"), the following table indicates the beneficial owners of more than 5% of the Corporation's outstanding common stock as of December 31, 2011:

| Name and Address of Beneficial Owner |

Shares Beneficially Owned |

Percent of Class |

|||||

|---|---|---|---|---|---|---|---|

| Janus Capital Management LLC 151 Detroit Street Denver, Colorado 80206 |

12,420,716 | (1) | 7.60 | ||||

|

The Vanguard Group 100 Vanguard Boulevard Malvern, Pennsylvania 19355 |

8,787,590 |

(2) |

5.40 |

||||

|

Blackrock Inc. 40 East 52nd Street New York, New York 10022 |

8,770,090 |

(3) |

5.39 |

||||

- (1)

-

Janus

Capital has a direct 94.8% ownership stake in INTECH Investment Management ("INTECH") and a direct 77.8% ownership stake in Perkins Investment

Management LLC ("Perkins"). Due to the above ownership structure, holdings for Janus Capital, Perkins and INTECH are aggregated for purposes of this filing. Janus Capital, Perkins and INTECH

are registered investment advisers, each furnishing investment advice to various investment companies registered under Section 8 of the Investment Company Act of 1940 and to individual and

institutional clients (collectively referred to herein as "Managed Portfolios").

As a result of its role as investment adviser or sub-adviser to the Managed Portfolios, Janus Capital may be deemed to be the beneficial owner of 8,991,985 shares or 5.5% of the shares outstanding of Ball Corporation common stock held by such Managed Portfolios. However, Janus Capital does not have the right to receive any dividends from, or the proceeds from the sale of, the securities held in the Managed Portfolios and disclaims any ownership associated with such rights.

As a result of its role as investment adviser or sub-adviser to the Managed Portfolios, Perkins may be deemed to be the beneficial owner of 1,000 shares or 0.0% of the shares outstanding of Ball Corporation common stock held by such Managed Portfolios. However, Perkins does not have the right to receive any dividends from, or the proceeds from the sale of, the securities held in the Managed Portfolios and disclaims any ownership associated with such rights. As a result of its role as investment adviser or sub-adviser to the Managed Portfolios, INTECH may be deemed to be the beneficial owner of 3,427,731 shares or 2.1% of the shares outstanding of Ball Corporation common stock held by such Managed Portfolios. However, INTECH does not have the right to receive any dividends from, or the proceeds from the sale of, the securities held in the Managed Portfolios and disclaims any ownership associated with such rights.

- (2)

- 229,624

shares with sole voting and shared dispositive power and 8,557,966 shares held with sole dispositive power.

- (3)

- 8,770,090 shares are held with sole dispositive power.

3

The following table lists the beneficial ownership of common stock of the Corporation of our director nominees, continuing directors, all individuals who served as either our Chief Executive Officer ("CEO") or our Chief Financial Officer ("CFO") during the last fiscal year, the three other most highly compensated executive officers of the Corporation and, as a group, all of such persons and our other executive officers as of the close of business on March 1, 2012.

|

|

|

|

|

Included in Shares Beneficially Owned |

Excluded from Shares Beneficially Owned |

|||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Title of Class |

Name of Beneficial Owner |

Shares Beneficially Owned(1) |

Percent of Class(2) |

Number of Shares Which Become Available or Subject to Options Exercisable or Which Become Exercisable Within 60 Days of March 1, 2012(3) |

Deferred Share or Stock Unit Equivalent(4) |

Restricted Stock Shares or Units(5) |

||||||||||||

Common |

Robert W. Alspaugh |

| * | | 15,869 | 21,444 | ||||||||||||

Common |

Charles E. Baker |

211,647 | (6) | * | 172,250 | 37,506 | 32,200 | |||||||||||

Common |

Hanno C. Fiedler |

116,730 | * | | | 20,132 | ||||||||||||

Common |

John A. Hayes |

656,992 | * | 506,676 | 193,744 | 194,230 | ||||||||||||

Common |

R. David Hoover |

2,247,765 | (7) | 1.4 | 1,665,088 | 620,603 | 96,108 | |||||||||||

Common |

John F. Lehman |

159,030 | * | | 52,067 | 19,444 | ||||||||||||

Common |

Scott C. Morrison |

248,960 | (8) | * | 138,248 | 101,400 | 66,000 | |||||||||||

Common |

Georgia R. Nelson |

6,000 | * | | 23,323 | 19,444 | ||||||||||||

Common |

Jan Nicholson |

294,420 | * | | 23,421 | 19,444 | ||||||||||||

Common |

Lisa A. Pauley |

209,494 | (9) | * | 97,025 | 42,145 | 23,400 | |||||||||||

Common |

Raymond J. Seabrook |

642,558 | (10) | * | 393,663 | 311,274 | 78,994 | |||||||||||

Common |

George M. Smart |

34,442 | * | | 12,735 | 19,444 | ||||||||||||

Common |

Theodore M. Solso |

80,846 | * | 16,000 | 48,141 | 19,444 | ||||||||||||

Common |

Stuart A. Taylor II |

80,678 | * | | 50,891 | 19,444 | ||||||||||||

Common |

Erik H. van der Kaay |

51,266 | * | | 41,681 | 19,444 | ||||||||||||

Common |

David A. Westerlund |

631,303 | (11) | * | 376,713 | 106,966 | 44,000 | |||||||||||

Common |

All of the above and present executive officers as a group (21) |

5,996,709 | (12) | 3.8 | 3,577,691 | 1,784,612 | 805,524 | |||||||||||

- (1)

- Full

voting and dispositive investment power, unless otherwise noted.

- (2)

- *

Indicates less than 1% ownership.

- (3)

- Includes

RSUs that may vest or options that may vest or be acquired upon exercise during the next 60 days.

- (4)

- These

deferred shares or stock units are equivalent to an equal number of shares of common stock that have been deferred to the Ball Deferred Compensation

Company Stock Plans, with no voting rights or dispositive investment power with respect to the underlying common stock prior to its issuance.

- (5)

- These

Restricted Stock Shares or RSUs have no voting rights or dispositive investment power.

- (6)

- Includes

1,040 shares owned by Mr. Baker's children, as to which he disclaims beneficial ownership.

- (7)

- Includes

366,002 shares held in trust for Mr. Hoover's spouse, as to which he disclaims beneficial ownership, and 74,708 shares held in trust for

Mr. Hoover.

- (8)

- Includes

50 shares owned by Mr. Morrison's child, as to which he disclaims beneficial ownership.

- (9)

- Includes

82,832 shares owned by Ms. Pauley's spouse, as to which she disclaims beneficial ownership.

- (10)

- Includes

9,750 shares owned by Mr. Seabrook's child, as to which he disclaims beneficial ownership.

- (11)

- Includes

6,156 shares owned by Mr. Westerlund's spouse, as to which he disclaims beneficial ownership; retired September 30, 2011.

- (12)

- Includes 540,538 shares to which beneficial ownership is disclaimed, and 3,577,691 shares that may be acquired during the next 60 days upon the exercise of stock options. In addition, 7,299 shares have been pledged as security.

4

VOTING ITEM 1ELECTION OF DIRECTORS

Pursuant to our Amended Articles of Incorporation and the Indiana Business Corporation Law, our Board of Directors ("Board") is divided into three classes, as nearly equal in number as possible, with directors serving staggered three-year terms. Amendments to the Indiana Business Corporation Law in 2009 made this classified Board structure statutorily required for Ball Corporation, effective from and after July 31, 2009. On April 25, 2012, three persons are to be elected to serve as directors until the 2015 Annual Meeting of Shareholders. Unless otherwise instructed on the accompanying proxy, the persons named in the proxy intend to vote for nominees Robert W. Alspaugh, R. David Hoover, and Jan Nicholson to hold office as directors of the Corporation until the 2015 Annual Meeting of Shareholders (Class III), or, in each case, until his or her respective successor is elected and qualified. All nominees have consented to be named as candidates in the Proxy Statement and have agreed to serve if elected. If, for any reason, any of the nominees becomes unavailable for election, the shares represented by proxies will be voted for any substitute nominee or nominees designated by the Board. The Board has no reason to believe that any of the nominees will be unable to serve.

In accordance with the Indiana Business Corporation Law, directors are elected by a plurality of the votes cast by the shares entitled to vote in the election at a meeting at which a quorum is present. If more "withhold" than "for" votes are received, our Bylaws require the director to resign and our Nominating/Corporate Governance Committee must make a recommendation to the Board for the Board to consider whether to accept the resignation. The relevant Bylaw provisions are set out in Exhibit A to this Proxy Statement. Abstentions and broker nonvotes are considered neither votes "for" nor "against." Proxies may not be voted for a greater number of persons than the three named nominees.

Set forth for each director nominee in Class III and for each continuing director in Classes I and II is the director's principal occupation and employment during the past five years or, if longer, the period during which the director has served as a director, and certain other information, including his or her public company directorships during the past five years.

5

DIRECTOR NOMINEES AND CONTINUING DIRECTORS

| To Be Elected for a Term of Three Years Until the 2015 Annual Meeting (Class III) | ||||

Robert W. Alspaugh |

Chief Executive Officer, KPMG International, 2002 to 2005. Age 65. |

Director since 2008. Member, Audit and Nominating/Corporate Governance Committees. Mr. Alspaugh is a director of Autoliv, Inc., Stockholm, Sweden, and VeriFone Systems, Inc., San Jose, California. |

||

R. David Hoover |

Chairman, Ball Corporation since January 2011. Chairman and Chief Executive Officer January 2010 to January 2011; Chairman, President and Chief Executive Officer, April 2002 to January 2010; President and Chief Executive Officer, January 2001 to April 2002; Vice Chairman, President and Chief Operating Officer, April 2000 to January 2001; Vice Chairman, President and Chief Financial Officer, January 2000 to April 2000; Vice Chairman and Chief Financial Officer, 1998 to 2000; Executive Vice President and Chief Financial Officer, 1997 to 1998; Executive Vice President, Chief Financial Officer and Treasurer, 1996 to 1997. Age 66. |

Director since 1996. Mr. Hoover is a director of Eli Lilly and Company, Indianapolis, Indiana, and Energizer Holdings, Inc., St. Louis, Missouri. In the past five years, Mr. Hoover served on the board of Irwin Financial Corporation, Columbus, Indiana, and Qwest Communications International, Inc., Denver, Colorado. |

||

Jan Nicholson |

President, The Grable Foundation, Pittsburgh, Pennsylvania, since 1990; Managing Director, Strategic Risk Assessment, MBIA Insurance Corporation, Armonk, New York, 1998 to 2000; Managing Director, Research and Development, Capital Markets Assurance Corporation (CapMAC), New York, New York, 1994 to 1998. Age 66. |

Director since 1994. Member, Audit and Finance Committees. Ms. Nicholson is a director of Radian Group Inc., Philadelphia, Pennsylvania. |

||

|

The Board of Directors recommends that shareholders vote "FOR" the election of each nominee for Director named above. |

||||

6

| To Continue in Office Until the 2013 Annual Meeting (Class I) | ||||

Hanno C. Fiedler |

Executive Vice President, Ball Corporation, and Chairman and Chief Executive Officer, Ball Packaging Europe, December 2002 to December 2005; Chairman and Chief Executive Officer, Schmalbach-Lubeca AG, 1996 to 2002. Age 66. |

Director since 2002. Member, Finance Committee. Mr. Fiedler serves on the Supervisory Board of manroland AG, Offenbach, Germany. In the past five years, Mr. Fiedler has served on the Supervisory Boards of Pfleiderer AG, Neumarkt, Germany; Langmatz GmbH (now Langmatz AG), Garmisch-Partenkirchen, Germany; Thyssenkrupp Steel AG, Duisburg, Germany; HowaldtswerkeDeutsche Werft AG, Kiel, Germany; and Pfleiderer Unternehmensverwaltung GmbH, Neumarkt, Germany. |

||

John F. Lehman |

Chairman, J.F. Lehman & Company, New York, New York, since 1990. Age 69. |

Director since 1987. Member, Finance and Nominating/Corporate Governance Committees. Mr. Lehman is a director of EnerSys, Reading, Pennsylvania, and Verisk Analytics, Inc., Jersey City, New Jersey. |

||

Georgia R. Nelson |

President and Chief Executive Officer, PTI Resources, LLC, Chicago, Illinois, since June 2005; President, Midwest Generation EME LLC, Chicago, Illinois, April 1999 to June 2005; General Manager, Edison Mission Energy Americas, Irvine, California, January 2002 to June 2005. Age 62. |

Director since 2006. Member, Human Resources and Nominating/Corporate Governance Committees. Ms. Nelson is a director of Cummins Inc., Columbus, Indiana. In the past five years, Ms. Nelson has served on the board of Tower Automotive, Inc., Novi, Michigan, and Nicor Inc., Naperville, Illinois. |

||

Erik H. van der Kaay |

Chairman of the Board, Symmetricom, Inc., October 2002 to October 2003; President, Chief Executive Officer, and Chairman of the Board, Datum, Inc., Irvine, California, April 1998 to October 2002 upon Symmetricom's acquisition of Datum. Age 71. |

Director since 2004. Member, Audit and Finance Committees. Mr. van der Kaay is a director of RF Micro Devices, Inc., Greensboro, North Carolina, and Orolia, S.A., Sophia Antipolis, France. In the past five years, Mr. van der Kaay has served on the boards of Comarco, Inc., Irvine, California, and TranSwitch Corporation, Shelton, Connecticut. |

||

7

| To Continue in Office Until the 2014 Annual Meeting (Class II) | ||||

John A. Hayes |

President and Chief Executive Officer, Ball Corporation, since January 2011; President and Chief Operating Officer, January 2010 to January 2011; Executive Vice President and Chief Operating Officer 2008 to 2010; President, Ball Packaging Europe and Senior Vice President, Ball Corporation 2007 to 2008; Executive Vice President, Ball Packaging Europe and Vice President, Ball Corporation 2005 to 2006; Vice President, Corporate Strategy, Marketing and Development 2003 to 2005; Vice President, Corporate Planning and Development 2000 to 2003; Senior Director, Corporate Planning and Development 1999. Age 46. |

Director since 2010. |

||

George M. Smart |

President, Sonoco-Phoenix, Inc., North Canton, Ohio, a subsidiary of Sonoco Products Company, 2001 to 2004. Age 66. |

Director since 2005. Member, Audit and Human Resources Committees. Mr. Smart is a director of FirstEnergy Corp., Akron, Ohio. |

||

Theodore M. Solso |

Chairman and Chief Executive Officer, Cummins Inc., Columbus, Indiana, 2000 to 2011. Retired December 31, 2011. Age 65. |

Director since 2003. Member, Audit and Human Resources Committees. In the past five years, Mr. Solso has served on the board of Irwin Financial Corporation, Columbus, Indiana, and Ashland Inc., Covington, Kentucky. |

||

Stuart A. Taylor II |

Chief Executive Officer, The Taylor Group LLC, Chicago, Illinois, since June 2001; Senior Managing Director, Bear, Stearns & Co. Inc., Chicago, Illinois, 1999 to 2001. Age 51. |

Director since 1999. Member, Human Resources and Nominating/Corporate Governance Committees. Mr. Taylor is a director of Hillenbrand, Inc., Batesville, Indiana, and United Stationers, Inc., Chicago, Illinois. |

||

8

DIRECTOR AND NOMINEE EXPERIENCE AND QUALIFICATIONS

Set out below are the specific experience, qualifications, attributes and skills of each of the Corporation's directors and director nominees which led the Board to conclude that each person should serve as a director of the Corporation.

Robert W. AlspaughMr. Alspaugh enjoyed a distinguished 35-year career with KPMG, with increasing responsibility, which culminated in his acting as Deputy Chairman and Chief Operating Officer of KPMG-U.S. from 1998 to 2002 and Chief Executive Officer of KPMG International from 2002 to October 2005. Mr. Alspaugh's extensive experience, qualifications and skills as a leader of one of the "big four" global accounting firms enhance his service on the Corporation's Audit Committee and he has provided valuable input as a result. He also sits on two other public company boards, one in the U.S. and the other in Europe (where he chairs the audit committee), thus providing good cross-functional background and experience, with an international component. Mr. Alspaugh's extensive professional experience as a leader of a major global accounting firm, advising and supporting large international corporations, as well as his service on other company boards, make him well qualified to serve as a director.

Hanno C. FiedlerAfter a successful career with TRW, Inc., in 1996 Mr. Fiedler became Chairman and Chief Executive Officer of Schmalbach-Lubeca AG, one of the largest and most successful rigid packaging companies based in Europe. When Ball acquired the beverage can business of Schmalbach-Lubeca in December 2002, Mr. Fiedler became Chairman and Chief Executive Officer of Ball Packaging Europe GmbH and also joined the Board of Ball Corporation. In that capacity, Mr. Fiedler provided excellent leadership to our newly-acquired European business which generated strong earnings performance during his tenure, despite the adverse effects of the German mandatory deposit system for rigid packaging which was initiated in 2003. Mr. Fiedler retired from active management of Ball Packaging Europe at the end of 2005, but has continued as the Chairman of its Supervisory Board to the present. He also serves on the Supervisory Boards of three major German companies. His leadership experience within the rigid container industry worldwide, with specific emphasis on Europe, makes him well qualified to serve as a director.

John A. HayesPrior to joining Ball Corporation in 1999, Mr. Hayes was a Vice President of Lehman Brothers Inc. and part of an investment banking team which focused on merger and acquisition and financing advice to several major companies, including the Corporation. At Ball, Mr. Hayes initially headed our corporate development and planning activities as Senior Director and then Vice President, Corporate Planning and Development, taking on the added responsibilities of marketing and new product development from 2003 to mid-2005. He then served as President of Ball Packaging Europe, which produced excellent financial results and strong revenue growth under his leadership. During 2008 and 2009, Mr. Hayes served as Ball's Executive Vice President and Chief Operating Officer, successfully leading our key operating divisions through the economic and financial crisis. In January 2010 he was named our President and Chief Operating Officer and joined the Ball Corporation Board. In January 2011, he became our President and Chief Executive Officer. Mr. Hayes' extensive investment banking and leadership experience within Ball make him well qualified to serve as a director.

R. David HooverMr. Hoover has enjoyed a varied and successful 42-year career with Ball, serving in multiple corporate and divisional roles, including as Vice President and Treasurer from 1987 through 1992, Chief Financial Officer from 1993 to April 2000, and Chief Operating Officer for the balance of 2000. He was our Chief Executive Officer from January 2001 to January 2011, and led the Corporation through an unprecedented period of growth in revenues, earnings per share and free cash flow. Mr. Hoover's considerable working knowledge and leadership experience with respect to our Corporation make him uniquely qualified to serve as a director. He has been a Ball Board member for 16 years, serving as Chairman since 2002, and serves as a director of two other major U.S.-based public companies. Mr. Hoover has also served on the Board of Trustees of DePauw University since 2002 and on the Board of Boulder Community Hospital since 2006.

John F. LehmanMr. Lehman served as Secretary of the Navy in the Reagan Administration from 1981 to 1987, after which he was Managing Director of Paine Webber Inc.'s Investment Banking Division from 1988 to 1990 where he led the firm's aerospace and defense advisory practice. He then established J.F. Lehman & Company, a New York-based investment company, and has served as its Chairman since 1990. Mr. Lehman also serves as a director of two other public companies. In addition, Mr. Lehman is Chairman of the Princess Grace Foundation and an Overseer of the School of Engineering at the University of Pennsylvania. He has a rare combination of extensive business experience, public service, political acumen and global perspective. Mr. Lehman served as a member of the National Commission on Terrorist Attacks Upon the United States, also known as the 9/11 Commission, from 2002 to 2004. He has been an astute and valuable member of Ball's Board for 25 years and has chaired its Finance Committee for many years.

9

Mr. Lehman's public service, financial industry experience and Ball Board experience make him well qualified to serve as a director.

Georgia R. NelsonMs. Nelson has enjoyed a successful career in the energy industry, serving as a senior executive for several U.S. and international energy companies, including as President of Midwest Generation EME, LLC from April 1999 to June 2005 and General Manager of Edison Mission Energy Americas from January 2002 to June 2005. She has had extensive international experience as well as environmental and policy experience on four continents. Ms. Nelson regularly lectures on business and corporate governance matters, including at Northwestern University's Kellogg Graduate School of Management, and serves on the advisory committee of the Center for Executive Women at Northwestern. Ms. Nelson is a National Association of Corporate Directors (NACD) Board Leadership Fellow. She also serves as a director of Cummins, Inc. and CH2MHILL Inc. Previously, Ms. Nelson served on three other publicly traded company boards. Ms. Nelson's leadership roles in global businesses, as well as her service on other company boards, clearly qualify her to serve as a director of our Corporation.

Jan NicholsonMs. Nicholson enjoyed a long and successful career in the financial services industry in New York, which, after an 18-year tenure at Citicorp, included positions as Managing Director, Research and Development for CapMAC from 1994 to 1998 and Managing Director, Strategic Risk Assessment for MBIA Insurance Corporation from 1998 to 2000. She also served as a director of Rubbermaid, Inc. from 1992 until 1999, and chaired its audit committee from 1994 through 1998. In addition, Ms. Nicholson is a director of Radian Group Inc., a public company, and has been President of The Grable Foundation since 1990. She has been a member of Ball's Board for 18 years and has chaired our Audit Committee since 2004. Ms. Nicholson's career in the financial services industry and her service on the Rubbermaid Audit Committee and board, as well as her long service in those capacities with Ball, make her well qualified to serve as a director.

George M. SmartMr. Smart's long career and success in the U.S. can manufacturing industry make him well qualified to serve as a director. He steadily assumed increasing responsibility at Central States Can Co., a division of Van Dorn Company, culminating in his acting as its President and Chief Executive Officer from 1978 to 1993. When Central States was acquired in 1993, Mr. Smart and his management team established a start-up company, Phoenix Packaging Corporation, to manufacture and sell full-panel easy-open ends for food containers, including to Ball's food can division. Serving as Chairman and Chief Executive Officer for Phoenix, Mr. Smart led its growth to a profitable company with revenues in excess of $80 million, when it was sold to Sonoco Products Company and became Sonoco-Phoenix, Inc. in 2001. Mr. Smart served as President of Sonoco-Phoenix until 2004 and has been Chairman of the Board of FirstEnergy Corp. since 2004. Mr. Smart also previously served on the boards of Belden & Blake Corporation, Commercial Intertech Corporation, Unizan Financial, Van Dorn Company, and as Chairman of the Can Manufacturers Institute.

Theodore M. SolsoMr. Solso has had a successful 40-year career at Cummins Inc., a Fortune 500 manufacturing company with operations around the world. This culminated with Mr. Solso becoming Chairman and Chief Executive Officer of Cummins in January 2000, a position he held through 2011, for a total of 12 years. Under his leadership, Cummins increased revenues from $6.6 billion in 2000 to over $18 billion in 2011. During the same period, its earnings per share and operating cash flow increased from $0.35 and $550 million, to $9.55 and $2.1 billion, respectively. Mr. Solso has been on our Board since 2003 and is a member of both The Indiana Academy and the President's management advisory board, as well as being a trustee of Earth University in Costa Rica. Mr. Solso's long experience in leadership positions with a major global manufacturing company make him well qualified to serve as a director.

Stuart A. Taylor IIPrior to starting his own private equity firm, Mr. Taylor spent 19 years in investment banking. The majority of that time was spent at Morgan Stanley in its Corporate Finance Department. In that capacity he executed a number of mergers and acquisitions and financings, including working with Ball in 1993 on the acquisition of Heekin Can Company. He also spent time at several other firms including Bear Stearns where he was a Senior Managing Director and Head of the Chicago office. In 2001, Mr. Taylor established The Taylor Group LLC, of which he is Chief Executive Officer, a successful investment company that primarily invests in small to mid-market businesses. Mr. Taylor has been a director of Ball since 1999, acted as our Presiding Director from 2004 to 2008 and chairs our Human Resources Committee. He is also a director of two other U.S.-based public companies. Mr. Taylor's extensive experience as an investment banker, entrepreneurial investor and Ball Board member make him well qualified to serve as a director.

Erik H. van der KaayMr. van der Kaay, a native of the Netherlands, had a long and successful career in the U.S. telecom industry, including service as a senior executive with Allen Telecom throughout the 1990s, culminating as Executive Vice President, and as Chairman, President and Chief Executive Officer of Datum, Inc. from 1998 to 2002

10

and as Chairman of Symmetricom, Inc. from 2002 to 2003. He has also served as the managing director of a Brazilian telecom company, as well as on the board of directors of several public companies and is currently a board member of RF Micro Devices in the U.S. and Orolia, S.A. in Europe, providing good cross-functional background and experience, with an international component. In addition, he has served since 2007 as a member of the South East Audit Committee Leadership Network convened by Ernst & Young and composed of audit committee members of leading public companies. Mr. van der Kaay's experience as a leader and as a director of several other companies as well as his business and financial acumen, and his international perspective, make him well qualified to serve as a director.

BOARD LEADERSHIP STRUCTURE AND RISK OVERSIGHT

In January 2011, John A. Hayes became our President and Chief Executive Officer ("CEO") and R. David Hoover, our predecessor CEO, continues to serve as Chairman of the Board. The decision to split the position of Chairman and CEO was part of an orderly succession plan by which Mr. Hayes transitioned into his current role. Mr. Hayes rose to the position of CEO after more than 11 years with Ball, most recently serving as President and Chief Operating Officer and a member of the Board. Mr. Hayes previously served as President of Ball Packaging Europe from 2006 to early 2008, and then as Executive Vice President and Chief Operating Officer of the Corporation. Splitting the role of Chairman and CEO has allowed Mr. Hayes the opportunity to focus on his new executive responsibilities in managing the Corporation; while having Mr. Hoover as nonmanagement Chairman has provided continuity. Mr. Hayes and Mr. Hoover have worked closely together for more than 12 years, and their continued collaboration in their respective roles has resulted in a smooth change in senior management that has been beneficial to shareholders.

Our Board of Directors is composed of Mr. Hoover, Mr. Hayes and nine other directors, eight of whom are independent directors. The Board has four standing committeesAudit, Nominating/Corporate Governance, Human Resources and Finance. Each of the committees, except for Finance, is composed solely of independent directors (the Finance Committee is primarily composed of independent directors), with each of the four committees having an independent director serving as chairman.

Pursuant to SEC and New York Stock Exchange ("NYSE") rules, regularly scheduled executive sessions of nonmanagement directors are held. Executive sessions of independent directors are also held at least annually. Such meetings promote open discussion by nonmanagement and independent directors, enabling them to serve as a check on management, if necessary. The meetings of the independent directors are chaired by the Presiding Director, who is an independent director appointed by the Board.

In accordance with NYSE requirements, our Audit Committee is responsible for overseeing the risk management function of the Corporation. While the Audit Committee has primary responsibility for overseeing risk management, the entire Board is involved in overseeing risk management for the Corporation. Additionally, each Board committee considers the specific risks within its area of responsibility. Our Internal Audit Department has, for many years, analyzed various areas of risk to the Corporation and has provided risk assessment and analysis to our Audit Committee. In 2007, the Corporation established a comprehensive Enterprise Risk Management process which is now supervised by our Senior Vice President and Chief Financial Officer, whereby key corporate and divisional risks are systematically identified and assessed on a quarterly basis. The results of this ongoing risk assessment are reported to our Audit Committee and to our Board at least annually.

One of the responsibilities of our Board of Directors is to evaluate the effectiveness of the Board and make recommendations involving its organization and operation. We recognize that different board leadership structures may be appropriate for different companies and at different times. We believe our current leadership structure, with Mr. Hayes serving as CEO, Mr. Hoover as Chairman of the Board, a Board with a majority of independent directors, an independent chairman for each of our standing Board committees and separate meetings of nonmanagement and independent directors, the latter led by the Presiding Director, provides the most effective form of leadership for our Corporation at this time. We believe that our directors provide effective oversight of risk management through the Board's regular dialogue with Ball management, the Enterprise Risk Management process, and assessment of specific risks within each Board committee's areas of responsibility.

11

Ball's Nominating/Corporate Governance Committee consistently applies the principles of diversity in its consideration of candidates for Board positions. In addition to considering characteristics such as race, gender and national origin, the Committee considers a variety of other characteristics, such as business and professional experience, education and skill, all leading to differences of viewpoint and other individual qualities that contribute to Board heterogeneity. This has resulted in a diverse group of talented and capable Board members, as described in more detail under "Director and Nominee Experience and Qualifications" on pages 9-11.

Corporate Governance Guidelines

The Board has established Corporate Governance Guidelines to comply with the relevant provisions of Section 303A of the NYSE Listed Company Manual (the "NYSE Listing Standards"). The Corporate Governance Guidelines are set forth on the Corporation's Web site at www.ball.com under the "Investors" page, under the link, "Corporate Governance." A copy may also be obtained upon request from the Corporation's Corporate Secretary.

Policies on Business Ethics and Conduct

Ball established a Corporate Compliance Committee in 1993 chaired by a designated Compliance Officer. The Committee publishes a code of business ethics, which is in the form of the Business Ethics booklet. The Board has adopted a separate additional business ethics statement referred to as the Ball Corporation Executive Officers and Directors Business Ethics Statement ("Executive Officers and Directors Ethics Statement") designed to establish principles requiring the highest level of ethical behavior toward achieving business success within the requirements of the law and the Corporation's policies and ethical standards. The Business Ethics booklet and the Executive Officers and Directors Ethics Statement are set forth on the Corporation's Web site at www.ball.com under the "Investors" page, under the link, "Corporate Governance." Copies may also be obtained upon request from the Corporation's Corporate Secretary.

Director Training

All new directors receive orientation training soon after being elected to the Board. Continuing education programs are made available to directors including internal presentations, third-party presentations and externally offered programs. Five directors attended externally offered director training programs in 2011.

Communications With Directors

The Corporation has established means for shareholders or others to send communications to the Board. Persons interested in communicating with the Board, its individual directors or its committees may send communications in writing to the Corporate Secretary or the Chairman of the Board. The communication should be sent in care of the Corporate Secretary, Ball Corporation, by mail to P.O. Box 5000, Broomfield, Colorado 80038-5000 or facsimile transmission to 303-460-2691.

In accordance with the NYSE and SEC requirements, the Corporation has established additional means for interested parties to send communications to the Board and selected committees, which are described on the Corporation's Web site at www.ball.com under the "Investors" page, under the link, "Corporate Governance."

Shareholder proposals for inclusion in the Corporation's proxy materials will continue to be handled and must be communicated as disclosed in this Proxy Statement on page 57.

Meetings of Nonmanagement and Independent Directors

The Board meets regularly and not less than four times per year. Nonmanagement directors meet regularly, usually in conjunction with a regular Board meeting. Independent directors meet at least annually. Georgia R. Nelson served as Presiding Director for meetings of independent directors held in 2011.

12

Director Independence Standards

Pursuant to the NYSE Listing Standards, the Board has adopted a policy adhering to the director independence requirements of the NYSE in determining the independence of directors. These standards are described on the Corporation's Web site at www.ball.com under the "Investors" page, under the link, "Corporate Governance."

The Board has determined that a majority of the Board is independent, and that based upon the NYSE independence standards, during 2011 each of the members of the Board was and currently is independent with the exception of Messrs. Fiedler, Hayes and Hoover.

CERTAIN COMMITTEES OF THE BOARD

The standing committees of the Board are the Audit, Nominating/Corporate Governance, Human Resources and Finance Committees.

Audit Committee:

The primary purpose of the Audit Committee is to assist the Board in fulfilling its responsibilities to oversee management's conduct and the integrity of the Corporation's public financial reporting process including the overview of (1) accounting policies, (2) the system of internal accounting controls over financial reporting, (3) disclosure controls and procedures, (4) the performance of PricewaterhouseCoopers LLP as the independent registered public accounting firm of the Corporation (the "independent auditor"), (5) the Internal Audit Department, and (6) oversight of our risk management. The Audit Committee is responsible for engaging and evaluating the Corporation's independent auditor, including the independent auditor's qualifications and independence; resolving any differences between management and the independent auditor regarding financial reporting; preapproving all audit and non-audit services provided by the independent auditor; and establishing procedures for the receipt, retention and treatment of complaints regarding accounting, internal accounting controls or auditing matters.

Members of the Audit Committee are Ms. Nicholson and Messrs. Alspaugh, Smart, Solso and van der Kaay. The Board has determined that each member of the Audit Committee is independent and financially literate, has accounting or financial management expertise and is an Audit Committee financial expert under the NYSE Listing Standards and the SEC regulations. The Audit Committee met five times during 2011.

The Report of the Audit Committee is set forth on page 54. The Committee has considered the non-audit services provided during 2011 and 2010 by the independent auditor as disclosed below and determined the services were compatible with maintaining the auditor's independence. The Committee believes the fees paid to the independent auditor in respect of the services were appropriate, necessary and cost efficient in the management of the business of the Corporation and are compatible with maintaining the auditor's independence.

Audit Fees and Services

The following table represents fees for professional services rendered by PricewaterhouseCoopers LLP for the audit of the Corporation's annual Consolidated Financial Statements and quarterly reports and the auditor's report under the Sarbanes-Oxley Act of 2002 for fiscal 2011 and fiscal 2010, together with fees for audit-related services and tax services rendered by PricewaterhouseCoopers LLP during fiscal 2011 and fiscal 2010. Audit-related services for 2011 consisted of consultations related to acquisitions and joint venture accounting and derivative transactions. Tax fees consisted principally of tax compliance, including tax compliance matters related to tax audits and return preparation fees and fees for tax consultations, primarily related to the Corporation's relocation of its European headquarters. Other fees included fees primarily related to an external quality assessment of the Corporation's internal audit function. Audit-related services for 2010 consisted of consultations related to a comfort letter for the Corporation's 2010 bond offering, advice related to the sale of a business segment and discontinued operations presentation, derivative transactions, various local and special audits, joint venture consultations, including consolidation, audit of specific accounting matters, and various consents related to SEC filings. Tax fees consisted principally of tax compliance, including tax compliance matters related to tax audits and return preparation fees and fees for tax consultations. Other fees primarily

13

included fees related to due diligence assistance on various acquisitions and advisory services related to consolidation and reporting process improvement initiatives.

|

|

Fiscal 2011 |

Fiscal 2010 |

|||||

|---|---|---|---|---|---|---|---|

|

|||||||

Audit Fees |

|||||||

Attestation Report and Accounting Consultations |

$ | 5,433,000 | $ | 5,481,000 | |||

Foreign Statutory Audits |

1,544,000 | 1,209,000 | |||||

Audit-Related Fees |

|||||||

Benefit Plans |

$ | 25,000 | $ | 29,000 | |||

Consultations |

206,000 | 395,000 | |||||

Tax Fees |

|||||||

Tax Compliance Matters |

$ | 932,000 | $ | 428,000 | |||

Tax Consultations |

3,641,000 | 1,413,000 | |||||

All Other Fees |

$ |

62,000 |

$ |

1,330,000 |

|||

The Audit Committee's Charter requires management to submit for preapproval all audit, audit-related and non-audit-related services to be performed by the independent auditor. Management and the independent auditor submit a report of fees for review and preapproval by the Committee on a quarterly basis. The Audit Committee requires management and the independent auditor to submit a report at least annually regarding audit, audit-related, tax and all other fees paid by the Corporation to the independent auditor for services rendered in the immediately preceding two fiscal years. The Committee considers whether the fees for non-audit and audit-related services are compatible with maintaining the auditor's independence and requires management and the independent auditor to confirm this as well. The Audit Committee preapproved 100% of all of the above-referenced fees paid in 2011 and 2010 for services that were provided by PricewaterhouseCoopers LLP.

There were no hours expended by persons other than the independent auditor's full-time, regular employees on the independent auditor's engagement to audit the Corporation's financial statements.

A copy of the Audit Committee Charter is set forth on the Corporation's Web site at www.ball.com under the "Investors" page, under the link, "Corporate Governance."

Nominating/Corporate Governance Committee:

The Nominating/Corporate Governance Committee is responsible for assisting the Board in fulfilling its responsibility to identify qualified individuals to become Board members; recommending to the Board the selection of Board nominees for the next Annual Meeting of Shareholders; addressing the independence and effectiveness of the Board by advising and making recommendations on matters involving the organization and operation of the Board, Corporate Governance Guidelines and directorship practices; overseeing the evaluation of the Board and its committees; and reviewing and assessing the Corporation's sustainability activities and performance. The Nominating/Corporate Governance Committee utilizes the standards set forth below for considering director nominees.

Members of the Nominating/Corporate Governance Committee are Messrs. Alspaugh, Lehman and Taylor and Ms. Nelson. The Board has determined that the members of the Committee are independent under the NYSE Listing Standards. The Nominating/Corporate Governance Committee met four times during 2011.

The Board has established a process whereby nominees for the Board may be submitted by members of the Board, the CEO, shareholders and any other persons. The Committee considers these recommended candidates in light of criteria set forth below.

The Committee will seek candidates who meet at a minimum the following criteria: (1) have sufficient time to attend or otherwise be present at Board, relevant Board committee and Shareholders' meetings; (2) will subscribe to Ball Corporation's Corporate Governance Guidelines and the Executive Officers and Directors Ethics Statement; (3) demonstrate credentials and experience in a broad range of corporate matters; (4) have experience, qualifications, attributes and skills that would qualify them to serve as a director; (5) will subscribe to the finalized strategic and operating plans of the Corporation as approved by the Board from time to time; (6) are not affiliated with special interest

14

groups that represent major causes or constituents; and (7) meet the criteria, if any, for being a director of the Corporation as set forth in the Indiana Business Corporation Law, the Articles of Incorporation and the Bylaws of the Corporation.

The Committee will apply the principles of diversity in consideration of candidates. The Committee may utilize and pay third-party consultants to identify and screen candidates on a confidential basis for service on the Board. The Committee will also determine candidates' qualifications in light of the standards set by the Committee and by evaluating the qualifications of all candidates in an attempt to select the most qualified nominees suited to serve as a director while attempting to ensure that a majority of the Board is independent and, where needed, to meet the NYSE and SEC requirements for financial literacy, accounting or financial management expertise or audit committee financial expert status.

The Nominating/Corporate Governance Committee will consider candidates recommended by shareholders in accordance with the Corporation's Bylaws. Any such recommendation should be in writing and addressed to the Chair, Nominating/Corporate Governance Committee, in care of the Corporate Secretary, Ball Corporation, by mail to P.O. Box 5000, Broomfield, Colorado 80038-5000.

The Nominating/Corporate Governance Committee received no recommendations for candidates as nominees for the Board from a security holder or group of security holders that beneficially owned more than 5% of the Corporation's voting common stock for at least one year as of the date of the recommendation.

A copy of the Nominating/Corporate Governance Committee Charter is set forth on the Corporation's Web site at www.ball.com under the "Investors" page, under the link, "Corporate Governance."

Human Resources Committee:

The primary purpose of the Human Resources Committee is to assist the Board in fulfilling its responsibilities related to the evaluation and compensation of the CEO and overseeing the compensation of the other executive officers of the Corporation; reviewing and approving the schedule of salary ranges and grades for the salaried employees of the Corporation; approving the Corporation's stock and cash incentive compensation programs including awards to executive officers and the number of shares to be optioned and/or granted from time to time to employees of the Corporation; approving and receiving reports on major benefit plans, plan changes and determinations and discontinuations of benefit plans; discussing the performance evaluation system and succession planning system of the Corporation, including discussions with the Chairman of the Board and the CEO about the succession plan for the Chairman of the Board and the CEO; hiring experts, including executive compensation consultants, as deemed appropriate to advise the Committee; assessment of compensation-related risks; and authorizing the filing of required reports with federal, state and local governmental agencies.

Members of the Human Resources Committee are Messrs. Smart, Solso and Taylor and Ms. Nelson. The Board has determined that the members of the Committee are independent under the NYSE Listing Standards. The Human Resources Committee met four times during 2011. A copy of the Human Resources Committee Charter is set forth on the Corporation's Web site at www.ball.com under the "Investors" page, under the link, "Corporate Governance."

Finance Committee:

The Finance Committee assists the Board in fulfilling its responsibility to oversee management in the financing and related risk management of the Corporation, the status of the Corporation's retirement plans and insurance policies and the Corporation's policies relating to interest rates, commodity hedging and currency hedging. The Committee may hire experts as deemed appropriate to advise the Committee in the performance of its duties. The Committee reports to the Board concerning the financing of the Corporation and the performance of the Committee.

The members of the Finance Committee are Messrs. Fiedler, Lehman and van der Kaay and Ms. Nicholson. The Committee met four times during 2011. A copy of the Finance Committee Charter is set forth on the Corporation's Web site at www.ball.com under the "Investors" page, under the link, "Corporate Governance."

15

BOARD MEETINGS AND ANNUAL MEETING

The members of the Board are expected to attend all meetings of the Board, relevant committee meetings and the Annual Meeting of Shareholders. The Board held five meetings during 2011. Every director attended 75% or more of the aggregate of the total number of meetings of the Board and the total number of meetings held by all committees of the Board on which the director served. All directors attended the 2011 Annual Meeting.

TRANSACTIONS WITH RELATED PERSONS, PROMOTERS AND CERTAIN CONTROL PERSONS

Ball Corporation has adopted a policy with respect to transactions with related persons requiring its executive officers and directors to comply with all SEC and NYSE requirements concerning transactions between the Corporation and "related persons," as defined in the applicable SEC and NYSE rules. With respect to related persons, David L. Taylor currently serves as President and Chief Executive Officer of a wholly owned subsidiary of Ball Corporation, and is the spouse of Lisa A. Pauley, an executive officer of the Corporation. For 2011, Mr. Taylor's base salary was approximately $405,000. To facilitate compliance with such policy, the Board adopted procedures for the review, approval or ratification of any transaction required to be reported under the applicable rules. The policy provides that each executive officer and director will promptly report to the Chairman of the Board any transaction with the Corporation undertaken or contemplated by such officer or director, by any beneficial owner of 5% or more of the Corporation's voting securities or by any immediate family member. The Chairman of the Board will refer any transaction to the General Counsel for review and recommendation. Upon receipt of such review and recommendation, the matter will be brought before the Nominating/Corporate Governance Committee to consider whether the transaction in question should be approved, ratified, suspended, revoked or terminated. This policy for transactions with related persons is in writing and is part of the Ball Corporation Executive Officers and Directors Ethics Statement. The written form of the policy can be found on the Corporation's Web site as indicated in the section "Policies on Business Ethics and Conduct" on page 12.

16

EXECUTIVE COMPENSATION

COMPENSATION DISCUSSION AND ANALYSIS

The Compensation Discussion and Analysis ("CD&A") portion of our proxy materials describes Ball Corporation's 2011 executive compensation program and its strong alignment with our pay-for-performance philosophy.

Ball Corporation experienced another excellent year in 2011including the successful transition to a new leadership team, beginning with the election of John A. Hayes as the Corporation's President and Chief Executive Officer, upon the retirement of R. David Hoover, who remains as Chairman of the Board. In addition, Ball's 2011 financial results were among the best in our Corporation's 132-year history, as more specifically described under the heading "Management's Discussion and Analysis" in the Corporation's Annual Report on Form 10-K. The chart below summarizes certain key financial results for fiscal year 2011 compared to fiscal year 2010:

|

|

2011 |

2010 |

% Growth |

|||

|---|---|---|---|---|---|---|

Revenue (net sales) |

$8.6 billion | $7.6 billion | 13.2% | |||

Net Earnings (comparable basis)* |

$460 million | $433 million | 6.2% | |||

Free Cash Flow* |

$505 million | $506 million | -0.2% | |||

Stock Price |

$35.71 | $34.03 | 4.9% | |||

Earnings Per Share (comparable basis)* |

$2.73 | $2.36 | 15.7% | |||

- *

- These financial measures are on a non-U.S. GAAP basis and should be considered in connection with the consolidated financial statements contained within Item 8 of the 2011 Annual Report on Form 10-K (the "annual report"). Non-U.S. GAAP measures should not be considered in isolation and should not be considered superior to, or a substitute for financial measures calculated in accordance with U.S. GAAP. A reconciliation of Non-GAAP measures to U.S. GAAP is available in Item 7 of the annual report.

Ball's stock price closed the year at $35.71, an increase of 4.9% over the prior year compared to 5.2% for the Dow Jones Industrial Average and 0% for the S&P 500. Including reinvested dividends, the Corporation generated a total return of 5.8% for the same period. Also during the year, the Corporation completed a two-for-one split of our common stock, increased the quarterly cash dividend by 40% to 7 cents per share on a post-split basis, which provided annual dividends of $46 million, and repurchased $474 million of the Corporation's common stock.

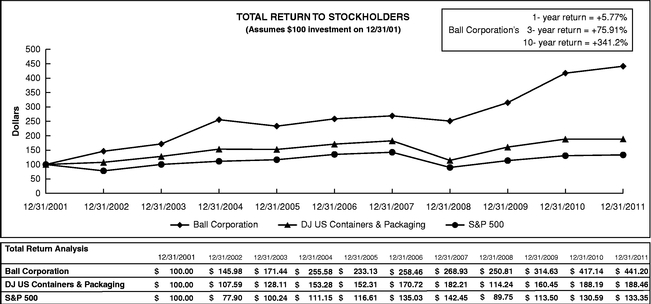

The strong business performance in 2011 is a continuation of the performance we have delivered over the last decade. The graph below compares the cumulative 10-year total return of holders of Ball Corporation's common stock with the cumulative total returns of the S&P 500 Index and the Dow Jones U.S. Containers & Packaging Index. The graph tracks the performance of a $100 investment in our common stock (with the reinvestment of all dividends) and in each of the indexes from December 31, 2001, to December 31, 2011.

Copyright© 2012 Standard & Poor's, a division of The McGraw-Hill Companies Inc. All rights reserved. (www.researchdatagroup.com/S&P.htm)

Copyright© 2012 Dow Jones & Company. All rights reserved.

The stock price performance included in this graph is not necessarily indicative of future stock price performance.

17

|

Much of our financial success is attributable to the fact that we consistently focus on the key components of our financial strategy, which include:

Generating free cash flow; Disciplined and balanced capital allocation; Growing earnings before interest and taxes ("EBIT") by maximizing value in existing businesses, expansion into new markets and products, and merger and acquisition activities; and Generating incremental Economic Value Added ("EVA®") with returns in excess of our weighted average cost of capital ("WACC"), which over time leads to a higher share price and shareholder returns. |

|

In 2011 we also developed and initiated our Drive for 10 strategy, which builds on Ball's strong foundation and emphasizes five key strategic levers that will allow us to achieve continued growth over the next decade. During the year we had many operational successes that directly aligned with our Drive for 10 strategy, including:

-

-

Successfully completing the acquisition and integration of Aerocan S.A.S. in Europe;

-

-

Expanding our geographic reach by building new beverage can plants in Brazil, China and Vietnam;

-

-

Strategically redeploying assets by relocating a metal beverage can production line originally intended for a plant in

Lublin, Poland, to our Belgrade, Serbia, plant;

-

-

Aligning our North American manufacturing footprint to better meet changing market demand;

-

-

Expanding specialty can production in our Forth Worth, Texas, plant by adding a new specialty can line capable of

producing both 16- and 24-ounce cans and adding an Alumi-tek Bottle line in our Golden, Colorado, plant; and

-

- Expanding Ball Aerospace's manufacturing center in Westminster, Colorado, and NASA's successful launch of the Ball-built NPP satellite.

Pay-for-Performance Serves as the Foundation of our Executive Compensation ProgramThe design, governance and administration of our executive compensation program is centered on the principle of aligning pay to performance, achieved by linking the majority of executive compensation opportunities to long-term shareholder returns and the value-added financial performance of the Corporation. We believe this principle has directly contributed to the successful performance of the business through:

-

-

A management-as-owners culture that builds a management team with meaningful ownership in the

Corporation. Executives are closely aligned to shareholder interests through established ownership expectations, equity-settled long-term incentives and specialized opportunities that

encourage individuals to make meaningful, personal investments in Ball Corporation common stock.

-

- Incentive pay programs that utilize value-added financial performance metricsspecifically, EVA®, return on average invested capital ("ROAIC"), and total shareholder return ("TSR")that are in our view most closely aligned with shareholder value generation by creating accountability for both the efficient deployment of capital and strong earnings generation.

18

The major compensation elements of Ball's pay-for-performance philosophy are shown in the table below, with the page in the CD&A that details the specifics of each of these components:

|

Compensation Element |

Basis for Performance Measurement |

Alignment with Principle of Pay-for-Performance |

Page |

|||||

|---|---|---|---|---|---|---|---|---|

| Short-Term Annual Cash Compensation | ||||||||

| Base Salary | Individual performance and contribution based on primary duties and responsibilities | Competitive compensation element required to recruit and retain top executive talent; pays for primary duties and responsibilities | 28 | |||||

| Economic Value Added Annual Incentive Plan |

EVA® Growth (net operating profit after-tax, less a cost of capital charge) |

Measures the increase in actual economic value generated by the business. | 28 | |||||

| Long-Term Incentives (Cash) | ||||||||

| Long-Term Cash Incentive Plan ("LTCIP") |

ROAIC Relative TSR vs. S&P 500 subset |

Rewards ROAIC performance above a target rate set above the Corporation's weighted average cost of capital and shareholder returns that outperform the market | 31 | |||||

| Acquisition-Related Special Incentive Plan | EBIT and Cash Flow (for Metal Beverage Packaging Division, Americas) | Rewards the successful integration and performance of a business acquired in 2009 | 32 | |||||

| Long-Term Incentives (Equity) | ||||||||

| Stock Options/Stock-Settled Stock Appreciation Rights ("SARs") | Stock Price Appreciation | Rewards absolute stock price growth over time | 33 | |||||

| Performance-Contingent Restricted Stock Units ("RSUs") |

ROAIC Stock Price |

Builds executive ownership with stock unit awards that vest contingent upon ROAIC over a 3-year period exceeding the Corporation's weighted average cost of capital | 33 | |||||

| Restricted Stock/RSUs | Stock Price | Granted from time-to-time, generally in connection with the promotion or recruitment of individuals to facilitate ownership and retention | 34 | |||||

| Deposit Share Program ("DSP") | Stock Price | Promotes an executives-as-owners culture by making deposit share opportunities from time-to-time in the discretion of the Committee, in exchange for the recipient voluntarily investing in and holding shares of Ball Corporation common stock | 34 | |||||

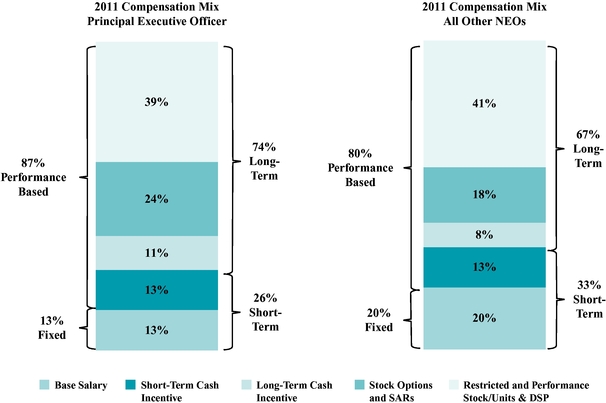

Our Heavy Weighting of Compensation to Performance Creates Pay-for-Performance LinkageConsistent with our management-as-owners, pay-for-performance philosophy described previously, the majority of the target total compensation for our executives is variable based on performance, which constitutes pay at risk. The CEO is eligible to participate in the same executive programs as the CFO and the other NEOs; however, a larger portion of the CEO's target total compensation is at risk. The following charts represent the mix of target total compensation awarded to the Corporation's CEO and other NEOs in 2011. As illustrated, 87% of the target total compensation awarded to the CEO and 80% awarded to the other NEOs in 2011 was based on elements that may vary from year to year depending on business performance. Furthermore, 74% of the CEO's and 67% of the other NEOs' target total compensation was based on long-term performance. This emphasis on longer-term compensation, through performance based long-term cash and stock awards, ensures a strong continued alignment between Ball's executive ownership and shareholder value creation objectives.

19

Our Compensation Plans are Closely Linked to Business PerformanceThe Corporation's fiscal 2011 financial results and the resulting EVA® improvement was directly linked to the pay outcome of our annual short-term incentive plan, since the payout factor is based on the amount of profits generated, in excess of both operating and capital costs, resulting in EVA® in excess of targets, as shown below:

|

Compensation Element |

2011 Performance Achievement |

2011 Pay Outcome |

||

|---|---|---|---|---|

Annual Cash Compensation |

||||

Economic Value Added Annual Incentive |

The actual EVA® generated in excess of Ball's internal 9% after-tax hurdle rate for fiscal year 2011 of $142.3 million exceeded our $96.3 million EVA® incentive plan target by $46.0 million | Payout for our NEOs was at 188% of target | ||

Likewise, our success in fiscal year 2011 reflects a continuation of the successful execution of our business strategy and strong performance in prior years; therefore, pay realized by our NEOs from long-term incentive performance cycles completed at 2011 year-end reflects our commitment to improved financial performance and stock price growth, as shown below:

|

Compensation Element |

2011 Performance Achievement |

2011 Pay Outcome |

||

|---|---|---|---|---|

Long-Term Incentives (Equity) |

||||

Performance-Contingent RSUs |

Actual 3-year average ROAIC of 11.66% exceeded the target weighted cost of capital of 6.8% | All performance-contingent RSUs granted in 2009 fully vested for all NEOs on January 31, 2012 | ||

20

|

Compensation Element |

2011 Performance Achievement |

2011 Pay Outcome |

||

|---|---|---|---|---|

Long-Term Incentives (Cash) |

||||

Long-Term Cash Incentive Plan |

Relative TSR versus the S&P 500 subset fell into 86th percentile, which exceeded the target of 50th percentile (for 50% of payout) Actual 3-year average ROAIC of 11.66% exceeded the target of 9.00% (for 50% of payout) |

All of our NEOs received LTCIP payout equal to 200% of target | ||

Acquisition-Related Special |

Cumulative 27-month EBIT was slightly above and cash flow was slightly below target | The most recent 27-month period resulted in an interim award of 33.29% of the target award | ||

We Are Committed to Shareholder Oriented Corporate GovernanceOur governance process ensures that the executive compensation program is appropriately maintained and updated to always meet a standard of excellence in pay-for-performance alignment. Specifically, a number of practices and policies are in place to promote the continuous improvement and accountability of our executive compensation program:

-