CORRESP: A correspondence can be sent as a document with another submission type or can be sent as a separate submission.

Published on May 3, 2011

May 3, 2011

Pamela Long

Assistant Director

Division of Corporation Finance

United States Securities and Exchange Commission

100 F. Street, N.E.

Washington, DC 20549-7010

|

Re:

|

Your letter dated 4/20/11 regarding Ball Corporation’s

|

|

|

Form 10-K for the Fiscal Year Ended December 31, 2010, Filed February 28, 2011

|

|

|

Definitive Proxy on Schedule 14A, Filed March 11, 2011

|

|

|

File No. 001-7349

|

Dear Ms. Long:

We understand that the purpose of your review process is to assist us in complying with the applicable disclosure requirements and enhancing the overall disclosures in the filings we make with the Commission and pursuant to your request we acknowledge that:

|

|

●

|

We are responsible for the adequacy and accuracy of the disclosures in our filings;

|

|

|

●

|

United States Securities and Exchange Commission staff comments or changes to disclosures in response to staff comments do not foreclose the Commission from taking any action with respect to our filings; and

|

|

|

●

|

We may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States.

|

Form 10-K for the Fiscal Year Ended December 31, 2010

General

|

|

1.

|

We note that you registered preferred stock purchase rights under Exchange Act Section 12(b). In this regard, we note the Form 8-A filed on August 3, 2006. Please revise the cover page of the Form 10-K in future filings accordingly.

|

We will revise the cover page of our future Form 10-K filings accordingly.

Ball Corporation

May 3, 2011

Page 2

|

|

2.

|

We note the prospectus supplements filed pursuant to Rule 424(b)(2) on March 19, 2010 and November 17, 2010. We are unable to locate the exhibit 5.1 legality opinions for the specific securities sold in these particular offerings, which refer to the shelf registration statement filed on Form S-3 on February 26, 2009. Please file the legality opinions by post-effective amendment or incorporate them by reference from Form 8-K, or advise.

|

For additional guidance, refer to Question 118.02 of the Securities Act Forms Compliance and Disclosure Interpretations, available on the Corporation Finance section of our website.

We are concurrently filing these two legality opinions on Form 8-K.

Business, page 1

|

|

3.

|

In future filings, please provide the following information in accordance with Item 101 of Regulation S-K:

|

|

|

●

|

the year the company was organized;

|

|

|

●

|

revenues from external customers, a measure of profit or loss, and total assets for each industry segment for each of the last three fiscal years or an appropriate cross-reference to this information if it is included elsewhere in the filing;

|

|

|

●

|

the competitive conditions relating to the aerospace and technology segment, including the principal methods of competition; and

|

|

|

●

|

the financial information relating to geographic segments or an appropriate cross-reference to this information if it is included elsewhere in the filing.

|

We will provide the information requested above in accordance with Item 101 of Regulation S-K in our future Form 10-K filings.

|

|

4.

|

We note your statement on page 7 that you depend on relatively few major customers and your disclosure on page 42 that The Pepsi Bottling Group, Inc. accounted for 10.4 percent of your consolidated net sales in 2010. In future filings, as appropriate, please provide the disclosure required by Item 101(c)(1)(vii) of Regulation S-K.

|

We will provide the appropriate disclosure as required by Item 101(c)(1)(vii) of Regulation S-K in future Form 10-K filings.

Patents, page 5

|

|

5.

|

We note your disclosure that none of your active patents are essential to the successful operation of your business as a whole. With a view towards future disclosure, please tell us whether any group of patents or trademarks is material to your company.

|

Ball Corporation

May 3, 2011

Page 3

We have a substantial portfolio of patents and other intellectual property; however, no active intellectual property or group thereof is material to our company.

|

|

6.

|

Please revise in future filings to discuss the duration of your intellectual property. Refer to Item 101(c)(1)(iv) of Regulation S-K.

|

Please note that the duration of our intellectual property rights is driven by statutes in various jurisdictions and varies based on the type of intellectual property right, jurisdiction and other factors, and it is therefore not practicable to provide a fixed time period. We can affirm that we manage our intellectual property portfolio to obtain the durations necessary to achieve our business objectives. For future filings, we will continue to review the issue and will consider providing a range of durations by jurisdiction if appropriate.

Employee Relations, page 6

|

|

7.

|

We note the cross-reference to the risk factor on page 10. Please revise in future filings to disclose the expiration dates of the collective bargaining agreements.

|

We disclosed on page 10 of our 2010 Form 10-K that “These collective bargaining agreements have staggered expirations during the next several years.” As such, we believe our disclosure is adequate as none of these contracts individually are material to our business, and we do not believe it provides meaningful information to our investors.

Legal Proceedings, page 14

|

|

8.

|

We note your cross-reference to Note 21 of your financial statements. However, the disclosure in Note 21 does not provide all of the information required by Regulation S-K Item 103, such as the relief sought in each lawsuit or administrative proceeding. Please revise accordingly in future filings.

|

We will revise our future Exchange Act filings accordingly to include the information required by Item 103 of Regulation S-K.

Management’s Discussion and Analysis of Financial Condition and Results of Operations, page 17

|

|

9.

|

We note from your Q4 2010 Earnings Conference Call that one of your key focuses for 2011 will be executing capital spending projects. In future filings, please describe your material commitments for capital expenditures as of the end of the latest fiscal period, and indicate the general purpose of such commitments and the anticipated source of funds needed to fulfill such commitments. See Item 303(a)(2) of Regulation S-K.

|

Historically, our capital expenditure commitments (those for which cancellation would have a financial impact on the company) have not been material relative to our consolidated financial position, liquidity or future cash flow requirements. However, we will continue to evaluate our position at future reporting periods and disclose as necessary under the applicable reporting requirements in future Exchange Act

Ball Corporation

May 3, 2011

Page 4

filings. We will also discuss the anticipated source of funds, which has historically been cash flows from our operations. We expect this to be the case in the future as well.

Management Performance Measures, page 24

|

|

10.

|

We note your disclosure of certain non-GAAP measures on page 24. In future filings, please briefly explain why management believes that presentation of the non-GAAP financial measure provides useful information to investors regarding your financial condition and results of operations and provide a reconciliation of the differences between the non-GAAP financial measures disclosed with the most directly comparable financial measures calculated and presented in accordance with GAAP. See Item 10(e)(1)(i) of Regulation S-K.

|

In accordance with Item 10(e)(1)(i), we will expand our disclosures to discuss why we believe the non-GAAP measures are important to investors. In future Exchange Act filings, we will also expand our reconciliations to the most comparable GAAP financial measure as appropriate.

Debt Facilities and Refinancing, page 26

|

|

11.

|

We note your discussion of the senior credit facility which will expire in December 2015, the $20 million credit facility available to your PRC operations, and the short-term uncommitted credit facility. We further note that you were in compliance with all loan agreements as of December 31, 2010 and that you have met all debt payment obligations. In future filings, please disclose any applicable covenants associated with your various credit facilities, whether you were in compliance with such covenants, and the applicable interest rates associated with the facilities. Additionally, it does not appear that you have filed with this Form 10-K or incorporated by reference to other filings the credit agreements for the PRC and short-term facilities. Please advise us as to whether these agreements have been filed previously with another Exchange Act report or file them, with all schedules and exhibits, in your next Exchange Act filing. Alternatively, please advise us as to why you are not required to file them.

|

We will expand our discussion of our material debt covenants and state whether we are in compliance with them on a more individual level in our future Exchange Act filings. We do not believe separate filings of the credit agreements you mention above are necessary due to the immateriality of the agreements individually or collectively. Also, for all but the immaterial debt items included in the “other” category in our debt footnote table, we believe we have provided the applicable interest rates associated with each separately disclosed facility.

Index to Exhibits, page 97

|

|

12.

|

We note that you file multiple exhibits under the same exhibit number. For example, we note that the rights agreement and an amendment to the rights agreement are both filed as exhibit 4.1(k). Please revise in future filings to file each exhibit under a separate number.

|

We will comply with this request in our future Form 10-K filings.

Ball Corporation

May 3, 2011

Page 5

Exhibit 31 – Section 302 Certifications

|

|

13.

|

In future filings, please file your Section 302 Certifications exactly as set forth in Item 601(b)(31)(i) of Regulation S-K. For example, please do not remove the word “fiscal” from the parenthetical in paragraph 4(d). Additionally, please file the CEO certification as Exhibit 31.1 and the CFO certification as Exhibit 31.2.

|

We will comply with this request in our future Exchange Act filings.

Definitive Proxy Statement on Schedule 14A Filed on March 11, 2011

Compensation Discussion and Analysis, page 19

Role of the Human Resources Committee and Executive Compensation Consultant, page 19

|

|

14.

|

We note that Towers Watson provided certain other services to the company. In future filings, to the extent the compensation consultant or its affiliates provide other services to the company, please disclose whether the Human Resources Committee or the Board of Directors approved such other services. See Item 407(e)(3)(iii)(A) of Regulation S-K.

|

We will comply with this request as may be required in future Proxy Statement disclosures. We note that the current compensation consultant and its affiliates do not provide other services to the Company.

Market Benchmarking, page 20

|

|

15.

|

From your disclosure in this section and throughout the CD&A, it appears that you benchmark total compensation and certain elements of compensation, such as annual incentive compensation, at the 50th percentile of the competitive market. Please revise in future filings to disclose where actual compensation fell as compared to the benchmark and, if applicable, explain why actual compensation fell above or below the benchmark. Using information for your most recently completed fiscal year, please show us in your response what your revised disclosure will look like. For additional guidance, please refer to Question 118.05 of our Regulation S-K Compliance and Disclosure Interpretations.

|

We believe the disclosure in our current Proxy Statement meets the guidelines suggested by Question 118.05. However, we have included additional disclosure responsive to your request in the enclosed excerpt from our current Proxy Statement under the heading “Market Benchmarking.” Additionally, please note that for proxy-related comments, the enclosed excerpt represents a revision of the 2011 proxy only. Alternatively, our discussion in the 2012 proxy will be dependent on the executive compensation during 2011 and subject to the approval of our Human Resources Committee.

Ball Corporation

May 3, 2011

Page 6

Base Salary, page 24

|

|

16.

|

It appears that the base salaries of the named executive officers increased between 2009 and 2010. However, you have not provided any disclosure explaining the decisions to increase base salaries. Please revise in future filings to clearly explain these increases. Using information for your most recently completed fiscal year, please show us in your response what your revised disclosure will look like.

|

We have included additional disclosure responsive to your request in the enclosed excerpt from our current Proxy Statement under the heading “Base Salary.”

Annual Incentive, page 25

|

|

17.

|

In future filings, please provide more information regarding how you determined the amount of annual cash incentive compensation to pay each name executive officer. See Item 402(b)(1)(v) of Regulation S-K. Specifically, please disclose the actual EVA and target EVA, including the relevant numbers for determining these amounts pursuant to the formulas disclosed on pages 24 and 25, and how you evaluated the actual results achieved against the performance goals to determine the amount of compensation to award the named executive officers. Refer to Item 402(b)(2)(v) of Regulation S-K. Additionally, we note that targets are established for each operating unit and for the company as a whole. Please disclose whether the target annual incentive percent for each named executive officer is related to the performance goal for an operating unit, the company, or both. Using information for your most recently completed fiscal year, please show us in your response what your revised disclosure will look like.

|

We have included additional disclosure responsive to your request in the enclosed excerpt from our current Proxy Statement under the heading “Annual Incentive – Performance Measures.”

|

|

18.

|

We note the disclosure that amounts awarded above 200% are “banked” and paid out over time in one-third increments based on certain performance measures. Please revise in future filings to disclose these performance measures and the timing of payouts. Using information for your most recently completed fiscal year, please show us in your response what your revised disclosure will look like.

|

We have included additional disclosure responsive to your request in the enclosed excerpt from our current Proxy Statement under the heading “Annual Incentive – Performance Measures.”

Long-Term Incentives, page 26

|

|

19.

|

We note that the total amount of long-term incentives was based in part on individual performance. In future filings, for each named executive officer, please detail the elements of individual performance and contribution that are taken into account when making this determination. Refer to Item 402(b)(2)(vii) of Regulation S-K. Using information for your most recently completed fiscal year, please show us in your response what your revised disclosure will look like.

|

Ball Corporation

May 3, 2011

Page 7

We have included additional disclosure responsive to your request in the enclosed excerpt from our current Proxy Statement under the heading “Long-Term Incentives.”

Performance-Based Cash Awards, page 26

|

|

20.

|

In future filings, please provide more information regarding how you determined the long-term performance-based cash awards for each named executive officer. See Item 402(b)(1)(v) of Regulation S-K. Please clarify the meaning of “target annual incentive over the three-year performance period” and disclose the target incentive percentages for the performance period ending in the most recently completed fiscal year. Finally, it may be helpful for investors if you provide an example using one of your named executive officers to show how you arrived at the amounts listed in the Summary Compensation Table. Using information for your most recently completed fiscal year, please show us in your response what your revised disclosure will look like.

|

We have included additional disclosure responsive to your request in the enclosed excerpt from our current Proxy Statement under the heading “Long-Term Incentives – Performance-Based Cash Awards.”

Special Acquisition Incentive Plan, page 27

|

|

21.

|

We note that you have not disclosed your performance measures under this plan due to the competitive sensitive nature of these financial metrics. Please provide your analysis supplementally as to how you would be competitively harmed if the specific performance goals or targets for the special acquisition incentive plan were disclosed, using the standard that would apply if you were requesting confidential treatment of information pursuant to Securities Act Rule 406 and Exchange Act Rule 24b-2. In future filings, please disclose the threshold, target, and maximum performance levels for each performance goal. See Item 402(b)(2)(v) and (vi) of Regulation S-K. In the event that you determine that disclosure of future target levels would result in competitive harm to the company pursuant to Securities Act Rule 406 or Securities Exchange Act Rule 24b-2, please discuss in future filings how difficult it will be for you to achieve the undisclosed target levels. Please refer to Instruction No. 4 to Item 402(b). We note your disclosure that a payout at or near target is the most likely outcome.

|

We note that we requested confidential treatment of this disclosure by letter to the SEC dated April 30, 2010, on the basis that such disclosure would result in competitive harm to the Company. Please also note that the SEC granted such request for confidential treatment by response letter to the company dated June 9, 2010. As you request, we will generally disclose the difficulty of achieving the undisclosed target levels in our 2012 Proxy Statement.

Equity-Based Awards, page 28

|

|

22.

|

Although you provide general disclosure relating to how the Human Resources Committee determined the total amount of the long-term incentive awards, your disclosure does not meaningfully convey the reasons why the Human Resources Committee awarded the specific amounts of stock options and stock appreciation rights, performance contingent restricted stock units, and restricted stock and restricted stock units pursuant to the Deposit Share Program. In future filings, for each type of long-term equity-

|

Ball Corporation

May 3, 2011

Page 8

|

|

based incentive award, please discuss in more detail how you determined the amount awarded to each named executive officer. See Item 402(b)(1)(v) of Regulation S-K. Using information for your most recently completed fiscal year, please show us in your response what your revised disclosure will look like.

|

We have included additional disclosure responsive to your request in the enclosed excerpt from our current Proxy Statement under the heading “Long-Term Incentives – Equity-Based Awards.”

Performance Contingent Restricted Stock Units, page 28

|

|

23.

|

In future filings, please discuss the awards for the performance period ending in the most recently completed fiscal year. Specifically, please disclose the performance goal and actual results achieved. Using information for your most recently completed fiscal year, please show us in your response what your revised disclosure will look like.

|

We have included additional disclosure responsive to your request in the enclosed excerpt from our current Proxy Statement under the heading “Long-Term Incentives – Performance Contingent Restricted Stock Units.”

We appreciate your comments and believe we have adequately addressed them in our response.

Sincerely,

/s/ Scott C. Morrison

Scott C. Morrison

Senior Vice President and Chief Financial Officer

COMPENSATION DISCUSSION AND ANALYSIS

This compensation discussion and analysis (“CD&A”) is intended to provide an overview of the decisions used to determine the executive compensation tables included in this Proxy Statement.

Compensation Objectives and Philosophy

The primary objective of Ball’s executive compensation program is to attract and retain exceptional leaders and enable them to behave like an owner—one of our Five Keys to Success. When setting executive compensation, Ball applies a consistent approach for all executive officers and intends that the combination of compensation elements closely aligns the executives’ financial interest with those of the shareholders. The program is mainly designed to:

|

●

|

Attract, motivate and retain a highly capable and performance-focused executive team;

|

|

●

|

Promote a culture of employee owners whose financial interests are aligned with those of the Corporation’s shareholders;

|

|

●

|

Pay for performance such that total compensation reflects the individual performance of executives and the absolute and relative performance of Ball; and

|

|

●

|

Efficiently manage the potential stock dilution, cash flow, tax and reported earnings implications of executive compensation, consistent with the other objectives of the program.

|

Target total compensation is comprised of base salary, annual economic value added incentive compensation and long-term incentive compensation in the form of both cash and equity. In support of Ball’s emphasis on significant ownership by key executives, Ball delivers long-term incentive opportunities that encourage ownership. Generally, the amount of compensation realized or potentially realizable does not directly impact the level at which future pay opportunities are set. However, when granting equity awards, the Committee reviews and considers both individual performance and the number of outstanding and previously granted equity awards.

In addition to promoting share ownership, the Corporation’s executive compensation objectives and philosophy focus on rewarding performance. This means that shareholder returns along with corporate, operating unit and individual performance, both short-term and long-term, determine the largest portion of executive pay.

Role of the Human Resources Committee and Executive Compensation Consultant

The Human Resources Committee (“Committee”) oversees the administration of the executive compensation program and determines the compensation of the executive officers of the Corporation. The Committee is solely composed of nonmanagement directors, all of whom meet the independence requirements of the NYSE. To assist the Committee in discharging its responsibilities, the Committee has retained an independent consultant (“Consultant”). This Consultant is employed by Pay Governance, LLC. The Consultant is engaged by and reports directly to the Committee. Specifically, the Consultant’s role is to develop recommendations for the Committee related to all aspects of executive compensation programs and the Consultant works with management to obtain information necessary to develop the recommendations.

During the first half of 2010, the Consultant was employed by Towers Watson. Since the majority of such consulting occurs in the last two quarters of the year, minimal executive compensation services were provided by Towers Watson in 2010. Effective July 1, 2010, the Consultant became an employee of Pay Governance, LLC, an independent company that is not affiliated with Towers Watson. The total fees paid for executive compensation services to Towers Watson for the period of January 1, 2010, thru June 30, 2010, were $56,716. The total fees for executive compensation services provided to the Committee by Pay Governance from July 1, 2010, to December 31, 2010, were $183,394. Pay Governance, LLC provides no other services to the Corporation.

The total fees for other services provided to the Corporation by Towers Watson during 2010 were $5,312,177. Towers Watson provides health and welfare and retirement plan strategy, design and actuarial services to the Corporation. The decision to engage Towers Watson for such services was determined by the executive overseeing the benefits organization and approved by the Executive Vice President, Administration. The Consultant had no role in the delivery of the health and welfare and retirement services described above. The Committee is assured that the services provided by the Consultant were objective and not influenced by the other services provided to the Corporation by Towers Watson because of the following: (1) the contractual arrangement for executive compensation services provided to the Committee was completely separate from the arrangement of other services provided to the Corporation; (2) the Consultant received no compensation based on the fees charged to the Corporation for other services; and (3) the Consultant did not participate in Towers Watson sales meetings

1

regarding opportunities at the Corporation. Additionally, the individual executive compensation consultant’s qualifications, expertise and protocols ensure that the services provided to the Committee are both objective and of high quality.

Process for Determining Executive Compensation

Typically, the Committee reviews and adjusts executive total compensation levels, including equity grants annually in January of each year. This practice was utilized when reviewing and adjusting 2010 executive total compensation.

The CEO’s target total compensation package is set by the Committee during an executive session based on the Committee’s review of the competitive information prepared by the Consultant, assessment of the CEO’s individual performance in conjunction with the financial and operating performance of the Corporation, and appropriate business judgment.

A recommendation for the target total compensation of the Corporation’s other executive officers, including the CFO and other NEOs, is made by the CEO after reviewing the executive’s and the Corporation’s performance in conjunction with the executive’s responsibility and experience when compared to the competitive information prepared by the Consultant. The compensation package for the other executive officers, including the CFO and the other NEOs, is established by the Committee taking into consideration the recommendation of the CEO and the executive officer’s individual job responsibilities, experience and overall performance.

To facilitate this process, the Consultant creates tally sheets for each executive, which are used by the Committee when setting target total compensation for the CEO and other executive officers. Tally sheets outline each executive’s annual target and actual pay as well as total accumulated pay under various performance and employment scenarios and corporate performance, both recent and projected. The Consultant also prepares for the Committee an independent review and recommendation of the CEO’s compensation. In its deliberations, the Committee meets with the CEO and other members of senior management, as appropriate, to discuss the application of the competitive benchmarking (pay and performance) relative to the unique structure and needs of the Corporation.

Market Benchmarking

The Corporation begins the annual process by reviewing each executive officer’s target total compensation in relation to the 50th percentile of comparably sized companies based on general industry data. The Corporation also takes into account, as an additional reference point, competitive compensation data from a selected group of peer companies consisting of leading container and packaging, distiller and brewer, food, household durable and nondurable goods companies (“Peer Group”). This general industry and Peer Group data is gathered by the Consultant and presented to the Corporation and the Committee in reports that provide a comparative analysis of our executive officer compensation to this competitive market compensation. The Consultant works in collaboration with the Corporation’s Compensation Department when preparing such reports. For 2010, target annual cash compensation was set at levels very near or below the relevant external market 50th percentile while long-term incentives were near or above external market median levels. This resulted in target total direct compensation levels below market for Messrs. Hayes and Morrison, who were new in their jobs, and modestly above market for Messrs. Hoover, Seabrook and Westerlund, who are all long service employees. Actual compensation for all NEOs fell above the 50th percentile external market data as a result of strong company performance, which demonstrates our executive compensation program pay for performance alignment.

For 2010 executive compensation planning, the companies comprising Ball’s Peer Group included the following:

|

●

|

Anheuser-Busch InBev

|

●

|

H.J. Heinz Company

|

●

|

Owens-Illinois, Inc.

|

|

●

|

Campbell Soup Company

|

●

|

The Hershey Company

|

●

|

Smurfit-Stone Container Company

|

|

●

|

The Clorox Company

|

●

|

Jarden Corporation

|

●

|

Sonoco Products Company

|

|

●

|

Colgate-Palmolive Company

|

●

|

Kellogg Company

|

●

|

Temple-Inland, Inc.

|

|

●

|

Fortune Brands, Inc.

|

●

|

Molson Coors Brewing Company

|

●

|

Wm. Wrigley Jr. Company

|

During the third quarter of 2010, the Committee engaged the Consultant to assess whether the Peer Group required changes to ensure it is reflective of Ball’s business type and competitive market for talent. In determining potential changes to comparator companies, the Consultant used both qualitative criteria and objective quantitative criteria, including:

|

●

|

Qualitative elements

|

|

|

○

|

Reflect the labor market for the Company’s executive talent, in terms of both industry and organizational complexity

|

|

|

○

|

Focus on direct peers from Ball’s primary industry (containers and packaging)

|

|

2

|

○ Supplemented with two additional groups of related companies sufficient to create a stable peer group that can be used over time:

■ Nondurable consumer product companies—either where containers and packaging are a critical element of final product or with a higher focus on meeting annual performance expectations, individual consumer as ultimate purchaser of product, and

■ Broader manufacturing companies—specifically within the aerospace, office services and supplies capital goods, chemical, paper product and steel industries.

● Quantitative elements

○ Organizational scope:

■ Primary measure: Revenue of ~$3 billion to $15 billion

■ Secondary measure: Market capitalization of ~$3 billion to $15 billion.

○ Financial metrics:

■ Market capitalization/revenue ratio: Multiples of ~ 0.5 to 2.0

■ Operating profit margin: Positive operating margin ranging from 5 to 20 percent

■ Three-year total shareholder return: No outlying large declines (given economic downturn), ideally outperforming the S&P 500

|

As a result of this assessment, the composition of the Peer Group was modified to include the following companies, which will be utilized for 2011 executive compensation planning:

|

●

|

Avery Dennison Corporation

|

●

|

Greif, Inc.

|

●

|

Pactiv Corp.

|

|

●

|

Bemis Company, Inc.

|

●

|

H.J. Heinz Company

|

●

|

PPG Industries, Inc.

|

|

●

|

Campbell Soup Company

|

●

|

ITT Corporation

|

●

|

Sara Lee Corp.

|

|

●

|

ConAgra Foods, Inc.

|

●

|

MeadWestvaco Corporation

|

●

|

Sealed Air Corporation

|

|

●

|

Crown Holdings Inc.

|

●

|

Molson Coors Brewing Company

|

●

|

Silgan Holdings, Inc.

|

|

●

|

Eastman Chemical Company

|

●

|

Owens-Illinois, Inc.

|

●

|

Sonoco Products Company

|

|

●

|

Goodrich Corp.

|

●

|

United States Steel Corp.

|

|

Companies in the New Ball Peer Group

Market Capitalization, Enterprise Value, Revenue and Net Income

|

||||||||||||||||

|

In millions

|

Market Capitalization*

|

Enterprise Value*

|

Revenue**

|

Net Income**

|

||||||||||||

|

25th Percentile

|

$ | 3,700 | $ | 5,100 | $ | 3,600 | $ | 150 | ||||||||

|

50th Percentile

|

$ | 4,800 | $ | 7,700 | $ | 6,400 | $ | 285 | ||||||||

|

75th Percentile

|

$ | 8,900 | $ | 10,300 | $ | 10,200 | $ | 600 | ||||||||

|

Ball Corporation

|

$ | 5,469 | $ | 8,105 | $ | 7,345 | $ | 388 | ||||||||

*As of September 15, 2010

**FY 2009

Risk Assessment

The Committee has reviewed the concept of risk as it relates to our compensation programs and does not believe our compensation programs encourage excessive or inappropriate risk. Overall, our internal risk assessment confirms that our compensation arrangements are low in risk and do not foster undue risk taking, because they are performance driven and have strong governance and control mechanisms. The Committee’s executive compensation Consultant conducted a thorough risk assessment of our executive compensation programs and assessed numerous criteria with particular attention to whether those programs implicate financial risks, operational risks or reputational risks. The Consultant reported to the Committee that Ball’s executive compensation programs are low in risk. In reaching that conclusion, the Consultant noted that there is strong Human Resource Committee involvement, long-term incentives are predominantly risk-based equity and thus tied to shareholder returns, market comparisons are utilized, ownership requirements are applied and Ball has embraced “economic value added” principles in its compensation for many years.

3

Stock Ownership Guidelines

Consistent with its ownership philosophy, Ball has established guidelines that all executive officers retain minimum ownership levels of the Ball Corporation Common Stock. As of December 31, 2010, all executive officers including the CEO and the other NEOs have met their ownership guidelines. The 2010 stock ownership guidelines (minimum requirements) were as follows:

|

Executive

|

Ownership Multiple

(of Base Salary)

|

|

|

CEO

|

5 times

|

|

|

CFO, EVPs and SVPs

|

3 times

|

|

|

Other Executives

|

1 to 2 times

|

Additionally, the Corporation has established a 10,000 share stock ownership guideline for each nonmanagement director.

When the Corporation’s share price appreciates, some executives and/or directors may desire to lock in a portion of that appreciation, thereby managing a portion of the economic risk associated with concentrated holdings of Ball Common Stock. The Corporation has evaluated the potential approaches that executives and directors can use. As a result of this review, executives are permitted to use prepaid variable forward contracts or contracts to purchase or sell Ball Corporation Common Stock pursuant to SEC Rule 10b5-1. Put and call options and other hedging transactions involving Corporation stock (including selling the stock “short”) are not permitted.

Elements of Ball’s Executive Compensation Program and 2010 Performance

The primary elements of Ball’s executive compensation program are designed to be consistent with the compensation objectives described above. The elements are outlined in the following table. The purpose of each element is also provided to demonstrate how each fits with the overall compensation objectives, specifically, stock ownership and pay for performance.

|

Element

|

Purpose

|

Performance Measures

|

2010 Performance

|

|

|

Base Compensation—Current Year

|

Annual Base Salary

|

Fixed element of pay based on an individual’s primary duties and responsibilities.

|

Individual performance and contribution based on primary duties and responsibilities.

|

All NEOs received base pay increases. Non-promotion related increases were less than 3 percent.

|

|

Annual Incentive—

Performance Based Cash

|

Annual Economic Value Added Incentive Compensation Plan

|

Designed to reward achievement of specified annual corporate and/or operating unit financial goals pursuant to economic value added principles.

|

Actual 2010 economic value added based on the amount of corporate net operating profit after-tax, less a charge for capital employed in the business, as compared to the 2010 economic value added target.

|

Resulted in an award of 202 percent of target for all NEOs. Amounts in excess of 200 percent were banked and remain at risk.

|

|

Long-Term

Incentive—

Performance Based Cash

|

Acquisition-Related Special Incentive Plan

|

Designed to promote the successful integration of newly acquired businesses thereby enhancing financial returns and cash flow.

|

Cumulative earnings before interest and taxes and cumulative cash flow of the Metal Beverage Packaging Division, Americas.

|

The first 15-month cycle ended December 31, 2010, resulted in an interim award payment of 23 percent of the total target award.

|

|

Long-Term Cash Incentive Plan

|

Designed to promote long-term creation of shareholder value in absolute terms (ROAIC) and relative terms (performance versus a group of companies in the S&P 500) and provide an executive retention incentive.

|

50 percent based on total shareholder return over three years relative to a group of S&P 500 companies and 50 percent based on ROAIC over three years, as compared to targets.

|

The 2008-2010 cycle resulted in an award payment of 200 percent of target for all NEOs based on performance above target for three years relative total shareholder return (84th percentile) and ROAIC (11.1 percent).

|

4

|

Component

|

Element

|

Purpose

|

Performance Measures

|

2010 Performance

|

|

Long-Term

Incentive—

Performance Based Equity

|

Stock Options and Stock-Settled Stock Appreciation Rights

|

Designed to promote share ownership and long-term performance resulting in the creation of shareholder value.

|

Stock price performance relative to the grant date stock price (exercise price) of the stock options/SAR grants.

|

Stock price performance ending December 31, 2010, excluding dividends:

Ball vs. S&P 500 one-year:

31.6 percent vs.

12.8 percent.

Ball vs. S&P 500 three-year:

53.89 percent vs.

negative 14.35 percent.

|

|

Restricted Stock/ Restricted Stock Units

|

Designed to promote share ownership, provide a retention incentive, and provide long-term incentive for the creation of shareholder value.

|

Attainment of required holding period and stock price performance.

|

||

|

Deposit Shares

|

Designed to promote executive financial investment in the Corporation, promote share ownership and provide long-term incentive for performance resulting in the creation of shareholder value.

|

Attainment of required holding period and stock price performance.

|

||

|

Performance Contingent Restricted Stock Units

|

Designed to promote share ownership through the achievement of financial returns in excess of the Corporation’s estimated weighted average cost of capital.

|

Actual ROAIC over three years, equal to or exceeds the Corporation’s estimated weighted average cost of capital established at the beginning of the performance period.

|

For all NEOs, resulted in 100 percent vesting on January 31, 2011, of the 2008-2010 performance-contingent restricted stock unit award, based on actual ROAIC over the three-year period exceeding the weighted average cost of capital target.

|

|

|

Benefits

|

Life and Pension Benefits

|

Support basic life and retirement income security needs.

|

N/A

|

N/A

|

|

Supplemental Executive Retirement Plan

|

Replicates benefits provided under the qualified pension plan, not otherwise payable due to IRS qualified plan limits.

|

|||

|

Non-Qualified Deferred Compensation

|

Provides eligible participants the ability to defer certain pretax compensation into a savings plan to support retirement income or other needs.

|

|||

|

Perquisites and Other Personal Benefits

|

Noncash compensation generally nominal in value ranging from 2 to 3 percent of total compensation, which may consist of components such as financial planning, company contributions, aircraft usage and insurance premiums. The percent of total compensation may exceed the nominal range for an executive on foreign assignment.

|

Specifics Related to the 2010 Executive Compensation Elements

Base Salary

The level of base salary takes into account job responsibilities, experience level and market competitiveness. Base salaries are generally reviewed annually in late January, with any changes becoming effective retroactively on January 1 of that year. Annual adjustments are based on individual performance, performance of the area of responsibility, the Corporation’s performance, competitiveness versus the external market and internal merit increase budgets. In 2010, based on strong company performance, external market base salary movement, and subjective judgment of individual performance, base salaries were increased for all NEOs. Additionally, Messrs. Hayes, Seabrook and Morrison received larger increases as a result of promotions and substantial changes in responsibilities.

|

Name

|

Base Percentage Increase

|

|

R. David Hoover

|

2.2percent

|

|

Scott C. Morrison

|

53.9percent

|

|

John A. Hayes

|

26.1percent

|

|

Raymond J. Seabrook

|

22.3percent

|

|

David A. Westerlund

|

2.2percent

|

5

Annual Incentive

This short-term pay for performance incentive is used to encourage and reward the CEO and other NEOs for making decisions that improve performance as measured by economic value added. It is designed to produce sustained shareholder value by establishing a direct link between economic value added and incentive compensation. This annual incentive to the CEO and other NEOs is paid consistent with the terms of the Ball Corporation Stock and Cash Incentive Plan and the Ball Corporation Annual Incentive Compensation Plan, which are administered by the Committee. Economic value added was selected as the measure for Ball’s Annual Incentive Compensation Plan because it has been demonstrated to correlate management’s incentive with total shareholder return. Economic value added is computed by subtracting a charge for the use of invested capital from net operating profit after-tax as illustrated below.

|

EVA =

|

Net Operating Profits After Taxes

(NOPAT)

|

Minus

|

Capital Charge (the amount of

capital invested by Ball multiplied

by the after-tax cost of capital)

|

Generating profits in excess of both operating and capital costs (debt and equity) creates economic value added. If economic value added improves, value has been created.

Performance Measures—Targets are established annually for each operating unit and for the Corporation as a whole based on prior performance. The Plan design motivates continuous improvement in order to achieve payouts at or above target over time.

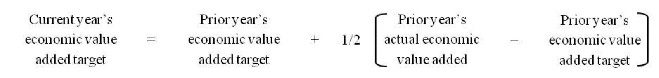

The Corporation’s and/or operating unit’s economic value added financial performance determines the amount, if any, of awards earned under the Annual Incentive Compensation Plan. Such awards are based on actual economic value added performance relative to the established economic value added target. For any one year, the economic value added target is equal to the sum of the prior year’s target economic value added and one-half the amount of the prior year’s economic value added gain or shortfall relative to the prior year’s economic value added target and may be calculated as follows:

Improvement in economic value added occurs when the amount of net operating profit after-tax less a charge for capital employed in the business increases over time. It establishes a direct link between annual incentive compensation and continuous improvement of return on invested capital relative to a 9 percent “hurdle rate.” The Corporation has established 9 percent as the “hurdle rate” when evaluating capital expenditures and strategic initiatives in most regions in which we do business. This “hurdle rate” is above the Corporation’s true cost of capital.

For a given year, a payout at 100 percent of target annual incentive compensation is achieved when actual economic value added is equal to the target economic value added target. Actual annual incentive payments each year can range from 0 to 200 percent of the targeted incentive opportunity based on corporate performance and/or the performance of the operating unit over which the executive has responsibility. For the Corporation’s consolidated plan, a payout of 0 percent is realized when actual economic value added is $98 million less than targeted economic value added. A payout of 200 percent is achieved when actual economic value is $49 million in excess of target economic value added. A payout greater than 200 percent may be achieved if actual economic value added is more than $49 million higher than target economic value added; however any amounts over 200 percent of target are banked and remain at risk until paid given that payment is contingent of future performance. The cumulative bank balance is paid over time such that one-third of the bank balance is paid in a given year whenever actual performance under the Annual Incentive Plan results in a payout. Also, when bank balances fall below $7,500, they are paid in full. All payments from the bank balance are made at the same time annual incentive payments are made. For 2010, target economic value added for the Corporation’s consolidated plan was $60 million. Actual economic value for 2010 was approximately $109 million, which resulted in a payout of 202 percent of target.

Target Incentive Percentages—This short-term performance-based incentive opportunity is established each year as a percentage of an executive’s annual base salary and is targeted at approximately the 50th percentile of the competitive market with the opportunity to earn more for above-target performance or less for below-target performance. For 2010, the target incentive opportunities and the actual award earned for the CEO and other NEOs are as follows:

6

|

Name

|

Target Annual

Incentive Percent

|

Actual Annual Incentive

Based on Performance

|

|

R. David Hoover

|

110 percent

|

222 percent

|

|

Scott C. Morrison

|

60 percent

|

121 percent

|

|

John A. Hayes

|

85 percent

|

172 percent

|

|

Raymond J. Seabrook

|

75 percent

|

152 percent

|

|

David A. Westerlund

|

70 percent

|

141 percent

|

Certain executives including the CEO and the other NEOs may elect to defer the payment of all or a portion of their annual incentive compensation into the 2005 Deferred Compensation Plan and/or the 2005 Deferred Compensation Company Stock Plan. The executive becomes a general unsecured creditor of the Corporation with respect to amounts deferred. Amounts deferred to the 2005 Deferred Compensation Plan, or its successor, are notionally “invested” among various investment funds available under the applicable Plan. A participant’s amounts are not actually invested in the investment funds for their account, but the return on the participant’s account is determined as if the amounts were invested in those funds. Amounts deferred into the 2005 Deferred Compensation Company Stock Plan receive a 20 percent Corporation match with a maximum match of $20,000 per year. Amounts deferred into this Plan will be represented in the participant’s account as stock units, with each unit having a value equivalent to one share of Ball Corporation Common Stock. Participants may later reallocate a prescribed number of units to other notional investment funds, comparable to those described above, subject to specified time constraints. One-half of the amount deferred into the 2005 Deferred Compensation Company Stock Plan must remain deferred until retirement or other termination of employment.

Long-Term Incentives

This element of compensation is designed to provide ownership and cash opportunities to promote the achievement of longer term financial performance goals and enhanced total shareholder returns. The Corporation’s long-term incentive opportunity is generally provided through a combination of equity and cash awards, which the Committee believes best matches the compensation principles for the program. In 2010, long-term incentives awarded prior to shareholder approval of the 2010 Stock and Cash Incentive Plan in April were provided pursuant to the existing 2005 Stock and Cash Incentive Plan; and awards following that approval were pursuant to the newly approved 2010 Plan. This Plan permits grants of cash awards, stock options, stock appreciation rights or stock awards (e.g., shares, restricted stock and restricted stock units).

In 2010, Ball delivered approximately 25 percent of the target long-term incentive through performance-based cash awards and approximately 75 percent through performance-based equity awards. This award mix was set to achieve the objectives described above, while viewed in light of market practices and cost implications. The total amount of long-term incentives, based on the grant date expected value, was established in relation to the 50th percentile of the competitive market as well as individual performance (based on the Committee’s subjective judgments regarding the performance of the areas of responsibility for each executive) and the Corporation’s financial and operating performance. This emphasis on long-term compensation, through performance-based long-term cash and equity awards, ensures a strong continued alignment with Ball’s executive ownership and shareholder value creation objectives.

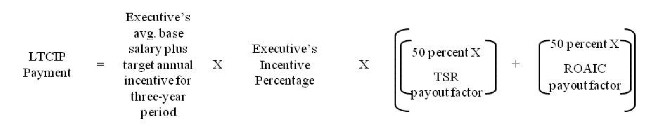

Performance-Based Cash Awards—Ball’s performance-based long-term cash incentive award is intended to focus executives on the achievement of multiyear performance goals that will enhance shareholder value. The Corporation’s total shareholder return and return on average invested capital (“ROAIC”) are considered in determining the amount, if any, of awards earned under the Corporation’s Long-Term Cash Incentive Plan (“LTCIP”). Performance is generally measured on a cumulative basis over a three-year performance period. Awards pursuant to the LTCIP are generally made on an annual basis such that three performance periods overlap. Any actual award earned is paid at the end of the three-year performance period.

The 2008 through 2010, 2009 through 2011, and 2010 through 2012 performance periods provide executives the opportunity to earn awards based on a combination of two performance measures. One-half of the award is based on the Corporation’s three-year total shareholder return as measured against the total shareholder returns of a group of companies in the S&P 500 not including companies in the S&P 500 Index that are classified as being part of the Financial or Utilities industry sectors or the Transportation industry group. Companies added to the S&P 500 during the performance period are also excluded. Total shareholder return is measured by comparing the average daily closing price and dividends of the Corporation in the third year of the performance cycle with the average daily closing price and dividends prior to the start of the performance cycle relative to the distribution of the equivalent total shareholder returns during the performance cycle of the group of companies as described above. The target performance requirement for the total shareholder returns measure is the 50th percentile of the S&P group described above. The other one-half of the award is based on ROAIC performance over

7

the three-year period. ROAIC is calculated by dividing the average of the Corporation’s net operating profit after-tax over the relevant performance period by its average invested capital over such period. The target performance requirement for the ROAIC measure is 9 percent, which is above the Corporation’s estimated weighted average cost of capital. The target, minimum and maximum performance requirements are as follows:

|

Performance Measure

|

Minimum

|

Target

|

Maximum

|

|

Total Shareholder Return

|

37.5th percentile

|

50th percentile

|

75th percentile

|

|

ROAIC

|

7 percent

|

9 percent

|

11 percent

|

For each measure, minimum performance results in a zero payout factor, target performance results in a 100 percent payout factor and maximum performance results in a 200 percent payout factor for the respective one-half of the award. Performance between minimum, target and maximum is extrapolated to determine the payout factor.

The incentive opportunity is established by considering external market long-term incentive data and Ball internal pay equity and is set as a percentage of the executive’s average base salary plus target annual incentive over the three-year performance period (i.e., average target annual cash compensation during the performance period). For the 2010 through 2012 performance period, the incentive opportunities for the CEO and other NEOs are as follows:

|

Name

|

Target Incentive Percentage

|

|

R. David Hoover

|

40 percent

|

|

Scott C. Morrison

|

25 percent

|

|

John A. Hayes

|

30 percent

|

|

Raymond J. Seabrook

|

25 percent

|

|

David A. Westerlund

|

25 percent

|

The executive’s award for any given performance cycle is calculated as follows:

Actual payments at the end of the performance period for each factor (total shareholder return (“TSR”) and ROAIC) can range from 0 to 100 percent of the target opportunity based on actual performance relative to the established performance measures described above.

As a result of the Corporation’s actual performance for the 2008 through 2010 performance period, cash payouts (made in early 2011) for the CEO and other NEOs in the plan are 200 percent of the target opportunities and are reported in the Summary Compensation Table. The potential award value of the 2010 through 2012 performance period, which was awarded to the NEOs in 2010, is reported in the Grants of Plan-Based Awards Table.

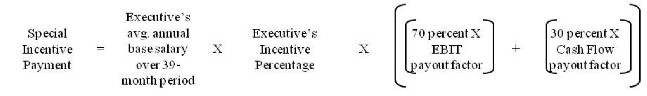

Special Acquisition Incentive Plan—In conjunction with the 2009 acquisition of certain beverage can manufacturing operations, the Corporation implemented an Acquisition-Related Special Incentive Plan designed to motivate participating employees to successfully integrate the acquisition into the Corporation. Payouts under this Plan are based on cumulative earnings before interest and taxes and cumulative cash flow over a 39-month period, with awards, if any, made at 15 months, 27 months and 39 months. Minimum, target and maximum values have been established for each performance measure; however, due to the competitive sensitive nature of such financial metrics, these values have been excluded. A payout at or near target is the most likely outcome. This incentive opportunity is established as a percentage of an executive’s average base salary over the 39-month performance period and is provided below for each NEO.

8

|

Name

|

Target Incentive Percentage

|

|

R. David Hoover

|

40 percent

|

|

Scott C. Morrison

|

40 percent

|

|

John A. Hayes

|

40 percent

|

|

Raymond J. Seabrook

|

40 percent

|

|

David A. Westerlund

|

40 percent

|

The executive’s actual award will be calculated as follows:

Actual payments at the end of the performance period can range from 0 to 150 percent of the target opportunity based on actual performance relative to the established performance measures. Actual performance between minimum (which results in zero payout), target (which results in 100 percent payout) and maximum (which results in 150 percent payout) is extrapolated to determine the payout factor. The first 15-month period was completed on December 31, 2010, and based on performance the NEOs each received an interim payment equal to 23 percent of the total target amount.

Equity-Based Awards—The Corporation’s equity awards may be provided through various forms (SARs, ISOs, NQOs, performance contingent units, restricted stock and restricted stock units), all of which are tied to the price of Ball Corporation Common Stock. Annual equity awards associated with target total compensation are typically granted in January on the date of the quarterly meeting of the Board; however, equity awards may be granted during the year as part of an executive’s promotion or for retention purposes. In the case of newly hired executives, equity awards may be granted upon the executive joining the Corporation. Equity based awards are determined for each NEO in order to bring target total direct compensation to the level deemed appropriate by the Committee in relation to the external market 50th percentile. In January 2010, NEOs were awarded SARs, ISOs on a basis limited to the Internal Revenue Code statutory maximum, and performance contingent restricted stock units. The estimated dollar value of the equity to be awarded is generally weighted 50 percent SARs/ISOs and 50 percent performance contingent restricted stock units, plus or minus 10 percent. The weighting for each NEO for equity granted in 2010 was as follows:

|

Name

|

Percent weighting

SARs/ISOs

|

Percent weighting

Performance

Contigent RSU

|

|

R. David Hoover

|

44 percent

|

56 percent

|

|

Scott C. Morrison

|

42 percent

|

58 percent

|

|

John A. Hayes

|

50 percent

|

50 percent

|

|

Raymond J. Seabrook

|

49 percent

|

51 percent

|

|

David A. Westerlund

|

43 percent

|

57 percent

|

The following further describes the various forms of equity awards:

|

●

|

Stock Options and Stock-Settled Stock Appreciation Rights: SARs, ISOs and NQOs are granted in order to reward executives for the creation of shareholder value, and will only provide value to executives if the price of Ball’s stock increases. Such awards generally vest at 25 percent per year for four years and expire in 10 years. The grant value of each SAR, ISO and/or NQO is based on the closing price of Ball stock on the date of grant. In 2006, Ball began granting to certain key executives stock-settled SARs based on the view that stock-settled SARs are an effective way to both manage equity dilution and promote share ownership. In 2007, the Board of Directors authorized for options or SAR grants on or after such date, that for certain participants who retire early, defined as the first to occur of either attaining both age 55 and 15 years of service or age 60 and 10 years of service, upon the execution of an agreement not to compete with the Corporation, a participant’s unvested stock

|

9

|

options and/or SARs will continue to vest under the regular vesting schedule and such participants will have five years from the retirement date or up to the original expiration date, whichever is sooner, to exercise vested stock options and/or SARs. In January 2010, the Committee approved the award of both SARs and ISOs to certain executives, including NEOs, which is reported in the Grants of Plan-Based Awards Table.

|

||

|

●

|

Performance Contingent Restricted Stock Units: The performance contingent restricted stock units are granted in order to encourage executives to assure long-term return on the Corporation’s invested capital in excess of its current estimated weighted average cost of capital. The award of performance contingent restricted stock units provides participants with the opportunity to receive common shares if the Corporation’s ROAIC during a three-year period is equal to or exceeds the Corporation’s estimated cost of capital as established at the beginning of the performance period. Units not vested at the end of the performance period are forfeited. In January 2010, the Board of Directors approved the award of performance contingent restricted stock units pursuant to the provisions of the 2005 Stock and Cash Incentive Plan. The performance period for the 2010 grants is a 36-month period that extends from January 2010 to December 2012 and the estimated weighted average cost of capital and required return for the performance period was established at 6.6 percent. The number of performance contingent restricted stock units awarded in 2010 to the CEO and other NEOs is reported in the Grants of Plan-Based Awards Table. Vesting of the units is solely based on meeting or exceeding the above-described performance goal of 6.6 percent. If the goal is met, all of the participant’s awarded units vest. If the goal is not met, all of the participant’s awarded units are forfeited. On February 1, 2010, performance contingent restricted stock units granted to NEOs in 2007, with a three-year performance period ending in 2009, vested as a result of the actual ROAIC during that three year performance period exceeding the estimated weighted average cost of capital target of 6.1 percent established at the time of grant. In 2007, the Committee authorized for performance contingent restricted stock units grants on or after such date, that for certain participants who retire early, defined as the first to occur of either attaining both age 55 and 15 years of service or age 60 and 10 years of service, upon the execution of an agreement not to compete with the Corporation, the participant’s units will vest at the end of the performance period if the performance goal is achieved.

|

|

|

●

|

Restricted Stock/Restricted Stock Units: The Corporation may grant restricted stock or restricted stock units pursuant to the Deposit Share Program (“DSP”), which was instituted in 2001. The DSP is intended to increase share ownership among certain executives who must make additional investments in the Corporation’s stock in order to participate. Under this program, an executive receives one share of restricted stock or one restricted stock unit for every share newly acquired by the participant (either in the market, through the exercise and holding of stock options or settlement of SARs, or deferral of incentive compensation to the deferred compensation company stock plan) during a preestablished acquisition period, up to a preestablished maximum number of shares. As long as the executive continues to hold the newly acquired shares, the restricted stock or units granted cliff vest four years from the date of grant; or, if stock ownership guidelines are met, 30 percent of the shares or units will vest at the end of the second year and third year and 40 percent will vest at the end of the fourth year. Restricted stock or units granted pursuant to the DSP are made on the 15th day of each month following the executive’s submission of adequate documentation to the Corporation detailing the acquisition of the newly acquired shares. In April 2010, the Committee approved a DSP opportunity award to a selected group of executives that included the CFO. Mr. Morrison was awarded the DSP opportunity in recognition of his promotion and to encourage increased stock ownership levels.

|

|

|

Restricted stock or restricted stock units not related to the DSP may also be granted to executives by the Committee or the CEO. Pursuant to the provisions of the 2010 Stock and Cash Incentive Plan, the Committee delegated to the CEO the authority to grant up to a maximum of 6,000 restricted shares or restricted stock units to any one individual in a calendar year, except the CEO may not make such grants to officers of the Corporation. Any such grant is ratified by the Committee at the first Committee meeting following such grant. Grants made are generally effective at the closing stock price on the day of the grant or may be effective at the closing stock price on a specific day in the future as defined by the Committee or the CEO. As an example, the future grant of a restricted stock award may be approved pending the effective date of a promotion, employment or a specific date. These awards generally vest in either 20 or 25 percent increments on each anniversary of the grant date. These grants serve as a long-term incentive element, promote share ownership and may provide an executive retention incentive.

|

10