DEF 14A: Definitive proxy statements

Published on March 17, 2006

QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant ý | ||

|

Filed by a Party other than the Registrant o |

||

Check the appropriate box: |

||

o |

Preliminary Proxy Statement |

|

o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

ý |

Definitive Proxy Statement |

|

o |

Definitive Additional Materials |

|

o |

Soliciting Material Pursuant to §240.14a-12 |

|

|

BALL CORPORATION |

||||

|

(Name of Registrant as Specified In Its Charter) |

||||

|

|

||||

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||||

| Payment of Filing Fee (Check the appropriate box): | ||||

ý |

No fee required. |

|||

o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|||

| (1) |

Title of each class of securities to which transaction applies: |

|||

| (2) |

Aggregate number of securities to which transaction applies: |

|||

| (3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

| (4) |

Proposed maximum aggregate value of transaction: |

|||

| (5) |

Total fee paid: |

|||

o |

Fee paid previously with preliminary materials. |

|||

o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|||

(1) |

Amount Previously Paid: |

|||

| (2) |

Form, Schedule or Registration Statement No.: |

|||

| (3) |

Filing Party: BALL CORPORATION |

|||

| (4) |

Date Filed: March 17, 2006 |

|||

|

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

||||

BALL CORPORATION

10 Longs Peak Drive, Broomfield, Colorado 80021-2510

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD WEDNESDAY, APRIL 26, 2006

The Annual Meeting of Shareholders of Ball Corporation will be held at the Corporation's offices, 10 Longs Peak Drive, Broomfield, Colorado 80021-2510, on Wednesday, April 26, 2006, at 9:00 a.m. (MDT) for the following purposes:

- 1.

- To

elect three directors for three-year terms expiring at the Annual Meeting of Shareholders to be held in 2009;

- 2.

- To

ratify the appointment of PricewaterhouseCoopers LLP as the independent auditor for the Corporation for 2006;

- 3.

- To

act upon a shareholder proposal to declassify the Board of Directors so that all directors are elected annually; and

- 4.

- To transact any other business as may properly come before the meeting, although it is anticipated that no business will be conducted other than the matters listed above.

Only holders of Common Stock of record at the close of business on March 1, 2006, are entitled to notice of and to vote at the Annual Meeting or any adjournment thereof.

A Proxy Statement appears on the following pages. Copies of the Annual Report and Form 10-K for 2005 are being mailed to you with this Notice of Annual Meeting of Shareholders and Proxy Statement.

| By Order of the Board of Directors | ||

|

David A. Westerlund Corporate Secretary |

March 20, 2006

Broomfield, Colorado

YOUR VOTE IS IMPORTANT

You are urged to complete, sign, date and promptly return your proxy in the enclosed

postage-paid envelope, or submit your proxy via the telephone or Internet,

as soon as possible, so that your shares can be voted at the meeting

in accordance with your instructions.

PLEASE NOTE: The 2006 Annual Meeting of Shareholders will be held to tabulate the votes cast and

to report the results of voting on the items described above. No management presentations

or other business matters are planned for the meeting.

Ball and

![]() are trademarks of Ball Corporation, Reg. U.S. Pat. & Tm. Office

are trademarks of Ball Corporation, Reg. U.S. Pat. & Tm. Office

BALL CORPORATION

10 Longs Peak Drive, Broomfield, Colorado 80021-2510

PROXY STATEMENT

March 20, 2006

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD WEDNESDAY, APRIL 26, 2006

To Shareholders of Ball Corporation:

This Proxy Statement and the accompanying proxy card are furnished to shareholders in connection with the solicitation by the Board of Directors of Ball Corporation (the "Corporation" or "Ball") of proxies to be voted at the Annual Meeting of Shareholders (the "Annual Meeting") to be held April 26, 2006, for the purposes stated in the accompanying notice of the meeting.

Please complete, sign, date and return your proxy card, or submit your proxy by telephone or via the Internet, as soon as possible, so that your shares can be voted at the meeting. Any Ball Corporation shareholder of record desiring to submit a proxy by telephone or via the Internet will be required to enter the unique voter control number imprinted on the Ball Corporation proxy card, and therefore should have the card for reference when initiating the process.

-

- To

submit your proxy by telephone, call 1-866-731-8683 on a touch-tone telephone and follow the simple menu instructions

provided. There is no charge for this call.

-

- To submit your proxy over the Internet, log on to the website at http://www.eproxyvote.com/bll and follow the simple instructions provided.

Similar instructions are included on the enclosed proxy card.

A shareholder of the Corporation may revoke a proxy at any time by sending written notice of revocation to the Corporate Secretary; by voting again by telephone, via the Internet or in writing; or by voting in person at the meeting.

VOTING SECURITIES AND PRINCIPAL SHAREHOLDERS

At the close of business on March 1, 2006, there were outstanding 104,421,930 shares of Common Stock (together with the associated preferred stock purchase rights under the Rights Agreement dated as of January 24, 1996, between the Corporation and Computershare Trust Company N.A.). Other than 42,651 shares of Common Stock granted as restricted stock without voting rights, each of the shares of Common Stock is entitled to one vote. Shareholders do not have cumulative voting rights with respect to the election of directors.

Based on Schedule 13G filings with the Securities and Exchange Commission ("SEC"), the following table indicates the beneficial owners of more than 5 percent of the Corporation's outstanding Common Stock as of December 31, 2005:

|

Name and Address of Beneficial Owner |

Shares Beneficially Owned |

Percent of Class |

||

|---|---|---|---|---|

| Lord Abbett & Co. 90 Hudson Street Jersey City, NJ 07302-3973 |

9,715,109 | (1) | 9.3 | |

Iridian Asset Management LLC 276 Post Road West, Suite 100 Westport, CT 06880-4704 |

7,033,188 |

(2) |

6.8 |

|

Vanguard Fiduciary Trust Company 500 Admiral Nelson Boulevard Malvern, PA 19355 |

6,695,242 |

(3) |

6.4 |

- (1)

- These

shares are held with sole voting and dispositive power.

- (2)

- Iridian

Asset Management LLC is jointly owned by the Governor and Company of the Bank of Ireland, IBI Interfunding, BancIreland/First Financial, Inc., BIAM (US) Inc.,

pursuant to a joint filing agreement dated February 3, 2006. The shares are held with shared voting and dispositive power.

- (3)

- These shares are held with shared voting and dispositive power.

The following table lists the beneficial ownership of Common Stock of the Corporation by director nominees, continuing directors, the Chief Executive Officer and the four other most highly compensated executive officers and, as a group, of such persons and the other executive officers as of the close of business on March 1, 2006.

|

Title of Class |

Name of Beneficial Owner |

Shares Beneficially Owned(1) |

Percent of Class(2) |

|||

|---|---|---|---|---|---|---|

| Common | Howard M. Dean | 111,820 | (3) | * | ||

| Common | Hanno C. Fiedler | 141,379 | (4) | * | ||

| Common | John R. Friedery | 286,636 | (5) | * | ||

| Common | R. David Hoover | 1,539,154 | (6) | 1.5 | ||

| Common | John F. Lehman | 117,253 | (7) | * | ||

| Common | Jan Nicholson | 199,382 | (8) | * | ||

| Common | Raymond J. Seabrook | 488,696 | (9) | * | ||

| Common | George A. Sissel | 284,316 | (10) | * | ||

| Common | George M. Smart | 17,181 | (11) | * | ||

| Common | Theodore M. Solso | 51,114 | (12) | * | ||

| Common | Stuart A. Taylor II | 83,789 | (13) | * | ||

| Common | Erik H. van der Kaay | 25,674 | (14) | * | ||

| Common | David A. Westerlund | 528,374 | (15) | * | ||

| Common | All of the above and present executive officers as a group (18) | 4,585,672 | (16) | 4.4 |

- (1)

- Full voting and dispositive investment power, unless otherwise noted.

- (2)

- * Indicates less than 1 percent ownership.

- (3)

- Includes 1,000 shares owned by Mr. Dean's wife, as to which he disclaims beneficial ownership, and 30,293 shares that he may acquire during the next 60 days upon the exercise of stock options.

- (4)

- Includes 10,000 shares that Mr. Fiedler may acquire during the next 60 days upon exercise of stock options. Also includes 22,000 shares of restricted stock without voting rights. Voting rights attach to the shares as the restrictions lapse.

- (5)

- Includes 81,344 shares that Mr. Friedery may acquire during the next 60 days upon the exercise of stock options. Also includes 57,215 stock units equivalent to 57,215 shares that have been deferred pursuant to the Ball Corporation Deferred Compensation Company Stock Plans with no voting rights or dispositive investment power.

- (6)

- Includes 319,524 shares held in trust for Mr. Hoover's wife, as to which he disclaims beneficial ownership, and 737,944 shares that he may acquire during the next 60 days upon the exercise of stock options. Also includes 297,105 stock units equivalent to 297,105 shares that have been deferred pursuant to the Ball Corporation Deferred Compensation Company Stock Plans with no voting rights or dispositive investment power.

- (7)

- Includes 32,000 shares that Mr. Lehman may acquire during the next 60 days upon the exercise of stock options. Also includes 14,082 stock units equivalent to 14,082 shares that have been deferred pursuant to the Ball Corporation Deferred Compensation Company Stock Plans with no voting rights or dispositive investment power.

- (8)

- Includes 44,000 shares that Ms. Nicholson may acquire during the next 60 days upon the exercise of stock options. Also includes 14,079 stock units equivalent to 14,079 shares that have been deferred pursuant to the Ball Corporation Deferred Compensation Company Stock Plans with no voting rights or dispositive investment power.

- (9)

- Includes 5,510 shares owned by Mr. Seabrook's children, as to which he disclaims beneficial ownership, and 234,772 shares that he may acquire during the next 60 days upon the exercise of stock options. Also includes 104,007 stock units equivalent to 104,007 shares that have been deferred pursuant to the Ball Corporation Deferred Compensation Company Stock Plans with no voting rights or dispositive investment power.

- (10)

- Includes 39,200 shares owned by Mr. Sissel's wife, as to which he disclaims beneficial ownership, and 38,000 shares that he may acquire during the next 60 days upon the exercise of stock options. Also includes 5,639 stock units equivalent to 5,639 shares that have been deferred pursuant to the Ball Corporation Deferred Compensation Company Stock Plans with no voting rights or dispositive investment power.

- (11)

- Includes 4,000 shares owned by Mr. Smart's wife, as to which he disclaims beneficial ownership.

- (12)

- Includes 6,000 shares that Mr. Solso may acquire during the next 60 days upon the exercise of stock options. Also includes 1,035 stock units equivalent to 1,035 shares that have been deferred pursuant to the Ball Corporation Deferred Compensation Company Stock Plans with no voting rights or dispositive investment power.

- (13)

- Includes 30,250 shares that Mr. Taylor may acquire during the next 60 days upon the exercise of stock options. Also includes 13,544 stock units equivalent to 13,544 shares that have been deferred pursuant to the Ball Corporation Deferred Compensation Company Stock Plans with no voting rights or dispositive investment power.

- (14)

- Includes 385 stock units equivalent to 385 shares that have been deferred pursuant to the Ball Corporation Deferred Compensation Company Stock Plans with no voting rights or dispositive investment power.

- (15)

- Includes 60,500 shares owned by Mr. Westerlund's wife, as to which he disclaims beneficial ownership, and 263,500 shares that he may acquire during the next 60 days upon the exercise of stock options. Also includes 97,141 stock units equivalent to 97,141 shares that have been deferred pursuant to the Ball Corporation Deferred Compensation Company Stock Plans with no voting rights or dispositive investment power.

- (16)

- Includes 110,685 additional stock units equivalent to 110,685 shares that have been deferred pursuant to the Ball Corporation Deferred Compensation Company Stock Plans with no voting rights or dispositive investment power.

VOTING ITEM IELECTION OF DIRECTORS

In 1985 the shareholders adopted the Amended Articles of Incorporation of Ball Corporation, dividing the Board of Directors (the "Board") into three classes, as nearly equal in number as possible, with directors serving staggered three-year terms. On April 26, 2006, three persons are to be elected to serve as directors until 2009. Unless otherwise instructed on the proxy card, the persons named in the accompanying proxy intend to vote for nominees Howard M. Dean, R. David Hoover and Jan Nicholson to hold office as directors of the Corporation until the 2009 Annual Meeting of Shareholders, or, in each case, until his or her respective successor is elected and qualified. All nominees have consented to be named as candidates in the Proxy Statement and have agreed to serve if elected. If, for any reason, any of the nominees becomes unavailable for election, the shares represented by proxies will be voted for any substitute nominee or nominees designated by the Board of Directors. The Board has no reason to believe that any of the nominees will be unable to serve.

In accordance with the Indiana Business Corporation Law, directors are elected by a plurality of the votes cast by the shares entitled to vote in the election at a meeting at which a quorum is present. Abstentions and broker nonvotes are considered neither votes "for" nor "against." Proxies may not be voted for a greater number of persons than the three named nominees.

Set forth for each director nominee in Class III and for each continuing director in Classes I and II are the director's principal occupation and employment during the past five years or, if longer, the period during which the director has served as a director, and certain other information.

DIRECTOR NOMINEES AND CONTINUING DIRECTORS

| To Be Elected for a Term of Three Years Until the 2009 Annual Meeting (Class III) | ||||

Howard M. Dean |

Chairman of the Board, Dean Foods Company, 1989 to April 2002; Chairman and Chief Executive Officer, 1989 to 2001; President and Chief Operating Officer, 1971 to 1989. Age 68. |

Director since 1984. Member, Human Resources and Nominating/Corporate Governance Committees. Mr. Dean is a director of YRC Worldwide Inc., Overland Park, Kansas. |

||

R. David Hoover |

Chairman, President and Chief Executive Officer, Ball Corporation, since April 2002; President and Chief Executive Officer, January 2001 to April 2002; Vice Chairman, President and Chief Operating Officer, April 2000 to January 2001; Vice Chairman, President and Chief Financial Officer, January 2000 to April 2000; Vice Chairman and CFO, 1998 to 2000; Executive Vice President and CFO, 1997 to 1998; Executive Vice President, CFO and Treasurer, 1996 to 1997. Age 60. |

Director since 1996. Member, Finance Committee. Mr. Hoover is a director of Energizer Holdings, Inc., St. Louis, Missouri, Irwin Financial Corporation, Columbus, Indiana, and Qwest Communications International, Inc., Denver, Colorado. |

||

Jan Nicholson |

President, The Grable Foundation, Pittsburgh, Pennsylvania, since 1990; Managing Director, Strategic Risk Assessment, MBIA Insurance Corporation, Armonk, New York, 1998 to 2000; Managing Director, Research and Development, Capital Markets Assurance Corporation (CapMAC), New York, New York, 1994 to 1998. Age 60. |

Director since 1994. Member, Audit and Finance Committees. Ms. Nicholson is a director of Radian Group, Philadelphia, Pennsylvania. |

||

|

The Board of Directors recommends that shareholders vote "FOR" the election of each nominee for Director named above. |

||||

|

To Continue in Office Until the 2007 Annual Meeting (Class I) |

||||

Hanno C. Fiedler |

Executive Vice President, Ball Corporation, December 2002 to December 2005; Chairman and Chief Executive Officer, Ball Packaging Europe, since December 2002; Chairman and Chief Executive Officer, Schmalbach-Lubeca AG, 1996 to 2002. Age 60. |

Director since 2002. Member, Finance Committee. Mr. Fiedler serves on the Supervisory Boards of Thyssen Krupp Steel AG, Duisburg, Germany; Pfleiderer AG of Neumarkt, Germany; and Howaldtswerke-Deutsche Werft AG, Kiel, Germany. |

||

John F. Lehman |

Chairman, J. F. Lehman & Company, New York, New York, since 1990; Chairman of the Board, OAO Technology Solutions, Inc., Greenbelt, Maryland, since 2001; Chairman of the Board, Sperry Marine Inc., Charlottesville, Virginia, 1993 to 1996; Managing Director, Investment Banking Division, PaineWebber Inc., New York, New York, 1988 to 1990; Secretary of the Navy, Washington, D.C., 1981 to 1987. Age 63. |

Director since 1987. Member, Finance and Nominating/Corporate Governance Committees. Mr. Lehman is a director of EnerSys, Reading, Pennsylvania. |

||

George A. Sissel |

Chairman of the Board, Ball Corporation, January 2001 to April 2002; Chairman and Chief Executive Officer, January 1998 to January 2001; Chairman, President and CEO, 1996 to 1998; President and CEO, 1995 to 1996. Age 69. |

Director since 1995. Member, Audit and Finance Committees. Mr. Sissel is a director of CIBER, Inc., Greenwood Village, Colorado. |

||

Erik H. van der Kaay |

Chairman of the Board, Symmetricom, Inc., October 2002 to October 2003; President, Chief Executive Officer, and Chairman of the Board, Datum, Inc., Irvine, California, April 1998 to October 2002 upon Symmetricom's acquisition of Datum. Age 65. |

Director since 2004. Member, Audit and Finance Committees. Mr. van der Kaay is a director of Comarco, Inc., Irvine, California; RF Micro Devices, Greensboro, North Carolina; and TranSwitch Corporation, Shelton, Connecticut. |

||

|

To Continue in Office Until the 2008 Annual Meeting (Class II) |

||||

George M. Smart |

President, Sonoco-Phoenix Inc., Canton, Ohio, a subsidiary of Sonoco Products Company, 2001 to 2004; Chairman and President, Phoenix Packaging Corporation, 1993 to 2001. Age 60. |

Director since 2005. Member, Human Resources and Nominating/Corporate Governance Committees. Mr. Smart is a director of FirstEnergy Corp., Akron, Ohio. |

||

Theodore M. Solso |

Chairman and Chief Executive Officer, Cummins, Inc., Columbus, Indiana, since January 2000. Age 59. |

Director since 2003. Member, Audit and Human Resources Committees. Mr. Solso is a director of Ashland Inc., Covington, Kentucky, and Irwin Financial Corporation, Columbus, Indiana. |

||

Stuart A. Taylor II |

Chief Executive Officer, The Taylor Group L.L.C., Chicago, Illinois, since June 2001; Senior Managing Director, Bear, Stearns & Co. Inc., Chicago, Illinois, 1999 to 2001. Age 45. |

Director since 1999. Member, Human Resources and Nominating/Corporate Governance Committees. |

||

Corporate Governance Guidelines

The Board has established Corporate Governance Guidelines to comply with the relevant provisions of Section 303A of the New York Stock Exchange ("NYSE") Listed Company Manual (the "NYSE Listing Standards"). The Corporate Governance Guidelines are set forth on the Corporation's website at www.ball.com, under the section "Investors," under the subsection "Financial Information" and under the link, "Corporate Governance." A copy may also be obtained upon request from the Corporation's Corporate Secretary.

Policies on Business Ethics and Conduct

Ball established a Corporate Compliance Committee in 1993 chaired by a designated Compliance Officer. The Committee publishes a code of business ethics, which is in the form of the Business Ethics booklet. The Board has adopted a separate additional business ethics statement referred to as the Ball Corporation Executive Officers and Directors Business Ethics Statement ("Executive Officers and Directors Ethics Statement") designed to establish principles requiring the highest level of ethical behavior toward achieving business success within the requirements of the law and the Corporation's policies and ethical standards. Copies of the Business Ethics booklet and the Executive Officers and Directors Ethics Statement are set forth on the Corporation's website at www.ball.com, under the section "Investors," under the subsection "Financial Information" and under the link, "Corporate Governance." A copy may also be obtained upon request from the Corporation's Corporate Secretary.

Communications With Directors

The Corporation has established means for shareholders or others to send communications to the Board. Persons interested in communicating with the Board, its individual directors or its Committees may send communications in writing via the Corporate Secretary or the Chairman of the Board. The communication should be sent in care of the Corporate Secretary, Ball Corporation, by mail to P.O. Box 5000, Broomfield, Colorado 80038-5000 or facsimile transmission to 303-460-2127.

In accordance with the NYSE and SEC requirements, the Corporation has established additional means for interested parties to send communications to the Board and selected Committees which are described on the Corporation's website at www.ball.com, under the section "Investors," under the subsection "Financial Information" and under the link, "Corporate Governance."

Shareholder proposals for inclusion in the Corporation's proxy materials will continue to be handled and must be communicated as disclosed in this Proxy Statement on page 25.

Meetings of Nonmanagement Directors

The Board meets regularly and not less than four times per year. Nonmanagement directors meet regularly, usually in conjunction with a regular Board meeting. Independent directors meet at least annually. The Presiding Director of meetings of nonmanagement and independent directors is Stuart A. Taylor II.

Director Independence Standards

Pursuant to the NYSE Listing Standards, the Board has adopted a policy adhering to the director independence requirements of the NYSE in determining the independence of directors. These standards are described on the Corporation's website at www.ball.com, under the section "Investors," under the subsection "Financial Information" and under the link, "Corporate Governance."

The Board has determined that a majority of the Board is independent, and the Board has determined that based upon the NYSE independence standards, that each of the members of the Board is now independent with the exception of Messrs. Hoover and Fiedler.

CERTAIN COMMITTEES OF THE BOARD

The standing committees of the Board are the Audit, Nominating/Corporate Governance, Human Resources and Finance.

Audit Committee:

The primary purpose of the Audit Committee is to assist the Board in fulfilling its responsibilities to oversee management's conduct and the integrity of the Corporation's public financial reporting process including the overview of the accounting policies and the system of internal accounting controls over financial reporting, disclosure controls and procedures and the performance of PricewaterhouseCoopers LLP as the independent registered public accounting firm of the Corporation (the Corporation's "independent auditor") and the internal audit department. The Audit Committee is responsible for engaging and evaluating the Corporation's independent auditor, including the independent auditor's qualifications and independence; resolving any differences between management and the independent auditor regarding financial reporting; preapproving all audit and non-audit services provided by the independent auditor; and establishing procedures for the receipt, retention and treatment of complaints regarding accounting, internal accounting controls or auditing matters.

Members of the Audit Committee are Ms. Nicholson (Chair) and Messrs. Sissel, Solso and van der Kaay. The Board has determined that each member of the Audit Committee is independent and financially literate, and the Board identifies Ms. Nicholson, among others, as having accounting or financial management expertise and as an Audit Committee financial expert under the NYSE Listing Standards and the SEC regulations. The Audit Committee met five times during 2005.

The Report of the Audit Committee is set forth on page 22. The Committee has considered the non-audit services provided during 2005 and 2004 by the independent auditor as disclosed below and determined the services were compatible with maintaining the auditor's independence. The Committee believes the fees paid to the independent auditor in respect of those services were appropriate, necessary and cost efficient in the management of the business of the Corporation and are compatible with maintaining the auditor's independence. The fees billed by PricewaterhouseCoopers LLP for services rendered during 2005 and 2004 are as follows:

Audit Fees

The aggregate fees billed by PricewaterhouseCoopers LLP for professional services rendered for the audit of the Corporation's annual consolidated financial statements included in the Annual Report on Form 10-K, quarterly reviews of the Corporation's consolidated financial statements included in the quarterly reports on Form 10-Q, the independent auditor's attestation report under the Sarbanes-Oxley Act of 2002 and accounting consultations directly related to the audit were $4,612,000 and $4,838,000 for 2005 and 2004, respectively. The fees for 2004 include $1 million for the audit of the 2003 financial statements that included the first full year audit of the acquired European operations, formerly known as Schmalbach-Lubeca GmbH. The aggregate fees billed for services rendered for statutory audits required by foreign countries for the Corporation's foreign investments were $1,852,000 and $1,152,000 for 2005 and 2004, respectively.

Audit-Related Fees

Fees for audits of the Corporation's benefit plans were $17,000 for each of 2005 and 2004. Other fees for audit-related services for various consultations on audit related matters and general consultations concerning the Sarbanes-Oxley Act of 2002 were $94,000 and $81,000 for 2005 and 2004, respectively.

Tax Fees

The aggregate fees billed for tax compliance, including tax compliance matters related to tax audits and return preparation fees were $1,025,000 and $1,443,000 for 2005 and 2004, respectively. The aggregate fees for tax consultations were $462,000 and $722,000 for 2005 and 2004, respectively.

All Other Fees

Fees of $113,000 and $4,000 were billed for 2005 and 2004, respectively, for other non-prohibited services including fees for access to PricewaterhouseCoopers LLP online accounting research software and other training and accounting advice for the Corporation's foreign investments.

The Audit Committee's Charter requires management to submit for preapproval all audit, audit-related and non-audit-related services to be performed by the independent auditor. Management and the independent auditor submit a report of fees for review and preapproval by the Committee on a quarterly basis. The Audit Committee requires management and the independent auditor to submit a report at least annually regarding audit, audit-related, tax and all other fees paid by the Corporation to the independent auditor for services rendered in the immediately preceding two fiscal years. The Committee considers whether the fees for non-audit and audit-related services are compatible with maintaining the auditor's independence and requires management and the independent auditor to confirm this as well. The Audit Committee preapproved 100 percent of all of the above-referenced fees paid in 2005 and 2004 for services that were provided by PricewaterhouseCoopers LLP.

The percentage of hours expended by persons other than the independent auditor's full-time, regular employees on the independent auditor's engagement to audit the Corporation's financial statements was less than 10 percent.

A copy of the Audit Committee Charter is set forth on the Corporation's website at www.ball.com, under the section "Investors," under the subsection "Financial Information" and under the link, "Corporate Governance."

Nominating/Corporate Governance Committee:

The Nominating/Corporate Governance Committee is responsible for assisting the Board in fulfilling its responsibility to identify qualified individuals to become Board members; recommending to the Board the selection of Board nominees for the next annual meeting of shareholders and addressing the independence and effectiveness of the Board by advising and making recommendations on matters involving the organization and operation of the Board, Corporate Governance Guidelines and directorship practices; and overseeing the evaluation of the Board and its Committees. The Nominating/Corporate Governance Committee utilizes the standards set forth below for considering director nominees.

Members of the Nominating/Corporate Governance Committee are Messrs. Taylor (Chair), Dean, Lehman and Smart. The Board has determined that the members of the Committee are independent under the NYSE Listing Standards. The Nominating/Corporate Governance Committee met four times during 2005.

The Board has established a process whereby nominees for the Board may be submitted by members of the Board, the Chief Executive Officer, shareholders and any other persons. The Committee considers these recommended candidates in light of criteria set forth below.

The Committee will seek candidates who meet at a minimum the following criteria: (a) candidates who have sufficient time to attend or otherwise be present at Board, relevant Board Committee and Shareholders' meetings; (b) candidates who will subscribe to Ball Corporation's Corporate Governance Guidelines and the Executive Officers and Directors Ethics Statement; (c) candidates who demonstrate credentials and experience in a broad range of corporate matters; (d) candidates who have experience and are focused on a broad range of corporate performance standards typical of publicly traded companies headquartered in the United States; (e) candidates who will subscribe to the finalized strategic and operating plans of the Corporation as approved by the Board from time to time; (f) candidates who are not affiliated with special interest groups that represent major causes or constituents; and (g) candidates who meet the criteria, if any, for being a director of the Corporation as set forth in the Indiana Business Corporation Law, the Articles of Incorporation and Bylaws of the Corporation.

The Committee will apply the principles of diversity in consideration of candidates. The Committee may utilize and pay third party consultants to identify and screen candidates on a confidential basis for service on the Board. The Committee will also determine candidates' qualifications in light of the standards set by the Committee and by evaluating the qualifications of all candidates in an attempt to select the most qualified nominees suited to serve as a director while attempting to ensure that a majority of the Board is independent and, where needed, to meet the NYSE and SEC requirements for financial literacy, accounting or financial management expertise or audit committee financial expert status.

The Nominating/Corporate Governance Committee will consider candidates recommended by shareholders. Any such recommendation should be in writing and addressed to the Chair of the Nominating/Corporate Governance Committee, in care of the Corporate Secretary, Ball Corporation, by mail to P.O. Box 5000, Broomfield, Colorado 80038-5000.

The Committee received no recommendations for candidates as nominees for the Board from a security holder or group of security holders that beneficially owned more than 5 percent of the Corporation's voting common stock for at least one year as of the date of the recommendation.

A copy of the Nominating/Corporate Governance Committee Charter is set forth on the Corporation's website at www.ball.com, under the section "Investors," under the subsection "Financial Information" and under the link, "Corporate Governance."

Human Resources Committee:

The primary purpose of the Human Resources Committee is to assist the Board in fulfilling its responsibilities related to the evaluation and compensation of the Chief Executive Officer and overseeing the compensation of the other executive officers of the Corporation; reviewing and approving the schedule of salary ranges and grades for the salaried employees of the Corporation; approving the Corporation's stock and cash incentive compensation programs, including awards to executive officers and the number of shares to be granted from time to time to employees of the Corporation; approving and receiving reports on major benefit plans, plan changes and determinations and discontinuations of benefit plans; discussing the performance evaluation systems and succession planning system of the Corporation, including discussions with the Chairman of the Board and Chief Executive Officer about the succession plan for the Chairman of the Board and Chief Executive Officer; hiring experts including executive compensation consultants as deemed appropriate to advise the Committee; and authorizing the filing of required reports with federal, state and local governmental agencies.

Members of the Human Resources Committee are Messrs. Dean (Chair), Smart, Solso and Taylor. The Board has determined that the members of the Committee are independent under the NYSE Listing Standards. The Human Resources Committee met five times during 2005. The Human Resources Committee Charter is set forth on the Corporation's website at www.ball.com, under the section "Investors," under the subsection "Financial Information" and under the link, "Corporate Governance."

Finance Committee:

The Finance Committee assists the Board in fulfilling its responsibility to oversee management in the financing and risk management of the Corporation, the status of the Corporation's retirement plans and insurance policies and the Corporation's policies relating to interest rates, commodity hedging and currency hedging. The Committee may hire experts as deemed appropriate to advise the Committee in performance of its duties. The Committee reports to the Board concerning the financing of the Corporation and the performance of the Committee.

The members of the Finance Committee are Messrs. Lehman (Chair), Fiedler, Hoover, Sissel and van der Kaay and Ms. Nicholson. The Committee met four times during 2005. A copy of the Finance Committee Charter is set forth on the Corporation's website at www.ball.com, under the section "Investors," under the subsection "Financial Information" and under the link, "Corporate Governance."

BOARD MEETINGS AND ANNUAL MEETING

The members of the Board are expected to attend all meetings of the Board, relevant Committee meetings and the Annual Meeting of Shareholders. The Board held five meetings during 2005. Every director except Mr. Lehman attended 75 percent or more of the aggregate of the total number of meetings of the Board and the total number of meetings held by all Committees of the Board on which the director served. Ten directors attended the 2005 Annual Meeting.

The following table sets forth information concerning the annual and long-term compensation for services in all capacities to the Corporation of the Chief Executive Officer and of the next four most highly compensated executive officers of the Corporation (the "Named Executive Officers") in office on December 31, 2005:

SUMMARY COMPENSATION TABLE

|

|

|

|

|

|

Long-Term Compensation |

|

||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

|

|

Annual Compensation |

Awards |

Payouts |

|

|||||||||||||||||

|

Name and Principal Position |

Year |

Salary |

Bonus(1) |

Other Annual Compensation |

Restricted Stock Awards(2) |

Securities Underlying Options |

LTIP(3) Payouts |

All Other Compensation(4)(5) |

||||||||||||||

| R. David Hoover Chairman, President and Chief Executive Officer |

2005 2004 2003 |

$ $ $ |

900,000 820,000 792,105 |

$ $ $ |

1,002,181 1,755,809 1,469,701 |

$ $ $ |

1,660,950 2,912,280 1,126,200 |

$ $ $ |

1,698,969 1,604,980 1,436,256 |

$ $ $ |

135,659 117,306 113,773 |

|||||||||||

Hanno C. Fiedler(6) Executive Vice President Ball Corporation and Chairman and Chief Executive Officer, Ball Packaging Europe |

2005 2004 2003 |

€ € € |

500,000 450,000 400,000 |

€ € € |

289,394 579,482 529,013 |

$ $ |

924,840 1,040,800 |

€ € € |

692,863 568,294 403,754 |

€ € |

960 960 |

|||||||||||

John R. Friedery Senior Vice President, Ball Corporation and Chief Operating Officer, North American Packaging |

2005 2004 |

$ $ |

390,000 375,000 |

$ $ |

332,945 521,007 |

$ $ |

432,120 696,825 |

$ $ |

354,298 417,611 |

$ $ |

39,980 38,676 |

|||||||||||

Raymond J. Seabrook Senior Vice President and Chief Financial Officer |

2005 2004 2003 |

$ $ $ |

358,500 342,500 327,500 |

$ $ $ |

281,606 514,211 439,952 |

$ |

98,869 |

$ $ $ |

387,555 620,920 225,240 |

$ $ $ |

440,424 437,791 409,866 |

$ $ $ |

65,511 61,686 59,900 |

|||||||||

David A. Westerlund Senior Vice President, Administration, and Corporate Secretary |

2005 2004 2003 |

$ $ $ |

320,000 305,000 290,000 |

$ $ $ |

250,785 457,075 359,488 |

$ $ $ |

387,555 620,920 225,240 |

$ $ $ |

389,889 383,769 354,986 |

$ $ $ |

64,499 60,769 57,701 |

|||||||||||

- (1)

- As

noted in the Report of the Human Resources Committee, Ball Corporation uses the term Incentive Compensation rather than Bonus. Also noted in the Report of the Human Resources

Committee is the performance level of the Corporation and each of the operating units in relation to incentive targets and the resulting impact on the "Bonus" amounts shown above.

- (2)

- In 2005 "Restricted Stock Awards" for all Named Executive Officers were awarded pursuant to the Deposit Share Program. Additionally, Mr. Fiedler was awarded restricted shares pursuant to the 2005 Stock and Cash Incentive Plan.

Mr. Hoover held restricted shares valued at $7,189,320 as of December 31, 2005. Restrictions will lapse on 67,200 shares in 2006, 48,700 shares in 2007 and 47,100 shares in 2008. Dividend equivalents are paid on these shares.

Mr. Fiedler held restricted shares valued at $2,462,640 as of December 31, 2005. Restrictions will lapse on 40,750 shares in 2006, 6,450 shares in 2007 and 6,450 shares in 2008.

Mr. Friedery held restricted shares valued at $2,073,384 as of December 31, 2005. Restrictions will lapse on 20,900 shares in 2006, 13,300 shares in 2007 and 13,200 shares in 2008. Dividend equivalents are paid on these shares.

Mr. Seabrook held restricted shares valued at $1,330,620 as of December 31, 2005. Restrictions will lapse on 7,700 shares in 2006, 10,850 shares in 2007 and 10,750 shares in 2008. Dividend equivalents are paid on these shares.

Mr. Westerlund held restricted shares valued at $1,866,840 as of December 31, 2005. Restrictions will lapse on 21,200 shares in 2006, 10,850 shares in 2007 and 10,750 shares in 2008. Dividend equivalents are paid on these shares.

- (3)

- In 2005 the amounts shown in "LTIP Payouts" consist of the following:

Mr. HooverLTCIP $1,316,198; Acquisition-Related, Special Incentive Plan $382,771.

Mr. FiedlerLTCIP €371,250; Acquisition-Related, Special Incentive Plan €321,613.

Mr. FriederyLTCIP $276,312; Acquisition-Related, Special Incentive Plan $77,986.

Mr. SeabrookLTCIP $288,263; Acquisition-Related, Special Incentive Plan $152,161.

Mr. WesterlundLTCIP $254,015; Acquisition-Related, Special Incentive Plan $135,874.

- (4)

- Compensation

deferred prior to 2001 under predecessor deferred compensation plans accrues interest at rates ranging from Moody's Corporate Bond rate to Moody's plus 5 percent.

Above market interest is shown for each individual in the "All Other Compensation" column.

- (5)

- The amounts shown in the "All Other Compensation" column for 2005 consist of the following:

Mr. Hooverabove-market interest on deferred compensation account, $101,942; company contribution to 401(k) Plan, $6,300; company contribution to Employee Stock Purchase Plan, $1,200; executive disability premiums, $2,633; company match pursuant to 2005 Deferred Compensation Company Stock Plan, $20,000; personal use of company airplane, $3,584.

Mr. Fiedlercompany contribution to Employee Stock Purchase Plan €960.

Mr. Friederyabove-market interest on deferred compensation account, $11,015; company contribution to 401(k) Plan, $6,300; company contribution to Employee Stock Purchase Plan, $1,200; executive disability premiums, $1,465; company match pursuant to 2005 Deferred Compensation Company Stock Plan, $20,000.

Mr. Seabrookabove-market interest on deferred compensation account, $36,222; company contribution to 401(k) Plan, $6,300; company contribution to Employee Stock Purchase Plan, $1,200; executive disability premiums, $1,789; company match pursuant to 2005 Deferred Compensation Company Stock Plan, $20,000.

Mr. Westerlundabove-market interest on deferred compensation account, $35,294; company contribution to 401(k) Plan, $6,300; company contribution to Employee Stock Purchase Plan, $1,200; executive disability premiums, $1,705; company match pursuant to 2005 Deferred Compensation Company Stock Plan, $20,000.

- (6)

- Mr. Fiedler is paid in euros, except stock awards which are U.S. dollar denominated. On December 31, 2005, the exchange rate was 1 euro = 1.184 U.S. dollars.

Long-Term Incentive Compensation

Stock Option Grants and Exercises

The following tables present certain information for the Named Executive Officers relating to stock option grants and exercises during 2005 and, in addition, information relating to the valuation of unexercised stock options:

STOCK OPTION GRANTS IN 2005

|

Name |

Options Granted(1) |

Percentage of Total Options Granted to Employees In Fiscal 2005 |

Exercise Price (per share) |

Expiration Date |

Grant Date Present Value(2) |

||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| R. David Hoover | 82,000 | 11.51 | % | 39.74 | April 27, 2015 | $ | 955,300 | ||||

| Hanno C. Fiedler | 0 | N/A | N/A | N/A | N/A | ||||||

| John R. Friedery | 22,000 | 3.09 | % | 39.74 | April 27, 2015 | $ | 256,300 | ||||

| Raymond J. Seabrook | 19,500 | 2.74 | % | 39.74 | April 27, 2015 | $ | 227,175 | ||||

| David A. Westerlund | 19,500 | 2.74 | % | 39.74 | April 27, 2015 | $ | 227,175 | ||||

- (1)

- Stock

options were granted on April 27, 2005, and were exercisable beginning one year after the grant and each year thereafter in 25 percent increments. Effective

October 26, 2005, the options became fully exercisable as a result of an acceleration of vesting.

- (2)

- Stock options with an expiration date of April 27, 2015, have an estimated value, at date of grant, of $11.65 per share based on the Black-Scholes option-pricing model adapted for use in valuing employee stock options. The estimated values under the Black-Scholes model are based on weighted average assumptions of volatility of 30.09 percent, a risk-free rate of return of 3.89 percent, a dividend yield of 1.01 percent, an expected option term of 4.75 years, and no adjustment for the risk of forfeiture. The actual value, if any, an executive may realize will depend on the excess of the stock price over the exercise price on the date the option is exercised. Consequently, there is no assurance the value realized by an executive will be at or near the value estimated by the Black-Scholes model.

AGGREGATED STOCK OPTION EXERCISES IN 2005

AND FISCAL YEAR-END OPTION VALUES

|

|

|

|

Number of Unexercised Options Held at December 31, 2005 |

Value of Unexercised In-the-Money Options at December 31, 2005(1) |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Name |

Shares Acquired on Exercise |

Value Realized |

|||||||||||||

|

Exercisable |

Unexercisable |

Exercisable |

Unexercisable |

||||||||||||

| R. David Hoover | 102,560 | $ | 3,025,310 | 677,944 | 75,000 | $ | 15,181,469 | $ | 1,065,824 | ||||||

| Hanno C. Fiedler | 0 | N/A | 10,000 | 10,000 | $ | 154,200 | $ | 154,200 | |||||||

| John R. Friedery | 28,656 | $ | 747,277 | 68,344 | 17,000 | $ | 841,365 | $ | 236,295 | ||||||

| Raymond J. Seabrook | 16,000 | $ | 490,483 | 220,772 | 18,000 | $ | 5,617,957 | $ | 252,270 | ||||||

| David A. Westerlund | 18,000 | $ | 598,560 | 249,500 | 18,000 | $ | 6,388,382 | $ | 252,270 | ||||||

- (1)

- Based on the closing price on the New York Stock ExchangeComposite Transactions of the Corporation's Common Stock on December 31, 2005, of $39.72.

Equity Compensation Plans

The following table summarizes information, as of December 31, 2005, relating to equity compensation plans of the Corporation pursuant to which grants of options, restricted stocks, restricted stock units or other rights to acquire shares may be granted from time to time.

|

|

Equity Compensation Plan Information |

||||||

|---|---|---|---|---|---|---|---|

|

Plan Category |

Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights (a) |

Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights (b) |

Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected in Column (a)) (c) |

||||

| Equity compensation plans approved by security holders | 4,811,602 | $ | 21.68 | 7,051,104 | |||

| Equity compensation plans not approved by security holders | | | | ||||

| Total | 4,811,602 | $ | 21.68 | 7,051,104 | |||

Long-Term Cash Incentive

The following table presents information for the Named Executive Officers concerning the long-term cash incentive programs and, in addition, information relating to the estimated future payouts.

LONG-TERM CASH INCENTIVE PLANAWARDS IN LAST FISCAL YEAR

|

|

|

|

Estimated Future Payouts(2) |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Name |

Number of Units(1) |

Performance Period Until Maturation |

|||||||||||

|

Threshold |

Target |

Maximum |

|||||||||||

| R. David Hoover | 0 | 1/1/04 - 12/31/06 | $ | 361,629 | $ | 723,258 | $ | 1,446,517 | |||||

| Hanno C. Fiedler(3) | 0 | 1/1/04 - 12/31/06 | € | 62,700 | € | 130,625 | € | 261,250 | |||||

| John R. Friedery | 0 | 1/1/04 - 12/31/06 | $ | 76,778 | $ | 159,954 | $ | 319,908 | |||||

| Raymond J. Seabrook | 0 | 1/1/04 - 12/31/06 | $ | 73,542 | $ | 153,213 | $ | 306,425 | |||||

| David A. Westerlund | 0 | 1/1/04 - 12/31/06 | $ | 65,758 | $ | 136,997 | $ | 273,994 | |||||

- (1)

- Participants

are not awarded a number of units. Awards are expressed as a percentage of average annual salary and "bonus" at target during the performance period. However, Named

Executive Officers whose Ball Corporation stock holdings are below the established guidelines will receive up to one-half of their award in Ball Corporation Restricted Stock.

- (2)

- Estimated

future payouts ("earned awards") are based on Ball Corporation's total shareholder return performance; i.e., stock price appreciation plus dividends, over

three-year performance cycles which begin at the start of each calendar year, relative to the total shareholder return of companies listed on the S&P Global Industry Classification

Standard ("GICS") which has replaced the S&P Industrials index.

- (3)

- Mr. Fiedler retired at the end of 2005. Estimated future payouts for the performance period are prorated based on his service through 2005.

Retirement Plans

The following table, for purposes of illustration, indicates the amounts of annual retirement income which would be payable in 2006 to the Named Executive Officers, except Mr. Fiedler, at normal retirement age 65. The calculation of retirement benefits under the plans generally is based upon average earnings (base salary only) for the highest five consecutive years of the ten years preceding retirement.

PENSION PLAN TABLE

|

|

Years of Service |

|||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Average Annual Earnings |

||||||||||||||||

|

15 |

20 |

25 |

30 |

35 |

||||||||||||

| $ | 250,000 | $ | 52,598 | $ | 70,130 | $ | 87,663 | $ | 105,196 | $ | 122,728 | |||||

| 300,000 | 63,848 | 85,130 | 106,413 | 127,696 | 148,978 | |||||||||||

| 350,000 | 75,098 | 100,130 | 125,163 | 150,196 | 175,228 | |||||||||||

| 400,000 | 86,348 | 115,130 | 143,913 | 172,696 | 201,478 | |||||||||||

| 450,000 | 97,598 | 130,130 | 162,663 | 195,196 | 227,728 | |||||||||||

| 500,000 | 108,848 | 145,130 | 181,413 | 217,696 | 253,978 | |||||||||||

| 550,000 | 120,098 | 160,130 | 200,163 | 240,196 | 280,228 | |||||||||||

| 600,000 | 131,348 | 175,130 | 218,913 | 262,696 | 306,478 | |||||||||||

| 650,000 | 142,598 | 190,130 | 237,663 | 285,196 | 332,728 | |||||||||||

| 700,000 | 153,848 | 205,130 | 256,413 | 307,696 | 358,978 | |||||||||||

| 750,000 | 165,098 | 220,130 | 275,163 | 330,196 | 385,228 | |||||||||||

| 800,000 | 176,348 | 235,130 | 293,913 | 352,696 | 411,478 | |||||||||||

The Corporation's qualified United States salaried retirement plans provide defined benefits determined by base salary and years of service. The Corporation has also adopted a nonqualified Supplemental Executive Retirement Plan that provides benefits otherwise not payable under the qualified pension plan to the extent that the Internal Revenue Code of 1986, as amended (the "Code"), limits the pension to which an executive would be entitled under the qualified pension plan. The benefit amounts shown in the preceding table reflect the amount payable as a straight life annuity and include amounts payable under the Supplemental Executive Retirement Plan. On November 30, 2003, the Corporation terminated the Split-Dollar Life Insurance Plan that provided a portion of the nonqualified pension benefit. Mr. Seabrook elected a cash distribution from this Plan that will reduce his retirement benefit.

Average Annual Earnings used under the pension formula to calculate benefits together with years of benefit service, as of December 31, 2005, for the Named Executive Officers are: R. David Hoover, $777,421 (35.54 years); John R. Friedery, $312,500 (17.33 years); Raymond J. Seabrook, $327,200 (13.21 years); and David A. Westerlund, $289,800 (30.32 years) offset by benefits received from a prior employer.

Mr. Fiedler's retirement income benefits are provided by a pension agreement that is part of his Employment Agreement. The Agreement provides a benefit of 60 percent of his last gross base salary provided he is employed on the earlier of December 31, 2005, or reaches age 60 and retires in good standing from the Corporation. Mr. Fiedler retired as an employee of the Corporation at the end of 2005 and his retirement benefit is €300,000 per year based on his 2005 salary of €500,000.

Termination of Employment and Change-in-Control Arrangements

The Corporation maintains revocable, funded grantor trusts, which, in the event a change in control of the Corporation occurs, would become irrevocable with funds thereunder to be available to apply to the Corporation's obligations under its deferred compensation plans covering key employees, including the Named Executive Officers, except Mr. Fiedler. Under the trusts, a "change in control" can occur by virtue, in general terms, of an acquisition by any person of 40 percent or more of the Corporation's voting shares; a merger in which shareholders of the Corporation before the merger own less than 60 percent of the Corporation's Common Stock after the merger; shareholder approval of a plan to sell or dispose of substantially all of the assets of the Corporation; a change of a majority of the Corporation's Board within a 12-month period unless approved by two-thirds of the directors in office at the beginning of such period; a threatened change in control deemed to exist if there is an agreement which would result in a change in control or public announcement of intentions to cause a change in control; and by the adoption by the Board of a resolution to the effect that a change or threatened change in control has occurred for purposes of the trusts. For amounts deferred on or after January 1, 2005, the definition of "change in control" has the meaning set forth in Section 409A of the Code, or any Treasury Department Regulations or Guidance. The trusts were funded as of December 31, 2005, with approximately $57.0 million of net equity of corporate-owned life insurance policies on the lives of various employees, including participants in the plans, and 1,037,890 shares of the Corporation's Common Stock and cash equivalents valued at $41.3 million ($39.72 per share) at the close of business on December 31, 2005, to support approximately $171.6 million of current deferred compensation account balances of the beneficiaries of the trusts in the event of a change in control. The Corporation has borrowing capacity to fully fund the trusts in advance of a change in control and is required to do so prior to a change in control. If the funds set aside in the trusts would be insufficient to pay amounts due the beneficiaries, then the Corporation would remain obligated to pay those amounts. In the event of the insolvency of the Corporation, the funds in the trusts would be available to satisfy the claims of the creditors of the Corporation. The trusts were not established in response to any effort to acquire control of the Corporation, and the Board is not aware of any such effort.

The Corporation intends to establish separate revocable, funded grantor trusts in 2006 which adopt the definition of "change in control" as set forth in the Treasury Department's Guidance and any regulations issued under Section 409A of the Code.

The Corporation has change-in-control severance agreements with certain key employees, including the Named Executive Officers, except Mr. Fiedler. The agreements are effective on a year-to-year basis and would provide severance benefits in the event of both a change in control of the Corporation and an actual or constructive termination of employment within two years after a change in control. Under the agreements, a "change in control" can occur by virtue, in general terms, of an acquisition by any person of 30 percent or more of the Corporation's voting shares; a merger in which the shareholders of the Corporation before the merger own 50 percent or less of the Corporation's voting shares after the merger; shareholder approval of a plan of liquidation or a plan to sell or dispose of substantially all of the assets of the Corporation; and if, during any two-year period, directors at the beginning of the period fail to constitute a majority of the Board. "Actual termination" is any termination other than by death or disability, by the Corporation for cause, or by the executive, other than for constructive termination. "Constructive termination" means, in general terms, any significant reduction in duties, compensation or benefits or change of office location from those in effect immediately prior to the change in control, unless agreed to by the executive. The severance benefits payable, in addition to base salary and incentive compensation accrued through the date of termination, shall include two times current annual base salary and target incentive compensation; the bargain element value of then-outstanding stock options; the present value of the amount by which pension payments would have been larger had the executive accumulated two additional years of benefit service; two years of life, disability, accident and health benefits; outplacement services; and legal fees and expenses reasonably incurred in enforcing the agreements. In the event such benefits, together with other benefits paid because of a change in control, would be subject to the excise tax imposed under Section 280G of the Code, the Corporation would reimburse the executive for such excise taxes paid, together with taxes incurred as a result of such reimbursement. The agreements were not entered into in response to any effort to acquire control of the Corporation, and the Board is not aware of any such effort.

The Corporation has severance benefit agreements with certain key employees, including the Named Executive Officers, except Mr. Fiedler. The agreements provide severance benefits in the event of an actual or constructive termination of employment. "Actual termination" is any termination other than by death or disability, by the Corporation for cause, or by the executive, other than for constructive termination. "Constructive termination" means, in general terms, any significant reduction in compensation or benefits, unless agreed to by the executive. The severance benefits payable, in addition to base salary and incentive compensation accrued through the date of termination, include two times current annual salary and target incentive compensation for Mr. Hoover and one and one-half times current annual salary and target incentive compensation for Messrs. Friedery, Seabrook and Westerlund; the present value of the amount by which pension payments would have been larger had the executive accumulated two additional years of benefit service for Mr. Hoover and one and one-half years of benefit service for Messrs. Friedery, Seabrook and Westerlund; two years of life, disability, accident and health benefits for Mr. Hoover and one and one-half years of life, disability, accident and health benefits for Messrs. Friedery, Seabrook and Westerlund; outplacement services; and legal fees and expenses reasonably incurred in enforcing the agreements. Upon the occurrence of a change in control as defined in the change-in-control severance agreements, the executive is entitled to the greater of each of the benefits provided in this agreement and each of the benefits provided in the change-in-control severance agreement, including reimbursement for excise taxes which may be incurred as a result of such payments.

The Corporation entered into an Employment Agreement with Mr. Fiedler negotiated in connection with the acquisition of Schmalbach-Lubeca AG and effective from December 19, 2002, through December 31, 2005. That agreement has expired and Mr. Fiedler retired as an employee of the Corporation at the end of 2005.

Directors' Compensation

Directors who are not employees of the Corporation receive as compensation a total target annual retainer composed of a $30,000 annual fixed retainer, plus an annual incentive retainer based upon the Corporation's actual operating performance for each fiscal (calendar) year. The annual incentive retainer is calculated in accordance with the Corporation's performance-based Incentive Compensation Plan at a rate of 50 percent of the director's annual fixed retainer. Both annual retainers are paid 50 percent in cash and 50 percent in restricted stock. The restrictions on the stock will lapse upon the director ceasing to serve as a director for any reason other than voluntary resignation, in which case the restrictions will not lapse and the director will forfeit the shares. For federal income tax purposes, the value of the shares will be taxable to the recipient as compensation income in an amount equal to the fair market value of the Corporation's Common Stock on the date the restrictions lapse. There has been no retirement plan for directors since 1997.

Nonemployee directors also receive a fee of $1,500 for attending each Board meeting, a fee of $1,250 for attending one or more committee meetings held on any one day and a fee of $1,250 per quarter for serving as a chair of a Board committee and a per diem allowance of $750 for special assignments. Directors who are also employees of the Corporation receive no additional compensation for their service on the Board or on any Board committee.

Nonemployee directors may elect to defer the payment of a portion or all of their directors' fees or retainers into the 2005 Deferred Compensation Plan for Directors or a portion or all of their directors' annual incentive retainer into the 2005 Deferred Compensation Company Stock Plan. These plans replace the directors' prior deferred compensation plans for fees and retainers earned prior to 2005. Amounts deferred or transferred into the 2005 Deferred Compensation Company Stock Plan receive a 20 percent company match with a maximum match of $20,000 per year. Amounts deferred, transferred or credited to this Plan will be represented in the participant's account as stock units, with each unit having the value equivalent to one share of Ball Corporation Common Stock. All distributions of accounts will be made in the form of Ball Common Stock following termination of each director's service. Amounts deferred to the 2005 Deferred Compensation Plan for Directors are "invested" among various investment funds available under the Plan. A participant's amounts are not actually invested in the investment funds for the account, but the return on a participant's account is determined as if the amounts were notionally invested in those funds.

Each nonemployee director will receive a 4,000-share restricted stock award upon reelection for a three-year term. Each newly eligible nonemployee director will receive a 4,000-share restricted stock award upon election or appointment for an initial term (except initial terms of less than one year), and upon reelection for a three-year term. The restrictions against disposal of the stock will lapse upon the termination of the director's service to the Corporation as a director, for whatever reason other than voluntary resignation during a term, in which case the restrictions will not lapse and the director will forfeit the shares. For federal income tax purposes, the value of the stock will be taxable to the director as compensation income in an amount equal to the fair market value of the Common Stock on the date the restrictions lapse. Messrs. Smart, Solso and Taylor each received a 4,000-share restricted stock award upon reelection as directors on April 27, 2005, under the terms of the 2005 Stock and Cash Incentive Plan. The Corporation has established a 10,000 share stock ownership guideline for each non-management director.

In 2001 the Corporation implemented a Deposit Share Program for its nonemployee directors. The program is intended to increase share ownership by directors who must make additional investments in the Corporation's Common Stock to participate in the program. Under this program, each director receives one share of restricted stock for every share acquired by the director. Restricted stock is granted pursuant to the shareholder approved Ball Corporation 2005 Stock and Cash Incentive Plan or its successor. Under the terms of the Deposit Share Program for Directors, which was amended and restated in April 2004, future awards have share acquisition periods and restricted stock lapse provisions established at the time of the award. On January 26, 2005, Mr. Smart was granted the opportunity to participate in the program up to a maximum of 6,000 shares that must be acquired during a two-year period beginning on the grant date. No other Deposit Share grants were made to nonemployee directors during 2005.

REPORT OF THE HUMAN RESOURCES COMMITTEE ON EXECUTIVE COMPENSATION

Overall Policy

The Human Resources Committee of the Board oversees the administration of executive compensation programs and determines the compensation of the executive officers of Ball Corporation. The Committee is composed solely of independent, nonemployee directors and employs a compensation-consulting firm to advise and provide input in the course of its deliberations.

Target total compensation of executive officers of the Corporation, including the Chief Executive Officer, is determined after reviewing the executive's performance viewed in conjunction with the executive's responsibility and experience when compared to the pay of similarly situated executives at other manufacturing firms of similar size. The external comparison is based upon the results of annual reports prepared by the corporate compensation department and the compensation consulting firm selected by the Committee. These reports gather information from compensation surveys that report on executive level positions at other manufacturing firms of similar size.

Annual Compensation

The Committee establishes target total annual compensation, defined as the sum of base salary and incentive compensation at target, for each of the Corporation's executive officers based on the individual's responsibility, experience and performance when compared to the 50th percentile of what comparable companies are paying. The target total annual compensation level for each executive, other than the Chief Executive Officer, is determined based on the recommendation of the Chief Executive Officer, together with the Committee's consideration of the executive's responsibility, experience in the position, individual performance and the performance of the executive's area of responsibility. The Chief Executive Officer's target total annual compensation is similarly determined by the Committee considering the Committee's assessment of the Chief Executive Officer's individual performance and the financial and operating performance of the Corporation, and considering this evaluation in relation to the market's 50th percentile. When establishing Mr. Hoover's target annual compensation for 2006, utilizing the evaluation process described above, the Committee determined that it desired to increase Mr. Hoover's target annual compensation to more closely approximate the market's 50th percentile.

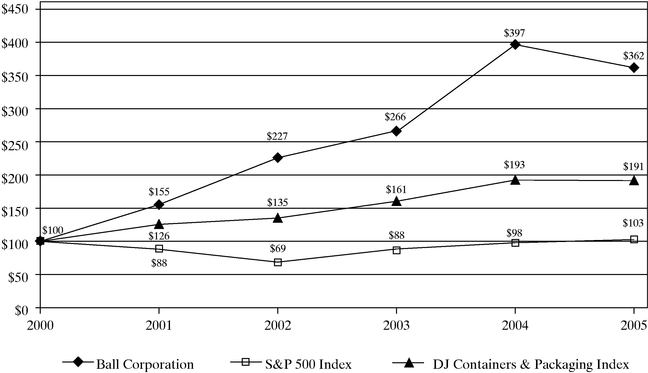

Compensation survey data is analyzed to determine competitive levels of target total annual compensation. The compensation surveys used include some, but not all, of the companies included in the performance graph on page 21 of this proxy. After the Committee has established the appropriate target total annual compensation for an executive, base salary is determined by dividing target total annual compensation by the sum of one plus the executive's incentive compensation participation rate. When target performance, as defined in the Annual Incentive Compensation Plan (the "Annual IC Plan") discussed below, is attained, the executive will be paid a total annual compensation, which equals that established by the Committee as appropriate for target performance. Incentive compensation participation rates for executives, including the Chief Executive Officer, are set generally by organizational level. Mr. Hoover's participation rate was set at 100 percent of his base salary for 2005 and 2006. Senior executive officers, other officers and other key employees participate at different and lower rates. The Committee intends that an executive's target incentive compensation should be a significant portion of target total annual compensation. It is not intended or perceived as a "bonus" but rather as the component of total compensation which is "at risk" as an incentive, dependent upon operating performance.

Base salary is referred to as "Salary" in the Summary Compensation Table and incentive compensation actually earned by an executive officer is reported under the heading "Bonus." Actual incentive compensation earned is driven by the economic value added targets approved by the Committee at the beginning of the year. The Annual IC Plan targets are calculated taking into account historical performance, the Corporation's cost of capital and the capital investment of each business unit. The resulting targets encourage continuous improvement in economic value added. The Annual IC Plan applies to the Named Executive Officers, among others.

The Annual IC Plan awards incentive compensation to executives based upon actual performance of the Corporation or, in certain cases, the actual performance of the profit center for which the executive is responsible in achieving improvements in economic value added relative to the established targets. Improvement in economic value added occurs when the ratio of net operating profit after tax to capital employed in the business increases over time. It establishes a direct link between incentive compensation and return earned on capital relative to a specified target return. Economic value added was selected as the measure for the Corporation's Annual IC Plan because it has been demonstrated that it correlates management's incentive with shareholder total return.

If actual performance for the year is higher than the target performance level, then the actual incentive compensation for such year will be higher than target. Whenever actual performance falls below the target performance level, the executive will receive incentive compensation which is less than target. If performance falls below the minimum acceptable level established in the Annual IC Plan, then no annual incentive compensation will be earned. For the year ended December 31, 2004, actual incentive compensation for the Named Executive Officers was above target reflecting above-target performance for the Corporation as a whole, for North American packaging operations and for Ball Packaging Europe. Incentive compensation levels for 2005 reflect performance approximately at target for the Corporation as a whole, above target performance for North American packaging operations and below target performance for Ball Packaging Europe. Incentive compensation for Messrs. Hoover, Seabrook and Westerlund was based entirely on the performance of the Corporation as a whole, while Mr. Friedery's incentive compensation was based primarily on the performance of North American packaging operations and partially on the performance of the Corporation as a whole and Mr. Fiedler's incentive compensation was based primarily on the performance of Ball Packaging Europe and partially on the performance of the Corporation as a whole.

Certain key employees, including the Named Executive Officers, except Mr. Fiedler, may elect to defer the payment of a portion or all of their incentive compensation into the 2005 Deferred Compensation Company Stock Plan and/or the 2005 Deferred Compensation Plan. These plans succeeded prior deferred compensation plans for incentive compensation earned before 2005. Amounts deferred or transferred into the 2005 Deferred Compensation Company Stock Plan receive a 20 percent company match with a maximum match of $20,000 per year. Amounts deferred, transferred or credited to this Plan will be represented in the participant's account as stock units, with each unit having the value equivalent to one share of Ball Corporation Common Stock. All distributions of accounts will be made in the form of Ball Corporation Common Stock following termination of employment. Amounts deferred or transferred to the 2001 Deferred Compensation Plan or its successor are "invested" among various investment funds available under the Plan. A participant's amounts are not actually invested in the investment funds for their account, but the return on a participant's account is determined as if the amounts were notionally invested in those funds.

Long-Term Incentive Program

The Corporation's long-term incentive program consists of plans based upon and designed to enhance the performance of Ball Corporation's Common Stock Equity grants, which may consist of options, stock appreciation rights and/or stock awards, which are designed to encourage employee stock ownership and to recognize and reward employees for their levels of responsibility in building shareholder value. Equity grants to employees, including the Named Executive Officers, except Mr. Hoover, are generally made by the Committee after considering the recommendation of the Chief Executive Officer, based primarily on the level of the employee's position within the Corporation and individual performance, taking into account the number of outstanding and previously granted awards. Equity granted to the Chief Executive Officer is determined by the Committee in relation to grant levels of other executive officers within the Corporation and an assessment of his performance as well as the number of outstanding and previously granted awards. As the equity grants are long term in nature, grants are determined independently of the shorter-term Annual IC Plan. The Corporation has established stock ownership guidelines for all officers, including the Named Executive Officers, as well as certain other key employees. These guidelines range from a minimum of one to five times base annual salary according to job position. Mr. Hoover's guideline is five times base annual salary. The guideline for the other Named Executive Officers is three times base annual salary. All executive officers, including the Named Executive Officers, currently meet their stock ownership guidelines.

The Long-Term Cash Incentive Plan (the "LTCIP") is limited in its participation to selected key employees, including the Named Executive Officers, who can potentially contribute materially to the success of Ball Corporation and its subsidiaries through their leadership skills, vision and dedication. The Plan provides cash awards based one-half on Ball Corporation's total shareholder return performance; i.e., stock price appreciation plus dividends, over three-year performance cycles that begin at the start of each calendar year, relative to the total shareholder return of companies comprising the S&P Global Industry Classification Standard ("GICS") and one-half on Ball Corporation's return on average invested capital ("ROAIC") over the three-year performance cycle measured against established ROAIC targets. LTCIP awards are shown in the Summary Compensation Table under "LTIP Payouts."

In March 2001 the Corporation implemented a Deposit Share Program for certain of its key employees, including the Named Executive Officers. The program is intended to increase share ownership by key employees who must make additional investments in the Corporation's Common Stock to participate in the program. Under this program, a participant receives one share of restricted stock for every share acquired by the participant. Restrictions lapse on the restricted stock after four years (or partially lapse earlier if share ownership guidelines are met) provided the acquired shares are retained until the restrictions lapse. Under the terms of the Deposit Share Program, which was amended and restated in April 2004, future awards have share acquisition periods and restricted stock lapse provisions established by the Committee at the time of the awards. In April 2005 grants were made to the Named Executive Officers pursuant to the Amended and Restated Deposit Share Program. The grants provided for a one-year period beginning in April 2005 for the acquisition of the Corporation's Common Stock up to preestablished maximums for each participant established by the Committee. Restricted stock is granted pursuant to the shareholder approved Ball Corporation 2005 Stock and Cash Incentive Plan or its successor. The values of matching restricted stock received pursuant to the April 2005 grant are shown in the Summary Compensation Table under "Restricted Stock Awards."