CORRESP: A correspondence can be sent as a document with another submission type or can be sent as a separate submission.

Published on June 3, 2011

June 3, 2011

Jay Ingram

Legal Branch Chief

Division of Corporation Finance

United States Securities and Exchange Commission

100 F. Street, N.E.

Washington, DC 20549-7010

Re: Your letter dated 4/20/11 regarding Ball Corporation’s

Form 10-K for the Fiscal Year Ended December 31, 2010, Filed February 28, 2011

Definitive Proxy on Schedule 14A, Filed March 11, 2011

Form 10-Q for the Fiscal Quarter ended April 3, 2011

File No. 001-7349

Dear Mr. Ingram:

We understand that the purpose of your review process is to assist us in complying with the applicable disclosure requirements and enhancing the overall disclosures in the filings we make with the Commission and pursuant to your request we acknowledge that:

|

●

|

We are responsible for the adequacy and accuracy of the disclosures in our filings;

|

|

●

|

United States Securities and Exchange Commission staff comments or changes to disclosures in response to staff comments do not foreclose the Commission from taking any action with respect to our filings; and

|

|

●

|

We may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States.

|

After giving consideration to your follow-up comments dated May 13, 2011, we have the following responses.

Ball Corporation

June 3, 2011

Page 2

Definitive Proxy Statement on Schedule 14A Filed on March 11, 2011

Long-Term Incentives, page 26

|

1.

|

We note your response to comment 19 in our letter dated April 20, 2011; however, we reissue the comment in part. On page seven of your attachment to your response letter, we note that the committee takes individual performance into account based on the committee’s subjective judgments regarding the performance of the areas of responsibility for each executive. In future filings, please detail the elements of individual performance and contribution that the committee takes into account or provide specific examples of the factors the committee considers for each individual named executive officer when determining the total amount of long-term incentives. Using the information for your most recently completed fiscal year, please show us in your response what your revised disclosure will look like.

|

We have included additional disclosure responsive to your request in the enclosed excerpt from our current Proxy Statement under the heading “Long-Term Incentives.” Please note that for all proxy-related comments, the enclosed excerpt represents a revision of the 2011 proxy only. Accordingly, our discussion in the 2012 proxy will be dependent on the executive compensation during 2011 and subject to the approval of our Human Resources Committee.

Performance-Based Cash Awards, page 26

|

2.

|

We note your response to comment 20 in our letter dated April 20, 2011; however, we reissue the comment in part. As previously requested, in future filings, please disclose the target incentive percentages for the performance period ending in the most recently completed fiscal year. We note your disclosure of the target incentive percentages for the 2010-2012 performance period. Using the information for your most recently completed fiscal year, please show us in your response what your revised disclosure will look like.

|

We have included additional disclosure responsive to your request in the enclosed excerpt from our current Proxy Statement under the heading “Long-Term Incentives – Performance-Based Cash Awards.”

We appreciate your comments and believe we have adequately addressed them in our response.

Sincerely,

/s/ Scott C. Morrison

Scott C. Morrison

Senior Vice President and Chief Financial Officer

ATTACHMENT – 2011 PROXY REVISED FOR SEC COMMENTS

COMPENSATION DISCUSSION AND ANALYSIS

|

Name

|

Target Annual

Incentive Percent

|

Actual Annual Incentive

Based on Performance

|

|

R. David Hoover

|

110 percent

|

222 percent

|

|

Scott C. Morrison

|

60 percent

|

121 percent

|

|

John A. Hayes

|

85 percent

|

172 percent

|

|

Raymond J. Seabrook

|

75 percent

|

152 percent

|

|

David A. Westerlund

|

70 percent

|

141 percent

|

Certain executives including the CEO and the other NEOs may elect to defer the payment of all or a portion of their annual incentive compensation into the 2005 Deferred Compensation Plan and/or the 2005 Deferred Compensation Company Stock Plan. The executive becomes a general unsecured creditor of the Corporation with respect to amounts deferred. Amounts deferred to the 2005 Deferred Compensation Plan, or its successor, are notionally “invested” among various investment funds available under the applicable Plan. A participant’s amounts are not actually invested in the investment funds for their account, but the return on the participant’s account is determined as if the amounts were invested in those funds. Amounts deferred into the 2005 Deferred Compensation Company Stock Plan receive a 20 percent Corporation match with a maximum match of $20,000 per year. Amounts deferred into this Plan will be represented in the participant’s account as stock units, with each unit having a value equivalent to one share of Ball Corporation Common Stock. Participants may later reallocate a prescribed number of units to other notional investment funds, comparable to those described above, subject to specified time constraints. One-half of the amount deferred into the 2005 Deferred Compensation Company Stock Plan must remain deferred until retirement or other termination of employment.

Long-Term Incentives

This element of compensation is designed to provide ownership and cash opportunities to promote the achievement of longer term financial performance goals and enhanced total shareholder returns. The Corporation’s long-term incentive opportunity is generally provided through a combination of equity and cash awards, which the Committee believes best matches the compensation principles for the program. In 2010, long-term incentives awarded prior to shareholder approval of the 2010 Stock and Cash Incentive Plan in April were provided pursuant to the existing 2005 Stock and Cash Incentive Plan; and awards following that approval were pursuant to the newly approved 2010 Plan. This Plan permits grants of cash awards, stock options, stock appreciation rights or stock awards (e.g., shares, restricted stock and restricted stock units).

In 2010, Ball delivered approximately 25 percent of the target long-term incentive through performance-based cash awards and approximately 75 percent through performance-based equity awards. This award mix was set to achieve the objectives described above, while viewed in light of market practices and cost implications. The total amount of long-term incentives, based on the grant date expected value, was established in relation to the 50th percentile of the competitive market as well as individual performance (based on the Committee’s subjective judgments regarding the performance of the areas of responsibility for each executive) and the Corporation’s financial and operating performance. This emphasis on long-term compensation, through performance-based long-term cash and equity awards, ensures a strong continued alignment with Ball’s executive ownership and shareholder value creation objectives.

When determining long term incentives awarded in 2010, the Committee recognized the Corporation’s strong operating and financial performance in 2009 resulting in a total shareholder return of 25.5 percent and a two-year total shareholder return of 17 percent, well in excess of the S&P 500 return. The Committee also recognized that all NEOs contributed to many other successes of the Corporation including:

|

●

|

Increasing our can manufacturing footprint by acquiring four beverage can manufacturing plants from AB-InBev and acquiring the Sanshui, China can and end plant

|

|

●

|

Continued aerospace operational success with the installation of two Ball-made instruments on the Hubble Space Telescope and successful launches of the WISE satellite and WorldView -2 satellite

|

|

●

|

The sale of our plastic pail business

|

|

●

|

Continued prioritization of our innovation and business development efforts in emerging markets and new product development

|

|

●

|

Our selection for the FTSE4 Good corporate responsibility index

|

|

●

|

Receiving the Ceres-ACCA award as co-winner of the “Best First Timer” report for our first published sustainability report

|

7

In addition to corporate successes, the Committee also recognized Mr. Hoover’s continued successful leadership of the Corporation’s strategic direction. Mr. Hayes’ award also reflected his increased responsibilities and operations oversight as chief operating officer of the Corporation. Mr. Morrison’s long term opportunity also reflected his new position as chief financial officer as well as the Corporation’s successful offering of $700 million of public notes with maturities in 2016 and 2019. Mr. Seabrook also assumed new responsibilities and successfully oversaw the growth of the Corporation’s footprint while continuing strong beverage and food manufacturing operating performance. Mr. Westerlund’s award also reflected effective management of several administrative areas along with his strategic focus on harmonization of the Corporation’s environmental, safety and human resources global activities.

Performance-Based Cash Awards—Ball’s performance-based long-term cash incentive award is intended to focus executives on the achievement of multiyear performance goals that will enhance shareholder value. The Corporation’s total shareholder return and return on average invested capital (“ROAIC”) are considered in determining the amount, if any, of awards earned under the Corporation’s Long-Term Cash Incentive Plan (“LTCIP”). Performance is generally measured on a cumulative basis over a three-year performance period. Awards pursuant to the LTCIP are generally made on an annual basis such that three performance periods overlap. Any actual award earned is paid at the end of the three-year performance period.

The 2008 through 2010, 2009 through 2011, and 2010 through 2012 performance periods provide executives the opportunity to earn awards based on a combination of two performance measures. One-half of the award is based on the Corporation’s three-year total shareholder return as measured against the total shareholder returns of a group of companies in the S&P 500 not including companies in the S&P 500 Index that are classified as being part of the Financial or Utilities industry sectors or the Transportation industry group. Companies added to the S&P 500 during the performance period are also excluded. Total shareholder return is measured by comparing the average daily closing price and dividends of the Corporation in the third year of the performance cycle with the average daily closing price and dividends prior to the start of the performance cycle relative to the distribution of the equivalent total shareholder returns during the performance cycle of the group of companies as described above. The target performance requirement for the total shareholder returns measure is the 50th percentile of the S&P group described above. The other one-half of the award is based on ROAIC performance over the three-year period. ROAIC is calculated by dividing the average of the Corporation’s net operating profit after-tax over the relevant performance period by its average invested capital over such period. The target performance requirement for the ROAIC measure is 9 percent, which is above the Corporation’s estimated weighted average cost of capital. The target, minimum and maximum performance requirements are as follows:

|

Performance Measure

|

Minimum

|

Target

|

Maximum

|

|

Total Shareholder Return

|

37.5th percentile

|

50th percentile

|

75th percentile

|

|

ROAIC

|

7 percent

|

9 percent

|

11 percent

|

For each measure, minimum performance results in a zero payout factor, target performance results in a 100 percent payout factor and maximum performance results in a 200 percent payout factor for the respective one-half of the award. Performance between minimum, target and maximum is extrapolated to determine the payout factor.

The incentive opportunity is established by considering external market long-term incentive data and Ball internal pay equity and is set as a percentage of the executive’s average base salary plus target annual incentive over the three-year performance period (i.e., average target annual cash compensation during the performance period). For the 2010 through 2012 performance period, the incentive opportunities for the CEO and other NEOs are as follows:

|

Name

|

Target Incentive Percentage

|

|

R. David Hoover

|

40 percent

|

|

Scott C. Morrison

|

25 percent

|

|

John A. Hayes

|

30 percent

|

|

Raymond J. Seabrook

|

25 percent

|

|

David A. Westerlund

|

25 percent

|

8

For the 2008 through 2010 performance period, the incentive opportunities for the CEO and other NEOs were as follows:

|

Name

|

Target Incentive Percentage

|

|

R. David Hoover

|

40 percent

(full cycle)

|

|

Scott C. Morrison

|

20 percent

(January 1, 2008, thru December 31, 2009)

25 percent

(January 1, 2010, thru December 31, 2010)

|

|

John A. Hayes

|

25 percent

(January 1, 2008, thru December 31, 2009)

30 percent

(January 1, 2010, thru December 31, 2010

|

|

Raymond J. Seabrook

|

25 percent

(full cycle)

|

|

David A. Westerlund

|

25 percent

(full cycle)

|

The target incentive percentage increases for Messrs. Hayes and Morrison effective January 1, 2010, were directly associated with the promotions each received at that time.

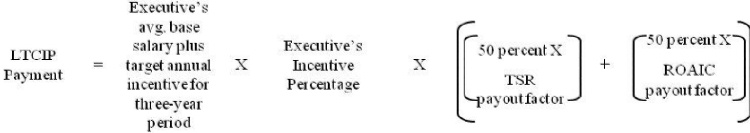

The executive’s award for any given performance cycle is calculated as follows:

Actual payments at the end of the performance period for each factor (total shareholder return (“TSR”) and ROAIC) can range from 0 to 100 percent of the target opportunity based on actual performance relative to the established performance measures described above.

As a result of the Corporation’s actual performance for the 2008 through 2010 performance period, cash payouts (made in early 2011) for the CEO and other NEOs in the plan are 200 percent of the target opportunities and are reported in the Summary Compensation Table. The potential award value of the 2010 through 2012 performance period, which was awarded to the NEOs in 2010, is reported in the Grants of Plan-Based Awards Table.

Special Acquisition Incentive Plan—In conjunction with the 2009 acquisition of certain beverage can manufacturing operations, the Corporation implemented an Acquisition-Related Special Incentive Plan designed to motivate participating employees to successfully integrate the acquisition into the Corporation. Payouts under this Plan are based on cumulative earnings before interest and taxes and cumulative cash flow over a 39-month period, with awards, if any, made at 15 months, 27 months and 39 months. Minimum, target and maximum values have been established for each performance measure; however, due to the competitive sensitive nature of such financial metrics, these values have been excluded. A payout at or near target is the most likely outcome. This incentive opportunity is established as a percentage of an executive’s average base salary over the 39-month performance period and is provided below for each NEO.

|

Name

|

Target Incentive Percentage

|

|

R. David Hoover

|

40 percent

|

|

Scott C. Morrison

|

40 percent

|

|

John A. Hayes

|

40 percent

|

|

Raymond J. Seabrook

|

40 percent

|

|

David A. Westerlund

|

40 percent

|

9